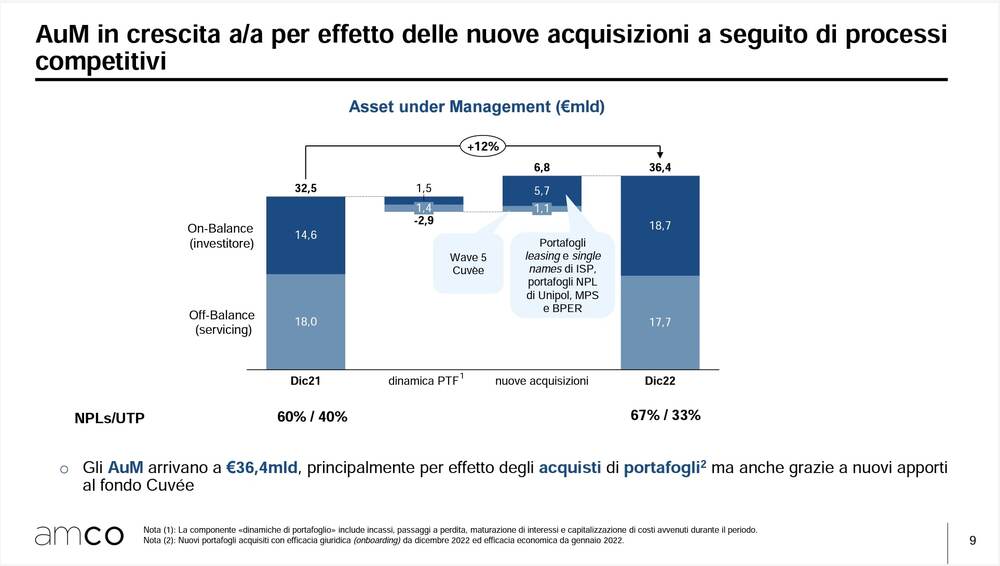

Thanks to new portfolio acquisitions, NPEs under management by AMCO, the Italian Treasury Ministry’s asset management company, rise to 36.4 billion euros at the end of 2022, up 12 percent from the 33 billion recorded at the end of 2021, although slightly below the 36,5 billion estimated at the end of 2022, at the presentation of the Strategic Plan 2025, which envisaged, among other things, by the end of the plan, purchases of new portfolios for 7.5 billion euros, balanced between NPLs and UTPs. The final numbers of assets under management at the end of 2022 were released by AMCO’s ceo Marina Natale, during the presentation of the 2022 budget results, which show a double-digit growth in collections, +12% to 1.52 billion against 1.35 billion in 2021 (see here a previous post by BeBeez).

Thanks to new portfolio acquisitions, NPEs under management by AMCO, the Italian Treasury Ministry’s asset management company, rise to 36.4 billion euros at the end of 2022, up 12 percent from the 33 billion recorded at the end of 2021, although slightly below the 36,5 billion estimated at the end of 2022, at the presentation of the Strategic Plan 2025, which envisaged, among other things, by the end of the plan, purchases of new portfolios for 7.5 billion euros, balanced between NPLs and UTPs. The final numbers of assets under management at the end of 2022 were released by AMCO’s ceo Marina Natale, during the presentation of the 2022 budget results, which show a double-digit growth in collections, +12% to 1.52 billion against 1.35 billion in 2021 (see here a previous post by BeBeez).

On 9 March, Thursday, Artemid and Capza Private Debt, two vehicles of the paneuropean private capital firm Capza, received the authorization for issuing financing facilities in Italy (see here a previous post by BeBeez). Paris-listed insurance giant AXA and Eurazeo are the main investors in Capza. Stefano Zavattaro is the firm’s partner & head of Italy.

The European Investment Bank (EIB) and the Italian Ministry of Tourism launched Fondo Tematico per il Turismo (FTT), a fund of funds that is part of the PNRR programme for supporting the sustainable leisure sector (see here a previous post by BeBeez). FTT wull invest in funds which in turn invests in equity, quasi-equity and debt of Italian companies. The fund will have resources of 500 million euros. The EIB will allocate such resources through Equiter with the support of Intesa SanPaolo (200 million under management), Banca Finint and Sinloc (175 million). FTT will appoint a further advisor through a call for tender. The advisors will allocate the resources of the fund through loans and hybrid products.

