Investindustrial, through the Investindustrial VII fund, announced in recent days two acquisitions in the United States in the food sector: on the one hand, Parker Food Group, a leading company in the development and production of special ingredients with high added value in the North American market, with particular attention to inclusions and seals, sold by The Riverside Company (see here the press release by Investindustrial and here the one by The Riverside); and on the other a significant part of the food preparation division of TreeHouse Foods Inc, a leader in the production and distribution of private label food products in the retail and catering channel in North America, listed on the NYSE (see here the press release by Investindustrial and here the one by TreeHouse).

Investindustrial, through the Investindustrial VII fund, announced in recent days two acquisitions in the United States in the food sector: on the one hand, Parker Food Group, a leading company in the development and production of special ingredients with high added value in the North American market, with particular attention to inclusions and seals, sold by The Riverside Company (see here the press release by Investindustrial and here the one by The Riverside); and on the other a significant part of the food preparation division of TreeHouse Foods Inc, a leader in the production and distribution of private label food products in the retail and catering channel in North America, listed on the NYSE (see here the press release by Investindustrial and here the one by TreeHouse).

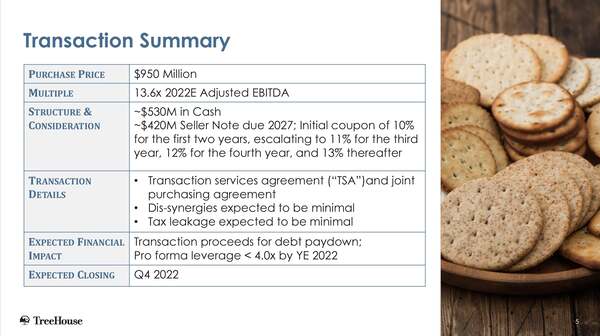

Interest in the latter had already emerged at the end of June, when it was said that the asset would be valued at 1.3 billion dollars, including debt (see here a previous article by BeBeez). In reality, the assets changing hands were valued at 950 million dollars, equal to 13.6x the adjusted ebitda expected for 2022, a figure that will be financed in cash by Investindustrial for 530 millions and for the other 420 millions with a senior bond maturing in 2027 with a coupon of 10% for the first two years and then increasing up to 13%, subscribed by TreeHouse itself. The food preparation division of TreeHouse Foods, active in the production and distribution, among other products, of: pasta, sauces, tomato preserves, salad dressings, mayonnaise, sauces, syrups, fillings for cakes and jams, plans to generate in 2022 revenues of approximately 1.6 billion dollars and an adjusted ebitda of approximately 70 millions.

The division, based in Chicago (Illinois), manages 19 distribution centers and 14 production plants in the United States, Canada and Italy, where there are two pasta production plants, one in Fara Gera d’Adda (Bergamo) and the other in Verolanuova (Brescia). TreeHouse in Italy is in fact active with the subsidiary Pasta Lensi srl, based in Verolanuova (Brescia), which produces gluten-free pasta, legume pasta and Kamut pasta under the Pasta Lensi brand, and lasagna, cannelloni with the Pastificio Annoni brand. and pizzoccheri. Pasta Lensi closed 2020 with 37.2 million euros in revenues, an ebitda of 3.9 million and net liquidity of 9.6 million (see here the analysis by Leanus, after registering for free).

TreeHouse, which is based in Oak Brook, Illinois, has long been working on a perimeter overhaul to focus on the fastest growing snack and beverage business and increase the value of its shares, which have underperformed the market in recent years, pushed by the activist fund Jana Partners, which entered the group’s capital in February 2021 (see here the press release of the time). Thus, for example, TreeHouse already sold the ready-to-eat cereals business to Post Holdings about one year ago (see the press release from that time here). Last March, the group reiterated its commitment to a strategic review of the business and made it clear that this includes putting the ready meals division on the market either in a single transaction or in several transactions (see the press release here).

Lazard and Bank of America acted as financial advisors to Investindustrial and Kirkland & Ellis provided legal advice. TreeHouse Foods Inc was advised by Evercore as financial advisor and Gibson Dunn acted as legal advisor. Centerview provided the fairness opinion to the TreeHouse Board of Directors.

The completion of the acquisition is expected in the fourth quarter of the year and the division will be integrated by Investindustrial with its subsidiary La Doria, a leading European producer of legumes, peeled tomatoes, tomato pulp and fruit juices – it will create one of the largest suppliers of food products private label in the world, delisted from the Italian Stock Exchange by Investindustrial together with the Ferraioli family, at the time the first major shareholder, last May (see here a previous article by BeBeez). The total revenues and global distribution from the combination of TreeHouse’s food preparation division with La Doria will create one of the largest private label food suppliers in the world. We recall that La Doria closed the first quarter of 2022 with 238.4 million euros of consolidated revenues (from 222.3 million in the first quarter of 2021), an ebitda of 23.5 million (from 20.2 million) and a financial debt net of 66.9 million (see the press release here), after closing the 2021 financial statements with 866 million euros of consolidated revenues, an ebitda of 89.6 million and a net financial debt of 114.3 million (see the press release here).

