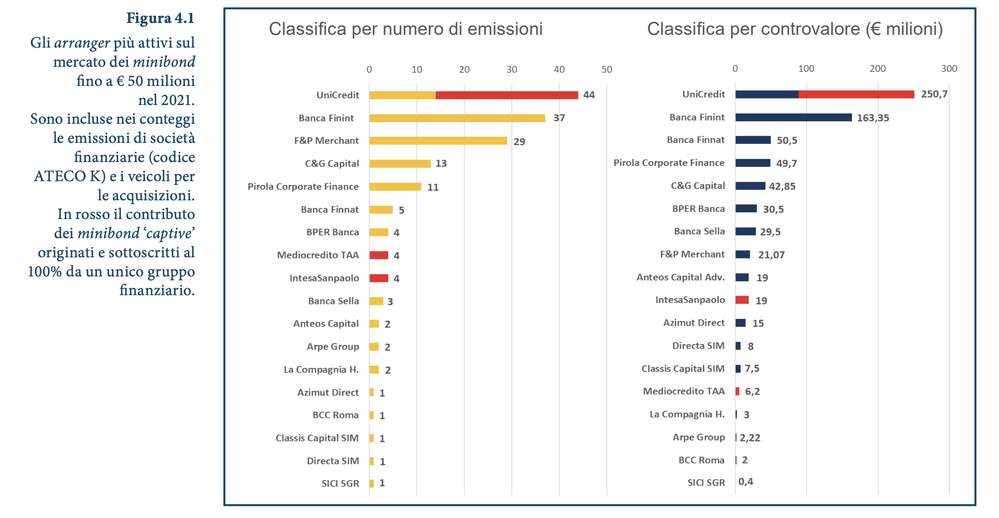

Unicredit heads the 2020 Milan Polytechnic University’s School of Management’s league table of minibonds arrangers for issuances (44) and value of the transactions (250.7 million) (see here a previous post by BeBeez). Banca Finint carried on 37 issuances worth a total of 163.35 million. BeBeez acted as media partner for the presentation of the Eighth Report of the Minibond Observatory. Frigiolini&Partners Merchant closed 29 transactions worth a total of 21.07 million (eighth place in the table) while Banca Finnat is third in the table for the volume of transactions of 163.35 million (5 issuances).

Unicredit heads the 2020 Milan Polytechnic University’s School of Management’s league table of minibonds arrangers for issuances (44) and value of the transactions (250.7 million) (see here a previous post by BeBeez). Banca Finint carried on 37 issuances worth a total of 163.35 million. BeBeez acted as media partner for the presentation of the Eighth Report of the Minibond Observatory. Frigiolini&Partners Merchant closed 29 transactions worth a total of 21.07 million (eighth place in the table) while Banca Finnat is third in the table for the volume of transactions of 163.35 million (5 issuances).

MSC Cruises, a subsidiary of MSC(Mediterranean Shipping Company), opened a construction site of the new cruise terminal in the port of Miami with the support of Fincantieri Infrastructure (see here a previous post by BeBeez). Cassa Depositi e Prestiti and Intesa Sanpaolo provided MSC with a financing facility of 350 million euros with the warranty of Sace. Simest will act for stabilizing the interest rate of the facility.

Duferco Energia received a green loan of 26 million euros from Cassa Depositi e Prestiti, Crédit Agricole Italia and the European Investment Bank for building 1800 new stations for recharging electric vehicles (See here a previous post by BeBeez). SACE provided a green warranty for 80% of the facility. CDP and Crédit Agricole Italia provided the company with two credit lines of 13 million each. The lenders invested 10 million of EIB’s provision. Duferco Energia has sales of 1.47 billion, an ebitda of 14 million and a net financial debt of 62.8 million.

Yesmoke, an Italian cigarettes manufacturer, issued a minibond of 750k euros for booosting its commercial expansion in Italy and abroad (see here a previous post by BeBeez). Confidi Sardegna subscribed the bond that is due to mature on 31 December 2028 and pays a fixed rate coupon of 4.25%. Rete Fidi Liguria provided a warranty for the issuance. By 2023, Yesmoke aims to sell its products in Europe and the Middle East. The company belongs Swiss Merchant Corporation and has sales of 6.5 million and an ebitda of 0.9 million.

