The EU Innovation Catalyst event gathered Europe’s policymakers, investors, innovators, and industry insiders on April 16 in Brussels to discuss the state of the startup ecosystem in Europe, future policies and opportunities to foster the growth of European innovation. The event also marked the launch for two ambitious EU-funded initiatives: StepUp Startups and Innovation Radar Bridge.

The event commenced with a keynote address by Eoghan O’Neill, Senior Policy Officer at the European Commission, who outlined the Commission’s commitment to driving innovation through strategic initiatives such as the Digital Markets Act (DMA) and the European Digital Innovation Hubs program. O’Neill’s remarks set the tone for a day filled with insightful discussions and forward-thinking initiatives.

Throughout the event, attendees delved into key topics shaping the European tech landscape. From the challenges confronting European startups to the role of smart policies in nurturing entrepreneurship, the conversations were both enlightening and thought-provoking. Expert reports provided invaluable insights into the future trajectory of the EU single market and strategies to enhance the continent’s competitiveness in the global arena.

One of the highlights of the event was the unveiling of two ambitious projects:

StepUp Startups: Led by Barrabés.biz in collaboration with EU-Startups and other esteemed partners, StepUp Startups aims to revolutionize Europe’s startup economy through data-driven insights, research, and events. Sandra Saiz Rodriguez, the project coordinator, outlined the initiative’s holistic approach, which includes the production of thematic reports, stakeholder engagement, and the organisation of events aimed at fostering collaboration and innovation across various sectors.

“StepUp Startups isn’t merely about envisioning a fairer European economy; it’s about deploying intelligence and tangible steps to make it a reality. Our launch event marks the commencement of a journey aimed at empowering the vibrant startup and scaleup ecosystems across Europe”, remarked Sandra Saiz.

