When you dream of launching a VC fund, you imagine a frustration-free world where you invest in the companies you choose and work with founders your way.

What you don’t think about is quite how hard it will be. Cocoa, my VC fund, is the joy of my life. But it’s also the most challenging thing I’ve ever done.

When you raise your first fund, especially if it’s small and you are solo, most LPs worry about how you will allocate your time, and scale investing and portfolio support. Yet the biggest, most unexpected bottleneck I encountered is around ops — everything from setting up a fund structure to all the processes and providers required to run a fund. Setting up a fund can feel like a Catch-22, with so many entities and jurisdictions that bring interlocking costs, tax and regulatory considerations.

In this piece — and part two which will follow — I’ll share what I’ve learnt setting up a fund, to hopefully help future emerging managers save time, money and headaches.

Disclaimer: Cocoa is built on AngelList, which means it’s a US fund and the structure is a bit unique, but here I’m focusing on a typical UK fund structure that hopefully is relatively transferable to other jurisdictions.

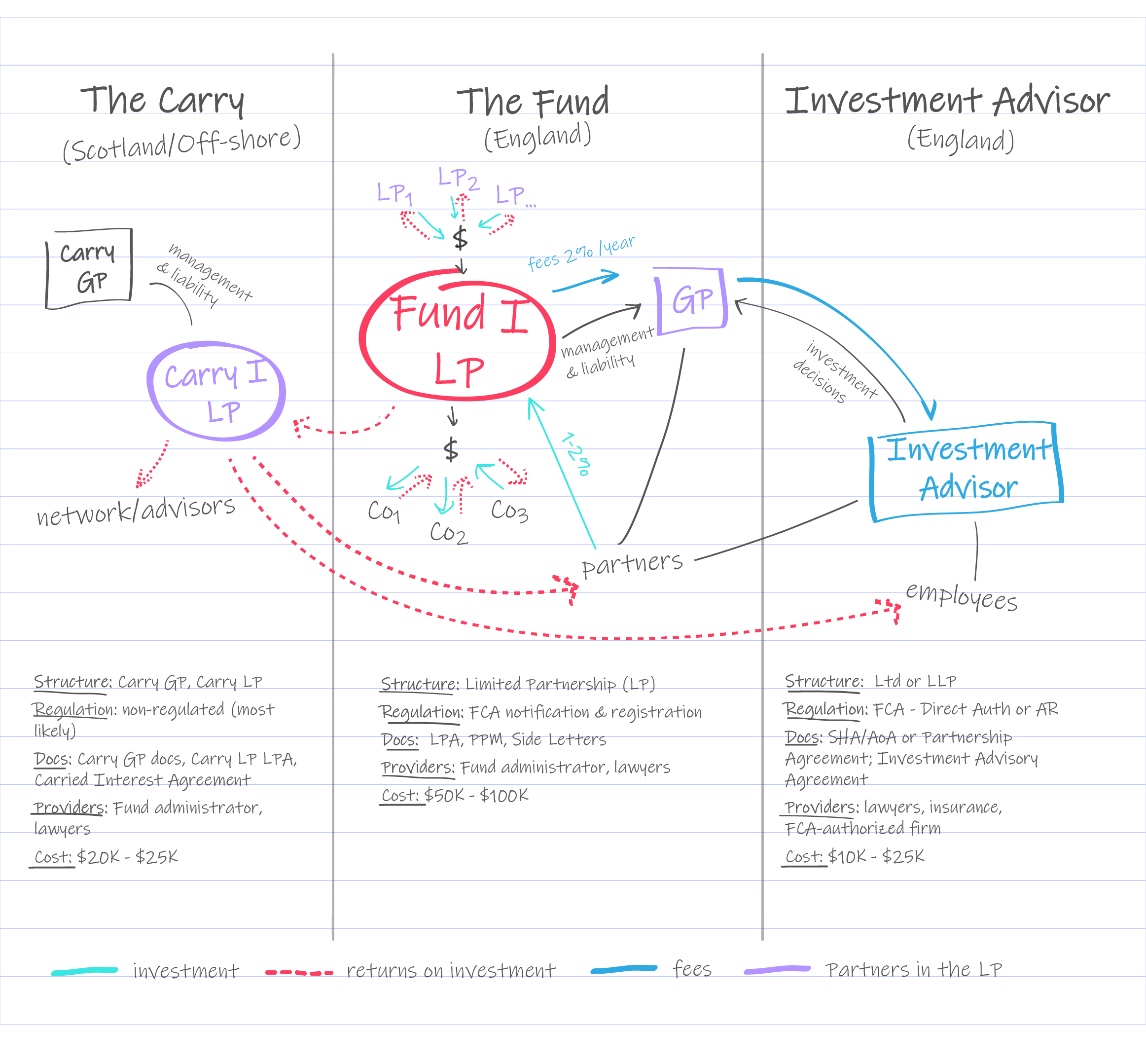

The Fund

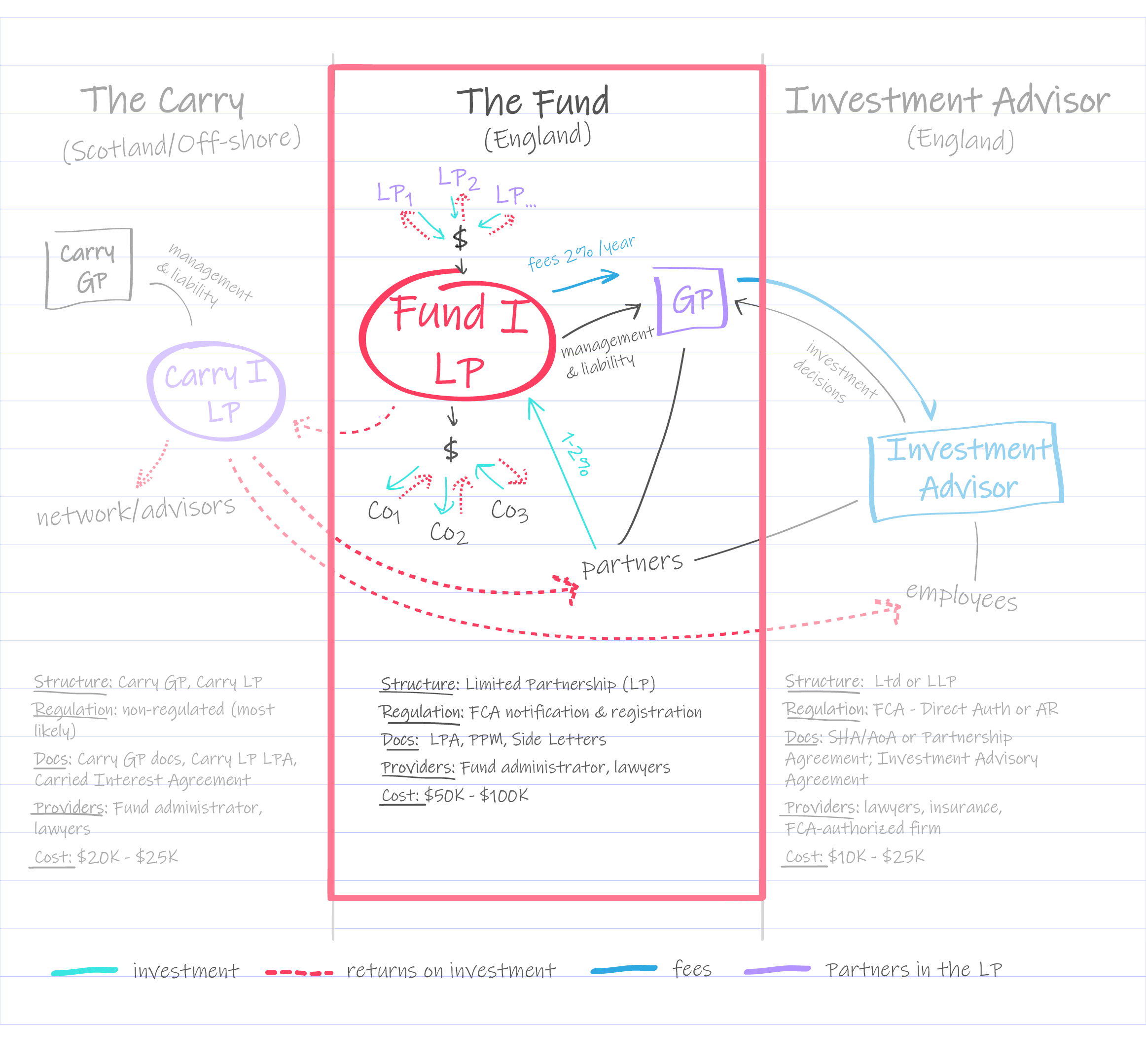

Structure: In the UK, the Fund is usually set up as an English Limited Partnership (LP). It is managed by a General Partner (GP) and it receives capital from investors, known as Limited Partners (LPs), to be invested into companies (portfolio).

