At the Goodwood Festival of Speed in July, Rowan Atkinson, known by most as Mr. Bean, drove a Toyota GR Yaris running on hydrogen.

This was not a fuel cell vehicle but a special car with hydrogen directly injected into its internal combustion engine.

It was not only an attempt to promote alternative fuels but also to extend the life of internal combustion engines. However, it also showed how hydrogen is winning over in an age where electrification is the norm in the auto industry.

With water as its only byproduct, hydrogen is widely seen as an important vector in the transition to a net zero economy.

“Hydrogen is today enjoying unprecedented momentum, driven by governments that both import and export energy, as well as the renewables industry, electricity and gas utilities, automakers, oil and gas companies, major technology firms and big cities,” Dr Fatih Birol, Executive Director, International Energy Agency, said in a report.

Hydrogen economy

Depending on whom you ask, hydrogen is either our path to net zero or a solution pushed by the fossil fuel industry.

To understand this, it is important to see the current energy landscape. On one hand, we have oil, natural gas and coal as molecular sources while on the other hand, wind and solar deliver energy via electrons, or electricity.

While electrification is all the rage right now, there are industries with high energy demand where electrification won’t work.

For such use cases, scientists and climate tech enthusiasts see hydrogen, a zero-carbon fuel with water as its only byproduct, as the real alternative. It also helps that hydrogen is the most abundant element on earth after oxygen.

With many countries looking for energy sovereignty and Europe shifting its dependence off Russian oil post Putin’s invasion of Ukraine, hydrogen has emerged the darling of the alternative energy industry.

This also reflects in funding received by hydrogen startups in Europe. According to Dealroom, Europe’s hydrogen startups received $437M in funding, a 592 per cent increase over 2020.

VC investment globally in green hydrogen producers also grew from $166M in 2020 to $3B last year, a 17x growth in two years.

Under its net zero strategy, Europe estimates the continent will need 70 million tonnes of hydrogen by 2050. That brings us to the challenge: production.

Classification of hydrogen

Even though it is abundant on earth, hydrogen does not appear on its own. In order to get hydrogen, we need to split it apart from other molecules, which requires a lot of energy.

This process is what critics keep complaining about and depending upon the process used to produce hydrogen, it is classified into green, grey, and blue hydrogen.

- Green hydrogen: It is produced by using renewable energy sources to separate out oxygen and hydrogen from water, also known as electrolysis.

- Grey hydrogen: The most commonly available hydrogen is grey hydrogen produced by using a process that relies on fossil fuels.

- Blue hydrogen: Blue hydrogen is produced using the same process as grey hydrogen but uses carbon capture and storage to collect the emissions produced in the process.

In the same IEA report, Dr Birol added, “The world should not miss this unique chance to make hydrogen an important part of our clean and secure energy future.”

The IEA estimates that only 0.1 per cent of hydrogen produced is green hydrogen and blue hydrogen is only a “low carbon fuel” since it is difficult to completely capture the emissions produced.

Once produced, hydrogen can be used either as a gas or transformed into a fuel but this production challenge remains paramount.