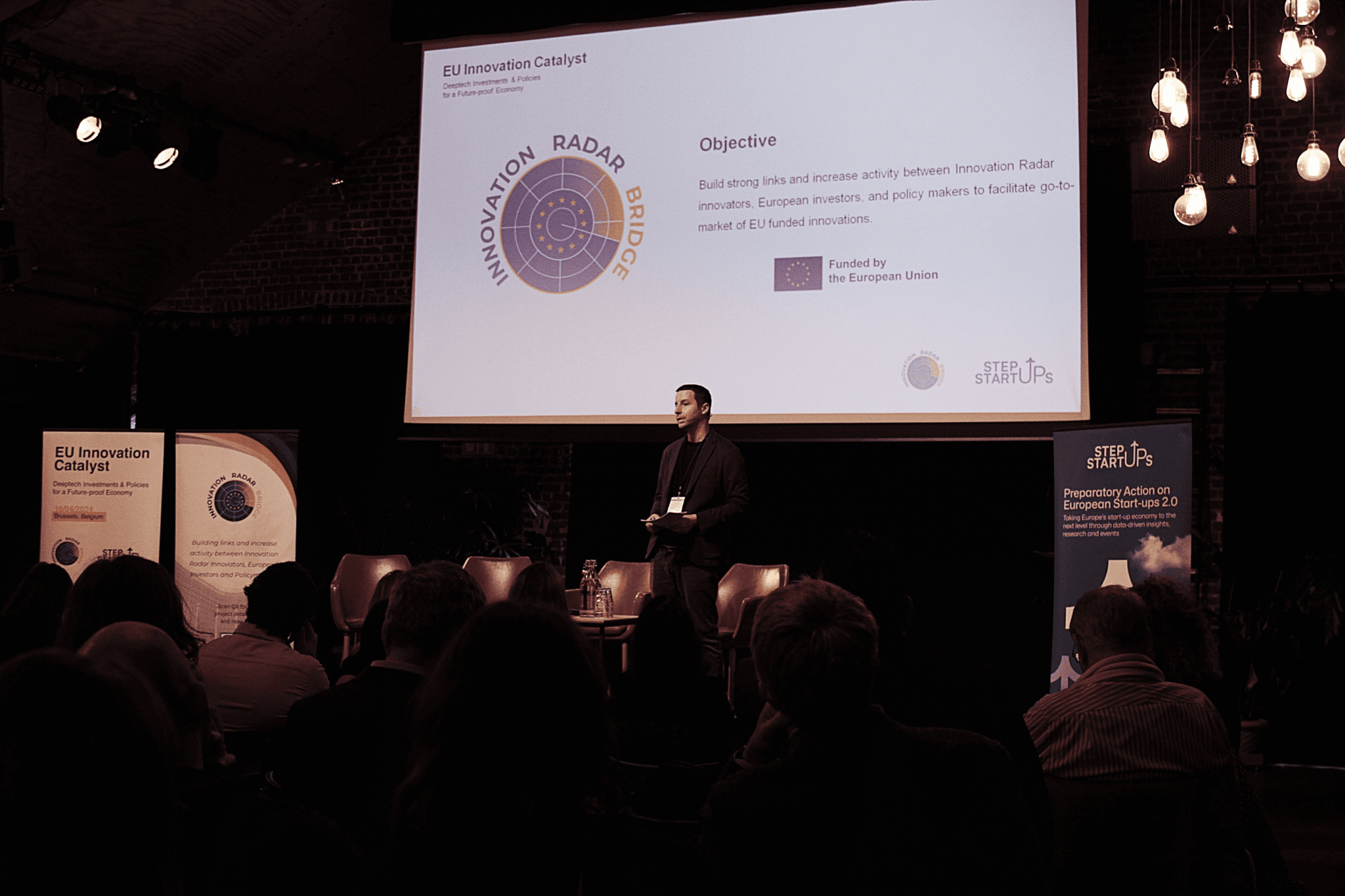

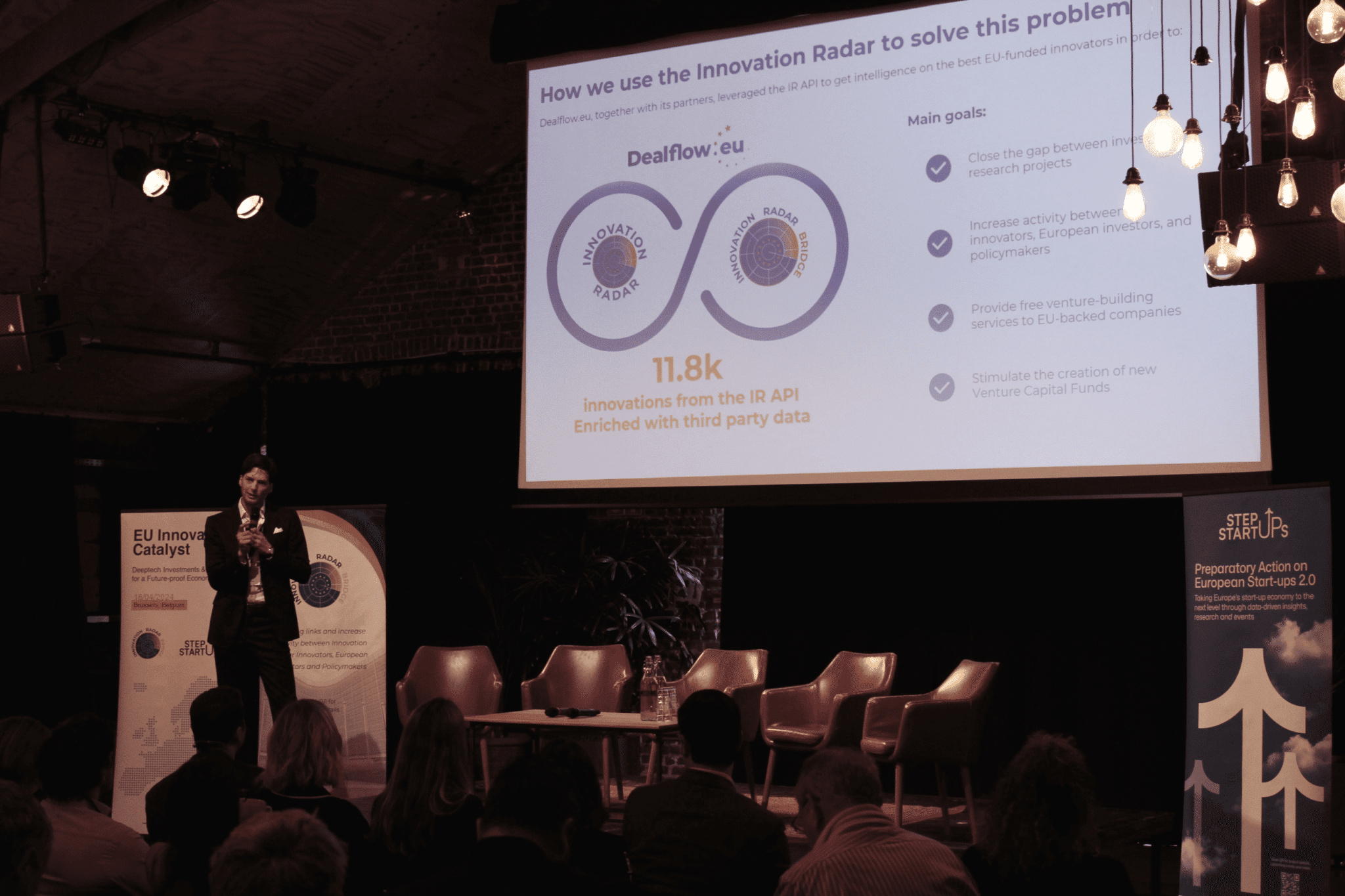

Innovation Radar Bridge: Presented by Thomas Ohr, CEO of EU-Startups, this collaborative effort seeks to bridge the gap between innovators, investors, and policymakers. Leveraging the power of the Innovation Radar, the project endeavours to amplify engagement and facilitate the adoption of groundbreaking innovations emerging from EU-funded programs.

According to Thomas Ohr, “The launch of Innovation Radar Bridge and StepUp Startups brought together a diverse group of startup ecosystem players to drive these projects forward. The engaging conversations sparked among attendees truly showcased our collective commitment to shaping a future-proof innovation landscape in Europe. The launch event was a resounding success, and we’re excited to see the impact of these initiatives unfold and keep engaging with the stakeholders over the following two years”.

With an emphasis on fostering collaboration and exchange, the event encapsulated the spirit of European innovation, leaving attendees inspired and empowered to drive transformative change.

Overall, the event embodied the spirit of European innovation, leaving attendees inspired and motivated to drive positive change