The partners of an LP are:

- General Partner: The GP is responsible for the Fund management. The GP has unlimited liability and so it’s advisable to establish the GP as a limited liability entity (Ltd or LLP), rather than have a person be the GP, to ring-fence liability for the debts and obligations of the Fund. The Fund pays the GP management fees for managing operations and carrying the liability: those fees are, on average, 2% of assets under management each year.

- Limited Partners: These are the investors in the Fund. And the clue is in the name — their liability is limited to the capital they commit. They share investment profits but cannot participate in day-to-day management and decision-making to keep their limited liability status.

- Carried Interest Partner: The Carry LP, often called the ‘Carried Interest Partner’, is a Limited Partner that receives 20-30% of the fund’s net returns, after the other Limited Partners have received all their capital back and have achieved a minimum return on their investment. More on the carry structure below, as it deserves its own section.

A Limited Partnership does not have a separate legal personality from its partners and cannot make decisions independently. In an LP, decision-making authority and liability lies with the GP, while the rest of partners are liable only up to the amount that they agree to subscribe to the partnership. The income, losses and tax obligations of an LP also pass through to the individual partners, which is why Limited Partnerships are known as pass-through or transparent entities.

Key fund terms: A fund typically has a 3-5 year investment period (time to make new investments) and a 10-12 year lifespan (time to hold investments before exiting), with the possibility of extending it by agreement with investors (10+2, 12+2). This is why fund managers usually raise a fund every 2-3 years. A fund can be denominated in any currency, so a UK-based fund can be in USD or EUR (but always mind the foreign exchange risk).

Regulation: In the UK, certain types of fund will need to be notified and registered with the Financial Conduct Authority (FCA) before they can admit investors and deploy capital, but a fund is not usually regulated in its own right. However, it must be operated by an FCA-authorised firm (we’ll expand on this below).

Key fund docs

- LPA: The Limited Partnership Agreement (LPA) governs the Fund, outlining how it will operate, investor contributions, management fees and distribution of investment proceeds (including the carry terms).

- PPM: The Private Placement Memorandum provides prospective investors with detailed information about the investment opportunity, including terms, risks and potential rewards.

- Side Letter(s): Specific terms and conditions requested by certain LPs that differ from the LPA are included in side letters — supplementary agreements between the General Partner (GP) and one or more Limited Partners (LPs). Example terms in a side letter may include specific tax or reporting requirements, excuse rights for prohibited investments (in the event the LP’s capital cannot be deployed in respect of certain types of investments), or the right for the investor to sit on the limited partner advisory committee (or LPAC).

Key providers to set up the Fund

- Lawyers: To set up the legal structure of the Fund and draft the documents.

- Fund administrator: Manages back-office functions such as accounting, financial reporting, capital calls and distributions, KYC/AML compliance and tax filings.

