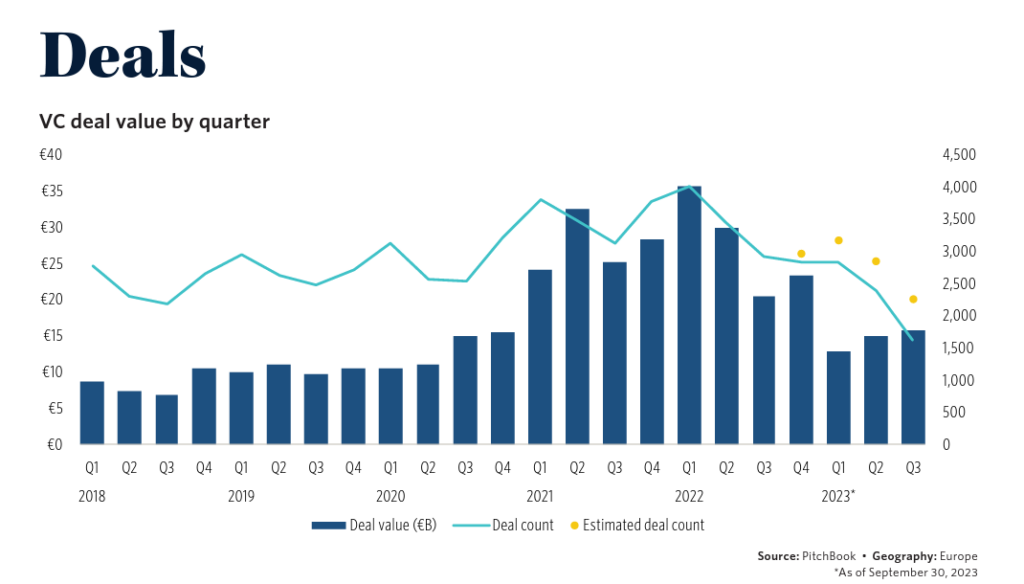

Europe has experienced continuous growth in venture deal value for the third consecutive quarter. However, the total annual value for 2023 is expected to lag significantly behind the figures from previous years.

PitchBook has released the Q3 2023 European Venture Report, showcasing a comprehensive analysis of the VC landscape in Europe during this period. The report covers key areas such as deals, nontraditional investors, cleantech, exits, and fundraising.

Here are the key takeaways from the report.

Deals

Venture capital deal value in Europe for the first nine months of 2023 was €43.6B, representing a 49.1 per cent decline compared to the same period in 2022.

Based on the total deal value of €109B in 2022, it is believed that there won’t be a significant enough recovery by year-end to boost 2023’s total compared to the past two years, says the report.

Every quarter, deal value in Europe has increased since Q1 2023, with Q3 deal value being 5.9 per cent higher than in Q2.

According to the report, these improvements suggest that the market may have moved beyond its lowest point, but uncertainty in the European macroeconomic environment persists.

Late-stage investments have shown more significant declines compared to early-stage investments. Venture growth deals, in particular, decreased by 61.9 per cent in Q3 2023 compared to the same period in 2022.

Early-stage venture capital deals have proven more resilient and have been increasing sequentially since Q1 2023. The report says Cleantech and AI technologies have been prominent in early-stage deals.

Early-stage investments are expected to continue to be more robust as investors take a long-term approach, and their returns are less immediately tied to exit markets, which still need to be stronger within the venture capital landscape.

“Overall, we believe early-stage investments should remain more resilient due to investors taking a long-term investment approach and returns being less imminently tied to exit markets — which continue to remain the weakest area within venture markets,” says the report.

According to the report, cleantech investments dominated the top 10 deals in Q3 2023, with the largest one occurring in France. Verkor, a low-carbon battery production company, secured a substantial €2.1B investment, including €600M in debt.

Cleantech is a major attraction for venture capital, evident in the second-largest deal of €1.5B invested in H2 Green Steel, supporting a green steel plant in Sweden with significantly reduced CO2 emissions.

Regionally, France and Benelux demonstrated remarkable resilience with a 37.7 per cent decline in deal value over the first nine months of 2022. It led to a significant increase in the region’s share of the European deal value, now accounting for 23.2 per cent.

The UK and Ireland maintained the lead with 33.0% of the deal value in Europe during Q3 2023.