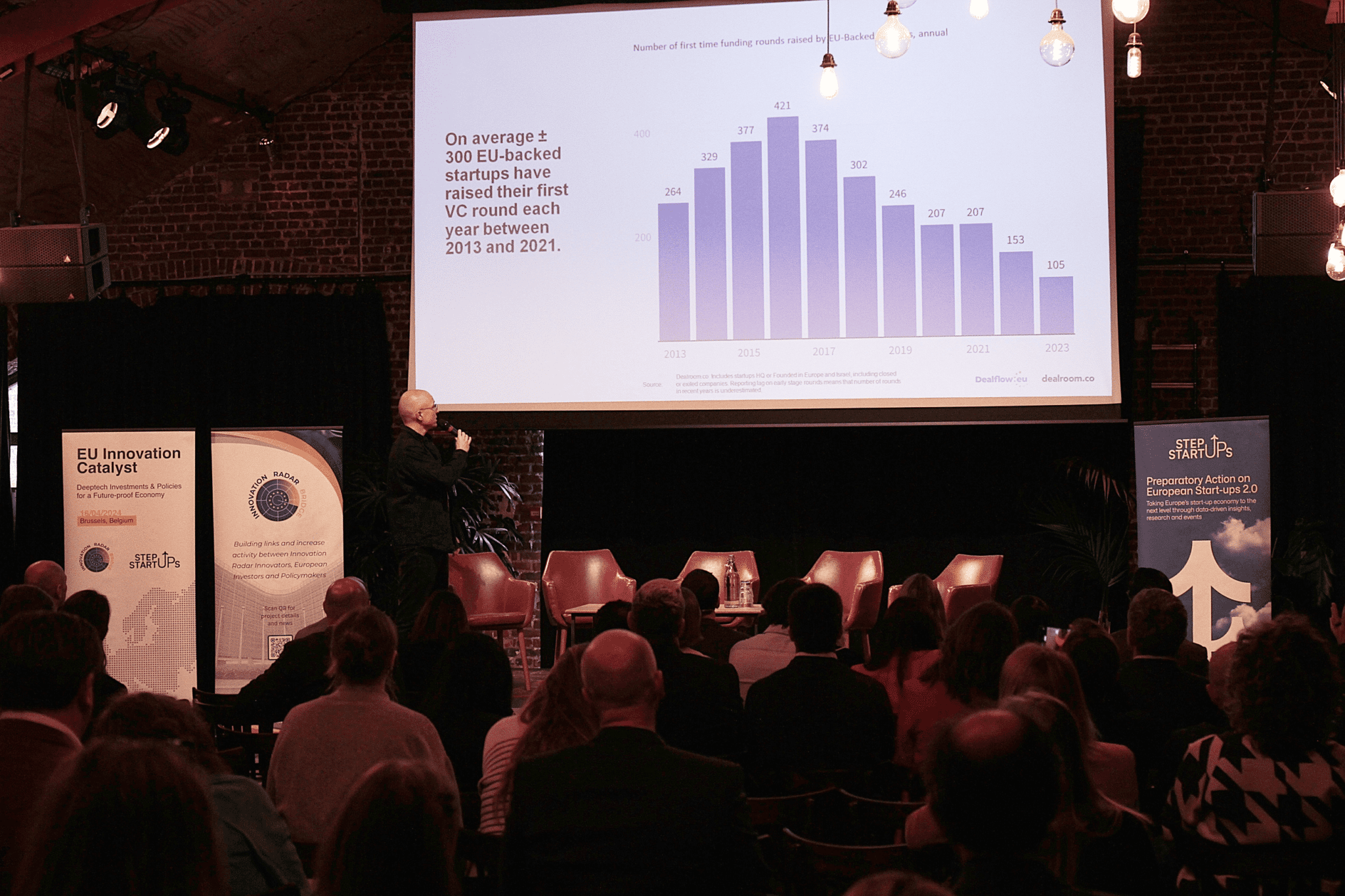

Thijs Povel, CEO of Dealflow.eu, shared success stories that resonated with attendees. He highlighted the pivotal role of the Dealflow matchmaking platform in bridging the gap between investors and startups, underscoring its contribution to a thriving investment landscape for European startups.

