Pitchbook has published its Q2 2023 European Venture Report, which provides an overview of deals, nontraditional investors, exits, and fundraising for the region in H1 2023.

According to the report, European VC dealmaking dropped significantly in the first half of 2023 as macroeconomic headwinds caught up with the VC ecosystem.

Here are some key findings of the report as we explore the implications for the European venture capital market.

European VC deal making drops

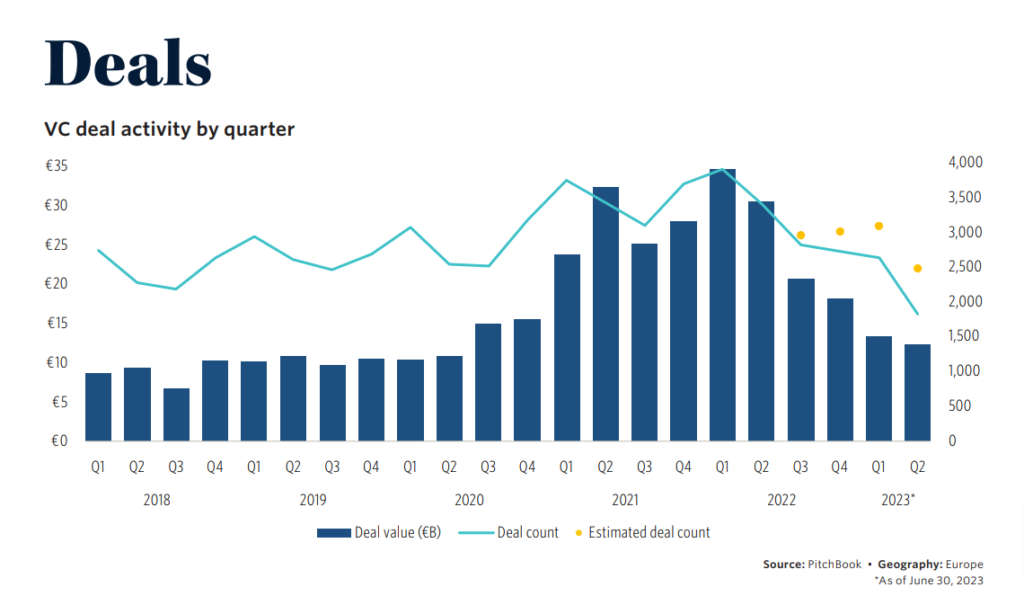

According to the report, European VC dealmaking dropped significantly in the first half of 2023, with deal value down 60.8 per cent compared with H1 2022 and 34.2 per cent lower than H2 2022.

The VC deal activity peaked in Q1 2022 and has been on a steady quarterly decline since, adds the report.

This decline is attributed to various factors, including higher interest rates, inflation, a closed IPO exit window, and challenging fundraising conditions.

While the US public markets have started to recover, the European monetary tightening cycle may continue for a longer period due to persistently high inflation. As private markets typically lag behind public markets, any signs of recovery in the public markets will indicate when the private market recovery can be expected.

Navigating the challenging landscape

In the face of declining dealmaking, VCs have had to adapt their strategies to survive. Startups and investors alike have recognised the difficulty of fundraising and the impracticality of exiting unprofitable businesses through IPOs.

Instead, VCs have been working closely with their portfolio companies to restructure operations internally and extend their runways as far as possible given the funding constraints.

This shift in strategy has led to a greater emphasis on cost management rather than pursuing growth at any cost. As a result, layoffs and hiring freezes have become prevalent throughout the startup ecosystem. The tech sector, in particular, has experienced a significant number of layoffs.

For example, GoCardless, a unicorn payments startup, announced a 15% reduction in its global workforce in June 2023.

Drop in deal activity

The Q2 2023 European Venture Report reveals a significant drop in VC deal activity across Europe. Deal value and count have declined, indicating a challenging environment for startups seeking funding.