Andrea C. Bonomi, chairman of Investindustrial’s Industrial Advisory Board, said: “We are proud to be able to enrich our portfolio of leading private label food companies thanks to the acquisition of the TreeHouse Foods divisions focused on the production of food preparations. . We believe that success in the food sector cannot be separated from offering the best possible service to our customers in support of high quality products at a competitive price. With this acquisition, we will strengthen our position as the industry leader in terms of customer excellence while continuing to improve service levels, product development and operational efficiency”.

Steve Oakland, ceo and chairman of TreeHouse Foods, commented: “Investindustrial is the ideal partner for our leading division in the food preparation sector. The fact that Investindustrial is also convinced of the opportunities that lie ahead for this market segment is a testimony the strength of this type of business, the strength of our private label product categories and the teams that work there every day. We look forward to seeing the company grow further in the future”.

As for Parker Food Group (PFG), based in Fort Worth (Texas), it produces inclusions (fillings and ingredients for baked goods and ice cream, such as chocolate chips), toppings, grains / streusel, pralines and components for biscuits that are sold to industrial B2C and B2B customers and to customers operating in catering services. PFG, which boasts the best profitability in the industry and has consistently recorded double-digit growth in turnover over the past 10 years, employs approximately 370 employees and is led by ceo Greg Hodder, who joined PFG in 1999. The company has invested heavily. significant at its manufacturing facilities and has a state-of-the-art manufacturing footprint with three facilities in the United States located in Mexico (Missouri), Perry (New York) and Fort Worth, respectively.

As for Parker Food Group (PFG), based in Fort Worth (Texas), it produces inclusions (fillings and ingredients for baked goods and ice cream, such as chocolate chips), toppings, grains / streusel, pralines and components for biscuits that are sold to industrial B2C and B2B customers and to customers operating in catering services. PFG, which boasts the best profitability in the industry and has consistently recorded double-digit growth in turnover over the past 10 years, employs approximately 370 employees and is led by ceo Greg Hodder, who joined PFG in 1999. The company has invested heavily. significant at its manufacturing facilities and has a state-of-the-art manufacturing footprint with three facilities in the United States located in Mexico (Missouri), Perry (New York) and Fort Worth, respectively.

Investindustrial, assisted in the transaction on PFG by advisors Lazard and Kirkland & Ellis, in addition to La Doria, already owns various investments in companies in the food sector. For example, in July 2018 he bought 70% of Dispensa Emilia, a leading fast casual restaurant company in Italy, founded in 2004 and based in Modena. Since January 2019, Investindustrial has 70% control of Italcanditi, the Italian leader in the production of fruit-based ingredients and creams for the food industry, which in turn has since carried out 4 acquisitions: 100% of Comprital Group, a company active in the production of ingredients and semi-finished products for artisanal ice cream and pastry; 70% of Rubicone, a leading company in the production of ingredients for artisanal ice cream; a business branch of a company producing fruit preparations for yogurt; and 100% Ortofrutticola del Mugello, a company specialized in peeling, refrigerating and freezing fresh chestnuts and marrons, as well as in the production and packaging of marron glacés. From October 2020, Investindustrial controls CSM Ingredients, a global leader in the research and production of food ingredients, which in turn took over Hi-Food, an innovative company specializing in the development of ingredients of natural origin, last February. To conclude, in Spain Investindustrial controlled Natra, an international producer of cocoa and chocolate products mainly for private labels, which had delisted from the Madrid Stock Exchange in 2019 and which it sold last July to CapVest. Counting only the Italian companies specialized in ingredients, namely CSM Ingredients, Hi-Food and Italcanditi, these three companies together have a turnover of almost one billion euros.

Investindustrial’s Andrea C. Bonomi commented: “Our vast experience in the food ingredients sector and our track record of growing the companies we have in our portfolio make us the perfect guide for a new, exciting and more international chapter in PFG’s development. We are building an Ingredient-Tech platform with a vision of creating unique and innovative solutions for the food industry. PFG will join our ingredient investment family and partner with existing companies in portfolio as CSM Ingredients, Hi-Food and Italcanditi “.

Greg Hodder, ceo of PFG, said: “With strong industry experience, Investindustrial can only be our best partner and with your help as a responsible investor and industry specialist, we look forward to accelerating the growth of PFG and to enter new markets”.