GRAZ, Austria–(BUSINESS WIRE)–USound, the leading developer and supplier of MEMS speakers for wearable and hearable devices, has announced that it has received a €10 million growth investment supporting high-volume MEMS production ramp ups for various true-wireless-stereo (TWS) earbud and over-the-counter (OTC) hearing aid customers.

The investment round was led by Austria’s leading venture capital investor, eQventure, with participation from one of the world’s leading technology entrepreneurs, Andreas “Andy” Bechtolsheim (co-founder of Sun Microsystems, early-stage investor in Google), serial entrepreneur and venture capitalist, Hermann Hauser (co-founder of ARM), as well from the USound management, including Ferruccio Bottoni (CEO), Andrea Rusconi-Clerici (CTO) and Herbert Gartner (CFO).

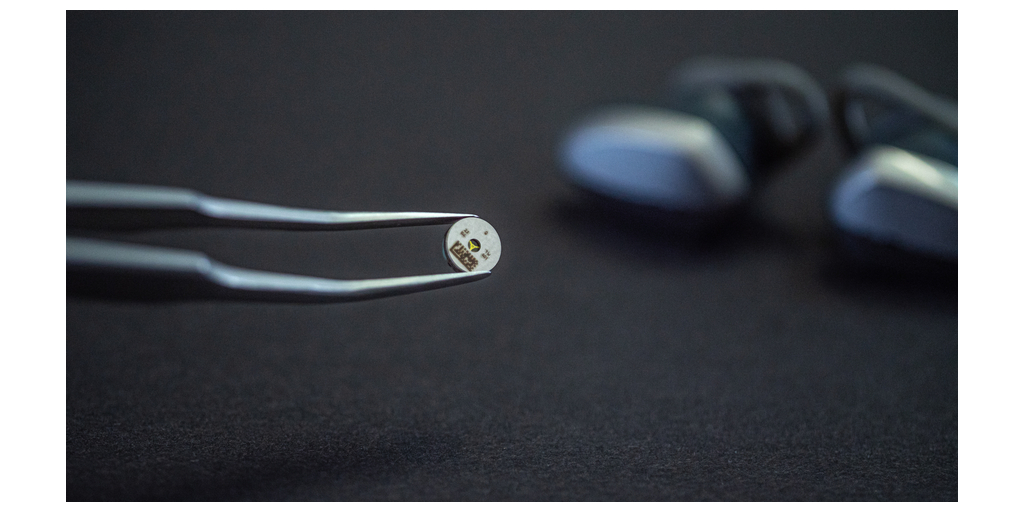

USound MEMS speakers take up 50% less space, use 80% less energy, and boast a greater frequency range than rival speaker products. The speakers can be seamlessly integrated into Bluetooth earphones, headphones, smartphones, VR/AR glasses, wearables, and over-the-counter hearing devices.

Most customers select USound’s thin, lightweight, full-range MEMS speakers because of their integration flexibility and the benefits of USound’s low-power amplifier. Due to its reduced size, USound’s MEMS speakers benefit the size and weight of future wearables, providing more in-ear comfort and style for consumers. Moreover, they have a dramatically reduced system costs due to their SMT reflow capability, enabling fully automated assembly of audio products to achieve the highest quality and performance. In comparison to a pure monolithic MEMS solutions, USound’s MEMS speakers are smaller and offer higher sound pressure levels, better sound quality, and lower manufacturing costs.

“After announcing our cooperations with major audio ODMs like Luxshare-ICT at the end of 2022 and Concraft / OBO Pro2 in the beginning of 2023, many OEM customers started using USound’s MEMS speakers for their next generation audio products. A new age for the audio industry has just begun,” stated Ferruccio Bottoni, Chief Executive Officer at USound.

About Andy Bechtolsheim

Andy Bechtolsheim is the co-founder and Chief Development Officer and Chairman of Arista Networks. In 1982, he cofounded the tech hardware firm Sun Microsystems with Bill Joy, Scott McNealy and Vinod Khosla. Oracle bought Sun in 2010 for $7.4 billion. Much of his fortune stems from an early investment in Google. Bechtolsheim studied Computer Science at Carnegie Mellon University and Stanford University.

About USound

USound is a fast-growing MEMS loudspeaker company enabling customers to bring new revolutionary audio products to the market. USound’s unique selling proposition is based on radical miniaturization, power reduction and increased production efficiency. USound products are safeguarded by over 350 patents. Learn more on www.usound.com

Contacts

Maria-Eleni Perpiraki

press@usound.com