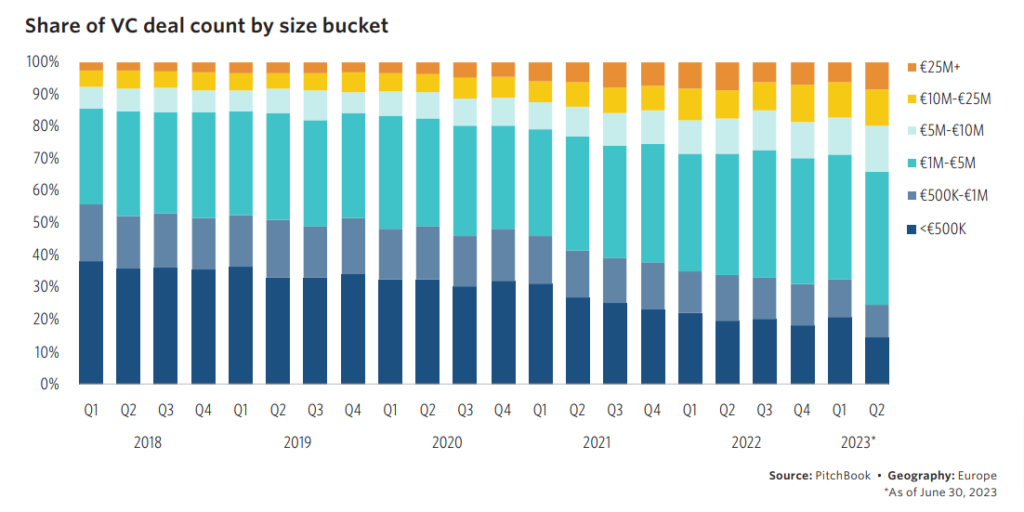

Larger deals have become more prevalent as follow-on VC investments provide an additional runway for startups. Smaller deals, particularly those in the range of €500,000 to €1M and under €500,000, have experienced the sharpest decline year-on-year.

The proportion of VC deal count has shifted towards the venture-growth and late stages at the expense of the angel and seed stages. This shift highlights the difficulty in securing funding in the current climate.

While median deal size has increased, averaging €2.1 million in 2023, average deal size has decreased as sponsors exercise caution in pursuing megadeals. Instead, the focus has shifted towards deals in the range of €10 million to €25 million.

Slowing Exit Activity and valuation declines

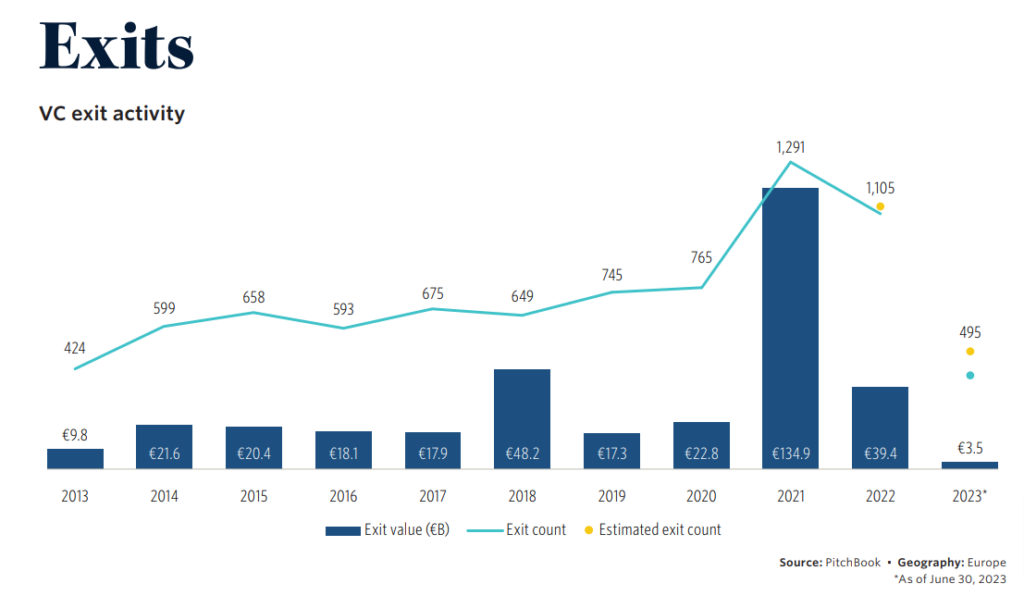

Exit activity in the European VC market has continued to decline, reaching decade lows. One of the main challenges faced by VC markets is the downward adjustments of portfolio company valuations, which have resulted in decreased exit values.

