What does a venture capitalist or a partner at a VC firm do every day? This question has always intrigued me and it has intrigued me even more as technology becomes the common denominator in everything we do right now.

I am sure they don’t invest in startups like we see on TV shows like Shark Tank but Stephen Cardwell, Partner and Head of Technology at Anticus Partners says their reliance on technology is unparalleled.

Similar to how businesses rely on Microsoft 365 for productivity, Cardwell calls PE Front Office an indispensable solution for them.

With over two decades of experience in the financial sector, Cardwell is an experienced debt and equity venture investor who currently heads up the Seedcorn fund at Anticus Partners.

From how Anticus Partners invests in startups, and their heavy leaning towards technology startups to using PE Front Office, day in and day out, Cardwell shows how the work is cut out for investment management and investor relations teams.

Backing technology companies

Anticus Partners is a venture capital investment specialist based in Barnsley, United Kingdom. The firm has one limited partner in the form of Finance Yorkshire. Cardwell says Anticus Partners is vested with the responsibility of “putting Finance Yorkshire’s money to work in the local economy.”

On a typical day, Cardwell tells me they spend most of their time engaging with startups and growth companies. While they have an agnostic approach to investing, the Seedcorn Fund supports lots of promising pre-seed startups in the technology space looking for finance to strengthen their business.

“Across both Seedcorn and Growth funds, our day is spent interacting with the marketplace, co-investors and new investors in that market, and looking for opportunities in our regional remit,” he adds.

While the growth fund is aimed at later-stage companies looking for a management buyout or cash out for founders, for example, the seedcorn fund supports earlier-stage businesses, in Yorkshire.

In addition to backing new technology startups, partners at the firm also engage with their portfolio management systems, which essentially means talking to founders they have backed to ensure they are on track and help resolve any challenges they might have in their business.

He adds, “We are also thinking about the next fundraiser for these guys as well, and how we can add value and help them along their journey, almost from a seed to early stage, to Series A and B rounds.”

Intrigued by what PE Front Office can do for you? Click here to request a free trial

PE Front Office to support the mission

The mission of Anticus Partners is to make a difference in Yorkshire’s local economy and they do this by investing locally and helping the local ecosystems to succeed globally.

In this endeavour of theirs, technology plays a crucial role and PE Front Office, in particular, plays a pivotal role.

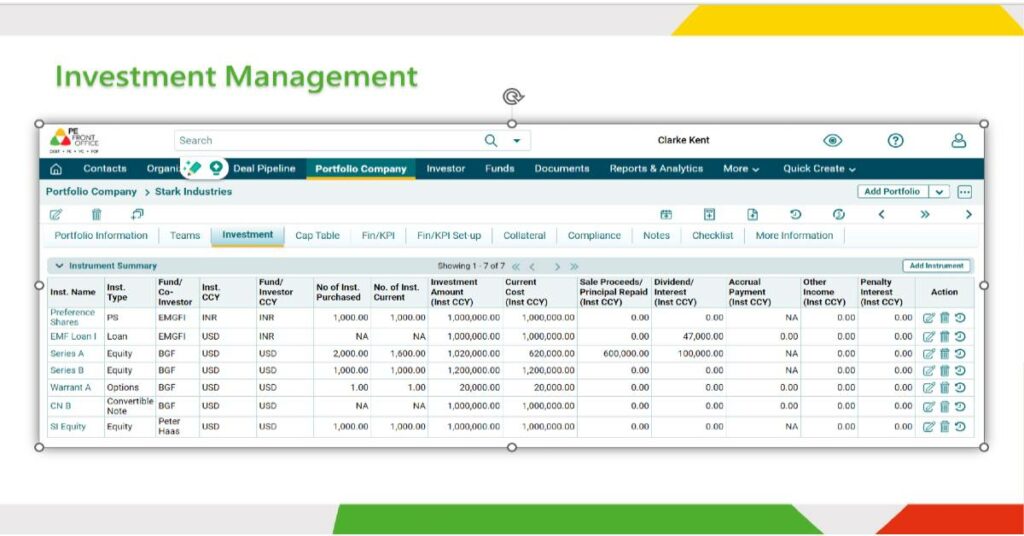

PE Front Office is an end-to-end integrated solution for alternative investment management that spans private equity, venture capital, fund of funds, limited partners, and private credit/debt, among others.

