German robotics company Neura Robotics has raised €120m in Series B financing to develop “cognitive” robots capable of “seeing”, walking and manipulating objects.

The robotics industry is growing even faster in Europe than the US and China, according to data compiled by investment platform Altindex, with a predicted market value of $28.8bn by 2029.

Neura Robotics’ round was led by Lingotto Investment Management; Blue Crest Capital Management, Volvo Cars Tech Fund, InterAlpen Partners, Vsquared Ventures, HV Capital, Delta Electronics, C4 Ventures, L-Bank and the company’s founder and CEO David Reger also participated.

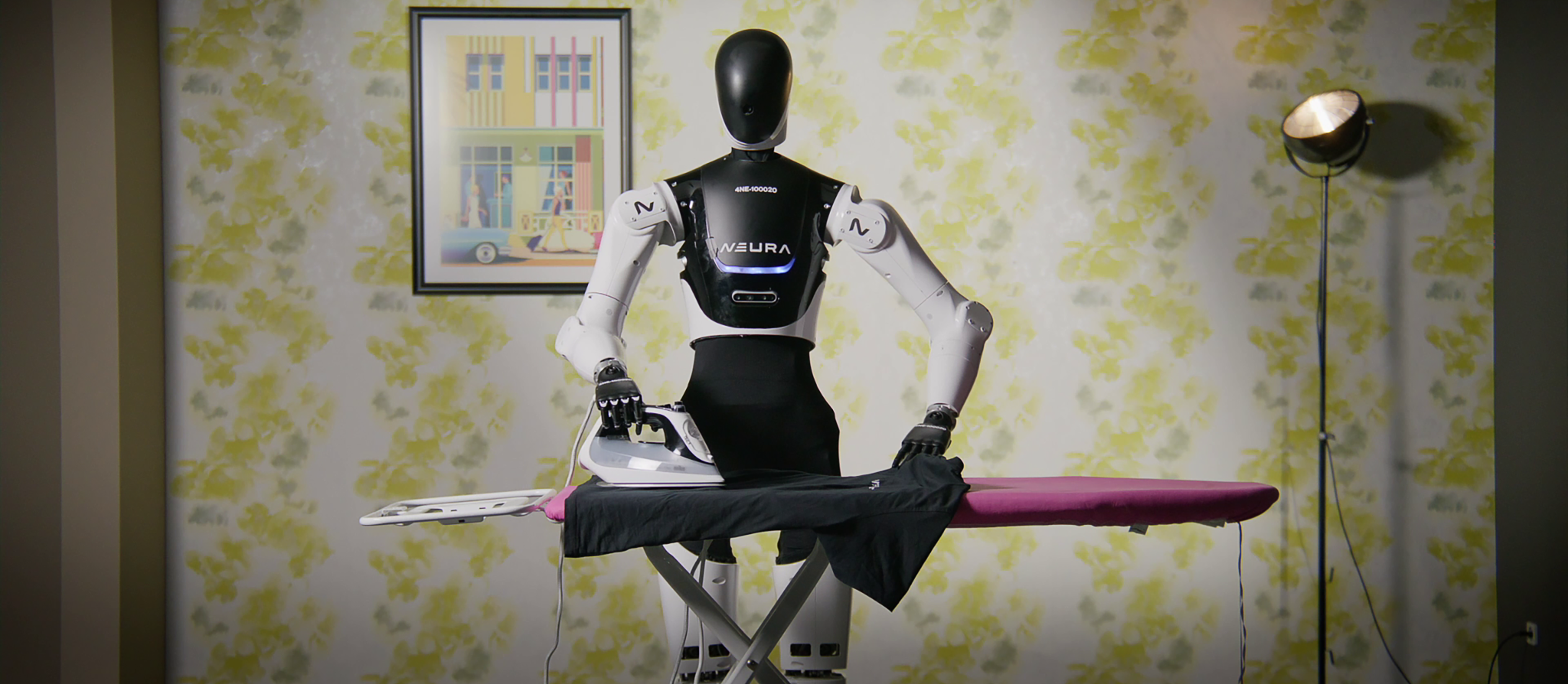

The company has five robot models including MAiRA, a cognitive robotic arm, the MAV mobile robot, which is trolley-like and capable of transporting heavy loads, and its newest edition, MiPA — a human-like model with a long robotic arm that can serve trays to patients in hospital or play catch with a child, which isn’t yet on the market.

Its humanoid robot, 4NE-1, is still in the pilot stage; a third generation of it will be released next year.

The company, founded in 2019 and based in Metzingen, moved the majority of its production back from China to Germany last year — in part to show confidence in Germany as a business location, and prove that Europe can spawn leading robotics companies.

Unlike other European robotics companies which focus exclusively on building hardware, Neura Robotics builds software too. It has a cloud-based software platform dubbed the ‘Neuraverse’, where the company’s partners and customers (such as tech and robotics companies and special machine providers) can build their own robotic applications. The software acts as a knowledge base that also trains Neura’s robots.

Neura Robotics says it achieved 10x revenue growth last year, but declined to give specific numbers. The company said it had grown its orderbook to the value of €1bn, and doubled its headcount to 300 people in the last year.

It says it will use the fresh capital to fuel its R&D and launch new products built on the Neuraverse platform.

Read the orginal article: https://sifted.eu/articles/neura-robotics-raises-120m-news/