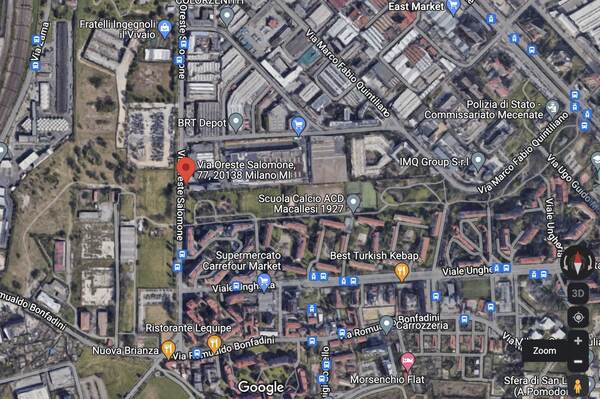

The joint venture that Patron Capital, Bluestone and FREO Group signed in October 2021 for investing up to 250 million euros for acquiring and developing real estate projects in Milan signed a 75 million euros worth preliminary contract for acquiring a lot in the South-East of Milan (See here a previous post by BeBeez). In early 2024, the buyers aim to develop a building with 200 flats over an area of a 18,000 sqms. Asti Architetti is in charge of the project.

The joint venture that Patron Capital, Bluestone and FREO Group signed in October 2021 for investing up to 250 million euros for acquiring and developing real estate projects in Milan signed a 75 million euros worth preliminary contract for acquiring a lot in the South-East of Milan (See here a previous post by BeBeez). In early 2024, the buyers aim to develop a building with 200 flats over an area of a 18,000 sqms. Asti Architetti is in charge of the project.

Borio Mangiarotti, an Italian real estate developer and general contractorof which Värde Partners has 20% since 2019, invested 20 million euros for acquiring two buildings in Milan, in the area of Istria Underground station (See here a previous post by BeBeez). The buyer will demolish the buildings for developing a residential project of 40 flats in early 2024. Studio Calzoni Architetti is in charge of the projects.

Concrete Investing, the Italian real estate equity crowdfunding that Lorenzo Pedotti heads, closed the campaign for the project MILO22 in Milan with a fundraising in the region of 2 million euros (See here a previous post by BeBeez). The project MILO22 has an expected IRR of 11.5%, an expected ROI of 21% and a holding period of 21 months. La Sole Immobiliare will sponsor a luxury development of two buildings with 18 flats in Citylife area.

Blue, a real estate investor that ceo Paolo Rella heads, completed the first acquisition on behalf of FIA Logistic Opportunities Fund Italy (See here a previous post by BeBeez). This vehicle acts for DAA Capital Partners. Blue acquired a Milan-based delivery station for which Amazon signed a lease contract. Carlo Puri Negri is the chairman of Blue (fka Sator Immobiliare).

Euro Immobiliare, the owner of the real estate assets of the Paterno Family, issued a senior secured minibond of 20 million euros maturing in 2029 (See here a previous post by BeBeez). NB EPL Fondo de Titulización, part of Neuberger Berman; SEAC Fin, a subsidiary of Confcommercio Trentino, and Banca Finint subscribed to the bond. Euro Immobiliare has a turnover of 8.1 million euros, an ebitda of 3.9 million, a net debt of 28.3 million, and equity of 36.9 million. Gilberti Triscornia e Associati acted as legal advisors to Euro Immobiliare while Gattai Minoli Partners assisted the investors.

In 2022, the real estate investments in Italy amounted to 11.7 billion euros (+ 12.5% from 10.4 billion in 2021), said a report of CBRE (See here a previous post by BeBeez). In 2019, real estate investments in Italy reached a peak of 12.3 billion

Habyt (fka Projects Co-Living), a Berlin-based proptech that Luca Bovone and Giorgio Ciancaleoni founded in 2017, announced its merger with Common, a North-American co-living company (See here a previous post by BeBeez). Italian venture capital P101 is an investor in Habyt.