Barcelona-based beauty tech startup Olistic has topped the newly launched Sifted 50: Southern Europe Leaderboard — a ranking of the 50 startups with the strongest revenue growth over the past three financial years across Italy, Spain, Portugal, Greece and Cyprus.

Founded in 2021 and backed by IRIS Ventures, Olistic scientifically treats hair loss and the factors that contribute to it with supplements sold directly to customers. The company achieved a compound annual growth rate (CAGR) of 529.01% across the past three financial years.

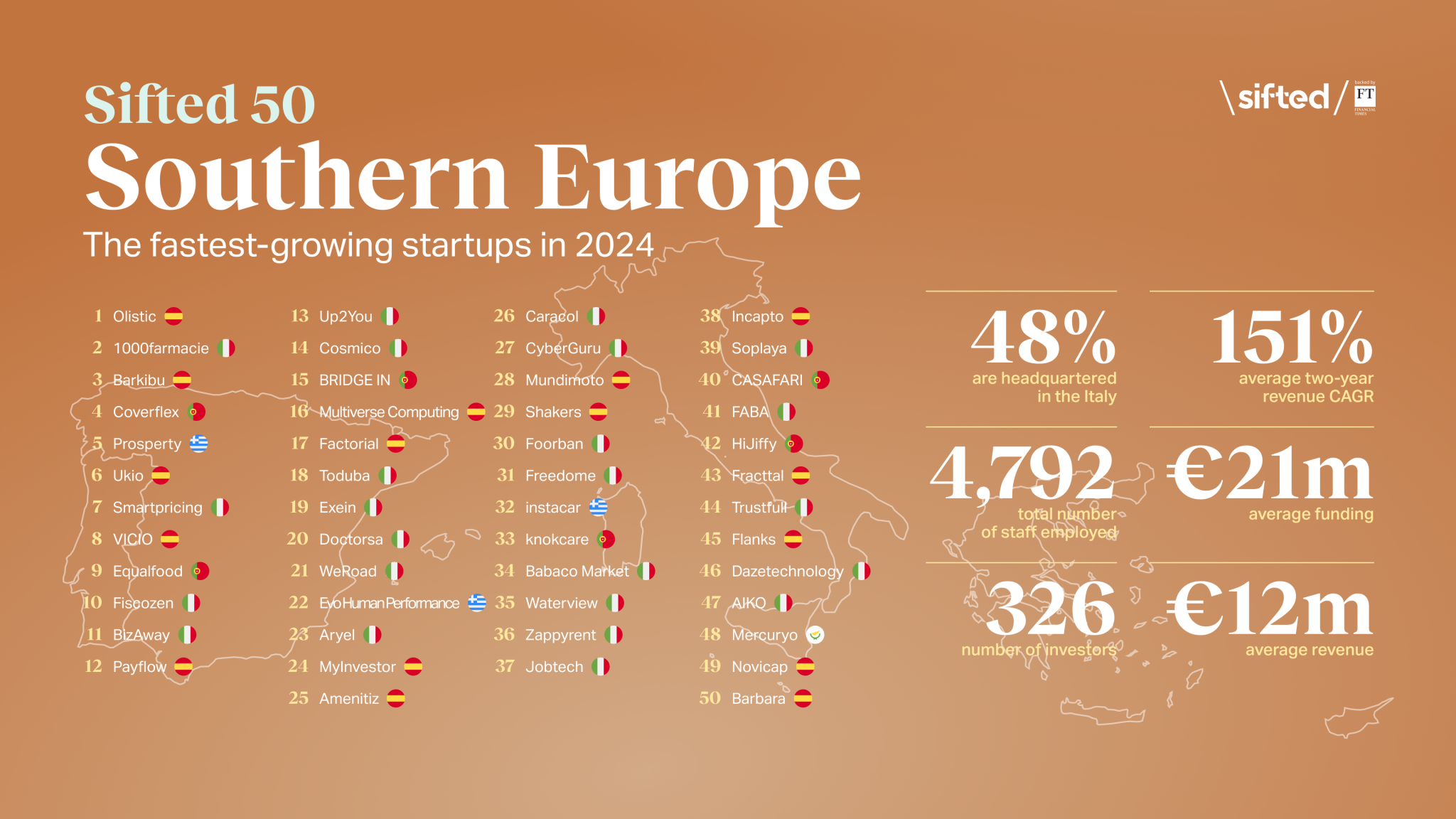

Following in second place is 1000Farmacie, a Milan-based digital marketplace for pharmacy goods with a CAGR of 333.10%, and in third place is Galicia, Spain-based Barkibu, a pet insurer with a CAGR of 314.04%.

The Sifted 50: Southern Europe in summary

Combined, the 50 startups have raised €1.03bn in funding and generated revenues of €1.02bn over the past three financial years, while employing nearly 4,800 people.

48% of the companies on the ranking are based in Italy; 32% in Spain; 12% in Portugal; 6% in Greece; and 2% in Cyprus. Companies from Andorra, Malta and San Marino were also eligible, but none made the shortlist.

The majority of companies on the ranking are early-stage — 74% last raised seed or Series A rounds, while just six startups last raised a Series B or C. Four startups most recently secured debt financing, including Spanish HR tech unicorn Factorial, which received $80m from General Catalyst in April.

B2B SaaS is the most dominant vertical in the ranking (19 companies). The next most represented verticals are consumer (13) and fintech (9).

The most active investors

Southern Europe’s class of 2024 have been bankrolled by 326 investors. The most active backers are Milan-based asset manager Azimut Group, Rome-based public investor CDP Venture Capital, Milan-based VCs P101 Ventures and United Ventures, and Paris-HQd investment firm Partech.

The 10 fastest-growing startups in Southern Europe

1/ Olistic — develops scientifically-backed supplements that treat hair loss

2/ 1000Farmacie — digital marketplace for pharmacy goods

3/ Barkibu — digital-first pet insurer

4/ Coverflex — helps companies offer flexible employee benefits

5/ Prosperty — a platform that lets you can buy, sell or rent property

6/ Ukio — short-term furnished apartment rental platform

7/ Smartpricing — revenue management software for both hotels and apartments

8/ VICIO — a burger delivery brand

9/ Equal Food — fruit and vegetable delivery platform

10/ Fiscozen — finance and tax management platform for freelancers and small businesses

How we selected the Sifted 50: Southern Europe

Startups were invited to apply to be on the ranking from May 20 to June 21, 2024.

To be eligible, companies had to meet the following criteria:

- Headquartered in Andorra, Cyprus, Greece, Italy, Malta, Portugal, Spain or San Marino;

- Private and independent and founded in or after 2014;

- Maximum headcount of 999;

- Majority of revenue must be generated by proprietary technology;

- At least three years of revenue data, with revenue (annualised if necessary) of at least €100k in the base year (2020, 2021 or 2022) and at least €1m in the most recent financial year (2022, 2023 or 2024). Companies were required to submit signed documentation to support disclosed financial information not publicly available.

Sifted Leaderboards do not claim to be exhaustive as private company data can be difficult to acquire. Leaderboards are based on historical financial data and are no guarantee of future company performance.

Read the orginal article: https://sifted.eu/articles/olistic-tops-sifted-leaderboard-southern-europe-fastest-growing-startups/