by Alessandro Albano

MutuiOnLine, one of the main comparators of real estate mortgages and leader in the Italian market for the distribution of credit and insurance products online, listed on the Milan Stock Exchange since 2007, has bought Rastreator.com, LeLynx.fr and Rastreator.mx, leading portals in the comparison and online brokerage of insurance products in Spain, France and Mexico, in a transaction worth 150 million euros (see the press release here), which marks the cross-border debut of what was one of the first Italian scaleups to reach the size of unicorn in 2000 (in the same way as the Yoox fashion e-commerce platform, see here a previous article by BeBeez), when this definition had not yet been coined as there was still no talk of fintech.

The sellers were the ZPG Comparison Services Holdings UK, a British real estate company that manages, among other things, the popular Zoopla platform, and Penguin Portals, a comparison company based in Cardiff, part from 2021 of the RVU group (which is controlled by ZPG itself), following the sale by Admiral Group (see the press release of the time here).

ZPG, which also controls the Uswitch price comparison service, and the comparison platform for the financial sector Money.co.uk , in turn it is owned by the US holding company Red Venture and by private equity funds managed by Silver Lake (which last June acquired control of Italian platform Facile.it from EQT and Oakley Capital, see here a previous article by BeBeez), GIC (Singapore sovereign fund, which in Italy has already invested for example in Cerved and Intercos) and PSP Investments (which in Italy has already invested in Recordati for example). Listed on the London Stock Exchange in 2014 (see the press release here), ZPG was then delisted by a consortium of investors led by Silverlake, flanked by GIC and PSP Investments in July 2018 following a takeover bid of 2.2 billions of pounds (see the Offer Document here).

Returning to the transaction with Mutuionline, the Italian company acquired from ZPG and Penguin 100% of the capital of Rastreator.com Ltd and Preminen Price Comparison Holdings Ltd, granted ZPG and Penguin an irrevocable put option relating to 100% of the capital of LeLynx sas and an agreement was signed for the transfer to one of the companies of the newly acquired perimeter of the IT center of excellence based in India, currently serving the companies involved in the transaction, through the transfer of a company branch from Inspop.com Limited.

The total outlay for all the acquired companies that will support Mutuionline is, as mentioned, equal, in terms of enterprise value, to 150 million euros, net of an adjustment for the net cash expected at the time of closing, expected within the first days of 2023. The operation will be financed by cash and credit lines already in place. By the end of 2022, the companies that will fall within the MutuiOnLine perimeter expect 62 million euros in revenues and an ebitda of over 8 million.

Marco Pescarmona, chairman of the MutuiOnline Group said: “We are grateful to RVU for giving us the opportunity to pursue this operation. Rastreator and LeLynx are pioneers and leaders in the business of comparison and brokerage in their respective countries, characterized by unexpressed potential for growth of the market. The entities acquired will continue to be guided by the current management, with whom we immediately found an excellent understanding. Our goal with this transaction is to transform our Broking Division into a multinational operator of excellence in the comparison and brokerage of financial products , with a consumer-centered business model. Finally, we thank Intesa Sanpaolo, Crédit Agricole Italia, Banco BPM and Unicredit for their continued support to our growth plans “.

Today MutuiOnLine has a market cap of around 982.4 million euros based on yesterday’s closing on Euronext Milan at 24.56 euros per share (+ 2.7%), but the story begins 22 years ago. The company was founded in 2000 by Pescarmona and Alessandro Fracassi thanks to the investment in seed capital of Nestor 2000 managed by Net Partners Ventures (co-founded by Fausto Boni, today in 360 Capital Partners) and Jupiter Ventures (founded by Paolo Gesess today a partner of United Ventures).

The two founders, through Alma ventures, still own a 32.5% stake of MutuiOnline, while the funds have gradually divested, with the German Investmentaktiengesellschaft fuer langfristige Investoren TGV who today controls around 21% and a free float of just over 41%.

The intuition of the two founders was initially to launch the www.mutuionline.it platform, to broker mortgages issued by banks, enrolling in the register of credit brokers, just established at the Italian Exchange Office following the publication of the implementation of art. 16 of the law of 7 March 1996, n. 108, published in the G.U. n. 243 of 17/10/2000. Then in 2001, thanks to the experience gained with that site, the company launched the www.prestitionline.it site to distribute consumer credit products and in particular personal loans on the web.

The third important step then took place, with the decision to expand the business to the outsourcing management of the investigation relating to mortgages and subsequently to the loans brokered on its platforms. Subsequently, the activity was extended to the intermediation of insurance products and consequently also to the outsourcing investigation relating to those products.