Furthermore, the proportion of US investors in Europe decreased, with their capital investment declining more than the overall market.

This shift could be due to higher market uncertainty, prompting US investors to focus on domestic opportunities and return to familiar markets for more stable returns.

Nontraditional investors

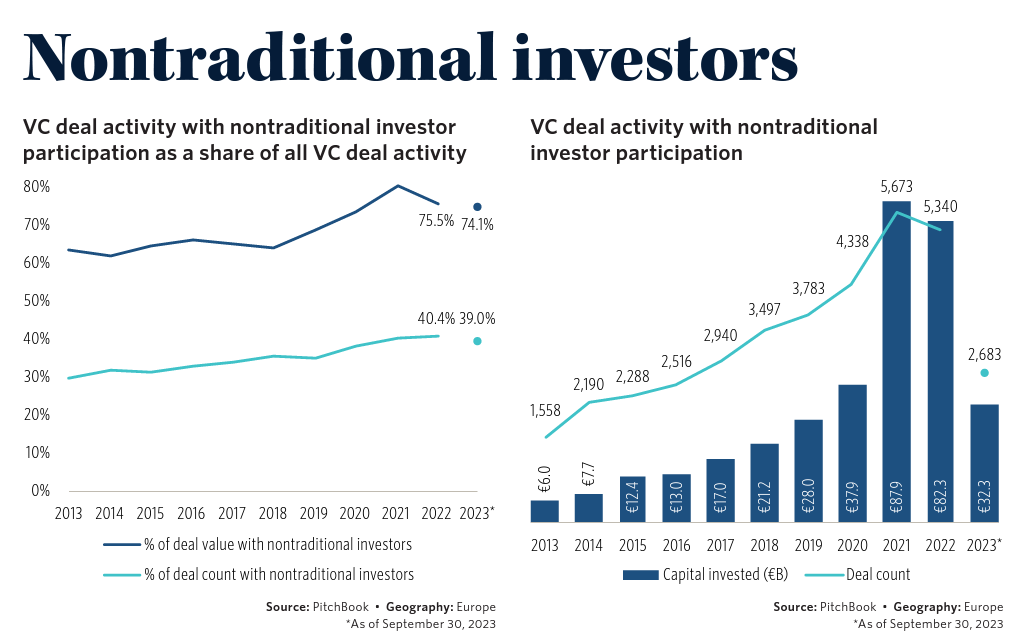

The PitchBook report says nontraditional investor participation in the venture capital (VC) market has decreased in line with the broader market.

VC deal value involving nontraditional investors dropped to €32.3M in Q3 2023, marking a 49.5 per cent decline compared to Q3 2022.

Nontraditional investors, including sovereign wealth and hedge funds, have seen a shift in their investment behaviour, as the report reveals. They have allocated a larger portion of their investments to the private market due to declining valuations in public equity markets.

This shift in investment strategy led to reduced VC deal activity in 2022. Still, there is now more resilience in nontraditional investor participation, with their share of overall deal value remaining at 74.1 per cent in European VC deals through Q3 2023.

Notably, the venture growth stage experienced the most significant decline in nontraditional investor participation, while the early stage demonstrated greater resilience, reflecting broader industry trends.

Cleantech

Cleantech deal activity is more resilient than the overall market, although it is expected to slow down from the previous year. According to the report, the decline in cleantech activity is milder than in the broader market.

Deal value in cleantech through Q3 2023, as a percentage of the full year 2022, stands at 57.2 per cent, while the total European VC market is at just 40 per cent. It suggests that cleantech remains more insulated from a market downturn.

Other key verticals in Europe, such as software as a service (SaaS), fintech, and AI & machine learning, have shown more significant declines in deal value this year.

Favourable regulations in Europe, especially on decarbonisation, are expected to support the growth of cleantech startups and the race toward achieving net-zero carbon emissions in the continent.

In Q3 2023, five of the ten largest deals in the quarter were cleantech deals, including the top three investments, indicating continued investor interest in the sector.

The limited exit activity in cleantech is evident, with exit value in Q3 2023 at only 7.1 per cent of the previous year’s level, while other verticals have seen higher exit activity.

European governments are increasing their investments in cleantech, with examples such as the French government offering tax credits to encourage investments in renewable and low-carbon technologies expected to generate substantial private investments by 2030.

