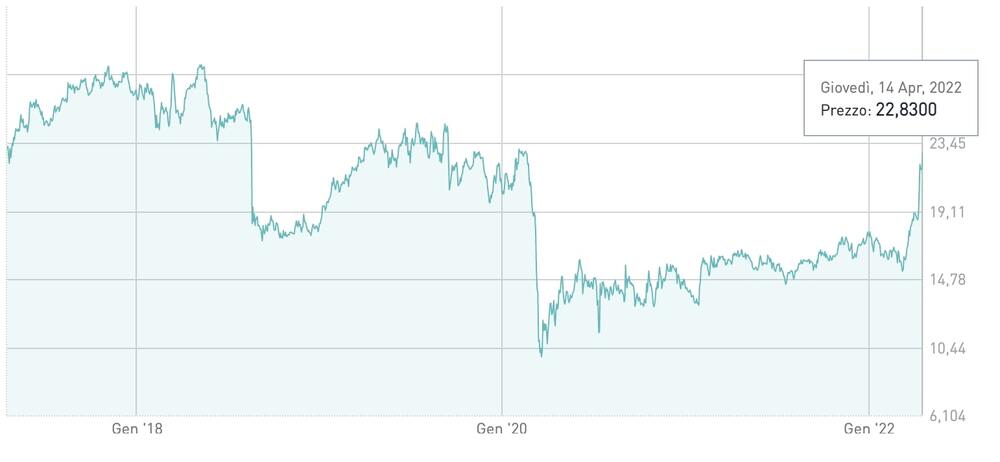

Yesterday came the awaited announcement of the next launch of a takeover bid on Atlantia by the Benetton family together with Blackstone Infrastructure Partners at a price of € 23.74 per share (including the dividend of € 0.74) (see here a previous article by BeBeez). Considering the price net of the dividend of 23 euros per share, in the event of total participation in the takeover bid, the maximum price to be paid out will be approximately 12.7 billion euros, which will be financed for approximately 4.48 billion in equity and for 8.225 billions from a pool of banks. The news yesterday obviously pushed up the Atlantia stock on the Italian Stock Exchange, which closed with a + 4.29% at 22.83 euros, equal to a market capitalization of over 18 billion euros. The move of the consortium formed by the Benettons and the US private equity giant on the infrastructural group, which today is already owned by the Benetton family for 33.1%, was expected around Easter, but it arrived with a few days of advance. The decision, we recall, was taken to face in advance a similar move that is being prepared by a consortium formed by the American fund Global Infrastructure Partners (GIP, the same that in 2018 invested in Italo Nuovo Trasporti Viaggiatori), the Canadian group Brookfield Asset Management (which also controls Oaktree Capital Management) and the Spanish construction giant ACS, led by Florentino Perez (also known for being the president of the Real Madrid football team) and partner of Atlantia in the Spanish group of Abertis motorways (see here a previous post by BeBeez).

In early April, Milan-listed TIM declined the offer of KKR after the fund said on 4 April, Monday, that without a due diligence it could not make any progress from the non-binding offer that tabled on 19 November 2021 at 0,505 euros per share (see here a previous post by BeBeez). The company reportedly attracted the interest of CVC Capital Partners who tabled a non-binding bid for a 49% of the Enterprise unit of ServCo on the ground of an enterprise value of 6 billion euros.

On 11 April, Monday, Infrastructure Investments Fund (IIF) officially launched its awaited public offer of 8,81 euros per share on Falck Renewables (see here a previous post by BeBeez). JPMorgan Investment Management manages IIF. Shareholders can tender the offer until 11 May, Wednesday. Falck Renewables has a market capitalization of 2.875 billion euros. IIF must buy all the available shares of Falck Renewables and those that the company will issue after having converted the equity linked green bond of 200 million due to mature in September 2025. The bid of IIF triggered the change of control clause for the issuer that now must repurchase the bond at par. On 25 February, Friday, Falck Renewables launched the repurchase offer for the bond that ended on 4 March, Friday and raised 165 million of bond. Falck paid 152.593,75 euros for 0.1 million of face value bonds.