The important growth of the business then stopped and collapsed in 2012, following the crash of the mortgage market in Italy. That year the revenues of the former startup reached only 38.5 million euros from 71.8 million in 2011. The recovery, however, was fast with 51 million in turnover in 2013 which became 68.3 million in 2013. 2014 and 120.7 million in 2015, up to 315 million in 2021 (from 259.4 million in 2020), an ebitda of 92.5 million (from 76.6 million) and a net financial debt of 53.8 million (from 73.4 million) (see the press release here). The first quarter of this year, the last available period, closed with a turnover of 77.9 million, down by 0.5% compared to the same period in 2021, the ebitda stood at 21.4 million (-2.9%), while the net result decreased by 11.5% to 11.6 million (see the presentation to analysts here).

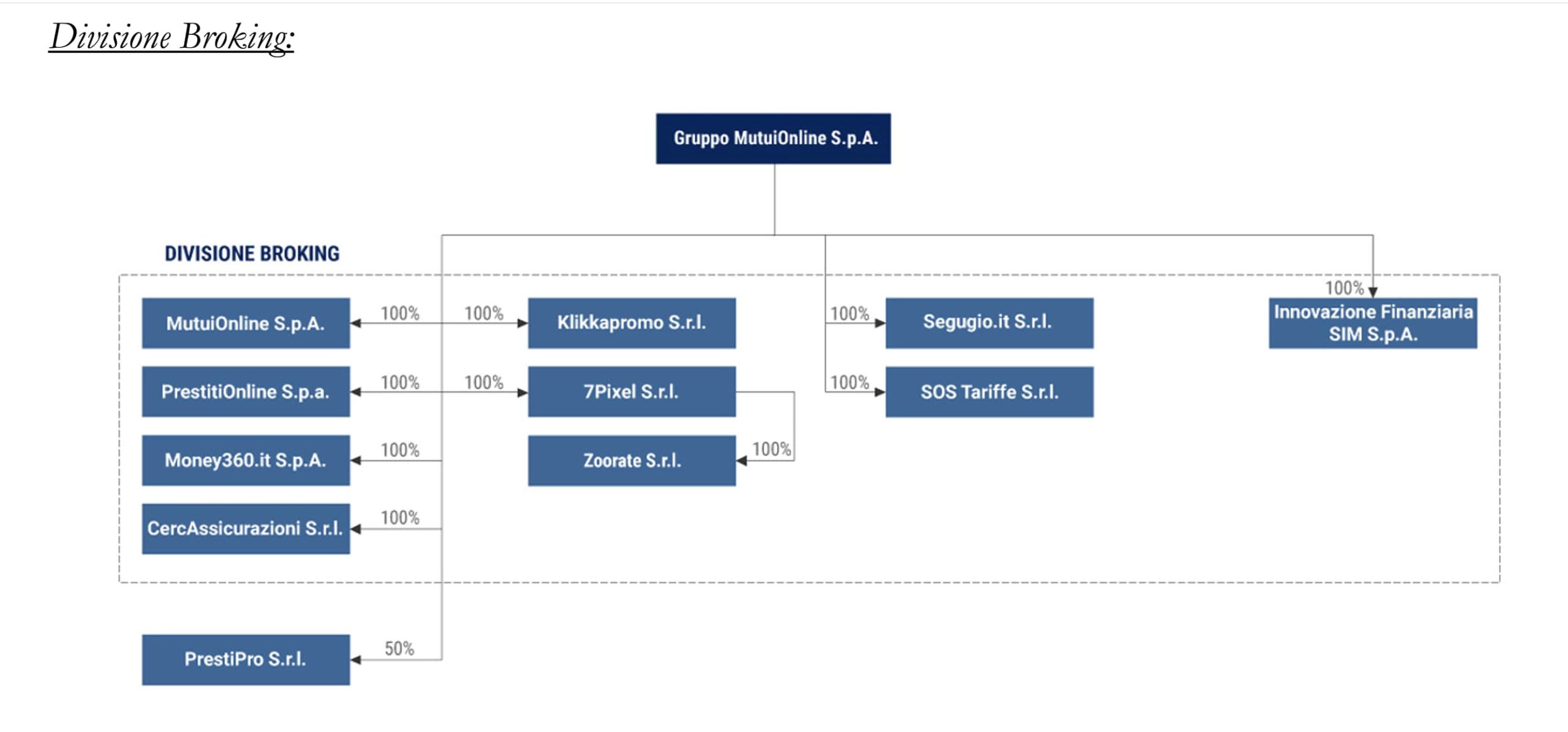

The growth of the group has also gone through a series of acquisitions. In particular, at the end of 2020 Mutuionline announced the acquisition of SOS Tariffs srl, owner of the homonymous web platform leader in Italy in the comparison and promotion of telecommunication and energy contracts (see here a previous article by BeBeez), while in 2015 it entered the perimeter the owner of the Trovaprezzi portal, 7Pixel srl, for a consideration of 55 million euros (see here the press release of the time). In 2016, 7Pixel had then bought a first 40% of the capital of Zoorate, an Italian company active in the collection and management of reputation for brands and online sellers, of which in 2021 the Mutuionline group also bought the remaining 60%, and the whose revenues in 2021 were equal to 1.85 million.