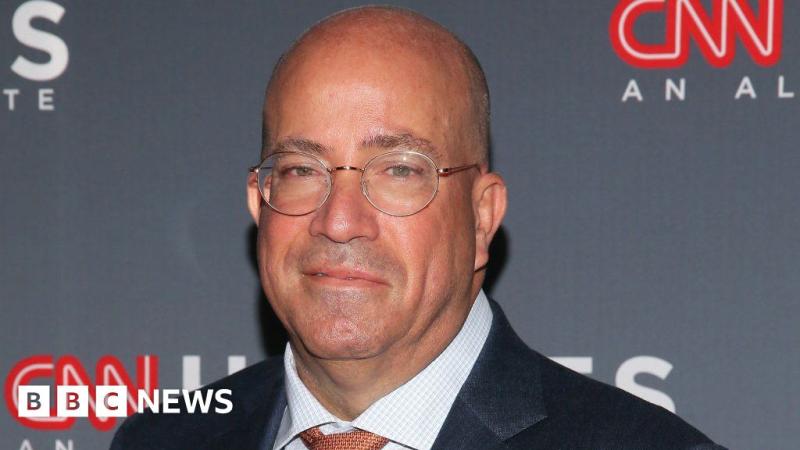

Jeff Zucker, AC Milan’s owner RedBird Capital Partners and International Media Investments signed a one billion US Dollars joint venture and created RedBird IMI, a contents firm (See here a previous post by BeBeez). Zucker will act as ceo and as operative partner of RedBird.

Alpha Private Equity and Peninsula Investments launched a 25 euros per share public offer on Milan-listed Prima Industrie (See here a previous post by BeBeez). The bidders aim to buy 39.3% of the target for a total of 102.96 million euros.

Italian football club Sampdoria could finally sell to Merlyn Partners, a vehicle that Alessandro Barnaba founded and that owns of UK team Leeds and French team Lille (See here a previous post by BeBeez). Sampdoria’s financial advisor Lazard received from Merlyn a binding offer of 30 million euros to pour through a capital increase and a further 20 million in fresh resources. On 19 December, Monday, Sampdoria’s shareholders will hold a meeting and make a decision.

Schema Alfa purchased all the remaining shares of Italian motorway manager Atlantia which delisted from Milan market on 9 December, Friday (See here a previous post by BeBeez). Atlantia now belongs to Edizione, Blackstone Infrastructure Partners and Fondazione CRT.

Credem Private Equity said on 6 December, Tuesday, that it is going to launch a 12 euros per share public offer on Milan-listed Finlogic, an Italian producer of smart labels (See here a previous post by BeBeez). Finlogic listed in 2017 at 3,60 euros per share and its current market capitalization amounts to 84 million euros. Credem Private Equity signed an agreement with the Battista Family (61.625%) owner and Vincenzo Battista (2.723%) that will sell their stakes and reinvest in the target. Credem set a 95% threshold for finalizing the offer.

Abiogen Pharma acquired German competitor Altamedics (See here a previous post by BeBeez). The transaction is worth in the region of 8 million euros. Abiogen Pharma has sales of 200 million, an ebitda of 83.4 million and net financial debts of 637.8 million.

Italian pharma company Kedrion, a portfolio asset of Permira, Abu Dhabi Investment Authority (ADIA), Ampersand Capital Partners, FSI, and CDP Equity, acquired Czech Republic competitors UNICAplasma and UNICAplasma Morava (See here a previous post by BeBeez). Milan Maly sold the businesses.

Gruppo Piacenza, an Italian producer of luxury fabric, acquired Lanificio F.lli Cerruti, a competitor, from Njord Partners (80%) and the Cerruti Family (20%) (See here a previous post by BeBeez). Lanificio Cerruti has sales of 28.2 million euros, an ebitda of minus 8.3 million and net lossess of 12.1 million.

UTurn Investments, a Family Office that Gianpiero Peron, Luca Mongodi and Alberto Nicoli head, acquired a controlling stake of 3T, an iconic Italian producer of bicycles (See here a previous post by BeBeez). René Wiertz, ceo, and Gérard Vroomen will keep a stake in the company and their operative roles, while Mongodi will join the management of 3T which has sales of 20 million euros and an ebitda of 5 million.

Telemos Capital acquired the majority of Vittoria, an Italian producer of bicycles wheels, controlled by the fund Wisequity V (See here a previous post by BeBeez). Sources said to BeBeez that Wise will retain 10% of the business while the ceo Stijn Vriends and the managers will keep 25-30%.

Star Capital’s portfolio company Typos acquired the majority of Italy’s Baldissar, an Italian printing and IT company, with the financial support of illimity Bank (See here a previous post by BeBeez). The fund also said that it is working on an acquisition to finalize in early 2023. Baldissar has sales of 4.5 million euros, an ebitda of 1.4 million and net cash of 1.9 million. After such an acquisition, Typos expects to generate revenues of 20 million with an ebit margin of above 20%.

Romi Fuke, the chairman of Italian fintech provider of non-cash money In-Lire, said to BeBeez that the company aims to find an industrial partner for expanding abroad (See here a previous post by BeBeez). The company is not interested in listing, Fuke said.

AVM Associati, a financial services firm that Giovanna Dossena and Claude Breuil created in 1995, launched a club deal for supporting the growth and development of Calcio Femminile Italiano, a web site about women football (See here a previous post by BeBeez). The club deal aims to pour resources in the target through a capital increase and change it as a media company.