Consumer tech startups fared surprisingly well on the inaugural Sifted 250 — a ranking of the 250 fastest-growing startups in Europe by revenue.

Six of the top 20 startups on the leaderboard were consumer-facing; the most of any vertical. B2B SaaS, which boasted 75 of the 250 companies, only had four representatives in the top 20, while fintech (64 of the 250) managed five. In total, 38 consumer tech startups featured, averaging a two-year compound annual growth rate (CAGR) of 225.7% — second of all the verticals behind fintech’s 231.2% and well clear of the average 204.6% achieved by the 250 companies.

Two companies stood out above the rest: Munich-based mobility startup FINN (#4), which topped the Sifted 50: Germany Leaderboard, and French pet insurer Dalma (#10).

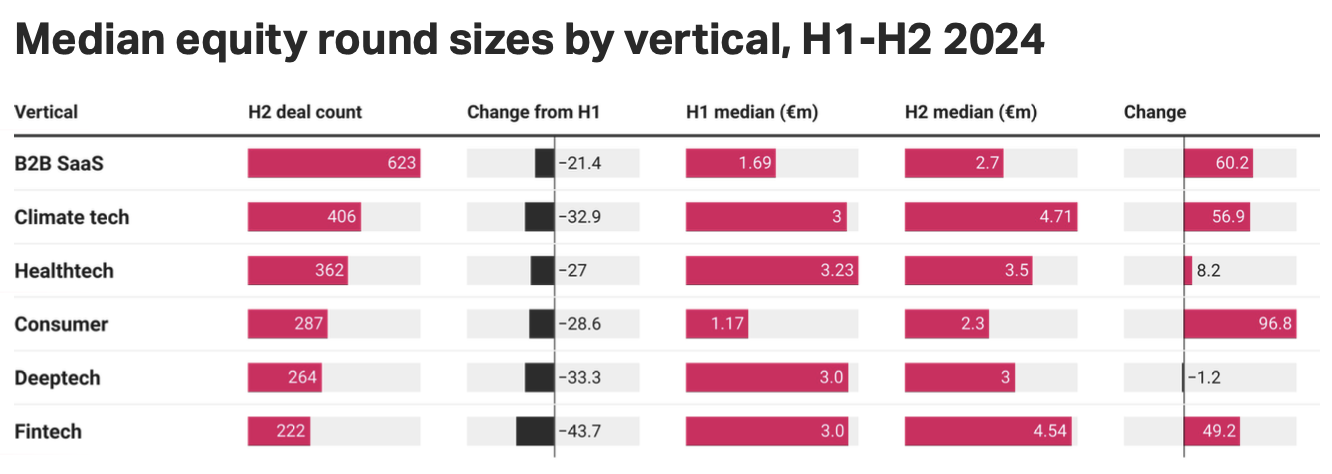

In 2024, European B2C startups have raised a total of €4.8bn in equity funding, according to Sifted data as of December 20. The sector’s H2 figure of €1.9bn isn’t all that far behind fintech’s €2.8bn, suggesting its status as the ugly duckling of European tech may now be outdated. The median round size of consumer tech startups increased by 96.8% between H1 and H2, from €1.17m to €2.3m.

10 fastest-growing consumer startups by revenue

1/ FINN

HQ: Munich, Germany

CAGR: 697.1%

What it does: Munich-based FINN offers an all-inclusive, monthly vehicle subscription service. Founded in 2019 by CEO Max-Josef Meier, it raised a €100m Series C in July 2024 at a €600m+ valuation led by the growth equity investment platform Planet First Partners. To date, it has secured €1bn in debt financing. FINN achieved revenues of €125.4m in the financial year to December 2022, growing from just €1.9m two years prior according to information submitted to Sifted.

2/ Dalma

HQ: Paris, France

CAGR: 549.1%

What it does: Dalma, headquartered in Paris and launched in 2020, offers health insurance for pets. The company was founded by CEO Alban de Préville, COO Raphaël Sadaka and CTO Harry Belinga. In May 2022, it raised a €13.2m Series A round with support from Northzone, Project A and Anterra.

