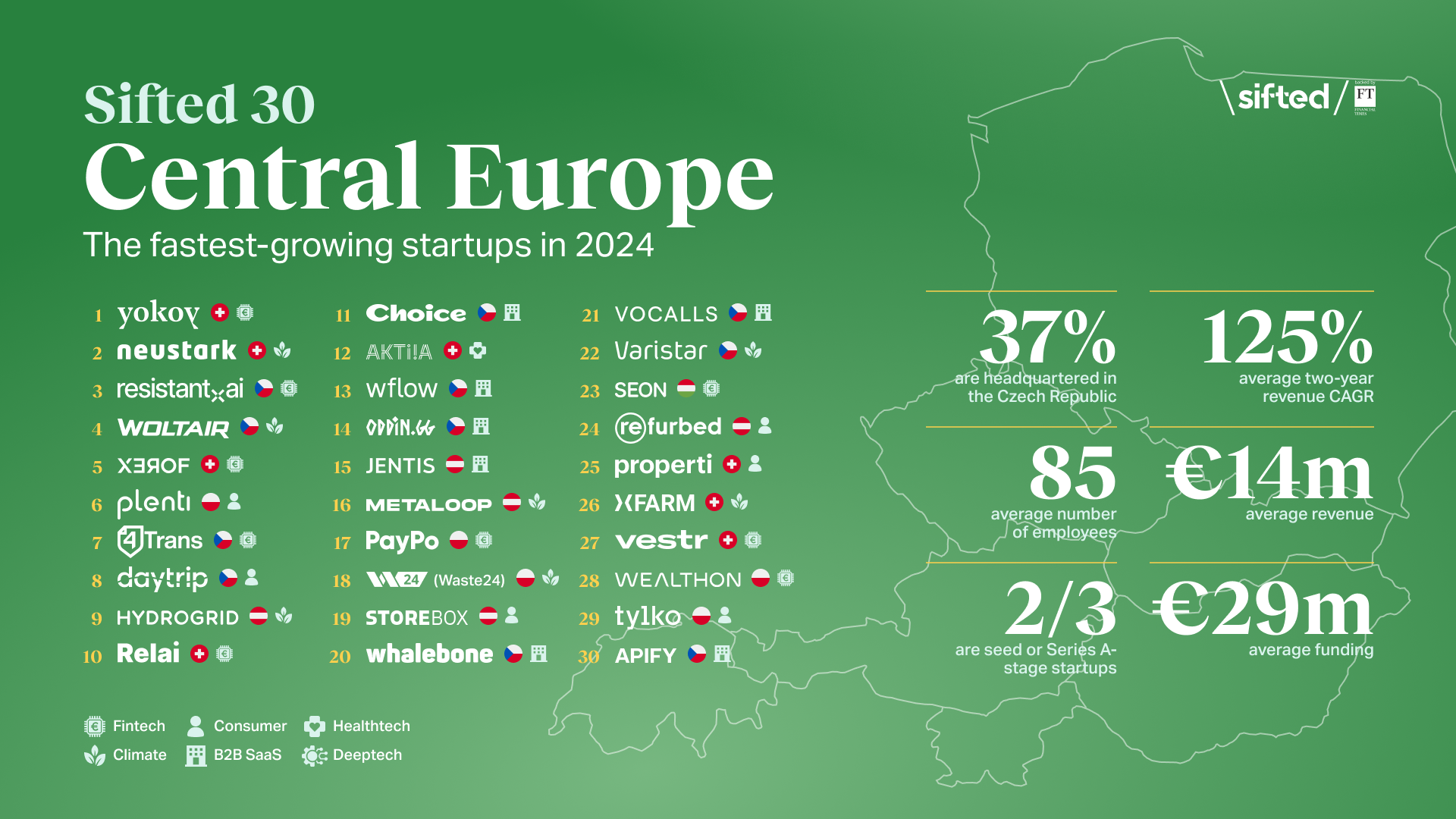

Zurich-based spend management startup Yokoy has topped the newly launched Sifted 30: Central Europe Leaderboard — a ranking of the 30 startups with the strongest revenue growth over the past three financial years across Czech Republic, Switzerland, Austria, Hungary and Poland.

The Sequoia and Balderton-backed fintech, launched by five founders in March 2019 and employer of more than 250 people, achieved a compound annual growth rate (CAGR) of 281.88% across the past three financial years.

Yokoy is closely followed by second place Neustark, a Bern-based carbon tech startup with a CAGR of 270.93%, and third place Resistant AI, a Czech fincrime startup with a CAGR of 261.09%.

The Sifted 30: Central Europe at a glance

The Sifted 30: Central Europe in summary

The top 30 have raised a total of €850m in funding and generated €792m in revenue over the past three financial years, averaging a two-year CAGR of 125%. On average they employ 85 people.

37% of the batch is based in the Czech Republic; 27% in Switzerland; and 17% in both Austria and Poland. Fraud prevention company SEON is the only Hungarian company in this year’s edition.

The majority of the cohort sits at the earlier stages of venture. Two-thirds of the startups on the list raised a Series A or seed round, with Series C as the latest round. Only one company — Czech farm data management platform Varistar — is bootstrapped.

Fintech is the most dominant vertical (9 companies), followed by B2B SaaS and climate (7), then consumer (6).

The most active investors

Out of 109 investors, the most active backers of companies on the list were Speedinvest, Evli Growth Partners, Redalpine, INVEN Ventures, Reflex Capital, J&T Ventures and Swisscom Ventures.

The list is backed by several other high-profile investors, such as Molten Ventures, Index Ventures, Sequoia Capital and FJ Labs.

The 10 fastest-growing startups in Central Europe

1/ Yokoy — AI-powered expense management software

2/ Neustark — Sucks CO₂ from air; converts it to rocks

3/ Resistant AI — Fraud detection & identity forensics

4/ Woltair — Connects customers with heat pump/solar installers

5/ Xerof — Crypto exchange service

6/ Plenti — Electronics rental service

7/ 4Trans — Fast SME financing

8/ Daytrip — Private driver hire service

9/ Hydrogrid — Software for managing hydropower plants

10/ Relai — Bitcoin-only saving & investments app

Sifted’s research team used their proprietary data to identify and contact relevant high-growth startups. Applications were accepted from April 15 to May 22, 2024.

To be eligible, companies had to meet the following criteria: headquartered in Austria, Czech Republic, Hungary, Liechtenstein, Poland, Slovakia, Slovenia and Switzerland; founded in or after 2014; maximum headcount of 999; private and independent; majority of revenue must be generated by proprietary technology; at least three years of revenue data; and revenue (annualised if necessary) of at least €100k in the base year (2020, 2021 or 2022) and at least €1m in the most recent financial year (2022, 2023 or 2024). Companies were required to submit signed documentation to support disclosed financial information not publicly available.

Sifted Leaderboards do not claim to be exhaustive as private company data can be difficult to acquire. Leaderboards are based on historical financial data and are no guarantee of future company performance.

Read the orginal article: https://sifted.eu/articles/yokoy-tops-sifted-leaderboard-of-central-europes-fastest-growing-startups-by-revenue/