Hiro Capital, the leading specialist European venture capital, focused on videogames, metaverse technologies, ceator platforms and gamified fitness, announced a few days ago the launch of Hiro Capital II, a €300m fund focused on backing the world’s emerging gaming and metaverse innovators. Hiro II will be announcing its first investments in April (see here the press release). A few days before Sure Valley Ventures too, the founder-led venture capital firm that invests in high growth software companies in sectors such as the metaverse, artificial intelligence (AI) and cybersecurity, announced that it has completed an £85m first close of a £95m UK software technology fund (see here the press release), while crypto investment firm Hack VC has launched a USD200m Crypto Seed Fund to invest in crypto, web3, and blockchain startups. The fund is backed by Sequoia Capital, Fidelity, a16z’s Marc Andreessen and Chris Dixon, Accolade Partners, Digital Currency Group, and numerous institutional investors and endowments (see here the press release).

Hiro Capital, the leading specialist European venture capital, focused on videogames, metaverse technologies, ceator platforms and gamified fitness, announced a few days ago the launch of Hiro Capital II, a €300m fund focused on backing the world’s emerging gaming and metaverse innovators. Hiro II will be announcing its first investments in April (see here the press release). A few days before Sure Valley Ventures too, the founder-led venture capital firm that invests in high growth software companies in sectors such as the metaverse, artificial intelligence (AI) and cybersecurity, announced that it has completed an £85m first close of a £95m UK software technology fund (see here the press release), while crypto investment firm Hack VC has launched a USD200m Crypto Seed Fund to invest in crypto, web3, and blockchain startups. The fund is backed by Sequoia Capital, Fidelity, a16z’s Marc Andreessen and Chris Dixon, Accolade Partners, Digital Currency Group, and numerous institutional investors and endowments (see here the press release).

Crunchbase, a well known information data provider platform on venture-backed global companies, said startups and scaleups companies related to the metaverse (tagged under gaming, online games, virtual worlds, and augmented reality) have raised nearly $10.4 billion as to last November 2021 across 612 deals, with Epic Games’ $1 billion funding round in April 2021 leading the pack (see here the press release) That’s a significant jump from the $5.9 billion companies tagged in those categories raised last year, and by far the most amount raised for the broader “metaverse category” in a single year in the last decade.

Attention from venture capital firms has obviously a good reason. Actually JPMorgan believes that there is over $1 trillion of value per year to be unlocked when it comes to metaverses. In their recently released report “Opportunities in the Metaverse,” JPMorgan picks the super-figure from a previous report by US cryptocurrency asset manager Greyscale published last November and says: “The metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues. As a result, we see companies of all shapes and sizes entering the metaverse in different ways, including household names like Walmart, Nike, Gap, Verizon, Hulu, PWC, Adidas, Atari, and others”.

And this is why JPMorgan decided to open shop in the metaverse: JP Morgan established itself as the first bank in the Metaverse by launching their Onyx Lounge in Decentraland, one of the four full active metaverse platforms. Clearly JPM has been focused on being first in the door in these new environments. They established a strong team to take on the Metaverse which was led by Christine Moy until late February when she left the firm for pursueing a still undisclosed new opportunity (see here The Block). In 2020 Moy co-founded Onyx, a JP Morgan business unit specializing in digital assets and the blockchain. They also worked on Coinbase’s direct listing in early 2021 and offered banking services to regulated crypto companies early on like Coinbase and Gemini.

Moy also co-wrote JP Morgan’s report on the metaverse which outlines the opportunities and critical areas of the space. In the report JPM focuses on the technology that supports the ecosystem and the commercial infrastructure that must be scaled in order to support the meta-economy. They recognize that the metaverse offers opportunities to host the workforce of the future in two facets. Firstly, the metaverse can support virtual workspaces that mimic corporate settings, reducing transportation costs and potentially boosting employee morale. Secondly, the metaverse will create a myriad of new jobs for computer engineers, designers, artists, and content creators. The regulatory and tax aspects of the metaverse will also continue to be developed over the next few years.

