An English version will be available soon

An English version will be available soon

Investindustrial is in talks to acquire the meal preparation division of the NYSE-listed US group TreeHouse Foods Inc, Bloomberg writes, specifying that the asset is said to be valued at 1.3 billion dollars, including debt.

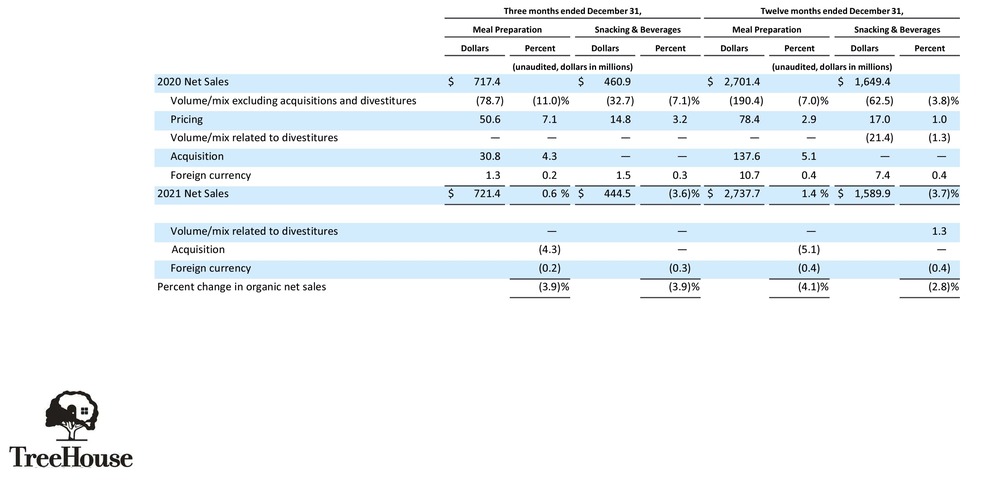

The division closed 2021 with net revenues of 2.74 billion dollars (from 2.7 billion in 2020, see the analysts’ presentation here) and the first quarter of 2022 instead recorded net revenues of 728.1 million. (from 678.5 million in the first quarter of 2021, see the analysts’ presentation here).

TreeHouse, which is based in Oak Brook, Illinois, has long been working on a perimeter overhaul to focus on the fastest growing snack and beverage business and increase the value of its shares, which have underperformed the market in recent years. The company is pushed towards this action by the activist fund Jana Partners, which entered the group’s capital in February 2021 (see the press release of the time here). Thus, for example, TreeHouse already sold the ready-to-eat cereals business to Post Holdings about a year ago (see the press release of the time here). Last March, the group reiterated its commitment to a strategic review of the business and made it clear that this includes putting the meal preparation division on the market either in a single transaction or in several transactions (see press release here).

TreeHouse in Italy is active with the subsidiary Pasta Lensi srl, based in Verolanuova (Brescia), which produces gluten-free pasta, legume pasta and Kamut pasta under the Pasta Lensi brand, and lasagna, cannelloni and pizzoccheri with the Pastificio Annoni brand. Pasta Lensi closed 2020 with 37.2 million euro in revenues, an ebitda of 3.9 millions and net liquidity of 9.6 millions (see the analysis by Leanus here, after registering for free).

The private equity group founded by Italian financier Andrea Bonomi already has various stakes in companies in the food sector. For example, in July 2018 it bought 70% of Dispensa Emilia, a leading fast casual restaurant company in Italy, founded in 2004 and based in Modena. In January 2019 Investindustrial acquired a 70% stake in Italcanditi, the Italian leader in the production of fruit-based ingredients and creams for the food industry, which in turn has since carried out 4 acquisitions: 100% of Comprital Group, a company active in the production of ingredients and semi-finished products for artisanal ice cream and pastry; 70% of Rubicone,, a leading company in the production of ingredients for artisanal ice cream; a business branch of a company producing fruit preparations for yogurt; and 100% Ortofrutticola del Mugello, a company specializing in peeling, refrigerating and freezing fresh chestnuts and marrons, as well as in the production and packaging of marron glacés. Since October 2020, Investindustrial is controlling CSM Ingredients, a global leader in the research and production of food ingredients, which in turn took over Hi-Food, an innovative company specializing in the development of ingredients of natural origin, last February. Finally, last May the Investindustrial VII fund delisted from the Star segment of the Italian Stock Exchange La Doria, the Italian group which is the leading European producer of preserved legumes, peeled tomatoes and tomato pulp in the retail channel and one of the main Italian producers of juices and fruit drinks. Finally, in Spain Investindustrial controls Natra, an international producer of cocoa and chocolate products mainly for private labels, which in turn was delisted from the stock exchange in 2019.