What better way to expand your brand than by partnering with renowned athletes who bring global reach, influence, and a reputation for excellence? Over recent years, many of the world’s most celebrated sports figures have ventured beyond their fields to become serious investors, with Europe’s startup scene emerging as a prime arena for this new focus. These athletes aren’t just capitalizing on opportunities; they’re actively seeking ventures that align with their personal stories of dedication, performance, and resilience—qualities they bring into their investment approach.

Europe has proven fertile ground for these athletes-turned-investors, who view startups as a way to extend their impact while engaging in fresh challenges. With a keen understanding of the discipline and competitive spirit, they find natural parallels in the entrepreneurial world, often becoming more than just passive backers. Many bring insights and strategic guidance that mirror their career achievements, helping startups navigate growth and the demands of their respective industries.

In this article, we’ll dive into the stories of some of the most successful athlete investments in European startups. From Roger Federer’s endorsement of sustainable running shoes to Serena Williams’ commitment to inclusive technology and wellness, these athletes are rewriting the narrative on sports stars as influential investors. Explore how these big names are empowering new ideas, pushing industry boundaries, and creating a legacy off the field by supporting some of Europe’s most promising startups.

Antoine Griezmann

Antoine Griezmann, born in France, is celebrated for his creativity and precision on the football pitch, known as a forward who brings strategy and flair to his game. Off the field, Griezmann has developed a keen interest in tech-driven education, combining his personal passion for gaming with a desire to impact young audiences positively.

One of Griezmann’s key investments is PowerZ, an educational technology startup that gamifies learning to engage children more effectively. By backing PowerZ, Griezmann promotes a modern, interactive approach to education that resonates with digital-native generations. His involvement highlights a commitment to accessible learning, positioning him as a strong advocate for innovative educational solutions across Europe.

Cristiano Ronaldo

Cristiano Ronaldo, hailing from Portugal, is a global icon whose legacy goes far beyond his achievements on the football field. Known for his dedication to health, fitness, and luxury, Ronaldo’s investment portfolio reflects these personal values and aligns with his brand as a disciplined, high-performance athlete.

David Beckham

David Beckham, a legendary English footballer, has transitioned from the sports world to become a savvy businessman with investments that span wellness, fashion, and tech. Known for his style and influence, Beckham’s entrepreneurial ventures reflect his commitment to forward-thinking, impactful businesses that resonate with his refined taste.

Beckham is a co-founder of Guild Esports, a London-based esports organization that represents his entry into the digital gaming space. He also invested in Lunaz, a UK-based company converting classic cars into electric vehicles, blending tradition with sustainability. Another of his ventures is IM8 a company dedicated to innovative, world-leading scientific advancements in health. Additionally, Beckham recently sold his stake at Cell AI, a cannabinoid wellness brand that taps into the rapidly growing wellness industry. His portfolio showcases a commitment to innovation in industries he’s passionate about, solidifying his role as a dynamic investor in Europe’s startup ecosystem.

Iker Casillas

Iker Casillas, the former Spanish goalkeeper, is a celebrated sports figure known for his leadership and skill on the field. Since retiring, Casillas has become a passionate supporter of tech-driven startups focused on sports and health, aligning with his experience and interests in performance and well-being.

Casillas invested in Kognia Sports Intelligence, an AI-powered video analysis startup that aims to enhance sports performance by providing in-depth tactical insights. Alongside Gerard Piqué, he invested in Kamleon, a Barcelona-based startup transforming bathrooms into smart spaces for monitoring well-being and health. Additionally, Casillas founded SportBoost, a sports startup accelerator that supports emerging talent and new companies in the sports technology sector. Through these investments, Casillas champions the use of technology to improve health and athletic performance, making him a strong advocate for innovation in the sports industry.

