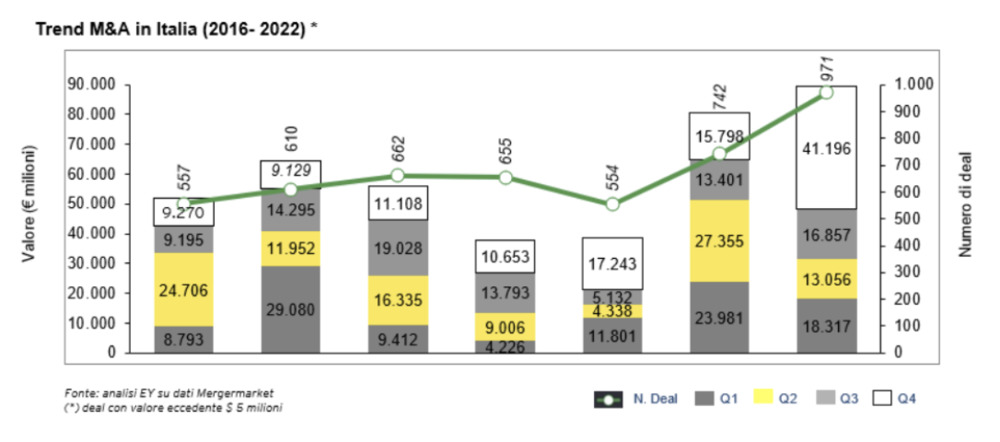

In 2022, market participants closed 1184 M&A transactions worth a total of 80 billion euros (1214 deals for 100 billion in 2021), said KMPG report “Mercato M&A in Italia nel 2022” (See here a previous post by BeBeez). The preliminary BeBeez data for 4Q22 say that market operators closed 543 deals (+9% from 497 of 4Q21). The BeBeez Private Equity Report 2022 will soon be available to BeBeez News Premium and BeBeez Private Data subscribers). See BeBeez 1H22 Private Equity Report and BeBeez 2021 Private Equity Report available to BeBeez News Premium and BeBeez Private Data subscribers.

In 2022, market participants closed 1184 M&A transactions worth a total of 80 billion euros (1214 deals for 100 billion in 2021), said KMPG report “Mercato M&A in Italia nel 2022” (See here a previous post by BeBeez). The preliminary BeBeez data for 4Q22 say that market operators closed 543 deals (+9% from 497 of 4Q21). The BeBeez Private Equity Report 2022 will soon be available to BeBeez News Premium and BeBeez Private Data subscribers). See BeBeez 1H22 Private Equity Report and BeBeez 2021 Private Equity Report available to BeBeez News Premium and BeBeez Private Data subscribers.

On 9 January, Monday, Milan-listed industrial company Saes Getters said it sold to US-based Resonetics its nitinol division and its US subsidiaries Memry Corporation and Saes Smart Materials (See here a previous post by BeBeez). The transaction value amounts to 900 million US Dollars. The buyer belongs to even shareholders GTCR and Carlyle. Nixon Peabody (US legal), Fieldfisher (Italian legal), Studio Maisto e Associati (Italian tax), Plante Moran (US tax), and Lazard assisted Saes Getters. Resonetics appointed Mediobanca.

Gruppo Hager, a provider of services and solutions for electric systems, acquired Pmflex, an Italian producer of electrical conduits, from the company’s managers and Frankfurt-listed Deutsche Beteiligungs (DBAG) (See here a previous post by BeBeez). The closing requires antitrust approval and may take place in 1Q23. Sources said to BeBeez that Pmflex will act as a separate legal entity and that the company attracted an unsolicited double-digit multiple bid. Hager has sales in the region of 2.6 billion euros.

IRCA, an Italian food company that belongs to Advent International, is holding exclusive talks for acquiring the sweet ingredients unit of Gruppo Kerry for 500 million euros on the ground of expected revenues of 405 million with an ebitda of 41 million (See here a previous post by BeBeez). In addition, Irca is negotiating for paying 375 million in cash and 125 million with a vendor loan. Kerry will reinvest the fetched proceeds in its Taste & Nutrition business.