On 11 April, Monday, HOPE (Holding Partecipazioni Economiche), an alternative investment fund for retail buyers, started to place its shares on Milan market ahead of raising up to 250 million euros to invest in private equity, real estate and sustainable infrastructures (see here a previous post by BeBeez). The placement will end on 11 October, Tuesday. Claudio Scardovi is the ceo of HOPE and previously worked as global co-head for financial services and managing director turnaround consulting firm Alix Partners.

CDP Equity sold its 17.5% in Milan-listed investment vehicle BF spa who owns a controlling stake of Bonifiche Ferraresi, an Italian land reclamation company (see here a previous post by BeBeez). CDP sold to the company’s ceo Federico Vecchioni (5.5% already owner of 14.3%), Dompè Holdings (6%, already owner of 14%). CDP will place the remaining 6% with other investors and signed with Vecchioni a put option that can exercise by November 2022. BF previously said it was going to sell 49% of Bonifiche Ferraresi by 2021 for raising resources to pour as corner investor in Fondo Italiano Agritech & Food (FIAF), a vehicle that Fondo Italiano d’Investimento launched in 2021. FIAF aims to develop the agritech and food sector and raise 300 -350 million euros. BF invested 60 million in FIAF, while CDP Equity poured 40 million. Milan-listed ENI paid 20 million for a 5% of Bonifiche Ferraresi and committed to subscribe a 20 million capital increase for acquiring a further 3.32%. Intesa SanPaolo committed to subscribe a 20 million capital increase for acquiring a 3.32% of BF Holding.

Milan-listed Tamburi Investment Partners acquired 28.5% of Italian agribusiness and circular economy company Simbiosi (see here a previous post by BeBeez). Simbiosi belongs to Francesco Natta and Rosita Natta and has sales of 3.6 million euros, an ebitda of 1.7 million and net cash of 3.1 million. Piero Manzoni is one of the company’s founders.

Advent International acquired Irca, an Italian B2B producer of ingredients for the sweets industry, from Carlyle (see here a previous post by BeBeez). Advent acquired the asset on the ground of an enterprise value of above one billion euros. Earlier in December, BeBeez reported that Irca’s enterprise value was of at least 800 million. Carlyle acquired the company in 2017 from Ardian for 520 million.

Design Holding, a high-end furniture company that belongs to Carlyle and Investindustrial, appointed Matteo Luoni as director for Group Strategy, M&A and Business Development (See here a previous post by BeBeez). Mr. Luoni previously worked for Bain & Company. Design Holding has sales of 520.6 million euros, an ebitda of 128.9 million, net profits of 20 million, and a net financial debt of 605.5 million.

Arcaplanet, an Italian retailer of pet products, appointed Nicolò Galante as ceo and Alessandro Strati as cfo (see here a previous post by BeBeez). Arcaplanet belongs to Cinven (63.8%), Fressnapf Beteiligungs (32.5%) and the founder MIchele Foppiani.

Style Capital aims to raise its second private equity fund 250 – 350 million euros for investing tickets of 20 – 80 million in Italian fashion luxury companies generating sales of 20 – 200 million di euro (see here a previous post by BeBeez). Roberta Benaglia acquired Dgpa in 2015 and rebranded it as Style Capital.

Mandarin Capital Partners rebranded as Mindful Capital Partners (MCP), managing partners Lorenzo Stanca, Alberto Camaggi and Andrea Tuccio said (see here a previous post by BeBeez). Alberto Forchielli heads MCP that was born in 2007 for supporting the Italian and Chinese companies. The fund attracted 328 million euros from Intesa SanPaolo, China Development Bank and China Exim Bank. Forchielli said that China’s support for Russian invation of Ukraine made necessary such a rebrand.

Maticmind acquired TecnologiePM from Massimiliano Pilone (see here a previous post by BeBeez). TecnologiePM is a provider of services for topographical surveys, geophysical and geochemical prospecting with IoT technology, two and three-dimensional software and artificial intelligence algorithms. The company has sales of 0.9 million euros with an ebitda of 0.17 million and net cash of 0.7 million. Luciano Zamuner (ceo) and Carmine Saladino (chairman and controllong shareholder) head Maticmind who has sales of 350 million. The company also belongs to Fondo Italiano d’Investimento and RedFish LongTerm Capital (42.4%) and in December 2020 received a 24 million loan from Banco Bpm, Cassa Depositi e Prestiti and Banca Mps.