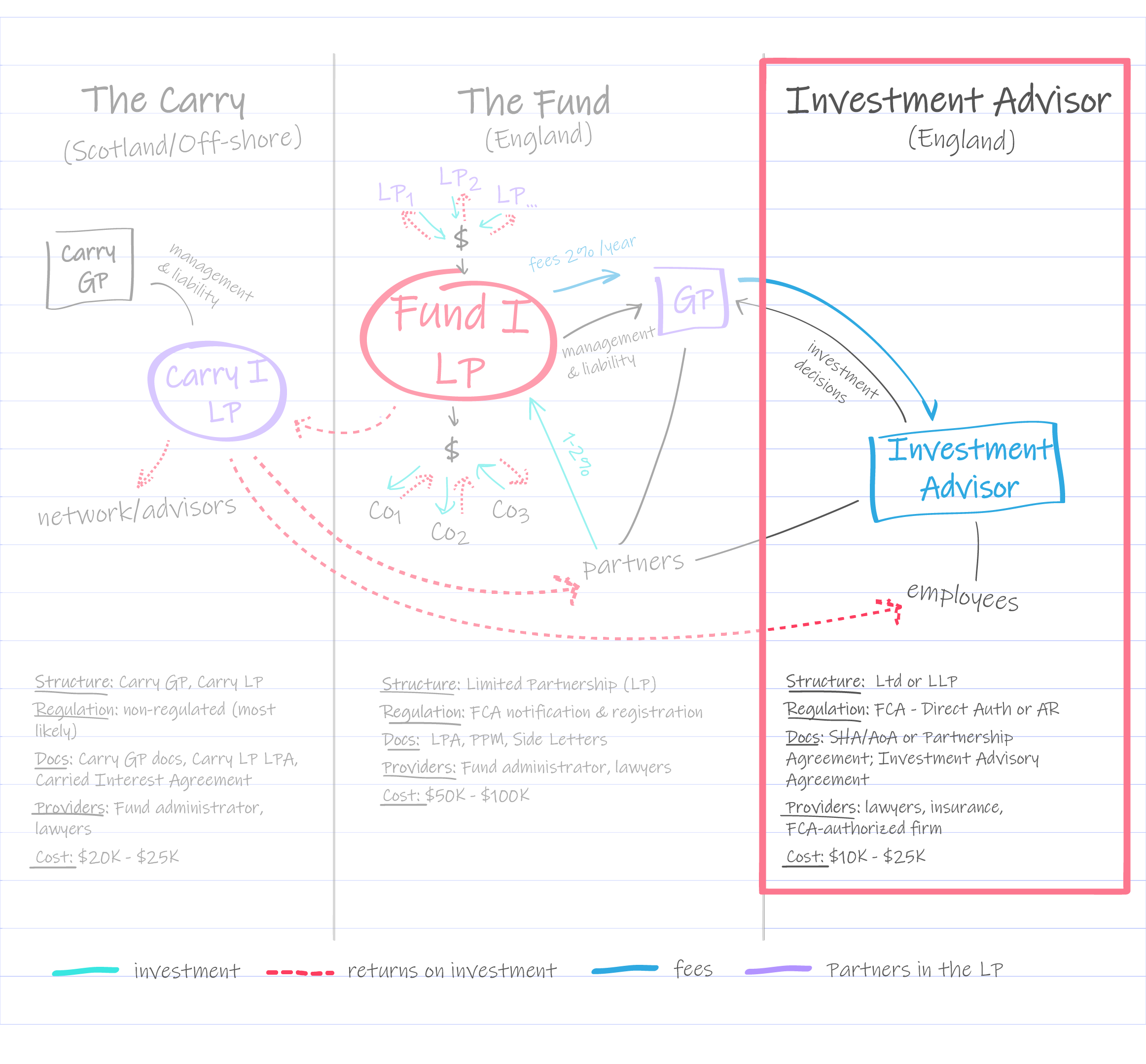

The Investment Advisor

Typically, the GP delegates the Fund’s business operations and investment decisions to another entity — the Investment Advisor — that is regulated, either directly or via the Appointed Representative Regime (see below). Management fees then flow from the fund or the GP to the Investment Advisor to cover operational costs like salaries, travel and office rent (we’ll explore these costs in Part II).

Structure: In the UK, an Investment Advisor can be a Ltd (Limited company) or an LLP (Limited Liability Partnership). Both a Ltd and an LLP can make decisions independently and there’s limited liability for shareholders or members. An Ltd and an LLP differ primarily in the membership structure and taxation. Consult a lawyer and tax advisor to determine which one suits your fund’s structure best.

Regulation: As mentioned above, in the UK a fund must be notified and registered with the FCA before it can admit investors and deploy capital, but it is not a regulated entity. However, it must be managed and operated by an FCA-regulated entity.

There are two main options for the Investment Advisor to comply with applicable regulatory requirements:

a) Direct Authorisation: the Investment Advisor is directly authorised by the FCA to carry on regulated activities in the UK and to operate the fund independently. This involves the Investment Advisor being regulated by the FCA, which means (among other things) needing to establish a full compliance function and to comply with regulatory capital requirements.

b) Appointed Representative: the Investment Advisor acts as an Appointed Representative of an FCA-authorised firm (known as AR Principal). The AR Principal manages the fund and is legally responsible for all investment decisions and regulated activities in the UK. The Appointed Representative (Investment Advisor) brings potential investments to the AR Principal for review and approval. The AR Principal will have extensive control over the operation of the Fund, because it has ultimate responsibility to the FCA as the regulated entity. Firms like The Fund Incubator offer this service for a monthly fee.