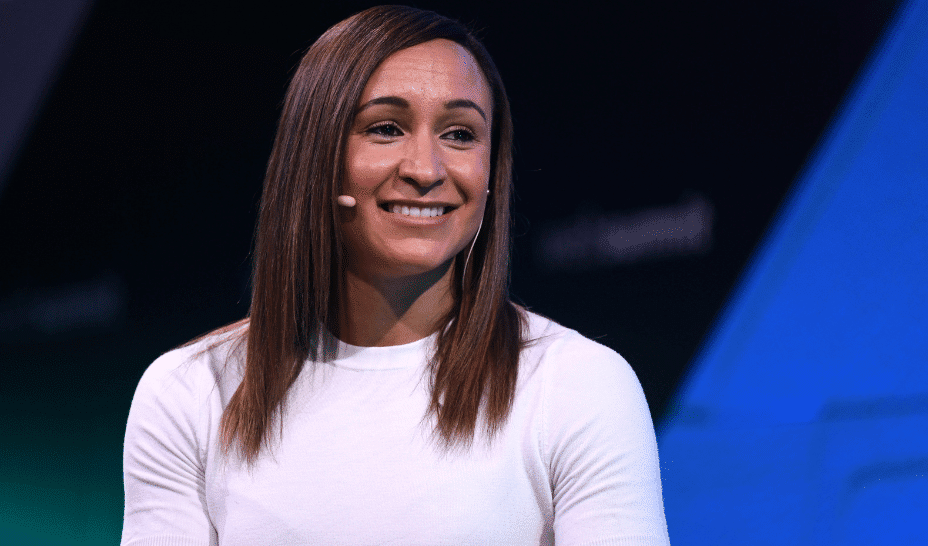

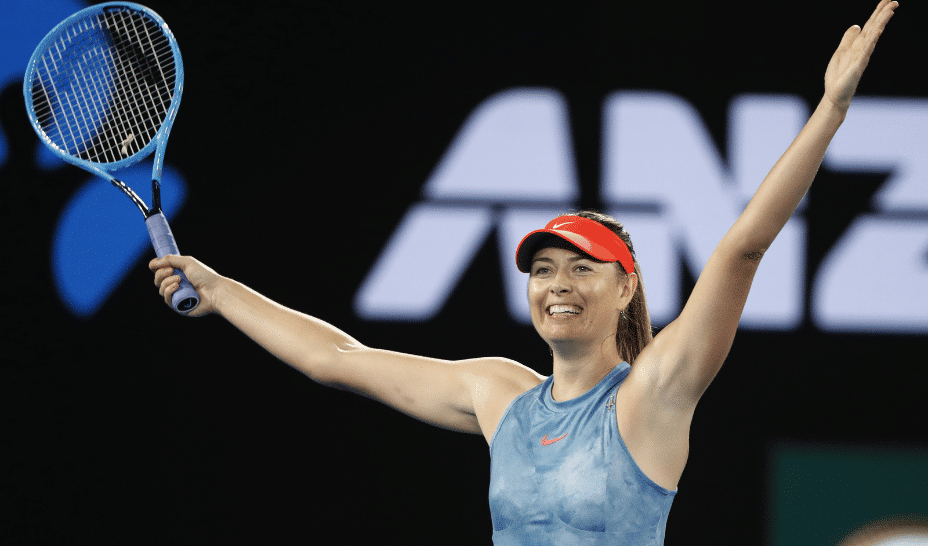

Maria Sharapova

Maria Sharapova, a former tennis champion from Russia, is renowned not only for her achievements in sport but also for her entrepreneurial acumen. Known for her commitment to wellness and sustainability, Sharapova has strategically backed companies that reflect her dedication to positive environmental impact.

One of her key investments is Supergoop!, a sunscreen brand dedicated to educating consumers on sun protection and creating accessible, everyday skincare products. She joined Supergoop! early on and has been instrumental in its growth. Additionally, Sharapova launched her own candy brand, Sugarpova, a premium candy line that reflects her personal brand of fun and luxury, it became very popular, and she decided to sell it in 2021. Sharapova is also an investor in wellness and beauty brands, including Bala Bangles, and Therabody. She also serves as a board member of Moncler, further expanding her influence in the luxury and lifestyle sectors.

Mario Götze

Mario Götze, a celebrated German footballer, known for his agility and creativity on the pitch. Off the field, he channels this innovative spirit into Companion-M, a media and venture firm he co-founded, aimed at empowering early-stage entrepreneurs. With a portfolio of over 40 startups, Companion-M focuses on areas such as technology, SaaS, climate tech, health tech, and Web3, showcasing Götze’s commitment to transformative, high-impact innovation.

Among Companion-M’s notable startup investments are Junto, an ed-tech platform revolutionizing digital learning, and ScorePlay, a sports tech company enhancing media management for athletes. Through these ventures, Götze extends his drive for excellence into the startup world, positioning himself as a strategic and influential backer within Europe’s dynamic entrepreneurial ecosystem. In addition to startups, Companion-M invests in funds like World Fund, a Berlin-based climate tech fund, aligning with Götze’s dedication to sustainability.

Pau Gasol

Pau Gasol, a Spanish basketball legend, has an investment portfolio that reflects his diverse interests in health, wellness, and sports. Known for his longevity and discipline as an athlete, Gasol’s investments focus on innovative wellness technologies that support physical and mental health.

Gasol is an investor in Therabody, a recovery tech company specializing in percussive therapy, and Oura, a wellness ring that tracks sleep and physical activity. Additionally, he has invested in BetterUp, a mental health and coaching platform. His portfolio underscores his commitment to supporting technologies that aid recovery and well-being, providing tools that promote healthier lifestyles for athletes and the general public.

