Year 2022 was a bad one for most fintech companies involved in m&a, venture capital and private equity deals as both total investment and number of deals fell to $164.1 billion and 6,006, respectively from 238.9 billions and 7,321 in 2021. Figures have just been published by KPMG in its last Pulse of Fintech Report H2 2022 ( see here the report).

Focusing on venture capital activities in fintech, the deal value was around $80.5 billion for 5136 deals in 2022. The performance declined, compared with its peak performance in 2021, which was around $122.9 billion in deal values among 6187 deals. Though there was a performance decrease, the deal values and the number of deals were still higher than in 2019 and 2020.

Also, the global private equity growth activities had a slightly decreased performance. The deal value in 2021 was around $11 billion for 154 deals, but only around $9.7 billion for 141 deals in 2022.

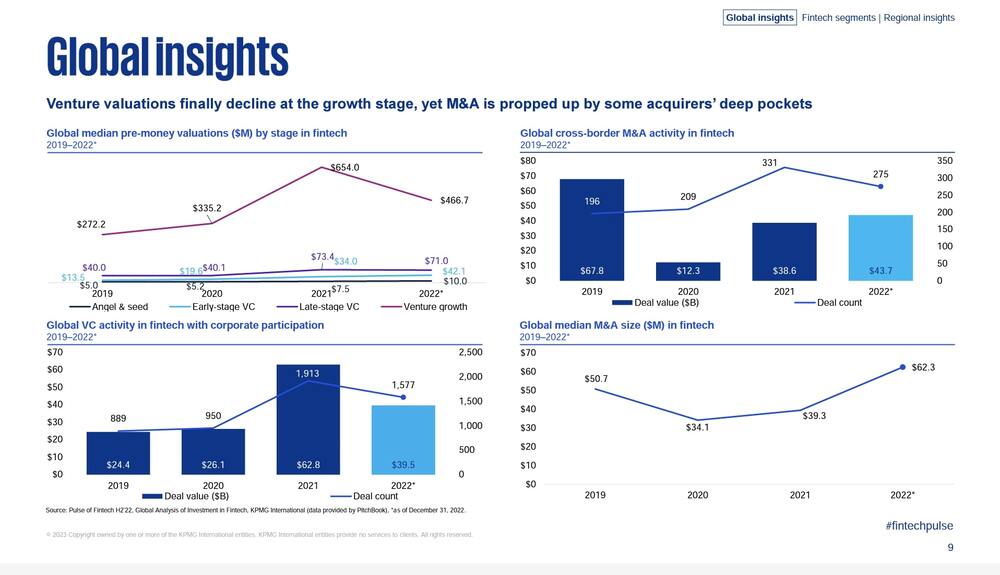

In addition, total M&A activities also experienced a performance decline from 2021 to 2022. The global deal value of M&A went from $105.1 billion to $73.9 billion, and the number of deals went from 980 to 729. However, the cross-border m&a activities in fintech had the opposite direction. There was a slight increase in the total deal value. The deal value in 2022 was around $43.7 billion and the deal value in 2021 was around $38.6 billion. Though the total deal value increased, the total number of deals decreased, going from 331 deals in 2021 to 275 deals in 2022. We can infer that the number of large deals increased in 2022. This can be easily explained by the fact that the median m&a deal value was $39.3 million in 2021 and $62.3 million in 2022.

The big drop in activity was in the last six months of 2022. Global fintech investment in H2’22 was actually $44.9 billion compared to the $119.2 billion seen in the first half of the year. The more than 50% decline highlights the impact of the sharp dropoff in large deals. H1’22 saw eight m&a deals greater than $1 billion globally, including the $27.9 billion acquisition of Australia-based Afterpay, two VC raises (Germany-based Trade Republic, UK-based Checkout.com) and one PE deal (US-based Genesis Digital Assets) . While H2’22 saw just four m&a deals over $1 billion buyout of US, the largest being the $8.4 billion of US-based Avalara. The largest VC raise of H2’22 was the $800 million raise by Sweden-based Klarna which however took a large cut to its valuation (see here a previous article by BeBeez), while the largest PE deal was a $250 million raise by US-based Avant.

As for private equity big deals, we point out that year 2023 statistics will be boosted by the announced acquisition by Milan-listed paytech Nexi (which still sees a large group of private equity investors in its capital) of an 80 percent stake of the merchant acquiring business of Spain’s Banco Sabadell on the basis of an enterprise value for 100 percent of €350 million (see here a previous article by BeBeez).

As for valuations it’s interesting to see that venture valuations finally decline at the growth fintech segments: global median pre-money valuations actually dropped to $466.7 million from 654 million in 2021. Yet m&a is still propped up by some acquirers’ deep pockets so that global median m&a size in fintech raised to $62.3 million from $ 39.3 million in 2021.

As for valuations it’s interesting to see that venture valuations finally decline at the growth fintech segments: global median pre-money valuations actually dropped to $466.7 million from 654 million in 2021. Yet m&a is still propped up by some acquirers’ deep pockets so that global median m&a size in fintech raised to $62.3 million from $ 39.3 million in 2021.

