Biopharmaceuticals, often known as bio-pharma, represent a dynamic sector within the pharmaceutical industry that uses biological processes to develop drugs and therapies. Unlike traditional pharmaceuticals, which are typically synthesized chemically, bio-pharma products are derived from living organisms such as cells, tissues, or proteins. This field offers targeted and precise treatments that can address complex diseases at a molecular level, often with fewer side effects compared to conventional drugs.

The development of biopharmaceuticals involves advanced biotechnology techniques, such as recombinant DNA technology, genetic engineering, and cell culture processes. This requires significant expertise and sophisticated research facilities, often leading to longer development timelines and higher production costs. However, in Europe, the bio-pharma sector is growing rapidly due to the substantial potential benefits of bio-pharma products. They provide innovative solutions for conditions that have been difficult to treat with traditional medicines, such as certain types of cancer, autoimmune diseases, and genetic disorders.

On that note, we have curated a list of 10 promising bio-pharma startups in Europe that are at the forefront of this innovation. These companies, all founded between 2019 and 2024, are advancing scientific knowledge and developing groundbreaking treatments that have the potential to transform healthcare globally.

Accession Therapeutics: Based in Oxford, Accession Therapeutics is developing novel immuno-oncology therapeutics, combining high specificity and potency to counter tumour diversity. It is the first company to engineer a viral point of entry to cancer cells while bypassing healthy cells. Founded in 2024, and Led by Dr Bent Jakobsen, the company has raised €60.8 million to revolutionize cancer therapy by eradicating tumour cells while sparing healthy ones.

Adendra: Headquartered in London, Adendra Therapeutics is developing next-generation immunotherapies for cancer and other illnesses by leveraging new insights into dendritic cell biology. Their technology targets dendritic cells’ ability to recognize signs of atypical cell death, which is common in tumours and viral infections. This approach aims to create novel small molecules and biological medicines that finely tune immune responses to various diseases. Founded in 2021, Adendra has raised €48.9 million.

Cellcolabs: Headquartered in Stockholm, Cellcolabs specialises in the industrial GMP production of high-quality Mesenchymal Stem Cells (MSCs) to make them available at scale, aiming to accelerate stem cell research and facilitate future market approval of MSC products. MSCs, known for their anti-inflammatory, immunomodulatory, and regenerative properties, hold great promise for treating severe and incurable diseases. Founded in 2021, Cellcolabs has raised €8 million.

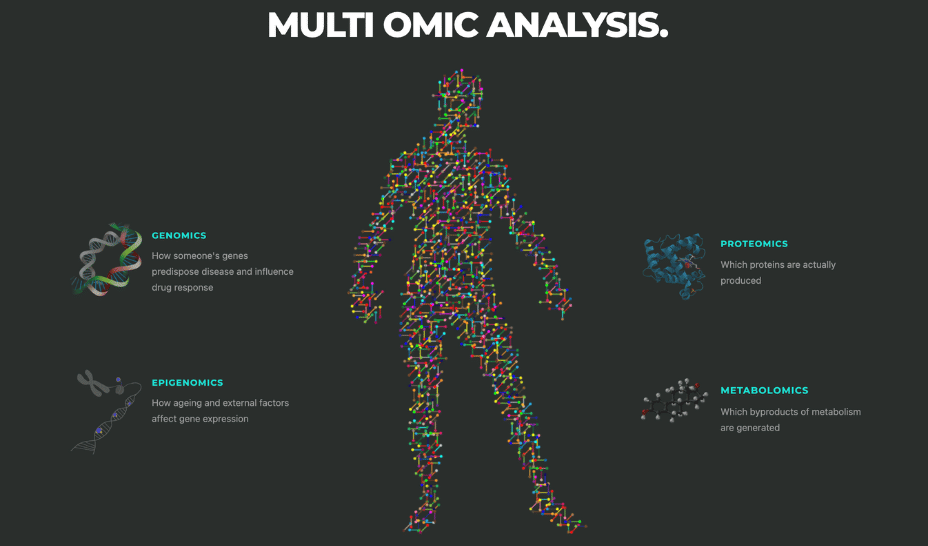

MultiOmic Health: London-based MultiOmic Health is an AI-enabled drug discovery startup focused on metabolic syndrome-related diseases such as atherosclerotic cardiovascular disease, type 2 diabetes, chronic kidney disease, etc. This precision medicine strategy aims to shorten and improve the success rates of clinical trials. MultiOmic’s MOHSAIC® platform integrates multi-omics analysis and computational systems biology to originate novel precision therapeutic concepts. Founded in 2021, MultiOmic Health has raised €8.1 million.