Moreso than getting active in the metaverse, JPM advocated for companies to start developing their metaverse strategy. The whitepaper says: “In the metaverse, some of the existing services and business models we are familiar with will continue to exist, but the metaverse opens a whole new realm of ways to engage which we expect will lead to uniquely new services and business models. Not everything in the metaverse will be relevant for every business. However, there is little downside to taking the opportunity to explore”

Clearly, the metaverse offers a wealth of opportunities for businesses of all kinds to engage, transact, and gain brand exposure. The metaverse will rely on a flexible financial system that seamlessly integrates the physical and digital worlds. JPM points out that there are many parallels between physical economies and in-game ecosystems with their own currencies, digital assets, a population of players, and even land in some cases.

They focus on three main verticals: “Industrializing game platform providers with bank-grade products and digital assets platform assets, enabling game and content creators to more easily commercialize their creations, and scaling the metaverse industry worldwide across multiple currencies and payment methods”.

Overall, the metaverse has many potential applications that will be utilized in the coming years. Since many of the current active metaverses are gaming platforms, it will be interesting to see how Facebook’s Meta goes beyond that. We recall that Facebook made a bold statement when they rebranded to Meta in October of 2021 (see here the press release). Their version of the Metaverse is looking to bring together our physical and digital lives where we can enjoy experiences as we would in the real world.

Apart from Meta, there are four main players in the metaverse now: the already quoted Decentraland, The Sandbox, Somnium Space and Cryptovoxels. The former are all realities, while Facebook’s metaverse is still a concept.

Decentraland is a decentralized virtual universe that gives full ownership of digital assets to its owners, which gives users control over the universe itself, unlike Facebook’s Meta. Decentraland was founded in xx by Ariel Meilich and Esteban Ordano in Bejing, China, and has raised over $25M in venture capital funding (from Animoca Brands among the others) as well as 25M$ in capital from their Initial Coin Offering (ICO) of their token, MANA, which gathered investments from Alpha Sigma Capital, Genesis One Capital and Fundamental Labs among others. The token MANA and platform live on the Ethereum blockchain. The ICO took place in August of 2017 at a price of roughly 2.4 cents per token and at the time of writing MANA trades at $2.58. MANA is the native currency of Decentraland, allowing users to purchase good and services and above all LAND. The latter is what they call their digital land, it was split up into parcels and is a nonfungible asset that can be bought with MANA. LAND is limited to a finite number and the users who own it own it permanently and can do whatever they want with their LAND. They can monetize their LAND by creating content, gaining visitor traction in a rather straightforward way.

Sandbox is another virtual universe that lives on the Ethereum blockchain. Developed by Pixowl, a California-based company founded in 2011 by Adrien Duermael, Arthur Madrid (ceo), Laurel Duermael and Sebastien Borget, started as a mobile game called The Sandbox in 2012 and then The Sandbox Evolution in 2016 with over 40M downloads combined. These games operated in a similar space as Minecraft and Roblox, and while they did not generate comparable revenues, still had over 1M active users per month in 2018, when Pixowl was acquired by Animoca Brands, a Hong-Kong based game software and venture capital company for $4.875M (see here the press release). Now The Sandbox is an Ethereum-based decentralized NFT gaming metaverse that enables non-tech savvy users to create, sell, use, and monetize their own virtual reality NFTs. The crypto metaverse uses its native token SAND to underpin the entirety of the in-game economy.

Somnium Space is a Virtual Reality world again on the Ethereum blockchain, where players can buy land, build or import NFTs, explore, and trade using Somnium’s game currency CUBE. The company was founded in London by Artur Sychov in 2017. It raised a 1M$ founding round in 2019 from undisclosed investors, after having raised its first 200k$ from the VR community by selling virtual land on crowdfunding websites like Indiegogo.

Somnium Space is a Virtual Reality world again on the Ethereum blockchain, where players can buy land, build or import NFTs, explore, and trade using Somnium’s game currency CUBE. The company was founded in London by Artur Sychov in 2017. It raised a 1M$ founding round in 2019 from undisclosed investors, after having raised its first 200k$ from the VR community by selling virtual land on crowdfunding websites like Indiegogo.