Coming back to the aggregated data, including venture, private equity and m&a activities,

on a regional basis, the Americas continued to account for the largest share of fintech investment globally, attracting $68.6 billion across 2,786 deals in 2022, of which the US accounted for $61.6 billion across 2,222 deals. Comparatively, the AsiaPacific region saw $50.5 billion in fintech investment across 1,227 deals, while the EMEA region attracted $44.9 billion across 1,977 deals. While both the Americas and Europe saw fintech investment decline, the AsiaPacific region slightly surpassed 2021’s peak high on the back of Afterpay acquisition.

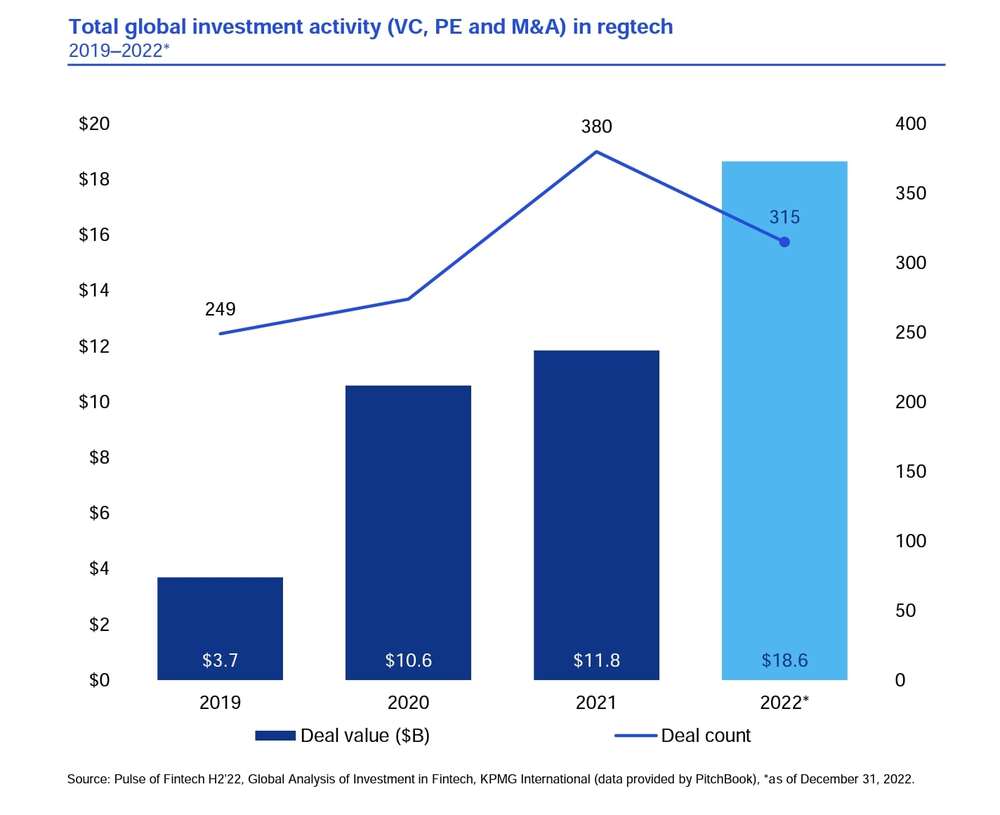

As for fintech sectors, performance was poor for every segment, with exception of Regtech which scored a significant increase in total deal value to around $18.6 billion for 315 deals. The increase is dramatic, its deal value in 2021 was only around $11.8 billion for 380 deals. This increase can be attributed to the largest buyout occurring in regtech, which is the $8.4 billion buyout. It appears that regtech is resilient to the deteriorated macro environment. It reflects the importance of helping financial institutions manage compliance and reporting obligations due to the increasing volume of digital transactions. With the increased cost of compliance and demand for instant financial transactions, regtech is able to provide cost-efficient and sustainable solutions to help manage compliance. This makes regtech more attractive.

As for fintech sectors, performance was poor for every segment, with exception of Regtech which scored a significant increase in total deal value to around $18.6 billion for 315 deals. The increase is dramatic, its deal value in 2021 was only around $11.8 billion for 380 deals. This increase can be attributed to the largest buyout occurring in regtech, which is the $8.4 billion buyout. It appears that regtech is resilient to the deteriorated macro environment. It reflects the importance of helping financial institutions manage compliance and reporting obligations due to the increasing volume of digital transactions. With the increased cost of compliance and demand for instant financial transactions, regtech is able to provide cost-efficient and sustainable solutions to help manage compliance. This makes regtech more attractive.