Choosing between these options depends on time (6+ months for Direct Authorisation vs. 6-8 weeks for Appointed Representative) and cost (upfront costs for Direct Authorisation vs. ongoing monthly fees for an Appointed Representative). Most funds start with the Appointed Representative structure and transition to Direct Authorisation for subsequent funds once they have more infrastructure and a larger team to handle the increased compliance and reporting burdens.

Key docs

- Investment Advisor incorporation docs: For an LLP, a Partnership Agreement is needed; for an Ltd, you’ll need a Shareholder Agreement and Articles of Association. These will be straightforward if you are solo, but may require more negotiation if you are forming a partnership alongside another partners.

- Investment Advisory Agreement: An agreement between the GP and the Investment Advisor outlining the Advisor’s role in sourcing, due diligence and recommending investment opportunities for the fund, in exchange for fees.

- (Appointed Representative Agreements: If the Investment Advisor is an Appointed Representative and not directly authorised by the FCA).

Key providers

- Corporate lawyers: To set up and incorporate the Investment Advisor and draft the necessary documents.

- FCA-Authorised firm: To act as regulatory umbrella (AR Principal) for the Investment Advisor, if not directly regulated by the FCA.

- Insurance: Before commencing operations, the Investment Advisor needs professional indemnity insurance to cover claims of negligence or inadequate work.