Cardwell sees the platform as key to their investment operations and says all the partners at Anticus have it open all the time.

For Anticus Partners, PE Front Office is not only a tool that helps them record details of the new deals coming in but also a system to track their work-in-progress (WIP).

He adds that they pull all the deals from the PE Front Office to discuss during their weekly meeting and also use the platform to meet financial regulations.

“It’s hugely important that we keep track of all the deals, not just for our professional running of the business, but we’re also financial conduct authority regulated,” explains Cardwell.

As a venture arm, Anticus Partners needs to keep all the details of their companies safely and securely in the cloud, along with all the supporting documents sent by their investee companies.

While speaking to Silicon Canals, Cardwell repeatedly brings up their fiduciary responsibility to the Financial Conduct Authority (FCA) and sees the PE Front Office as a key tool on the origination side to accurately hold data of their investee companies.

As a SaaS application, the role of PE Front Office doesn’t end there. Cardwell says that Anticus uses the application to increase its contact list as well as the database of investors.

“So, we use it [PE Front Office] a great deal for the origination part,” Cardwell quips.

Huge value proposition

Cardwell likens the importance of PE Front Office to that of productivity tools like Microsoft 365 and calls it a huge value proposition for them.

“PE Front Office is a huge value proposition for us,” Cardwell says, adding, “because we have one storage area for all our documents that are coming through from our investee companies like financials, board packs, and so forth.”

In many ways, PE Front Office forms the backend and backbone of Anticus Partners’ business operation by supporting them with their financial reporting.

As a VC firm, Anticus Partners uses PE Front Office to store information like convertible loan notes, shares, and loan schedules.

This end-to-end aggregation of all financial data allows Anticus Partners to report back their financial performance to Finance Yorkshire every quarter.

“As we’re going along, we can keep track of how the companies have been doing repaying our loans or repaying capital, or when we’re coming into discussions with the companies to convert our loans,” says Cardwell.

He adds, “All that is frankly running our business and all that is in the PE Front Office as well.”

Software and vendors galore

In addition to being a technologist and venture investor, Cardwell is also an excellent storyteller. Like every industry, he says the venture capital world also got into digitisation in a big way.

At Anticus, he says they began to look for a software platform to support their investment management during 2020 and 2021 when they had new funds coming in and Cardwell was made responsible for evaluating all the systems for the new fund.

While looking at four or five vendors, he reviewed PE Front Office and immediately liked the holistic nature of the platform.

“We had a lot of discussions with other companies and they either did the origination well or the portfolio management well, but they just didn’t combine a system with having both sides of the equation in it,” he explains.

When platforms did do both sides of the equation well, Cardwell says they required expensive add-ons and in PE Front Office, they found a solution that didn’t cost a lot of money and was a system designed to run their business.

An interesting observation from Cardwell is that they can still do their work using Microsoft Word and Excel. “It would be difficult and challenging to run the business without PE Front Office as the frontend and the backend,” he observes.

Cardwell adds that PE Front Office has also boosted their efficiency with its reports generation capability that eliminates all manual calculation and delivers reports that Finance Yorkshire would like to see on a quarterly basis.

Lastly, he says having most of their client data on PE Front Office also helps with the regulatory nature of the business since this setup allows for total backup of client information and ensures that the data is safe and secure at all times.

Intrigued by what PE Front Office can do for you? Click here to request a free trial

Tech and Investment

At Anticus Partners, Cardwell has a unique role of looking at both investment and technology. With PE Front Office serving as both the backend and the frontend of their business, he says they have a fairly stable tech base and don’t see any major changes in the space.

However, he says the investment landscape will continue to evolve with Yorkshire being “hugely buoyant” in startup tech software companies.

When the investor ecosystem can’t seem to stop talking about AI, Cardwell says their interest is not just AI but a load of software and general tech, across the region from Sheffield, Doncaster, Leeds, Barnsley, and Hull.

He says, “These whole ecosystems, which kind of weren’t there five or six years ago, have now sort of sprung to life.”

For 2024, he sees an opportunity for Anticus Partners to engage with great startup founders, and growth-stage businesses: building successful companies in the Yorkshire region and helping them further their shareholder value through “our investment.”

One thing that remains undeniable is that PE Front Office will play a huge role in those investments right from the origination stage to portfolio management.

Read the orginal article: https://siliconcanals.com/news/startups/pe-front-office-anticus-partners-investor-management/