Colliers Global Investors Italy (fka Antirion) received from Banco BPM a multi-tranche mortgage facility for regenerating Feltrificio Scotti, a 12500 sqm area in Monza (see here a previous post by BeBeez). Fivelex Studio Legale e Tributario assisted Colliers Global Investors Italy while Banco BPM retained Dentons.

Ecopol, an Italian producer of water-soluble and biodegradable films for single-dose detergents of which Tikehau Investment Management has 31.44%, received a financing facility of 18 million euros from Crédit Agricole Italia, Banco BPM, Intesa Sanpaolo, and UniCredit (see here a previous post by BeBeez). The company will invest such proceeds in the development of a production plant in Georgia, USA, and its internationalization.

Aciam, an Italian waste management company, received a green financing facility of 11 million euros from Banco BPM, BCC Banca Iccrea and BCC Roma for which SACE provided a warranty (see here a previous post by BeBeez). Aciam will invest such proceeds in the developement of an advanced biomethane plant in the central Italian region of Abruzzo. ATI Atzwanger, GM Green Methane and Torelli Dottori will carry on the construction. Aciam has sales of 12.3 million, an ebitda of little above 0.406 million and a net debt of 5.7 million.

Baia Silvella, a manager of campings and leisure parks, issued a minibond of 10 million euros that Banca Finint and BCC Banca Iccrea placed (see here a previous post by BeBeez). Veneto Sviluppo, Mediocredito Centrale, BCC Banca Iccrea, Volksbank, and Mediocredito Trentino-Alto Adige subscribed the 6-year unsecured bond. Advant Nctm acted as deal legal counsel. The company will invest such proceeds in its 35 million programmes for developing further structures and refurbishing the existing ones. Baia Silvella has sales of 54.5 million, an ebitda in the region of 23.2 million and an ebitda margin of 42%.

Faresin Formwork, an Italian construction company, attracted a 9 million euros financing facility from Banco BPM (80% warranty of SACE) for implementing ESG investments in its headquarter (see here a previous post by BeBeez). The company will develop a photovoltaic plant with relamping led technology. Faresin has sales of 32.3 million, an ebitda of 3.8 million and a net debt of 10.8 million.

Fincantieri will back its Italian suppliers with cash invoice rate linked to their ESG rating (see here a previous post by BeBeez). UniCredit, Crédit Agricole Eurofactor, Ifitalia (part of BNP Paribas), and SACE FCT (the factoring unit of Gruppo SACE that acts as funder) will support the company for this project. The suppliers will get a rating from E to A (top mark). Fincantieri will carry on an annual assessment of the suppliers’ rating for further enhancing their constant improvements.

Italian industrial company Merlo signed an exclusive partnership with Milan-listed Banca Ifis (see here a previous post by BeBeez). Merlo’s customers may access to better conditions for Ifis factoring facilities. Merlo has sales of 500 million euros, an ebitda in the region of 70 million and net cash of 100 million. The company belongs to Andrea Merlo (ceo), Paolo Merlo and Silvia Merlo.

Milan IR Top Consulting, an ECM advisory firm, and Milan-listed Banca Generali launched Modello Global Finance (MGF) for supporting the international growth of SMEs (see here a previous post by BeBeez). MGF areas of focus range from ESG, to administration, finance and control, to strengthening the governance structure.

Intesa SanPaolo, the chambers of commerce of Milan Monza Brianza Lodi, Innexta, Fondazione Cariplo, and Cariplo Factory allocated one billion euros for Laboratorio ESG – Environmental Social Governance (ESG Lab), a programme for incentivising the SMEs of Milan and Monza e Brianza area to carry on investments in sustainability (see here a previous post by BeBeez). Esg Lab will supply advisory through the platform Circularity, the regenerative design company Nativa and Circular Economy Lab. The resources of the lab are part of Motore Italia, a strategic programme of Intesa SanPaolo for the Lombardy region with resources of 13 billion.