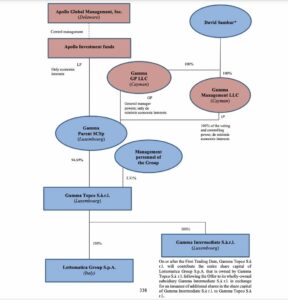

Italian gambling company Lottomatica received the approval of Italian stock market regulator Consob for its IPO prospect at 9-11 euros per share (see here a previous post by BeBeez). After the listing, Apollo Global Management will have 71.8% – 75.9% of the firm (67.8%-72.5% in case of over-allotment option). The company will sell current shares for up to 175 million euros and issue further through the launch of a capital increase worth up to 425 million. The company will have a market capitalization of 2.265 – 2.67 billion (see here a previous post by BeBeez). The greenshoe option is worth up to 90 million. The enterprise value for the IPO is in the region of 4.3 billion. Barclays Bank Ireland PLC, Deutsche Bank, Goldman Sachs, JP. Morgan, UniCredit, Apollo Capital Solutions, Banca Akros, BNP Paribas, Mediobanca, Equita SIM, Credit Suisse, Latham & Watkins, Paul, Weiss, Rifkind, Wharton & Garrison, and Linklaters are working on the IPO.

Italian gambling company Lottomatica received the approval of Italian stock market regulator Consob for its IPO prospect at 9-11 euros per share (see here a previous post by BeBeez). After the listing, Apollo Global Management will have 71.8% – 75.9% of the firm (67.8%-72.5% in case of over-allotment option). The company will sell current shares for up to 175 million euros and issue further through the launch of a capital increase worth up to 425 million. The company will have a market capitalization of 2.265 – 2.67 billion (see here a previous post by BeBeez). The greenshoe option is worth up to 90 million. The enterprise value for the IPO is in the region of 4.3 billion. Barclays Bank Ireland PLC, Deutsche Bank, Goldman Sachs, JP. Morgan, UniCredit, Apollo Capital Solutions, Banca Akros, BNP Paribas, Mediobanca, Equita SIM, Credit Suisse, Latham & Watkins, Paul, Weiss, Rifkind, Wharton & Garrison, and Linklaters are working on the IPO.

Ecomembrane, an Italian producer of systems for gas stocking, will soon list on Milan market with a capitalization of 36.5 million euros after having raised 15 million for institutional investors (see here a previous post by BeBeez). The company issued new shares through a capital increase of 11 million. Lorenzo Spedini, ceo, sold part of his stake. Ecomembrane retained as advisors Private Equity Partners, Equita sim, Grimaldi Alliance, BDO Italia, Reply Consulting, and Spriano Communication. Ecomembrane appointed Fabio Sattin and Alessandra Stea as board members.

FSI announced the acquisition of a relevant minority of Bancomat, an Italian network of ATM machines (see here a previous post by BeBeez). The fund will subscribe to a 100 million euros capital increase. Bancomat appointed as advisors Mediobanca, Studio Legale Gattai, Minoli, Partners, PwC, and Salvatore Maccarone. FSI retained WePartner, Studio Legale Pedersoli, KPMG, and CMC Labs.

Made in Italy Fund, a vehicle of Quadrivio & Pambianco, acquired 74.36% of Milan-listed fashion firm Cover50 from FHold, the holding of Pierangelo Fassino (66%) and Edoardo Fassino (34%) (see here a previous post by BeBeez). Made in Italy must now acquire 25.64% of the target for up to 15.12 million euros. FHold reinvested for a minority of the business. Banco BPM signed a commitment letter for financing the transaction. Banca Mediolanum Investment Banking, Pedersoli Studio Legale, Caravati Pagani – Dottori Commercialisti Associati, and PwC assisted the buyers. FHold retained Studio Dondona.

Clessidra Private Equity acquired Everton, a producer of tea for the big distribution from Cronos Capital Partners, a vehicle of Alessandro Besana and Lorenzo Bovo that purchased 57% of the business from the Dodero and Donelli Families in 2020 (see here a previous post by BeBeez). Federico Dodero, the ceo of Everton, and other managers will reinvest for a minority of the business. Clessidra appointed as advisors Equita KFinance, Equita (debt advisor), Target Law, KPMG, Bain, Bonfiglioli Consulting (operations), Studio RDRA (tax). Vitale & Co. (financial advisor), Studio Gattai, Minoli, Partners, LCA (legal advisor), and Deloitte (tax advisor) assisted the vendors.

On 28 April, Friday, Fimer, an Italian producer of photovoltaic inverters that is in receivership, Arezzo Court may make a decision about the controversy between former directors (Claudio Roberto Calabi, Francesco Di Giovanni and Alvise Deganello) and the company’s owners, the Cazzaniga Family (see here a previous post by BeBeez). The company attracted a 50 million euros (equity and financing) offer from McLaren and Greybull Capital. However, the Cazzaniga Family is more keen on Clementy Group and replaced the previous directors with Luca Bertazzini and other managers.