North Holland: Europe’s hydrogen hotspot

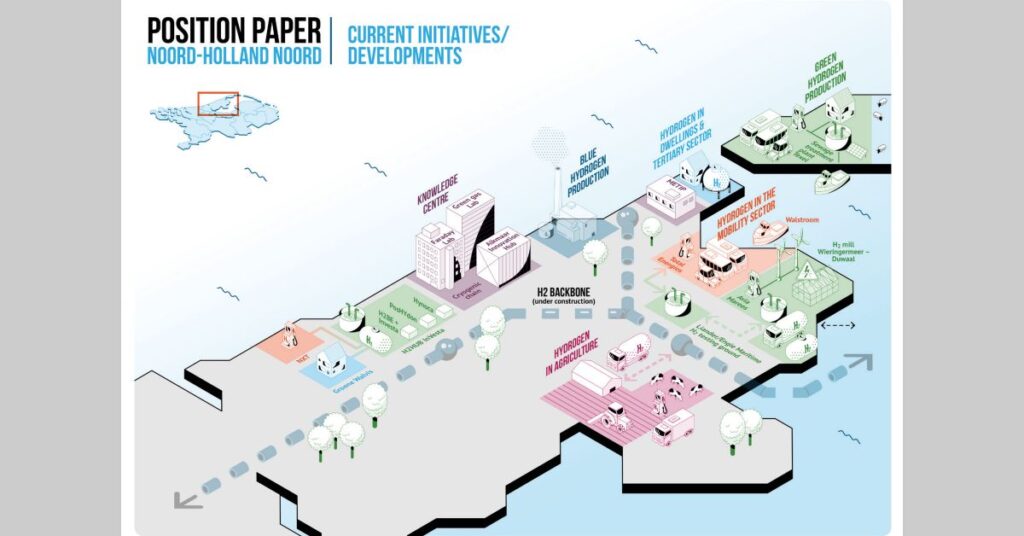

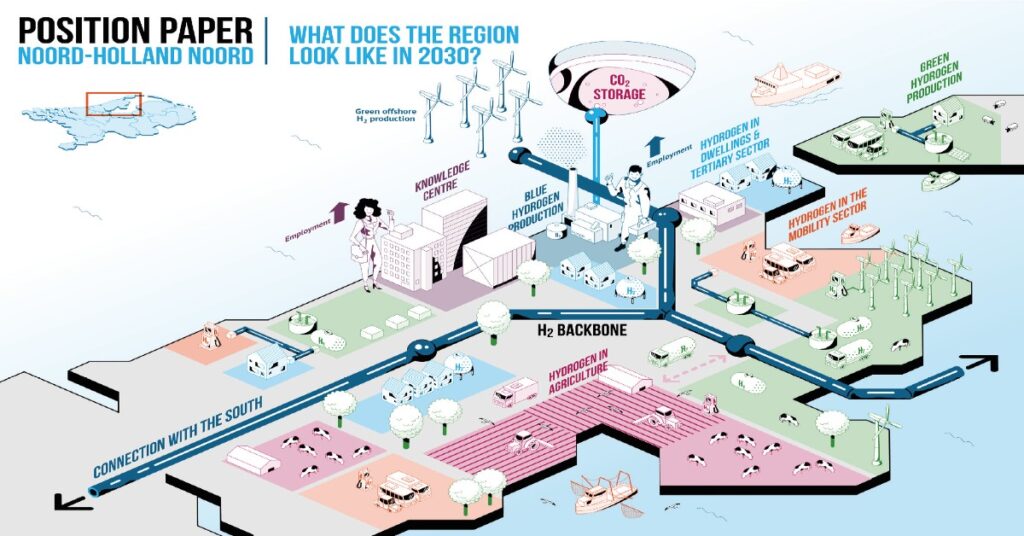

It won’t be far-fetched to call the North Holland region as the hotspot for hydrogen development in the Netherlands and Europe.

This is in direct conjunction with the Dutch government’s ambitious target of lowering its greenhouse gas (GHG) emissions by 55 to 60 per cent by 2030 compared with 1990 levels.

It has also set a goal of becoming a carbon-neutral energy system by 2050. One of the ways to get there is by adopting hydrogen in its energy transition.

Hydrogen plays such an important role that in May 2023, the North Holland region was awarded the European Hydrogen Valley status, a distinction given to regions making efforts to develop energy systems based on sustainable hydrogen.

Wilmar van Grondelle from the City of Amsterdam says the region is developing a hydrogen economy with many value chains, adding, “Green hydrogen will become an important new energy carrier in our future sustainable energy system.”

He further explains that the main value chains in the Amsterdam or North Sea Canal Area are sustainable fuels, sustainable aviation, green steel and balancing the energy system.

To make this possible, the North Holland region has already embarked on local production of green hydrogen with HyCC’s 500MW project and Vattenfall’s 20MW project.

There is also a large-scale production of sustainable electricity through wind parks at the North Sea with estimated production of 21GW in 2030. It will be scaled to 70GW by 2050.

Other initiatives include the H2A import consortium in the Port of Amsterdam with the stated goal of importing 1 million tons of hydrogen to the Port of Amsterdam.

There is also infrastructure being laid in the form of a national high-pressure hydrogen infrastructure and a local low-pressure distribution pipeline network to the industries in the Amsterdam industrial cluster.

Douke Visserman, Business developer of hydrogen applications at Hygro, calls this the early stage of deployment with the hydrogen value chain continuously growing.

