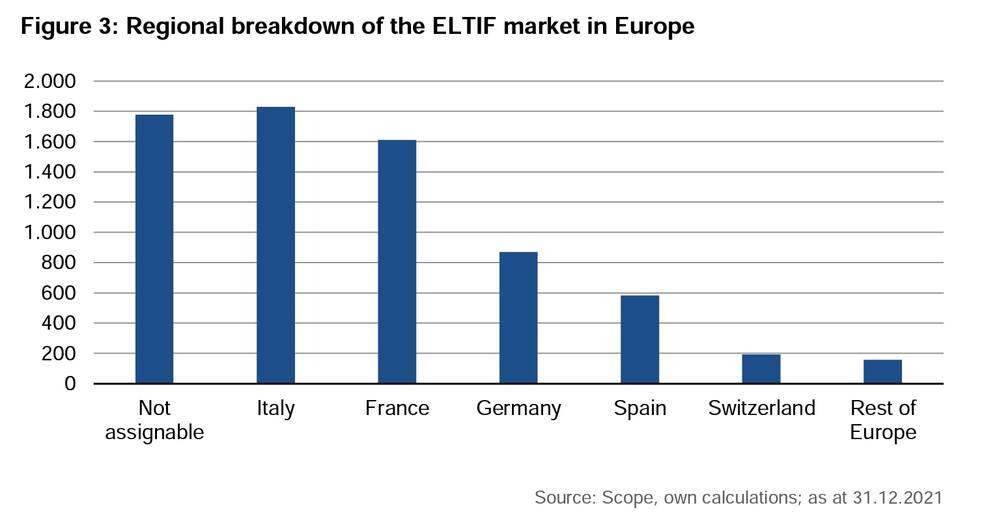

Eltifs in Europe have 7.2 – 7.7 billion euros of assets under management (2.4 billions at the end of April 2021), said Scope Ratings’ Report European ELTIF Study Market Development and Perspectives who surveyed the data of 43 out of the 53 funds between November2021 and March 2022 (See here a previous post by BeBeez). In Italy, 28 Eltifs have assets under management for 1.83 billion. The funds allocated 36% of their resources in the private debt sector.

Eltifs in Europe have 7.2 – 7.7 billion euros of assets under management (2.4 billions at the end of April 2021), said Scope Ratings’ Report European ELTIF Study Market Development and Perspectives who surveyed the data of 43 out of the 53 funds between November2021 and March 2022 (See here a previous post by BeBeez). In Italy, 28 Eltifs have assets under management for 1.83 billion. The funds allocated 36% of their resources in the private debt sector.

Riello Investimenti Partners (RIP) subscribed a 3.15 million euros minibond that Milan-listed Clabo, a producer of glasses for the horeca sector, issued and for which Sace provided a warranty for 90% of the amount (See here a previous post by BeBeez). The bond is due to mature on 31 March 2030 and pays a quarterly coupon of 6.5% + 3M Euribor with a 24-months preamortisation. The company will start paying the quarterly coupons from 30 June 2024. Gruppo Clabo will invest the raised proceeds in increasing its market share in the small retail segment trhough its US subsidiary HMC, launching new products in Europe and Asia, and its organic development. Clabo has sales of 50.8 million with an ebitda of 6 million.

Synergas, an Italian shipping company, received a 6-years 52.5 million euros financing facility from illimity Bank and direct lending fund Muzinich (fka Springrowth Capital) while SACE provided a warranty (See here a previous post by BeBeez). Synergas will invest the proceeds in refinancing its debt and acquiring Syn Tabit and Syn Turais, two 88 million worth vessels for shipping gas that the company previously leased. Synergas belongs to Francesca Mattioli (25%), Monica Mattioli (25%), Mario Mattioli (25%), and Paola Mattioli (25%).

Renco, a general contractor for the oil & gas sector that belongs to the Gasparini family, received from Unicredit a 24-months financing facility of 20 million euros for which the European Investment Bank (EIB) for 75% of the loan (See here a previous post by BeBeez). The company will invest the proceeds in its working capital and current portfolio of orders. Renco has sales of 348 million, an ebitda of 3.8 million and a net debt of 30.6 million.

Italian car rental Sicily by Car received a 15 million euros ESG financing facility from Intesa SanPaolo and the green warranty of SACE (see here a previous post by BeBeez). Sicily by Car has sales of 98.7 million, an ebitda of 20.3 million and a net financial debt of 13 million.

Italian furniture producer NIAS received from Unicredit a 1.5 million euros financing facility with a warranty for 80% of Fondo di Garanzia per le PMI – Mediocredito Centrale (MCC) (see here a previous post by BeBeez). This loan is part of Unicredit’s Futuro Sostenibile, a credit programme for companies that aim to implement ESG strategies. Nicola Sardone is the ceo and founder of NIAS who also aims to get a sustainability and ESG rating from ESG EcoVadis, a French agency. The comopany has sales of 17.3 million and net losses of 0.2 million.

In 2021, Welldone Global Advisory, a consultancy platform for the financing of SMEs and startups that Vincenzo Macaione heads and Cordinfin owns, generated a turnover of 800k euros (330k in 2020) (see here a previous post by BeBeez). The company expects to generate a turnover of 1.5 million in 2022. Welldone is also active in the sector of UTP and special situations credit servicing and own Byron Capital spv.

Gruppo Collextion, an Italian investor in debt, acquired from Arrow Global Italia, a subsidiary of London-listed Arrow Global Group, the Italian credit servicer Whitestar (fka Parr Credit) (see here a previous post by BeBeez). Collextion also purchased the target’s subsidiaries New Call and Parr Shpk, based in Albania. In 2018, Arrow Global acquired Europa Investimenti and Parr Credit from Raimondo Romitelli for 20 million euros or 7x ebitda. White star has revenues of 11.4 million, an ebitda of minus 5.3 million and net cash of 1.4 million.

In 2021, Welldone Global Advisory, a consultancy platform for the financing of SMEs and startups that Vincenzo Macaione heads and Cordinfin owns, generated a turnover of 800k euros (330k in 2020) (see here a previous post by BeBeez). The company expects to generate a turnover of 1.5 million in 2022. Welldone is also active in the sector of UTP and special situations credit servicing and own Byron Capital spv.