Rea Dalmine, a subsidiary of Ambienthesis (part of Gruppo Greenthesis), received a sustainable loan of 35 million euros from Banco BPM, BPER Banca and Mediocredito Centrale (see here a previous post by BeBeez). Azimut Direct, a fintech subsidiary of Milan-listed Azimut, collaborated for structuring the transaction and helped its clients to invest in the loan. The financing facility is split in two credit lines that the company can use in a single solution with biannual payments ending on 31 December 2031. Rea Dalmine will invest such proceeds for implementing ESG and circular economy strategies. The banks will charge the company with a lower interest rate upon the achievement of recovery performance targets of Rea’s industrial assets. Rea Dalmine has sales of 25 million, an ebitda of 8.6 million. Greenthesis owns 85% of Ambienthesis and belongs to RAPS SAS di Rina Marina Cremonesi e C. The firm has sales of 129.4 million, an ebitda of 29.4 million and a net financial debt of 29.6 million.

Serioplast Italy, an Italian packaging company, received from Unicredit a 2-years green loan of 5 million euros for which the European Investment Bank (EIB) provided a Risk Sharing (See here a previous post by BeBeez). Serioplast will invest these proceeds in implementing sustainable production processes. Unicredit will charge the company with a lower interest upon the achievement of ESG targets. Serioplast Italy belongs to Gruppo Old Mill Holding, a company that Franco Cistellini, Dario Innocenti (chairman) and Luigi Innocenti (ceo) founded in 1974 and that has sales of 320 million. Serioplast has revenues of 271 million, an ebitda of 18.7 million and a net financial debt of 99.4 million.

Impresa Sangalli Giancarlo & C, an Italian provider of environmental services, received from Unicredit a 6-years green loan of 7 million euros with the warranty of Sace (See here a previous post by BeBeez). The company will invest the proceeds in its organic growth. Impresa Sangalli belongs to Rosa Maria Riboldi (90%) and Massimo Sangalli (10%). The company has sales of 98.5 million, an ebitda of 12.8 million and a net financial debt of 4.08 million. Alfredo Robledo is the company’s chairman

RDR, an Italian water treatment company, received mid and long-term credit lines for 12.5 million euros from MPS, Deutsche Bank and BNL for financing its 2021-2024 business plan (See here a previous post by BeBeez). The Di Ruocco Family owns the company while Luca Serena is the ceo. RDR has sales of 49.8 million with an ebitda of 5.9 million and a net debt of 4.5 million.

PGIM Investments opened a bureau in Milan and Alessandro Aspesi will act as Country Head for Italy (see here a previous post by BeBeez). PGIM Investments is the distribution unit of PGIM funds, who belongs to Prudential Financial, a subsidiary of US insurer Prudential. So far, PGIM’s activity in Italy has been carried out on two asset classes, real estate and private debt. The first one is managed through PGIM Real Estate Luxembourg, headed by the Italian manager Raimondo Amabile in the position of head of Europe and investment director. While the private debt activities have been carried out by Pricoa Capital, the brand with which PGIM Private Capital operates, and has already fully subscribed 19 issues in Italy, of which five in 2021.

Earlier in February, Milan Court accepted the debt restructuring agreement that Focus Investments, a subsidiary of Prelios, signed with its creditors (see here a previous post by BeBeez). The company made a deal with Borromini spv (a securitization vehicle that belongs to Davidson Kempner Capital Management, who is Prelios main shareholder), AMCO, Banco BPM, and Banca Monte dei Paschi di Siena. In late 2021, Borromini purchased the liabilities that Focus Investments had with IntesaSanpaolo, UniCredit, Banca Popolare di Sondrio, and BPER. Davidson Kemper aims to sell Prelios for one billion euros while keeping a controlling stake of Focus Investments, market rumours say. Borromini will convert in equity credits for 34.2 million. AMCO will convert debts worth 3 million in equity and write off liabilities of 14.9 million that the company had with MPS and Banco BPM. The agreement also provides for the restructuring of the financial debt through an initial cash release of EUR 69 million and the repayment of the remaining exposure through the use of proceeds from the valuation of the company’s investment portfolio. Creditors not participating in the agreement will be repaid in full within the terms of the law.

Earlier in December, Amco signed an agreement with Edilmarina, the owner of Argentario Golf Resort&spa, for restructuring the company’s 23 million euros debt (see here a previous post by BeBeez). Edilmarina has sales of 4.2 million, losses of 1 million, equity of 4 million, an ebitda of 0.226 million and a net financial debt of 22 million. Edilmarina belongs to Irish insurer SEB Life (97%), and Girasole (3%). Press reports quoted sources as saying that Edilmarina effectively belongs to Marco Mascioli and the ceo Maria Grazia Orsini. Amco has 33 billion of NPEs under management .