3/ Seat Unique

HQ: London, UK

CAGR: 532.8%

What it does: Founded in 2018 by CEO Robin Sherry, the company connects venues, clubs and promoters directly with fans seeking VIP and hospitality tickets to live events across sports, music and culture. The company notched up £19.9m in revenues in the financial year to April 2023, growing from £497k two years prior according to information submitted to Sifted. Investors include Nickleby Capital, a private investment office backed by serial entrepreneurs, which led its £14.5m Series A extension, and a number of high-profile athletes including footballer John Terry, cricketers Ben Stokes and Stuart Broad, and Olympic champion Jessica Ennis-Hill.

4/ Olistic

HQ: Barcelona, Spain

CAGR: 529%

What it does: Barcelona-based Olistic develops natural supplements in drinkable formats for hair health and wellness. Founded in 2021, the company sells its products through its website and via pharmacies and hospitals. Its cofounders are Pedro Luis Gonzalez Atienza and Pablo Nueno (CEO). The company raised a €6m Series A in July 2022 led by Iris Ventures.

5/ Turing College

HQ: Vilnius, Lithuania

CAGR: 490.2%

What it does: Turing College is a Lithuania-based online AI college for working professionals, which offers courses in programming, marketing and data. The edtech startup was founded in 2020 by CEO Lukas Kaminskis, CPO Tomas Moška and CBDO Benas Šidlauskas. It raised a €500k seed round in January 2023 with funding from Y Combinator, Iron Wolf Capital, Tesonet Ventures, Spring Capital and angels. Turing College achieved revenues of €2m in the financial year to December 2023, growing from €60k two years prior, according to information submitted to Sifted.

6/ Tourlane

HQ: Berlin, Germany

CAGR: 447.7%

What it does: Tourlane, the Berlin-based holiday planning and booking platform, specialises in individual travel routes off the beaten track. Founded in 2016, it raised a €25m Series D last month led by Sequoia Capital — which also co-led its €59m Series C in November 2020. Target Global and HV Global also participated. In the driver’s seat is CEO Julian Weselek.

7/ Forest

HQ: London, UK

CAGR: 412.7%

What it does: London’s Forest — launched in 2020 by former executives from ride-hailing startup Cabify — is significantly smaller than many micromobility startups but announced to Sifted in November 2023 that it had become profitable, unlike many of its competitors. The company achieved revenues of £10.2m in the financial year to December 2023, growing from £387k two years prior according to information submitted to Sifted. Backers include Güil Mobility Ventures and Fen Ventures.

8/ Holibob

HQ: Edinburgh, UK

CAGR: 340.6%

What it does: Edinburgh-based Holibob aggregates holiday packages and sells its platform as a white-label product to online travel agents. Having got going just months before the pandemic hit in late 2019, Holibob came out the other side stronger, benefiting from the large pent-up demand for foreign holidays and staycations. It raised a $12m Series A last year and is seeing rapid growth — generating £2.1m revenues in the financial year to December 2023, up from £109k two years prior according to information submitted to Sifted.

9/ Ukio

HQ: Barcelona, Spain

CAGR: 291.5%

What it does: Ukio is a Barcelona-based short-term furnished apartment rental platform, run by brothers Jeremy Fourteau and Stanley Fourteau since 2020. The company’s strong revenue performance in 2023 — when it made €25m in sales — convinced its bosses to expand to Paris in 2024. The company raised a €27m Series A round, made up of equity and debt, in 2022, led by Felix Capital, with participation from Kreos Capital, Heartcore and Breega.

10/ VICIO

HQ: Barcelona, Spain

CAGR: 235.2%

What it does: Barcelona-based food delivery brand VICIO specialises in the online sale of burgers. Founders Aleix Puig — who won the Spanish version of MasterChef in 2013 — and Oriol de Pablo have expanded the business around Spain. The company scored €17m funding from Iris Ventures and superstar footballers Leo Messi and Antoine Griezmann in 2023.

The full, downloadable list of consumer tech startups on the Sifted 250:

Read the orginal article: https://sifted.eu/articles/europe-fastest-growing-consumer-startups-revenue/