Cryptovoxels is a virtual world and metaverse, powered again by the Ethereum blockchain where players can buy land and build stores and art galleries. Cryptovoxels’ token is the Cryptovoxels Parcel (CVPA) which is an NFT as it represents the land in Origin City, and each parcel is unique. The company was founded by Ben Nolan the owner of Nolan Consulting, an independent game developer based in Wellington, New Zealand.

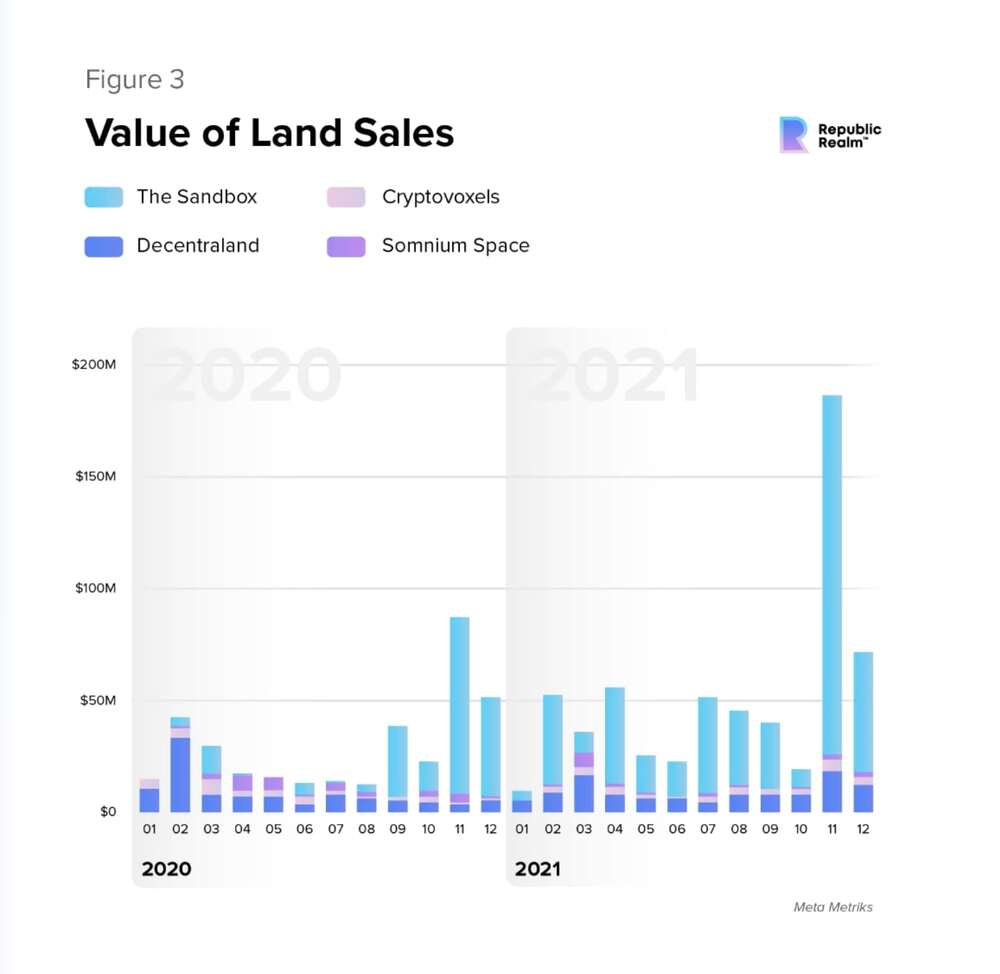

Transactions on virtual real estate space are actually growing incredibly fast, in fact, the average price for a parcel of land across the four ecosystems doubled from $6k to $12k from June to December of 2021, JPMorgan recalls in its report, picking the figure from Republic Realm’s 2021 Metaverse Real Estate Report. These ecosystems are similar to the real world in that certain parcels hold more value due to location. For example, a plot of land adjacent to Snoop Dogg’s parcel in the Sandbox sold for $450k on December 4, 2021. The space is booming, with over $500M in real estate sales in 2021 and projections of over $1B in 2022.

Viraaj Dhawan contributed to this article