Italian club deal Orienta Capital Partners acquired the majority of Contrader, an IT consultancy firm, with the financing support of Invitalia, Umberto Paolucci the target’s founder Sabatino Autorino, and the management (see here a previous post by BeBeez). Prior to the acquisition Contrader’s owners were Autorino (65%), FARE Spot (30%) and Dicembre (5%). Banca Ifis financed the transaction with a senior facility and retained Simmons & Simmons as advisor. Gitti & Partners assisted Orienta. Hilex advised Autorino. Lincoln International acted as debt advisor, Grant Thornton carried on the financial and tax due diligence. Gellify has been in charge of business due diligence. Contrader has sales of 10.9 million euros, an ebitda of 2.5 million and net cash of 0.775 million.

VeNetWork, an Italian club deal, launched VeNeSport, an ecosystem for sportswear firms that announced the acquisition of Unimonteco, an Italian producer of ski boots (see here a previous post by BeBeez). VeNeSport retained Be Advisor, while Grimaldi Alliance assisted the vendors. Unimonteco has sales of above 4.4 million euros, an ebitda of 1.7 million and net cash of 3.7 million. Loris Corrado is the ceo of Unimonteco.

Italian strategic consulting firm BIP, a portfolio company of CVC Capital Partners since 2021, acquired The Visual Agency (TVA), an Italian information design company (see here a previous post by BeBeez). Trotter Studio Associato, Studio Legale Bertacco Recla & Partners and Studio Legale Michelini assisted BIP. TVA retained Alberto Vita Samory. Paolo Guadagni, ceo, and Paolo Ciuccarelli founded the target in 2011. TVA has sales of 1.6 million euros, an ebitda of 43,000 euros and a net financial debt of 42,000 euros. Prior to the sale, the company belonged to Guadagni (55.25%), Ciuccarelli (8.5%), Francesco Foscari Rezzonico (21.25%), and Bea Media Company (15%).

London’s iAM Capital Group acquired Capo Mimosa, a camping based in the North Western Italian Liguria region (see here a previous post by BeBeez). The fund will convert Campo Mimosa in a luxury resort. At the end of 2021, iAM Capital Group launched a real estate platform with CS Capital for investing 50 million euros in Italian sites to refurbish with an ESG approach.

Itelyum Regeneration, an Italian waste management company that belongs to Stirling Square and DBAG, announced the acquisition of 60% of competitors Secomar and Ambiente Mare from Navenna-Petrokan (see here a previous post by BeBeez). Osborne Clarke assisted Itelyum while the vendors retained Giliberti Triscornia e Associati. Secomar has sales of 5.1 million euros, an ebitda of 2.6 million and net cash of 2.8 million. Ambiente Mare has revenues of 3 million, an ebitda in the region of 43,000 euros and net cash of one million. Marco Codognola is the ceo of Itelyum.

Delta Med, an Italian producer of medical devices that has belonged to White Bridge Investments since October 2021, acquired a controlling stake of DBM, a manufacturer of prefilled syringes from Roberto Cadringher (90% owner) and his family (see here a previous post by BeBeez). Delta Med retained as advisors White&Case, Athena and Deloitte. DBM hired Nicolò Del Guerra, Domenico Zalum, Carlotta Gagliano, Vitale-Zane & Co, and Studio Pozzi – Dottori Commercialisti Associati. The Cadringher Family will reinvest for a minority of DBM, while Roberto Cadringher will join the board of Delta Med. DBM has sales of 2.7 million euros, an ebitda of 0.345 million and net debt of 2.1 million.

Jakala, an Italian martech company that belongs to Ardian, acquired FFW, a Danish digital transformation company (see here a previous post by BeBeez). The buyer appointed as advisors Barclays, Giovannelli e Associati, Moalem Weitemeyer, Gattai, Minoli Partners, Weil, Gotshal & Manges (financing), KPMG, PwC, and Gitti & Partners. Jakala has sales of above 500 million euros.

RedFish Long Term Capital (RFLTC) acquired Movinter, an Italian producer of piping systems for high-speed programmes, from siblings Vito and Stanislao Sambin (see here a previous post by BeBeez). Sources said to BeBeez that RedFish will list on Milan market by June 2023. Such an acquisition is part of a strategy of horizontal integration in the sectors of aerospace and rail & navy. RFLTC appointed AMTF Avvocati as advisors, while the vendors hired Studio Pedersoli. The Stambin siblings founded the target in 1999. The company has sales of above 20 million euros, an ebitda of 3.4 million and a 60 million order book.

Green Arrow appointed Nunzio Luciano as chairman (see here a previous post by BeBeez). Luciano replaced Luisa Todini in the role. The manager previously acted as chairman of Cassa Forense, the pension fund of Italian lawyers, chairman of the European Investment Fund’s advisory board and is currently head of the strategic comitee of Green Arrow Infrastrutture per il Futuro (GAIF).