As for payments, the performance of 2022 is acceptable, with $53.1 billion deal values. The peak performance was in 2019, and every year after it had a significantly lower performance than it was in 2019. The performance of 2022 was attributed to the largest deal in 2022, which is Austria’s $27.9 billion in payment. The deal value is slightly lower than 2021’s deal value, of $57.1 billion. However, the number of deals decreased dramatically, going from 967 deals in 2021 to 731 deals in 2022. Though there was a decrease in the number of deals in 2022, it is still the second most deals. In the first half of 2023, it is expected that with an increasing focus on developing and investing in B2B payments solutions; payments companies may want to reach their breath. Also, payment companies in Asia may shift their focus to deepening customer engagement. Financial strong organizations may be willing to buy technology capabilities at lower valuations.

Total global investment activities in insurtech did not perform well in 2022, it declined to a seven-year low in terms of deal value. The deal value in 2022 was only around $7.1 billion for 349 deals. There were around $12.1 billion deals for 485 deals in 2021. Compared with the deal values in 2021, the performance of 2022 dropped significantly. Though there was underperformance in 2022, there were some positive aspects in the second half of 2022. Regions like the Americas, EMEA, and Asia-Pacific attracted some large deals. There was a $500 million acquisition and a $315 million venture capital from the U.S., a $400 million venture capital from German, as well as a $300 million venture capital from Singapore. Due to the challenging nature of the macroeconomy in 2022, insurtech market performance and valuations declined. Many insurtech investors took a pause and waited for uncertainty to pass. Also, insurtech investors shifted their investment focus. They used to focus on the growth of companies, but in 2022, those insurtech investors prioritized profitability. Thus, some startup companies re-evaluated where the value of their companies is from a technology and insurance point of view. In addition, a shifting of focus also occurred among corporate investors. Previously, corporate investors in the insurtech market focused on investments that brought new capabilities to their organizations. However, in 2022, some corporate investors were looking for partnership-based investments. Also, in the insurtech market, it is expected that there is a stronger focus on enablement and SaaS solutions during the first half of 2023.

Ad for cybersecurity, total global investment activities had a significant decline in 2022. The total deal value went from $5.1 in 2021 to $2.1 billion in 2022. However, the number of deals did not drop, both 2021 and 2022 had 68 deals. Such a phenomenon might be caused by the lack of mega-deals in cybersecurity, and it implied that investors still had a high interest in cybersecurity. Venture capital investment in cybersecurity takes a large proportion of the total value, there is around more than $5 million in investment from venture capital. In addition, data management and protection companies attracted a large amount of attention, and the deal size in the data management space experienced rapid growth. This might be attributable to the increase in the importance of data protection. Furthermore, there were discrepancies in cybersecurity operation control between different hyper-scale cloud providers, this raised more interest in investing in solutions associated with security control. Furthermore, automation, machine learning, and smart data analytics are factors that cybersecurity investors are looking for. Moreover, different geographical regions have different focuses on cybersecurity investments. In 2022, privacy and GDPR were the focus in Europe, while the U.S. focused on automation and cyber defense.

Total global investment activity in wealthtech also declined in 2022. It went from its peak in 2021 of $2 billion to $1.2 billion in 2022. The number of deals also decreased, there were 55 deals in 2021 and 48 deals in 2022. Though the performance of wealthtech dropped, it was still a strong year. The deal value in 2019 and 2020 was only around $0.4 billion and $0.2 billion. The year 2022’s $1.2 billion deal value was still high. The deal value was attributed to a $323 acquisition from the UK and $300 million from Singapore. In 2022, there were more and more wealthtech that focused on providing solutions to let broader investors have access to more asset classes. Investors overall have many convenient ways to access wealth information which caused a growing interest in investing in solutions that facilitate wealth management. There is a hot trend in developing solutions and innovative technologies that enhance the knowledge that is available to wealth managers. Highly personalized information can be available for clients through innovations.

Blockchain and cryptocurrency also faced a significant drop in total global investment activity from a peak high of $30 billion in 2021 to $23.1 billion in 2022. The number of deals also decreased from 1807 deals in 2021 to 1537 deals in 2022. Though there is a decrease in 2022, the deal value and a number of deals are still performing well, compared with a deal value of around $5.3 billion in 2019 and 2020. However, we need to pay attention to the deals in 2022. A large proportion of the investments came from the first half of the year. The large deals in the first half of the year included a $1.1 billion SPAC business combination from a Japan-based company Coincheck and a $1.1 billion VC from a Germany-based company Trade Republic. The largest deal in the second half of the year was much smaller, which was a $300 million deal from Singapore. Furthermore, there was around a $32.5 billion crypto exchange company that went bankrupt in 2022. Along with this, there is an increase in the due diligence process and more risk assessment. There was an emergence in the regulatory framework related to crypto regulations in 2022 that aim to protect consumers and retail investors. Moreover, investors have a growing interest in crypto solutions and this makes the broader blockchain space gain more interest and attention. In 2023, It is expected that there will be an increasing focus on institutional SME solutions, and more regulations that govern crypto companies and activities. Thus, investors are expected to have a growing focus on jurisdictions with stronger crypto regulations.