Exits

Exit activity in the venture capital (VC) ecosystem has shown limited recovery in 2023, fluctuating around a low-single-digit billion value throughout the year, unveils the report.

In the first three quarters of 2023, exit value reached €9.1B, 72.8 per cent lower than the same period in the previous year.

Further, 2023 is expected to be the most depressing year for exit value since 2013, says the company.

The report suggests that the revival of exit activity is expected to depend on a recovery in broader valuations and public listings.

The ratio of total investments-to-exits has decreased from 11.9x in 2022 to 11.5x at the end of Q3 2023, primarily due to a greater decline in the number of investments compared to exits.

The report says the IT hardware demonstrates the most resilience, while the energy sector experiences the greatest declines in exit activity during the first nine months of the year.

The resilience in IT hardware is attributed to acquisitions like Augmenta and Panthronics.

In software’s largest sector, exit value declines are moderate, decreasing by 69.3 per cent through Q3 2023 compared to the first three quarters of 2022.

In the third quarter of 2023, exit activity was prominent in five sectors, with software and biotech & pharma generating the most value.

The top 10 exits in Q3 2023 also featured a dominance of the software industry with the largest exit being the acquisition of biologics player Kerecis for €1.2B in the biotech & pharma sector.

Fundraising

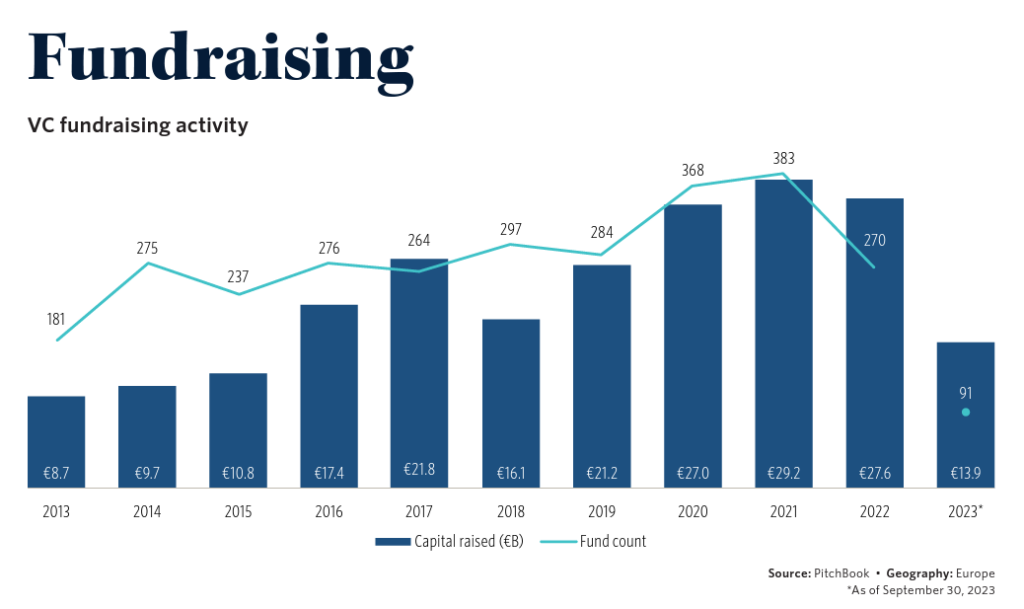

In Q3 2023, VC fundraising was only at half the level of 2022, with €13.9B raised in the first nine months compared to €27.6B in 2022.

While weaker year-over-year, fundraising has increased since H1 2023 with €8.9B raised.

The report anticipated that fundraising in 2023 will surpass 2022 levels, unlike the trend seen in private equity which has been strong. One of the reasons for this lag is the need for megafunds in VC, which can significantly impact total capital raised.

The largest VC funds in 2023, like NATO’s Innovation Fund and Highland Europe Technology Growth V, are much smaller than the top private equity funds.

Smaller VC firms face an even tougher fundraising environment, with LPs prioritising relationships with established firms.

There is a shift of capital towards more experienced VC managers, comprising 59.6 per cent of capital raised in Q3 2023, up from 53.3 per cent in 2022.

The number of first-time VC funds closing in Q3 2023 (23) is significantly lower than the total in 2022 (76).

Read the orginal article: https://siliconcanals.com/news/q3-2023-european-venture-report/