Both the volume and value of exits in H1 2023 remained significantly depressed, indicating caution among companies and investors. In H1 2023, exit value amounted to €3.5B, a run rate that implies full-year 2023 will come in 82.2 per cent below 2022’s total exit value.

Corporate acquisitions remain the most common exit option with debt-heavy leveraged buyouts losing share. The IT hardware sector has shown the most resilience in exit valuations, while the energy sector has experienced the least resilience.

The H1 2023 run rate of IT hardware exit value implies the sector is on track to pace 58.5 per cent below 2022 levels. This is ahead of other sectors where declines in activity have been more severe, such as biotech & pharma, which are pacing 90.7 per cent below 2022 levels.

The biggest laggard so far this year appears to be the energy sector — its exit value of €31.7M is significantly lower than 2022’s total of €1.9B.

Cleantech continues to be a prevalent vertical. However, without signs of sequential recovery, any pickup in exit activity throughout 2023 will heavily depend on the public listing markets, which are expected to remain subdued in the second half of the year.

Fundraising Challenges

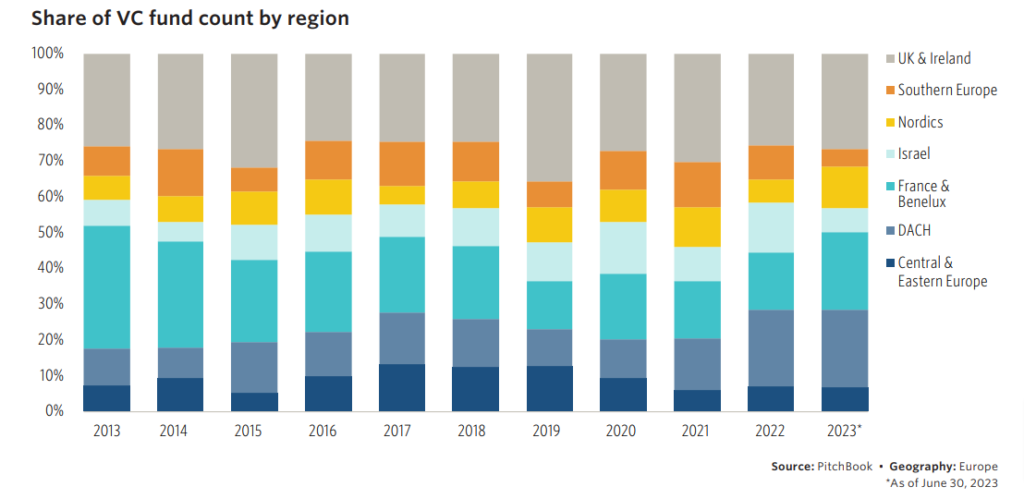

Fundraising activity in Europe has also faced significant headwinds. In H1 2023, the total capital raised amounted to €8.9B, suggesting a full-year pace 36.7 per cent below 2022 levels.

Experienced investors have increasingly taken deal value away from emerging firms as managers with longer track records have become more popular among limited partners (LPs) seeking stability amidst higher uncertainty and lower private market returns.

The majority of fund closings in H1 2023 occurred in the UK & Ireland, while several open funds remain in Europe overall. Fund close times have noticeably lengthened, but if these funds are successfully closed throughout the year, they could significantly boost fundraising totals for the full year.

Regional Analysis

The report also provides insights into regional variations in the European venture capital market.

The UK and Ireland have witnessed the highest number of fund closings, indicating their resilience in fundraising efforts, followed by a tie between the Germany, Austria & Switzerland (DACH) regions, and France & Benelux. However, open funds remain across Europe, suggesting ongoing investment opportunities.

It is worth noting that the duration for fund closings has significantly lengthened, reflecting the challenges faced by investors in the current environment.

Despite these challenges, closed funds throughout the year could potentially contribute to an increase in fundraising totals for 2023.

Read the orginal article: https://siliconcanals.com/news/startups/european-vc-dealmaking-plummets-h1-2023/