Consumer access to counterfeits and demand have skyrocketed in the last several years. With a significant share of counterfeit fashion products, 1 in 5 consumers under the age of 35 has purchased a counterfeit fashion and apparel item.

Counterfeiting involves the illegal reproduction or unauthorised use of intellectual property, often resulting in lower-quality imitations sold at cheaper prices. This issue extends beyond fashion to electronics, handbags, watches, and medications. The total value of counterfeit and pirated goods reached $3 trillion in 2022, tripling since 2013.

Counterfeiting is a serious crime that harms consumers, businesses, and the economy. The European Union Intellectual Property Office (EUIPO) estimates counterfeits cost the EU €60 billion annually and lead to 434,000 job losses. These products can be dangerous, often failing to meet safety standards. Nearly 97% of recorded dangerous counterfeit goods pose serious risks, and counterfeit clothing treated with toxic chemicals can cause health issues like skin irritation and rashes.

The availability of online sales channels like DHGate and AliExpress has made it easier to access counterfeit goods, offering a seamless shopping experience similar to Amazon. Previously, counterfeit goods were mainly sold through discreet street vendors and markets. For instance, Canal Street in New York City is known for its notorious counterfeit operations, where shoppers are discreetly led to back rooms to complete transactions. There are similar operations across Europe in large metropolitan or tourist areas such as La Rambla in Barcelona and the Grand Bazaar in Istanbul. Furthermore, counterfeit manufacturers have improved their quality, producing “super fakes” that are nearly indistinguishable from authentic products.

Why should you care about counterfeiting?

The rise of counterfeits has significant implications for the fashion and retail industry. Understanding these issues highlights the broader impact of counterfeiting on the industry and consumer safety:

- Links to Crime: Counterfeiting and piracy are often tied to organised crime. Sales of counterfeits can fund criminal and terrorist activities, as seen in cases like the Charlie Hebdo attacks, where counterfeit goods were sold to finance weapons.

- Economic Impact: Fashion brands lose revenue due to counterfeiters who evade taxes and quality standards. This theft of intellectual property costs the clothing industry €12 billion annually, according to the EUIPO, and harms brands and their workforce.

- Market Infiltration: Counterfeit goods increasingly circulate in the market, sometimes unknowingly sold by wholesalers and retailers. Retailers face return fraud, losing $10.40 for every $100 of returned merchandise, totalling $24 billion annually.

- Circular Fashion: The growing secondhand apparel market, expanding three times faster than the global apparel market, is also affected by the infiltration of counterfeit products.

The Digital Services Act, a new European regulation, aims to hold online platforms accountable for illegal content, including counterfeits. Platforms will be required to proactively detect and remove counterfeit goods, trace sellers, and implement mechanisms to flag illegal content. Non-compliance can result in significant fines. This act became applicable to all companies on February 17th, 2024.

Anti-counterfeiting solutions from European startups and companies

To address the challenges of counterfeiting, European startups have been developing innovative solutions. Let’s take a closer look at some of them:

Fashion resale platforms with authentication services

Consumers are increasingly seeking sustainable and cost-effective solutions, leading them to sell or rent pre-owned items and buy secondhand goods. Unfortunately, these circular marketplaces can unintentionally facilitate the sale of counterfeit products, putting both consumers and businesses at risk. Concerns about fraud and authenticity persist, with nearly 90% of consumers worried about the authenticity of items in resale marketplaces. Effective monitoring is crucial for building trust in these models.

Most fashion resale platforms now offer authentication services to buyers, where products are authenticated by an expert who can identify counterfeits and genuine products. In the luxury segment, consumers expect authentication as a standard, and resale marketplaces have responded accordingly. Both Vinted and Ebay offer authenticity services and guarantee services available on their platforms for luxury fashion products.

Second-hand fashion businesses face profitability challenges due to thin margins and the manual labour involved in sorting and processing items. Major European resale platforms like Vinted, Depop, and Vestiaire Collective are not yet profitable. Managing an authentication team adds significant operational overhead.

For example, Vestiaire Collective has five authentication centres internationally – their French authentication centre has 120+ employees. Each authenticator at Vestiaire Collective goes through 180+ hours of training. However, this is necessary to build consumer trust in purchasing second-hand products.

Tech-driven counterfeit detection solutions

In the fashion industry, authentication is mostly completed manually, by hand, and is prone to human error. Manual authentication alone is not a scalable solution. Some resale platforms are using technology such as AI and building image recognition or detection technologies in-house to combat counterfeit listings.

