Biotechnology, or biotech, uses living organisms to create products and technologies that improve our lives. This field spans not only healthcare but also sectors such as agriculture, environmental protection, and industrial processes, leading to innovations such as life-saving drugs, genetically modified crops, and sustainable production methods. By integrating biology, chemistry, physics, and engineering, biotech addresses complex challenges.

The UK stands out in the global biotech landscape, driven by strong investment, cutting-edge research, and a collaborative ecosystem. In 2023, UK biotech companies secured £1.8 billion in funding, leading Europe in cell and gene therapy investments and clinical trials. Despite facing challenges in manufacturing scalability, talent acquisition, and patient access, the UK’s vibrant startup scene, supported by academic institutions and industry partnerships, continues to thrive.

Following our recent listicle on biopharma, this article highlights the most promising biotech startups in Europe. These companies are making significant contributions to medical and environmental advancements, exemplifying innovation and scientific excellence. This dynamic sector is transforming fields and attracting significant investment, underscoring the impactful nature of the European biotech industry.

Amber Therapeutics: Based in London, Amber Therapeutics develops advanced neuromodulation therapies to treat mixed urinary incontinence in women. Their innovative Picostim™ System targets the pudendal nerve with a fully implantable device that can both stimulate and sense responses, adapting to individual needs. The AURA-2 study showed the system is safe, effective, and significantly improves quality of life. Founded in 2021, Amber combines medical device expertise with a focus on innovative solutions for unmet clinical needs. The company has raised €94.9 million to advance its innovative treatments.

Ascend Gene & Cell Therapies: Headquartered in Potters Bar, Ascend Gene & Cell Therapies supports manufacturing and process development projects from design through to clinical and commercial scales. They partner with biotechnology teams to embed scalable manufacturing in their operations from the outset. They focus on quality and adaptability, investing in technologies to meet diverse process needs. Founded in 2021, Ascend Gene & Cell Therapies has raised over €122 million.

Clean Food Group: Based in London, Clean Food Group provides sustainable ‘CLEAN’ alternatives to traditional fats and oils, ranging from liquid oils like soybean to hard fats like palm oil, cocoa butter, and milk fat. Their mission is to produce food ingredients that are better for the environment and health without compromising on taste or performance. Founded in 2022, Clean Food Group has raised €8.9 million.

Clock Bio: Headquartered in Cambridge, Clock Bio aims to extend and improve quality of life by reversing the effects of ageing in cells using human pluripotent stem cells. They develop treatments to prevent and treat age-related diseases by decoding rejuvenation programmes in human cells. Clock Bio’s ageing model force-ages hiPSCs to trigger self-rejuvenation, using CRISPR screens to identify key genes. This technology helps them understand rejuvenation biology and create innovative treatments. Founded in 2020, Clock Bio has raised €3.7 million.

ExpressionEdits: Based in Haverhill, ExpressionEdits operates in the biotechnology industry, focusing on the redesign of synthetic DNA instructions. Their AI-powered platform integrates millions of biological data points with machine learning algorithms to optimise gene design. This technology allows them to predict and prioritise key gene properties, enabling the production of previously elusive therapeutic proteins. Founded in 2021, ExpressionEdits has raised €12 million to redefine the status quo of protein expression, which is crucial for advancements in biotech and synthetic biology.

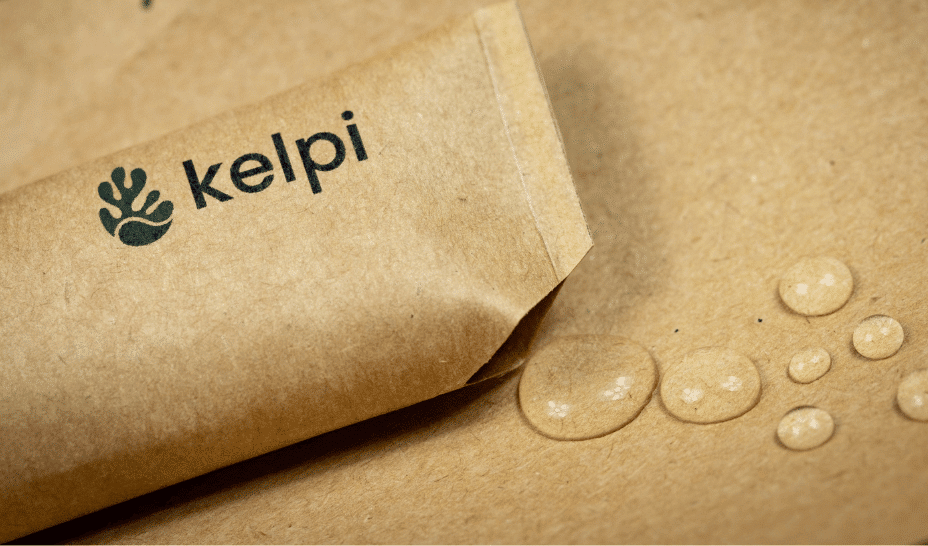

Kelpi: Located in Bristol, Kelpi develops sustainable, compostable, and recyclable packaging solutions using seaweed-based bioplastic coatings. They collaborate with global brands to replace single-use plastics with environmentally friendly alternatives. Kelpi’s team combines world-class scientists and proven business leaders to tackle plastic pollution and climate change. Founded in 2020, Kelpi has raised €9.7 million.

OXCCU: Based in Oxford, OXCCU develops renewable energy technology aimed at achieving a circular economy for fuels, chemicals, and plastics. Their technology converts CO2 and hydrogen into sustainable aviation fuel, chemicals, and biodegradable plastics. Their one-step process simplifies traditional methods, making them more cost-effective and efficient. Founded in 2021, they have raised over €24 million, aiming to provide sustainable alternatives to fossil fuels and support a carbon-neutral future.

Rhizocore: Based in Edinburgh, Rhizocore produces locally adapted mycorrhizal fungi to improve tree planting success. By using native fungi, they offer a sustainable solution to accelerate woodland regeneration, enhance forest productivity, and boost natural capital benefits. Their product, the Rhizopellet, contains fungi tailored to each planting site, helping young saplings thrive with increased growth rates, stronger resilience, and better carbon capture. Founded in 2021, they have raised over €4.7 million.

Solasta Bio: Headquartered in Glasgow, Solasta Bio develops bio-safe, sustainable pest control solutions for agriculture. Their precision-targeted biotechnologies effectively protect crops from specific pests without harming non-target species, including pollinators, humans, and the environment. These solutions are environmentally friendly, biodegradable, and prevent resistance build-up. Founded in 2020, Solasta Bio has raised over €7 million, aiming to provide innovative and sustainable alternatives to traditional pesticides.

Tenpoint Therapeutics: Located in Camborne, Tenpoint Therapeutics develops regenerative therapies to treat ocular diseases by replacing damaged or lost cells in the eye. They use engineered cell-based therapeutics and in vivo reprogramming to restore vision. Their approach includes creating pluripotent stem cells, differentiating them into specialised ocular cells, and transplanting them into the eye. Founded in 2020, Tenpoint Therapeutics has raised €64.5 million, aiming to revolutionise vision restoration with long-lasting treatments that reverse the course of eye diseases.

By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service!

Read the orginal article: https://www.eu-startups.com/2024/07/from-labs-to-market-10-promising-biotech-startups-based-in-the-uk/