Dutch startup SeaO₂ has announced over €2 million in new funding to advance its technology for removing CO₂ from seawater. The funding aims to support SeaO₂’s goals of removing one megaton of CO₂ by 2030 and one gigaton by 2045.

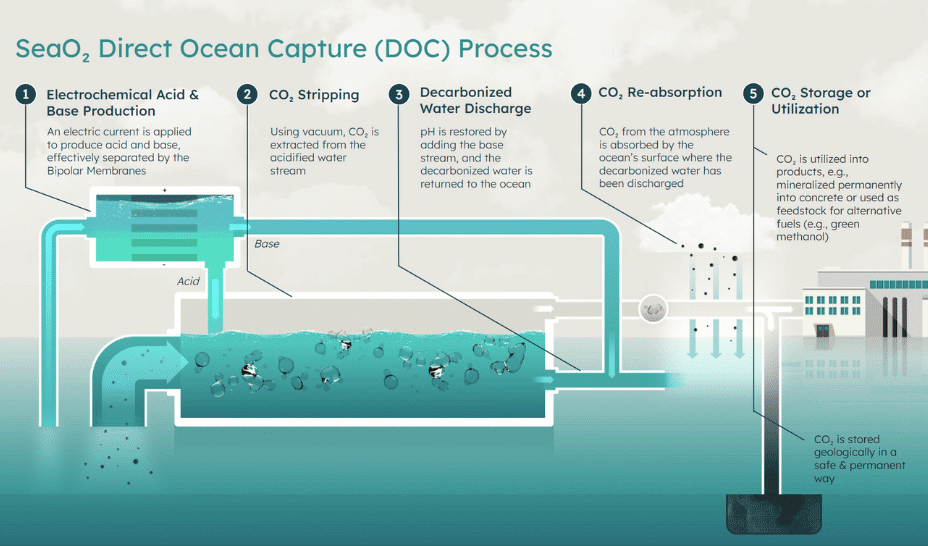

SeaO₂’s Direct Ocean Capture (DOC) technology extracts CO₂ from seawater, returning carbon-free water to the ocean to improve its natural ability to absorb CO₂ from the atmosphere. This investment will enable SeaO₂ to transition from prototype to pilot plant, expand its team, and implement a Monitoring, Reporting, and Verification (MRV) system. The pilot plant, expected to launch in summer 2025, will have an annual capacity of 250 tons of CO₂.

Expressing his enthusiasm, CEO and co-founder Ruben Brands said: “This investment recognizes our team’s hard work and dedication. With this extra support, which so far included grants, subsidies, our own investments, and early customers, we can scale our operations and accelerate our impact on climate change even more rapidly. It is a crucial step towards our goal of removing a megaton of CO₂ by 2030 and a gigaton by 2045, advancing our mission in the fight against climate change.”

Milestones and Partnerships

SeaO₂ has developed partnerships with organisations like XPRIZE Carbon Removal, TU Delft, Klarna, Wetsus, and Redstack. These collaborations have supported SeaO₂’s technological growth and expansion in the climate tech industry. Recently, SeaO₂ also participated in a carbon removal project with Paebbl in the Wadden Sea, placed in the top 100 of the XPRIZE competition, and delivered presentations at events including The Next Web, Tech Tour Oceans, and Tech Tour Water.

Regarding the company’s rapid development, Ruben added: “Obviously, we want to scale up as fast as possible. That’s why we have participated in several accelerator programs like CEEZER, Blue Invest, AirMiners, and Remove. Currently, we are learning a lot by participating in the PortXL, Creative Destruction Lab / Xprize CDR program, and Ocean Vision programs.”

The company’s involvement in initiatives like the Carbon Business Council, the Negative Emissions Platform, and CCU Alliantie also reflects its commitment to advancing climate tech initiatives.

Investors’ Perspectives

Investors have shown strong support for SeaO₂’s mission. DOEN Participaties shared: “We are investing in SeaO₂ because current carbon removal methods are not yet effective at the required scale. Therefore, innovations like SeaO₂ are urgently needed, and funding is essential to drive the sector forward and unlock its potential for global impact.”

CarbonFix commented: “CarbonFix is proud to have helped build this coalition. Our role in the ecosystem is to catalyze networks, funding, and talent to unlock innovative pathways in the fight against climate change. SeaO₂ is a prime example of this impact.”

Read the orginal article: https://www.eu-startups.com/2024/11/amsterdam-based-seao%E2%82%82-secures-over-e2-million-to-advance-its-co%E2%82%82-removal-technology/