Monzo is one of Europe’s most well-known fintechs. The UK neobank has raised more than $1.9bn in funding from investors including Google’s CapitalG, Hedosophia, Coatue and Accel and has grown to become one of the UK’s largest neobanks with more than 10m customers and £11.2bn in deposits.

Founded in 2015 as a basic current account product with a prepaid card, it’s since expanded into stocks and shares, buy now, pay later and is currently introducing a pension product.

The neobank reported full-year profitability for the first time this summer and announced plans to launch in the EU. More recently, it joined the wave of fintechs raising funding through secondary share sales.

Monzo currently employs more than 3,700 people, according to its latest financial results. But its five cofounders aren’t among them; its C-suite has changed quite a bit in the last nine years.

Some notable departures include founding CEO Tom Blomfield, who left in 2021 and is currently group partner at startup accelerator Y Combinator, and CTO and cofounder Jonas Templestein, who left to found his own AI startup last year. CFO James Davies also left to join energy company Ovo in October this year.

At the tail end of last month, Monzo announced it was topping up its C-suite with two additions: Tom Oldham, a former exec at Brazilian neobank Nubank who’s coming on board as CFO, and Mark Newbery, a former investment banker at Barclays who’s taking on the role of UK CFO.

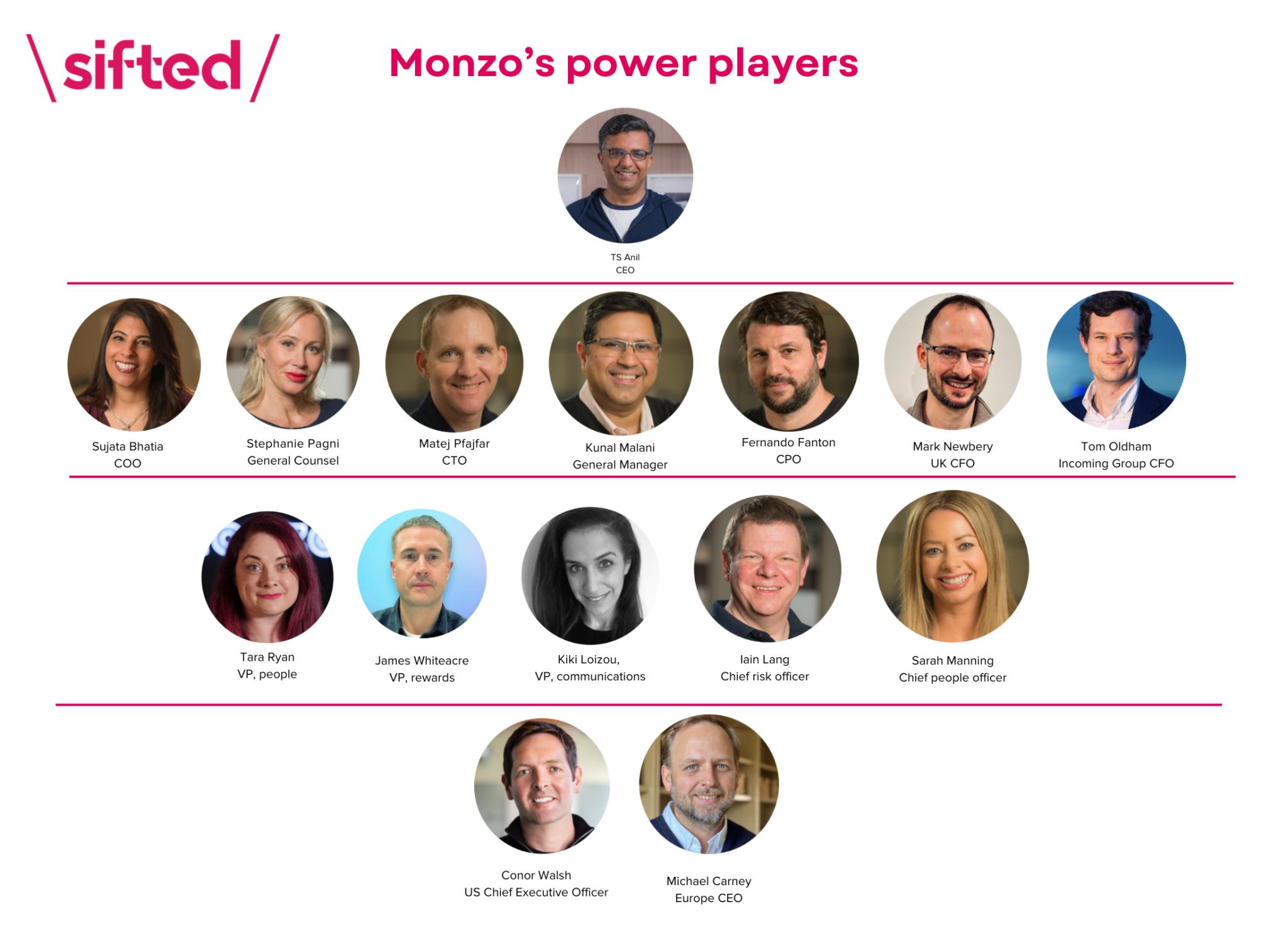

Below are the top power players at Monzo, according to the company’s website as well as insiders at the neobank. Excluding Monzo’s new joiners, our list of power players have been at Monzo for an average of 3 years and 10 months.

At the top

Current CEO TS Anil’s CV boasts a long list of banking credentials and he was chosen for the role because of his experience in traditional finance — whereas his predecessor Blomfield cofounded Monzo four years after cofounding payments fintech GoCardless.

Anil started his banking career at Citi India, and later cut his teeth at US bank Capital One, London Stock Exchange-listed Standard Chartered and payments giant Visa before joining Monzo in 2020 as its US CEO.

He then took over from Blomfield in 2021 only one year after joining the neobank, when Monzo was in a very different position to now. The company had been burned by a valuation drop from a £60m funding round raised during the height of the Covid-19 pandemic, which shaved 40% off its valuation.

Accountants auditing its financial results also said there was “material uncertainty” over the company’s future in both its 2019 results and 2020-2021 results. Monzo reported a pre-tax loss of £114.8m in its 2020-2021 annual report.

Two former employees who spoke to Sifted credit Anil for turning the neobank’s fortunes around from then. Monzo hit annual profitability for the first time this summer and has raised funding across three different financings this year. In October, it upped its valuation to $5.9bn in an employee share sale.