He says the Amsterdam region is already home to four hydrogen refuelling stations and the Dutch government has agreed to have 50 hydrogen refuelling stations operational across the country by 2025.

Hygro, which received a €11.8M grant to accelerate sustainable hydrogen production in April this year, plans to “contribute to this goal by releasing another 5 hydrogen refuelling stations in North-Holland by 2025.”

Balancing energy transition

While electrification has become the buzzword among automakers, the ground reality is that electrification alone won’t help lower carbon emissions.

There is a need to evaluate other green fuels and especially look for ways to supplement the limitations of wind and solar energy.

City of Amsterdam’s Van Grondelle says that hydrogen production is essential to balance the energy system since wind power is not always generated.

He sees the 70GW wind at sea capacity in 2050 as a way to turn the North Sea into a future power station.

“The wind-at-sea project will therefore be coupled to an electrolyser where hydrogen will be produced,” he says.

As mentioned earlier, electrolysis is the way to get green hydrogen and since the energy supplied is green energy, there will be no emissions in the process.

The Dutch government is not stopping at using wind power to support green hydrogen production on land but also investigating the possibility of hydrogen production at sea, right next to the wind park.

This is an area where Dutch startup HYGRO could play an enormous role. Visserman says the startup is bullish on hydrogen becoming a primary energy carrier in transition because of the cost associated with building the infrastructure.

Compared to electricity transmission and distribution infrastructure, Visserman explains that hydrogen pipelines are about 20 times cheaper per kW connection capacity.

He adds, “The social benefits of using hydrogen to distribute energy are significant and provide a solution to the current problems with electricity grid congestion due to limited available grid capacity.”

Van Grondelle agrees with Visserman adding that transport and storage of hydrogen will be more efficient and cost-effective than electricity and sees the use of hydrogen directly as an energy source further reducing losses.

However, the transition to hydrogen as a primary energy carrier is not without its own challenges.

Challenges and the road ahead

The key challenge to the hydrogen equation is development of fuel cells. For passenger cars powered by hydrogen, fuel cells are going to be the standard but they are not yet as durable as internal combustion engines.

However, a fuel cell electric vehicle offers extended range, short refilling times, and lower carbon footprint in manufacturing compared to a battery-powered electric vehicle.

Visserman sees these as temporary challenges and argues that the production volume of hydrogen fuel cells is growing fast.

He cites a prediction by Toyota that they will be able to reduce the cost of fuel cells by 50 per cent and still make a profit if they can sell 200,000 units as a testament to rapid development in hydrogen fuel cell technology.

Fuel cell technology is not the only challenge though. We have seen how promising technologies have lost their sheen due to lack of funding.

In the case of hydrogen, there is definite interest among investors but the governments have the most outsized role to play when it comes to funding.

Van Grondelle says the large investments made by the EU and the Dutch government to speed up the hydrogen transition as a great start.

However, he sees a need for large investments to create a level playing field for hydrogen production companies and offtakers.

“It is important to create clear laws and legislation regarding hydrogen applications,” he says, before adding, “currently the non-existence of these laws and legislation is holding back the development of the hydrogen economy.”

Visserman agrees that green hydrogen production, distribution, and applications are capital intensive investments because of the need to build physical infrastructures.

However, he argues that the value chain from wind to wheel will be more affordable than electricity and thus able to return a healthy profit “given the regulations and incentives are aligned with its adoption and roll-out over the coming years.”

Van Grondelle redraws our attention to more than €15B invested by the Dutch government to stimulate the hydrogen economy in the country and the rise of the North Holland region as a hydrogen hotspot with European Hydrogen Valley status.

At this stage of hydrogen development, the social benefit is already realised across the value chain and Visserman says consistent rules and incentives will only scale the adoption and use of hydrogen.

Not all the projects mentioned have been realised but one thing is evident, the Netherlands is brimming with activity to enable an energy transition where hydrogen could become the primary energy source.

The country has laid the groundwork, enabling the infrastructure, and fueling the value chain but the success will depend on its ability to keep the momentum going.

Read the orginal article: https://siliconcanals.com/news/startups/energy-startups/hydrogen-north-holland-energy-transition-fuel-sustainability/