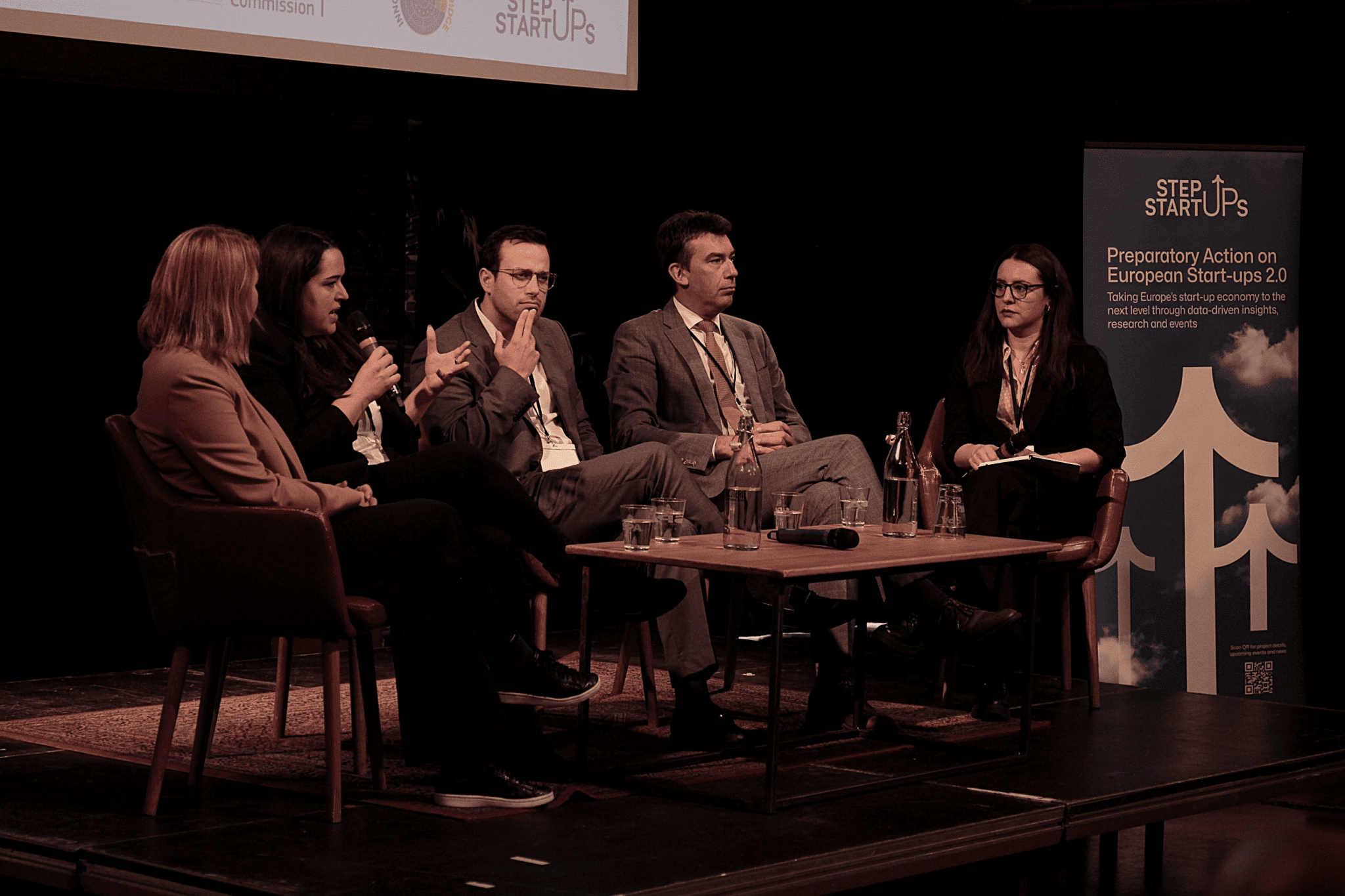

Panel discussions also provided a platform for in-depth exploration of critical issues facing Europe’s tech ecosystem.

Smart Policies for SMEs and Startups

The panel convened experts representing pivotal roles in shaping and executing innovation policies across the European Union. Throughout the session, panelists explored the intricate connection between policy formulation and fostering innovation, particularly within Europe’s dynamic startup landscape. Discussions delved into the pivotal role of smart policies as accelerators for nurturing entrepreneurship, propelling technological advancements, and bolstering sustainable economic development within the EU.

Insights shared during the discourse aimed to equip EU-funded innovators with actionable strategies, tap into latent investment opportunities, and propel the European startup ecosystem towards enhanced global competitiveness. Key speakers included Jekaterina Novikova from the European Commission’s Directorate General for Research and Innovation, Dragoş Tudorache, MEP and Co-Rapporteur of the AI Act at the European Parliament, Ana Barjasic, a Board Member at the European Innovation Council, and Arthur Jordão, Executive Director at ESNA – Europe Startup Nations Alliance.

Unlocking the Investment Potential of EU-Funded Innovators

The panel ignited passionate discourse on the critical nexus between policy implementation, EU funding, and the flourishing startup ecosystems across Europe. Alessandra Scotti illuminated the significance of sector-specific investors as linchpins in nurturing a mature ecosystem, where targeted investments catalyze innovation in specialized domains. Astrid Bartels, with a seasoned perspective, delved into the transformative impact of EU funding on the venture capital landscape, shedding light on market gaps and avenues for strategic intervention. Matthieu de Beule brought a dynamic dimension to the discussion, offering invaluable insights into leveraging EU funding for cutting-edge projects like digital twin technologies. His firsthand experience navigating the EIC Accelerator funding programme under Horizon Europe added depth and practicality to the dialogue. Anne Lidgard provided a captivating comparative analysis, juxtaposing funding environments between Europe and Silicon Valley, while underscoring the nuanced societal considerations that shape investment landscapes on both sides of the Atlantic.

Opportunities created by the Digital Markets Act

The panel sparked a riveting discussion on the transformative opportunities it brings to the European tech landscape. Eoghan O’Neill electrified the audience with insights into DMA’s potential, particularly highlighting the creation of third-party app stores and NFC antenna access. His vision for a future where European tech giants rival their global counterparts painted a picture of innovation and self-sufficiency. Sabine Vermassen echoed this sentiment, emphasising how DMA regulations aim to democratise the market, opening doors for emerging companies to thrive in a more accessible ecosystem.

Ide Claessen injected a dose of introspection, stressing the importance of honesty and focus in navigating the evolving market dynamics shaped by DMA regulations. Marcin Waldowski illuminated the practical challenges of compliance, underscoring the effort required to adapt to new standards, such as accessing Apple’s NFC antenna. As the panel contemplated the DMA’s impact a decade hence, Eoghan O’Neill’s visionary speculation on future headlines, including scenarios of European acquisitions reshaping the tech landscape, fueled optimism for a future where Europe stands at the forefront of technological innovation and autonomy.

As the launch event drew to a close, there was a palpable sense of optimism in the air. Through collaborative efforts and innovative initiatives like the StepUp Startups and the Innovation Radar Bridge, stakeholders are poised to unleash the full potential of Europe’s tech ecosystem. With a shared vision and collective determination, Europe is primed to lead the way in driving technological innovation and economic prosperity on a global scale.

Next events

Join us on May 10th during the EU-Startups Summit for the Innovation Radar Bridge startups vs. policy interception event, where EU-funded innovators, investors, corporates, policymakers, and media will convene to explore novel approaches to address policy-related challenges and opportunities impacting startups across Europe. Get your tickets here.

Read the orginal article: https://www.eu-startups.com/2024/04/energising-the-european-tech-ecosystem-highlights-from-the-eu-innovation-catalyst-event-in-brussels/