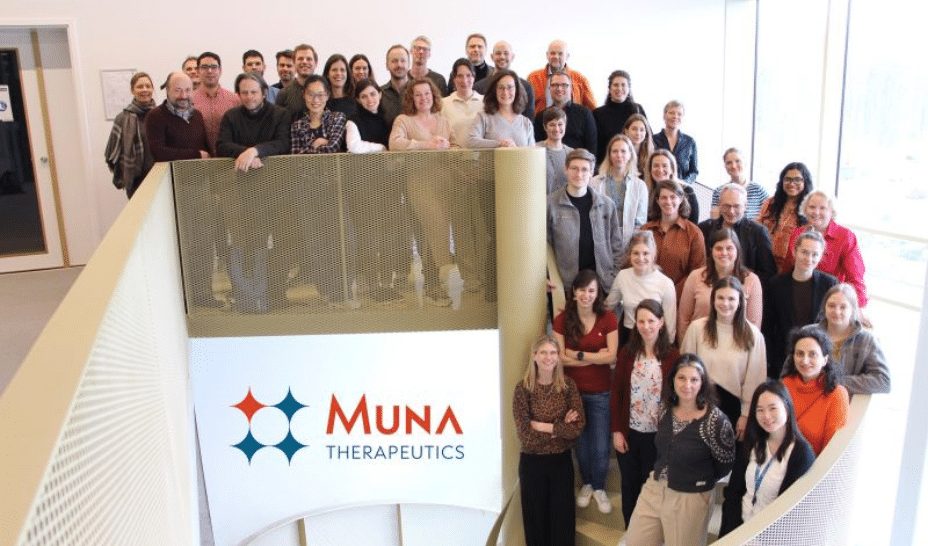

Muna Therapeutics: Headquartered in Copenhagen, Muna Therapeutics is a private biopharmaceutical company that discovers and develops therapies to slow or stop neurodegenerative diseases such as Parkinson’s, Alzheimer’s, and dementia. Their research focuses on preserving brain functions and halting disease progression by integrating insights from genetics, bioinformatics, and cell biology. Muna uses a powerful drug discovery engine combining protein structural approaches, AI-driven computational chemistry, and cell-based screening. Founded in 2020, Muna Therapeutics has raised €71.9 million.

Neurosterix: Based in Geneva, Neurosterix is developing allosteric modulators for neurological disorders. Their platform identifies molecules that modulate target receptors by binding outside the active site, differing from traditional drugs. This approach aims to create medicines with improved efficacy, safety, and tolerability. Neurosterix focuses on providing better treatment options for patients with underserved neurological conditions. Founded in 2024, Neurosterix has raised €58.1 million.

Nuage Therapeutics: Located in Barcelona, Nuage Therapeutics utilises chemical biology and biomolecular condensation to develop selective drugs targeting proteins with disordered regions for challenging indications, thereby improving patients’ lives. Founded in 2021, Nuage Therapeutics has raised €12 million to advance its mission through cutting-edge scientific research and strategic partnerships.

Ochre Bio: Based in Oxford, Ochre Bio develops therapies to tackle liver health challenges, from increasing donor liver supply to reducing cirrhosis complications. Their approach includes deep phenotyping of livers and designing precision RNA therapies to regenerate human livers outside the body. Founded in 2019, Ochre Bio has raised €36.7 million to address chronic liver disease, a rising global health issue, by leveraging advanced computational and multi-omic technologies. With decades of genomics and drug development expertise, their scientific teams aim to make healthy livers available for patients worldwide.

Quercis Pharma: Based in Zug, Switzerland, Quercis Pharma is developing novel, orally available anti-thrombotic, anti-cancer, antiviral, and immuno-modulatory treatments for life-threatening conditions with significant unmet medical needs. Their lead drug candidate, Kinisoquin™, targets venous thrombosis and pulmonary embolism in high-risk cancer patients and those with sickle cell disease. Quercis Pharma’s unique mechanism of action reduces thrombosis risk without increasing bleeding, and its drugs have shown promising safety and efficacy in clinical trials. Founded in 2019, Quercis Pharma has raised €138.4 million to make these treatments accessible to underserved and impoverished populations worldwide.

Cimeio Therapeutics: Located in Basel, Switzerland, Cimeio Therapeutics develops curative therapies for hematologic disorders using cell-shielding technology paired with immunotherapies. Their technology protects healthy cells while targeting diseased ones, enhancing safety and effectiveness. They employ gene editing to shield cell surface receptors from depletion. This novel approach aims to treat difficult hematologic conditions. Founded in 2020 with the mission to significantly improve the eligibility and outcomes of hematopoietic stem cell transplants and adoptive cell therapy, they have raised over €46 million.

By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service!

Read the orginal article: https://www.eu-startups.com/2024/07/leading-innovation-10-promising-european-startups-focusing-on-biopharmaceuticals/