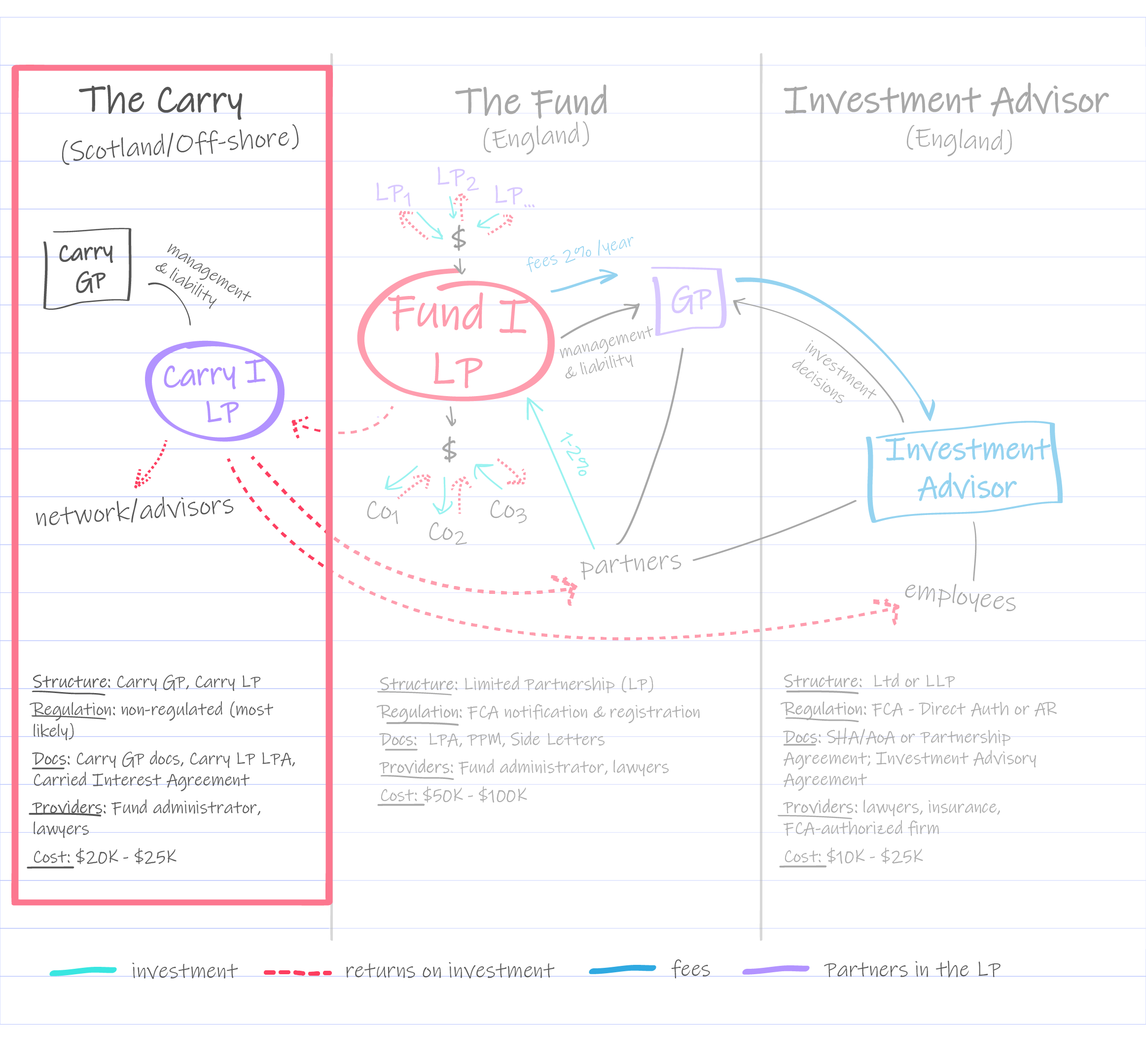

The Carry

Carried interest, typically 20%-30% of the Fund’s net returns, is how VC firms reward and motivate investment partners, employees and networks who contribute value — by sourcing deals and supporting due diligence and portfolio companies.

Structure: The Carry LP is often also structured as a Limited Partnership, like the underlying Fund. As a Limited Partnership, the Carry LP will also require a GP to manage it. The carry interest beneficiaries will be Limited Partners in the Carry LP. And to earn carried interest from the Fund’s proceeds, the Carry LP is a Limited Partner in the Fund.

For UK fund structures, the carry structure is generally set up in Scotland or off-shore (Guernsey, Jersey). Deciding where to set up the carry entity should be based on set-up and running costs, as well as regulatory requirements. If you’re wondering why tax is not a key factor when setting up the Carry LP, it’s because the carry entity is a tax-transparent entity. The carry beneficiaries pay tax in their own jurisdiction, rather than in the jurisdiction of the carry entity.

Regulation: The Carry LP is likely to be non-regulated and operated by the Investment Advisor (either directly or by the FCA-regulated AR Principal). Regulatory requirements are different offshore.

Providers: In Scotland, you will need a local law firm to set up the carry entity and fulfil secretarial duties. Offshore, you will need fund administrators to manage the carry GP and LP and they’ll manage the local lawyers.

Key docs

- Carry LP LPA: Same applies as for the Fund LPA.

- Carry GP incorporation docs: To establish the Carry GP.

- Carried Interest Agreement: To assign and regulate the distribution of the carried interest amongst the Carry LP partners.

Elephant in the room: the costs of setting up a fund

Management fees are 2% of a fund’s Assets Under Management (AUM) per year over the lifetime of the fund (10 years, generally). This means that the smaller the fund, the lower the management fees. Personally, I like the alignment of incentives that come with a small fund’s lower fees and greater emphasis on carry; as I’m not getting tons of fees, I will only make money (earn carry) if I make money for LPs first — but I’ll also have to make do with fewer resources.

Hence, for small funds, accurate cost estimates and cash flow planning is essential. We’ll dive into the costs of running and building a viable small fund in Part II. But for now, when launching, there are two big expenses to keep in mind:

- Set-up costs: These can range from $100k to $200k. Some set-up costs can be charged to the fund, reducing the management fees, but also the capital available for investments.

- GP commit: You’ll be expected to contribute 1-2% of the fund size as an LP (e.g., $100k-$200k for a $10M fund). If you lack the cash, options like loans or fee adjustments are available. Discuss this with your LPs as this is about “skin in the game”.

Setting up a venture fund is a +10 year commitment and regulatory obligations and associated costs continue for the duration of the fund—even long after management fees have stopped. It is important to plan for that.

TL;DR

When you start a fund, you go from being a full-time investor to being a full-time investor, part-time lawyer, accountant and PA. If you don’t do something, it doesn’t get done.

If, knowing this and after reading this post, you’re still excited to launch your fund, here’s a final tip: when setting up your fund structure, optimise for simplicity and flexibility. Things are already complex enough, keep the structure as simple as possible — it will make everything easier and more fun.

And stay tuned for Part II for more tips on how to actually run the fund.

Thank you Flora and Barry from TFI and David Griffith-Jones from Slaughter & May for kindly reading this post and making sure I didn’t get you/or myself in any trouble.

And on that note, a reminder that nothing in this article should be taken as legal or tax advice. The examples and options shared are simply for general information, and it’s always a good idea to do your own research and consult with a professional to find what works best for your situation.

Cocoa Advisor LLP is an Appointed Representative of The Fund Incubator Limited which is authorised and regulated by the Financial Conduct Authority – FRN 208716

Read the orginal article: https://sifted.eu/articles/how-to-set-up-vc-fund-structure/