There are few technology solutions available on the market to automate counterfeit detection. Edinburgh, UK-based, Pasabi offers solutions to ensure trust and safety on online platforms, they offer an AI-powered counterfeit goods detection technology and help platforms detect coordinated networks of bad actors. Barcelona-based, Red Points is another provider automating counterfeit detection across the web.

Red Points’ solution is used by trademark and copyright holders to help them protect their brands’ reputations and mitigate revenue loss; the solution is used by household names such as Fila, Hugo Boss, and Puma. Their platform also automates brand protection enforcement and infringement removals.

Digital product passports

Europe’s Digital Product Passport (DPP) is proposed legislation by the European Commission to promote sustainability, transparency, and circularity in product lifecycles. The DPP will be a digital record containing data about a product’s materials, components, manufacturing processes, repair instructions, and end-of-life handling. It aims to enable sustainability in the fashion industry by allowing users to track the origin of products and confirm their authenticity. DPPs will roll out in phases starting this year, with all textile products sold in the EU requiring a DPP by 2030.

Several initiatives and European technology companies have emerged to build digital product passport solutions ahead of the incoming regulation. Although these solutions are still nascent and not yet widely adopted, they are expected to be the most reliable source of truth for authenticity as they are embedded into products at the source of production

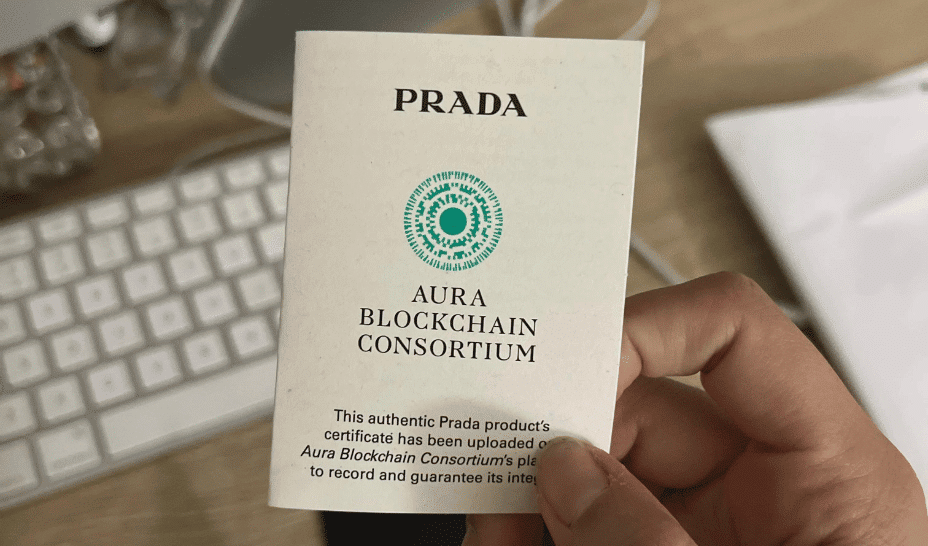

The Aura Blockchain Consortium, a non-profit organisation founded in 2021 by luxury groups like LVMH, Prada Group, Cartier, and OTB Group, aims to create a technological standard for the luxury industry and enhance customer experience with blockchain-based solutions. The solution offers product authentication, supply chain transparency, and ownership transfer services. Major fashion brands like Louis Vuitton, Bulgari, Tod’s, Dior, and Prada have already implemented Aura’s Digital Product Passports (DPPs) for product authentication and traceability. As of May 2024, Aura Blockchain Consortium has confirmed that they have created products for over 40 million items.

Various startups are building digital ID solutions to enhance customer experiences, increase awareness of product circularity, and confirm authenticity and ownership. Paris-based Arianee has partnered with brands like Mugler, Ba&sh, and Panerai to offer a digital ID solution leveraging web3 concepts and embedded tokenisation. EON has created a digital ID attached to products for end-to-end traceability, partnering with European fashion brands like Chloé, Pangaia, and Zalando. EON has also been selected to participate in the EU-funded CIRPASS-2 pilots to advance the EU’s DPP legislation. Another example is Milan-based Certilogo, which offers a digital ID solution for fashion, allowing customers to confirm product authenticity. Acquired by eBay in 2023, Certilogo strengthens eBay’s capabilities in authentication and brand protection as a leading resale marketplace.

Read the orginal article: https://www.eu-startups.com/2024/05/the-counterfeit-crisis-in-fashion-why-it-matters-and-tech-solutions-leading-the-way/