ReLife, an Italian waste management company that belongs to F2i sgr, acquired Centro Brianza Macero (CBM), a competitor that Alessandro, Mauro and Luca Pellegatta manage (See here a previous post by BeBeez). CBM has sales of 11 million euros. After such an acquisition, ReLife has sales of 300 million. F2i acquired 70% of ReLife in 2021 from the Benfante Family, Ghigliotti Family, Malaspina Family, and Xenon Private Equity on the ground of an enterprise value of 500 million.

Azimut Alternative Capital Partners (AACP), the US subsidiary of Milan-listed Azimut, acquired a 10% of BroadLight Holdings, an US private equity that targets technology and consumer firms (see here a previous post by BeBeez). AACP acquired a permanent stake of BroadLight for supporting its working capital. AACP has alternative assets under management worth 12 billion US Dollars.

Montefiore Investment, a French mid-market private equity fund, appointed Carlo Mammola as Senior Advisor and Co-Head for its Italian bureau (see here a previous post by BeBeez). Mr. Mammola previously worked as ceo of Fondo Italiano d’Investimento and as head of private equity at Bank of America. The manager founded Argan Capital and Milan Spac Italy 1 Investments who carried on a business combination with IVS Group after having raised 150 million euros

Metrika Tech acquired 70% of Abissi, an Italian Red Team cybersecurity company, from Abinsula and founder Luca Savoldi and Lucio Floris (see here a previous post by BeBeez). Savoldi kept a 20%, while Abinsula has 10% and Florissold his whole stake. Metrika’s managing director Dario Albarello said to BeBeez that the fund will support the company for further acquisitions.

Gioconda, the Italian subsidiary of private equity LBO France, acquired the majority of Astidental Bquadro, a distributor of items for dentistry (see here a previous post by BeBeez). Paolo Gibellino (chairman and ceo), Franco Ravanetti and other managers will keep their operative roles and reinvest in the business.

Belgium’s investment holding NXMH raised to 100% its stake in Agras Delic, an Italian producer of pet food, through its US portfolio asset Whitebridge Pet Brands (see here a previous post by BeBeez). NXMH ha directly acquired 60% of Agras in 2016 while Pietro Molteni kept a 36.38%. Whitebridge Pet Brands is born in 2015 out of the merger of Cloud Star with Petropics. In 2021, NXMH acquired a controlling stake in Whitebridge Pet Brands.

Finrel, an Italian producer of industrial components, acquired 51% of Tecnord from Delta Power Company Rockford (see here a previous post by BeBeez). Finrel belongs to the Casappa family and has sales of 130 million euros, an ebitda of little above 15 million and net cash of 3.2 million. Tecnord has revenues of 58 million.

Essilor Luxottica committed to pay 29.4 million euros for a 90.9% of Milan-listed Giorgio Fedon & Figli, an Italian producer of spectacle cases, on the ground of an enterprise value of 43 million euros (net debt of 10.6 million) or 17.03 euros per share (see here a previous post by BeBeez). Essilor Luxottica will delist Fedon and buy the remaining shares at the same price. Giorgio Fedon & Figli main shareholders are CL & GP, Piergiorgio Fedon, Sylt, Italo Fedon, Laura Corte Metto, Francesca Fedon, Roberto Fedon, Flora Fedon, and Rossella Fedon.

NB Renaissance acquired 92.8% of Arbo, a producer of boiler spare parts, from Bravo Capital Management and Narval Investimenti, part of Gruppo Bancario Ersel (see here a previous post by BeBeez). Arbo’s ceo Daniele Franco and coo Giovanni Casali acquired 7.2% of the firm. Mediobanca assisted the vendors. Arbo has sales of 80 million euros and an ebitda of 9.2 million.

Affidea, a medical diagnostic company that belongs to Swiss-Italian entrepreneur Ernesto Bertarelli, acquired the majority of Brust-Zentrum Zürich (BZZ) (see here a previous post by BeBeez). Giuseppe Recchi is the ceo of Affidea who hired Jefferies and Goldman Sachs for finding a financial partner. The asset attracted the interest of Eqt, Partners Group,Intermediate Capital Group, AP Moller, and Biogroup.