A report by INSEAD and Jada Fund of Funds demystifies the complexities of valuation in the venture capital market and offers a roadmap to value early-stage companies.

SINGAPORE and ABU DHABI, UAE and FONTAINEBLEAU, France, Oct. 28, 2024 /PRNewswire/ — How do venture capital (VC) funds value their portfolio companies throughout the holding period? This is a challenging question when dealing with start-ups with little or no financial, operating or product history in emerging markets.

Claudia Zeisberger, Senior Affiliate Professor of Entrepreneurship and Family Enterprise at INSEAD and David Munro, Head of Research at 5 Quadrants, co-authored the report “VC Valuation in MENA: A Reality Check” commissioned by Jada Fund of Funds, taking a deep dive into the common methodologies employed by venture capitalists.

Based on data, surveys and interviews with experienced fund managers and investors across the Middle East and North Africa (MENA) region, the report offers insights into the policies, practices, concerns and aspirations of the participants in MENA’s rapidly developing private capital markets.

MENA’s start-up scene is rapidly reaching critical mass with tailwinds from a young demographic, ample capital and governmental support, especially in Saudi Arabia, where initiatives like Vision 2030 have made it a VC magnet. Developing knowledge of more accurate and reliable valuations would be a way to strengthen the private capital ecosystem in the promising region.

This report is timely, as the global tech sell-off of 2022-2023 brought home the importance of accurate, transparent and consistent valuation methods. Especially in the opaque world of private capital, sound valuation is fundamental to maintaining trust and transparency in the market.

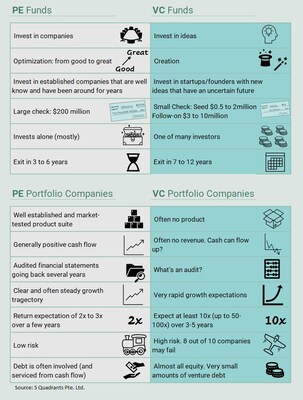

At the start of the report, Zeisberger and Munro qualified that not all private capital is the same: While PE optimises a company, VC creates a company. The distinction comes with different risk levels, investment horizons, expected returns, and, more importantly, different valuation methods.

The report delves into the complexity of valuing start-ups, issues such as the proliferation of SAFE notes and ill-managed capitalisation tables, and analysis of common valuation tools such as venture valuation and comparative company analysis. More importantly, it explains why the selected tool should correspond with the stage of the start-up and how, in some cases, interviewees employ a combination of tools. In other words, valuation is more a craft than an art or a science.

Photo – https://mma.prnewswire.com/media/2538175/image_848950_29267364.jpg

Logo – https://mma.prnewswire.com/media/2506154/INSEAD_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/improving-valuation-accuracy-a-new-guide-for-vcs-in-mena-302285875.html

View original content:https://www.prnewswire.co.uk/news-releases/improving-valuation-accuracy-a-new-guide-for-vcs-in-mena-302285875.html

Read the orginal article: undefined