Monzo’s C-suite

Anil is also surrounded by a leadership team that include former executives from banking giants such as HSBC and American Express as well as tech companies such as Latin American superapp Rappi and Google.

Another key driver of change at the neobank is chief operating officer Sujata Bhatia. She spent 16 years at American Express, and joined Monzo just four months before Anil took over the CEO role in 2020.

Bhatia played a key role in diversifying the neobank’s revenue streams, improving financial crime controls and customer service, according to an interview with the Monzo exec last year.

“TS and I talk about this a lot — it was just a steady swell of momentum,” she told Sifted. “I took what I’d learnt at Amex during the financial crisis […] There was a lot of over-communicating, narrowing scope and focusing on the five things we need to do to be successful.”

Other members of the C-suite include former Barclays exec Stephanie Pagni, who serves as general counsel at the neobank; ex-Google engineering director Matej Pfajfar, who’s Monzo’s chief technology officer; former Just Eat chief product and technology officer Fernando Fanton, who’s Monzo’s chief product officer; and former Tandem Bank chief growth officer Kunal Malani who’s general manager of Monzo group.

Newbery and Oldham (who’s yet to officially join) may be new additions to the neobank, but will hold considerable influence over the company if rumours of its IPO intentions turn out to be true.

Monzo’s rising stars

James Whiteacre, Kiki Loizou and Tara Ryan were also cited as rising stars at the neobank, equal to the level of influence of certain C-suite members including chief risk officer Iain Laing and chief people officer Sarah Manning.

In particular, VP of people Ryan was singled out as having played an influential role in the company’s culture according to the two former employees. One of the people said that Ryan, in particular, emphasised a culture of zero tolerance towards any instances of disrespect and discrimination.

In comparison to its rival Revolut’s “get shit done” environment, Monzo’s company culture emphasises transparency and collaboration, staff at the neobank previously told Sifted.

International team

Rounding out the list are the executives in charge of Monzo’s international plans, the only people on the list based outside of the challenger bank’s home base in the UK.

Monzo’s 9.7m customers are largely based in the UK and have only relatively recently entered the EU and the US. Last year, Monzo hired Conor Walsh, former head of global product at US payments fintech Cash App, to head up stateside expansion, in its second attempt to make it big in the US.

And in October this year, it was announced that former Stripe executive Michael Carney will lead Monzo’s EU charge. Carney will be in charge of building out its operations in Ireland, where it’ll seek a banking licence from the country’s central bank.

Read the orginal article: https://sifted.eu/articles/monzo-power-players-2024/