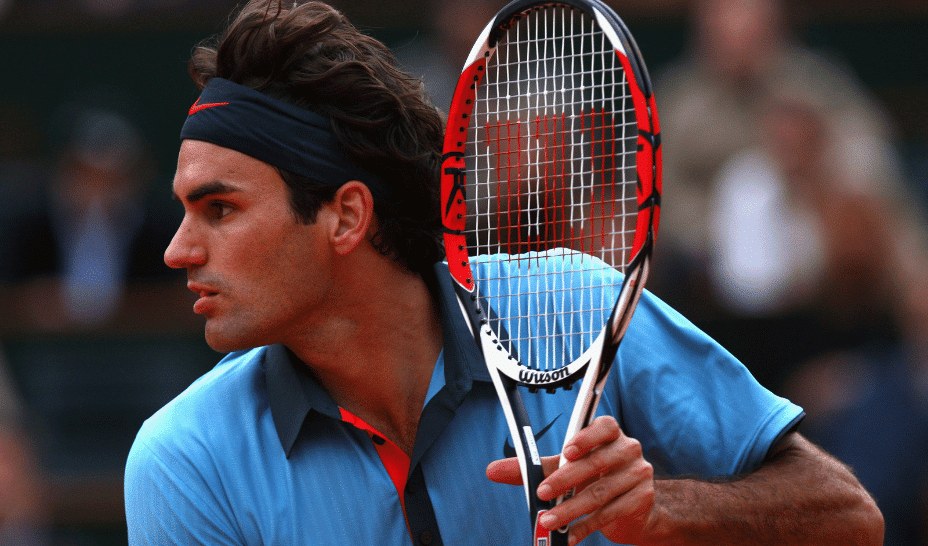

Roger Federer

Roger Federer, a Swiss tennis icon, is celebrated for his elegance and precision, traits that extend to his business ventures. Federer has leveraged his brand to support startups that emphasize quality, innovation, and sustainability, reflecting his discerning taste and commitment to impactful investments.

Federer’s most prominent investment is in On, a Swiss running shoe and apparel brand that went public in 2021 with a valuation of $6.5 billion. He also invested in NotCo, a Chilean food tech startup with a focus on plant-based products, which achieved unicorn status. Federer’s backing of these companies illustrates his interest in sustainable innovation and positions him as a forward-thinking investor in the European startup landscape.

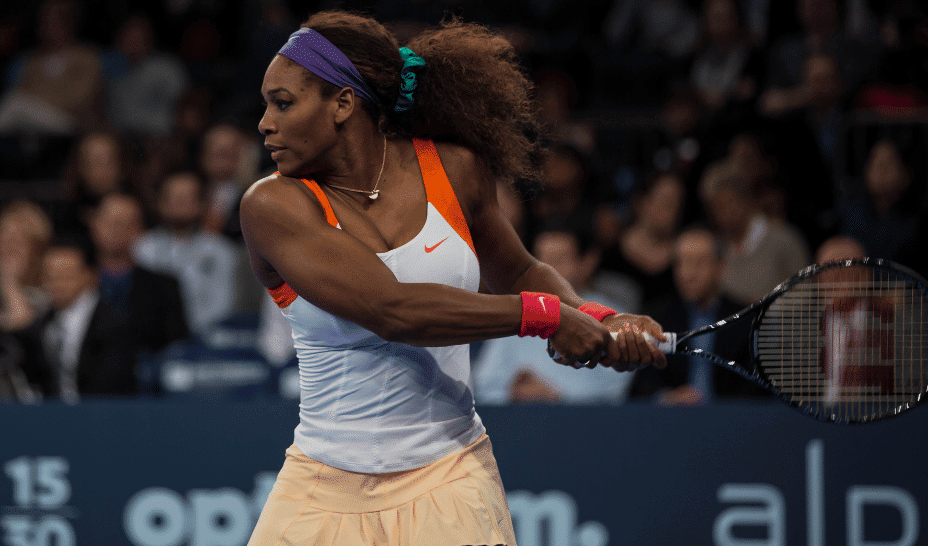

Serena Williams

Serena Williams, an American tennis legend, has expanded her influence beyond the court as a venture capitalist, supporting startups with a focus on diversity, inclusion, and innovation. Through her firm, Serena Ventures, Williams has backed numerous companies in tech and wellness that reflect her values of empowerment and social impact.

Williams has invested in MasterClass, an online education platform with a significant European subscriber base. Her involvement with Nexar, an AI-powered dashcam startup aimed at improving road safety, aligns with her commitment to tech that drives social good. These are some od the investments that showcase her strategic approach to supporting companies that make a meaningful difference, both in Europe and globally.

Read the orginal article: https://www.eu-startups.com/2024/10/championing-innovation-10-sports-legends-fuelling-european-innovation/