Blue (fka Sator Immobiliare), a fund that ceo Paolo Rella heads, acquired a Milan-based delivery station that Amazon is renting on behalf of FIA Logistic Opportunities Fund Italy (See here a previous post by BeBeez). Carlo Puri Negri is the chairman of Blue whose 19 funds worth 1.6 billion euros.

Eurovita attracted a 300 million euros offer from JC Flowers (See here a previous post by BeBeez). The asset belongs to Cinven since 2016. IVASS, the Italian authority for the insurance sector, asked Eurovita to launch a capital increase of 250 million euros.

Alliance Etiquettes, a French printer of premium lables that belongs to Chequers Capital, acquired the control of Italian competitor Tonutti Tecniche Grafiche (See here a previous post by BeBeez). Maria Teresa Tonutti (33%), Manlio Tonutti (30%) and Marco Tonutti (31%) sold the majority of the business and reinvested for a minority of Alliance Etiquettes. Maria Teresa Tonutti will act as Italy’s country manager for the buyer and join the company’s executive board with Oliver Laulan (cfo) and Erik de Woillemont (md). The Tonutti Family retained Grimaldi Alliance and DVR Capital as legal and financial advisor. Advant Nctm provided Alliance Etiquettes with legal counsel. After such a transaction, Alliance will have sales of 120 million euros.

Naturalia Tantum, a producer of natural cosmetics and food integrators that belongs to Assietta Private Equity, acquired Italian competitors Harbor from Alto Partners and Filippo Corsini, L’Amande and Zeca (See here a previous post by BeBeez). Assietta retained as advisors Equita, Houlihan Lokey and Bper Corporate & Investment Banking (M&A), KPMG and Audirevi (tax and financial due diligence). After such transactions, Naturalia Tantum has sales of 60 million euros and an ebitda margin in the region of 20%. Francesco Iovine, the ceo of Naturalia Tantum, said that the company is interested in further acquisitions to achieve sales of 100 million by 2026. In October 2022, Assietta Private Equity hired Equita and Houlihan Lokey for selling Naturalia.

Lukoil sold its Priolo refinery plant to G.O.I. Energy Limited, an energy portfolio company of Argus (See here a previous post by BeBeez). The Italian Government and other authorities must give their approval for the closing of the transaction. BonelliErede (legal) and Ernst & Young (finance) assisted GOI Energy.

Tre Zeta Group, an Italian producer of luxury parts for sneakers and shoes that belongs to Koinos Capital since December 2021, acquired Italian competitor Suolificio Magonio (See here a previous post by BeBeez). Stefano Palazzi, Sandra Piccini and Carlo Piccini sold the business and kept their management role. Tre Zeta has sales of 70 million euros. Magonio has revenues of 14.5 million.

Soul Movie, a media company, acquired EMG Studios from PAI Partners (See here a previous post by BeBeez). Soul Movie retained Armodìa – Professionisti Associati as M&A advisor. Macchi di Cellere Gangemi acted as legal advisor to Gruppo EMG. Soul Movie belongs to Rita Cetra (60%) and Francesco De Siena (40%). The company has sales of 8.3 million and an ebitda of 0.5 million.

Venice Court accepted the receivership application of Slim Fusina Rolling, a producer of industrial aluminium rolled products (See here a previous post by BeBeez). If Chiara Boldrin and Giovanni Anfodillo, the extraordinary commissioners, Niche Fusina Rolled Products (NFRP) will take over Slim Fusina Rolling. Concord Resources Limited and Dada Holdings own 51% NFRP of which Invitalia has 49%. Slim Fusina received legal assistance from K&L Gates while PwC acted as lead financial advisor. Concord Resources and Dada hired Gianni & Origoni as legal advisor.