London-based VC Fuel Ventures has just secured some fresh LP cheques: £20m from Shijingshan Modern Innovation Industry Fund and Zhongguancun Development Group, both Chinese companies.

It’s a trend the firm thinks is set to grow: with China hawk Donald Trump about to return to US office and set to increase tariffs and other trade barriers on China, Fuel principal Mark Pearson thinks the UK can benefit from an influx of Chinese capital looking for a new home.

“We think it’s an open game for us, if the money’s not going to the US,” says Pearson.

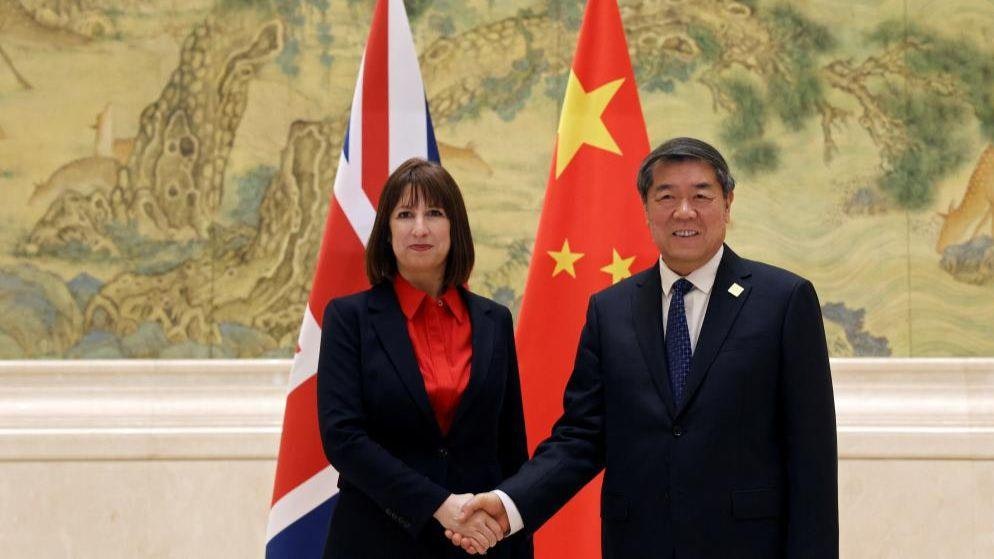

It comes as UK Chancellor Rachel Reeves last week headed to China with a delegation of bankers, seeking closer ties to Beijing as part of the UK’s growth agenda. Reeves returned with trade agreements worth £600m over the next five years; but the government, and any VCs backed by Chinese LPs, will have to counter growing concerns about the security of working with China.

Billions up for grabs?

Fuel was founded nine years ago and has deployed £200m into pre-seed and seed stage companies in the UK. The majority (85%) of Fuel’s 70 LPs are from China and it has an employee stationed in China working on investor relations.

Based on figures from Statista from the first time Trump took office, Fuel projects that funding from China to the US could drop from $28bn in 2023 to $10bn in the first year after Trump returns, then down to $3bn thereafter. If the fund’s projections are correct, it would mean billions of capital up for grabs.

At the same time, China’s domestic venture capital market is attracting less funding: investment into Chinese startups has fallen each year since 2021 — and investment in 2024 was half that of 2021, according to data from Dealroom.

Amid that backdrop, the UK is increasingly attractive for Chinese investors, Pearson says. “They love that there’s talent, there’s knowledge and there’s IP,” he says.

Angelica Anton, who raised $500m from Chinese LPs in 2017 for her fund Silk Ventures, agrees that European VCs are benefiting from the shift. “Chinese LPs are allocating a larger proportion of their capital to European funds relative to other markets,” Anton says.

The function of Chinese capital itself is also evolving, Anton says: funds which were primarily focused on building China’s strength in critical industries are now financial instruments aimed at achieving returns.

Pearson says the LPs invested in Fuel have done so primarily for financial returns, but also to keep their “finger on the pulse” of UK tech and potentially enter into joint ventures with portfolio companies, or acquire them.

There’s a recognition in China that not all tech can be built in the country and that it needs to build relationships, he says. Pairing with a VC backed by Chinese capital can help portfolio companies enter the market, which Pearson describes as otherwise “ruthless and competitive”.

Fuel and Silk are not the only European VC funds with a Chinese LP. London-based Firstminute Capital counts Chinese conglomerate Tencent — which was blacklisted by the US last week — as one of its LPs.

Lawsuits and expulsions

Although anti-China sentiment is stronger in the US, there are also growing concerns in the UK. In recent weeks, the UK has expelled an alleged Chinese spy and British MPs have questioned executives from Chinese fast fashion outlet Shein over how it safeguards against forced labour.

In startup land, UK spinout Oxford Nanopore, which works on gene sequencing tech, filed a lawsuit against Chinese biotech BGI in November. Oxford Nanopore alleges that BGI used confidential information to replicate its technology. BGI declined to comment on the case.

“In China, they will reverse engineer everything. IP and copyright rules don’t exist,” says Suki Fuller, an intelligence advisor and fellow at the Council of Competitive Intelligence Fellows.

An investment banker, often tasked with finding capital for startups, tells Sifted that biotech and life sciences companies will often ask their firm to screen out any capital with links to China over IP fears.

“China was a big source of capital in 2022, that’s now gone, people are too nervous,” says the banker, who asked to remain anonymous so as not to compromise future deals.

There’s also the case of British defence startup Hadean, which is racing to find investors to replace Chinese backer Tencent after it was placed on a blacklist by US officials earlier this month. Hadean has contracts with both NATO and the UK’s Ministry of Defence. Tencent invested as part of a £24m round in 2022 and owns 5% of the company.

The biggest risk to UK startups taking funding from Chinese-backed LPs is that the UK brings in similar parameters to the US, Fuller warns — meaning those companies would be unable to supply certain critical industries.

Despite the concerns, Fuller thinks that, in today’s difficult fundraising environment, VCs will take the capital. “I just think people are going to take the money. They’re going to take the money because they think it’s the fastest way for them to grow.”

Read the orginal article: https://sifted.eu/articles/uk-vcs-chinese-lps-us/