Despite it being one of the worst times in memory to raise a VC fund, upstart investors in Europe are having a moment. More new VC firms are being launched than ever before — and more solo GP funds too.

Emerging managers in Europe are also, surprisingly, raising more than their US peers on average, according to a new report published today by LTV Capital, a fund of funds.

It’s tracked over 800 emerging managers raising around the world over two years — and thinks this boom of new funds is a sign of the times, and of Europe’s maturation as an ecosystem.

“It’s the end of a fund cycle; there are a bunch of funds that haven’t performed, and a bunch that probably won’t raise their next fund… Teams are getting smaller and company valuations are underwater, so there’s a natural progression of people from larger firms and established managers moving to start new funds,” says Farhan Lalji, founder and general partner at LTV.

“It’s also become a lot easier to start a new fund recently,” he adds; platforms like AngelList and Carta make the admin side a lot less work. “A lot of people wouldn’t have known where to begin a few years ago.”

LTV’s report’s findings are based on data from more than 559 emerging managers — defined as those on their first three funds and/or with under €100m in assets under management — from across the globe, gathered from pitch decks, data rooms and conversations. The majority of the funds are based in the UK (192, or 34%), continental Europe (172, or 31%) and the US (122, or 22%). 66% are first-time funds.

Green flags and red flags

“The quantum of capital surprised me,” says Lalji, referring to the finding that the average fund size raised by emerging managers in Europe is bigger than in the US; €61m in continental Europe and €52m in the UK, compared to €47m in the US.

“But then we realised it makes sense from a structural perspective” — public funds that back VCs like the EIB and BB have thresholds for the amount managers need to be raising to access their capital. “In the US they don’t have that same floor.”

Other than capital raised, LTV also found notable differences between the pitch decks of European and US emerging GPs.

Over 50% of emerging US VC manager pitch decks have no mention of performance measures — such as TVPI, DPI, MoIC or IRR. Meanwhile, just under 80% of emerging European fund managers mention at least one performance measure and over a third mention at least three.

“Investors in US fund managers are more open to what’s possible in a fund manager,” says Lalji. “They see the value in the experience as operators or networks that new managers may have. With European managers, their LP targets tend to want to see more track record or performance in the managers they are backing.”

“Inevitably, it comes down to market maturity and cultural differences,” says Dario de Wet, cofounder and partner at LTV. “Naturally, the US venture capital industry is more mature, so LPs and GPs are more comfortable emphasising alternative signals of potential performance.”

Decks also vary hugely on how partners talk about themselves as a team, says Lalji — and how they talk about their network.

“There’s a difference between ‘we’re really good friends with everyone at Sequoia’ and ‘here are the five GPs at much larger funds that have made big fund commitments’,” he adds; the latter is far more of a green flag.

Gender gap

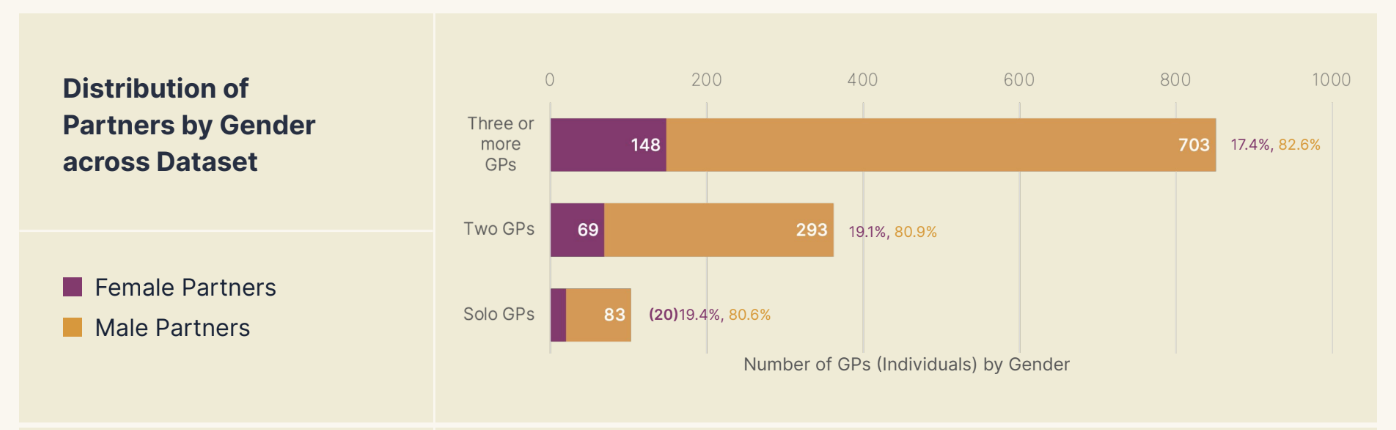

LTV also found that women are in the minority among emerging managers; 80% of the solo GPs on the list are men.

Over two-thirds (69%) of the funds with two GPs were an all-male partnership, and just under two-thirds (61%) of the three-person partnerships are all-male.

“Even in emerging managers and GPs of at least 2-3 managers, we’re still not seeing gender representation,” says Lalji.

“I don’t think it’s a pipeline problem. Sometimes I think it’s risk tolerance; if you fail as a female founder of a fund the reputational risk might be harder for women than men.”

Women also tend to be more realistic (or less optimistic) with how much they set out to raise. “We see some phenomenal women raising funds, and sometimes we’re like, ‘Why are you only raising this much?’”

Tough times

Far from all of the emerging managers LTV sees will close their fund at target — and some won’t close at all.

“The majority will raise under target,” says Lalji. “Sometimes the targets are quite high; a fund manager will set a target of €100m, and then realise that actually the fund economics work at €50m.”

“We go in knowing a lot won’t get to target. We’re looking at what their likelihood is to get to target, and what the economics look like if they can’t get to their target.”

It’s a warning sign if a fund manager says they’re raising €100m and they’ve already employed a lot of people and spent a bunch of the capital, he adds.

There’s also the option for fund managers to give up entirely. “If they can’t hit their target, they will in some cases return the capital,” says De Wet. “It’s not unheard of.”

Read the orginal article: https://sifted.eu/articles/emerging-managers-europe-report/