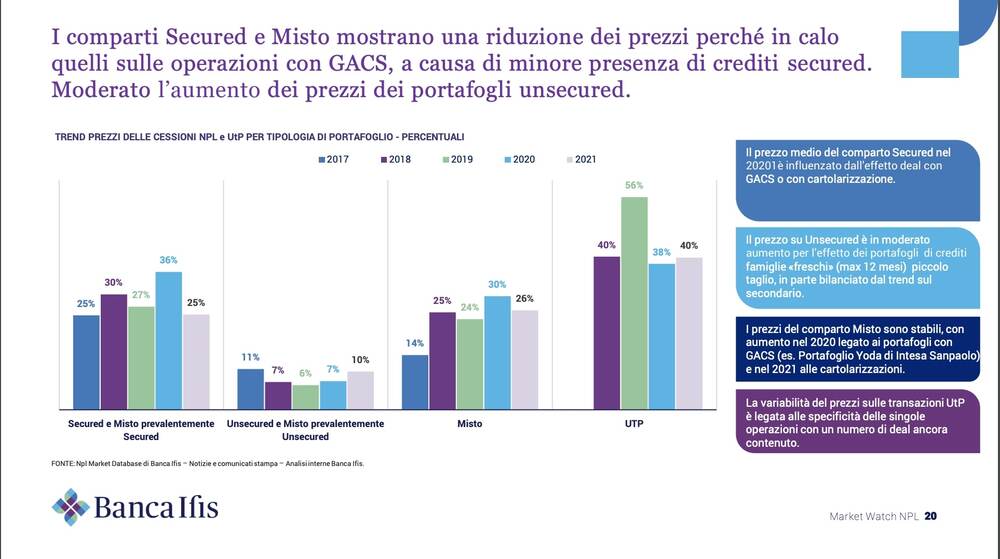

In 2021, 31 billion euros of gross NPEs were sold, the lowest value since 2017, said Milan-listed Banca Ifis in its Market Watch Npl 2022 report (see here a previous post by BeBeez). Prices for secured NPLs went down while price of UTPs increased to 40% (38% in 2020). BeBeez monitored deals for 27 billion on the grounds of data available in January 2022. See here the NPL BeBeez 2021 Report available for the subscribers to BeBeez News Premium and BeBeez Private Data.

In 2021, 31 billion euros of gross NPEs were sold, the lowest value since 2017, said Milan-listed Banca Ifis in its Market Watch Npl 2022 report (see here a previous post by BeBeez). Prices for secured NPLs went down while price of UTPs increased to 40% (38% in 2020). BeBeez monitored deals for 27 billion on the grounds of data available in January 2022. See here the NPL BeBeez 2021 Report available for the subscribers to BeBeez News Premium and BeBeez Private Data.

Cherry Bank is the name of the bank born out of the merger of Cherry 106 (fka Cassiopea NPL) with Banco delle Tre Venezie (BTV) (see here a previous post by BeBeez). Giovanni Bossi is the firm’s main shareholder (40.7%) and ceo. BTV’s previous shareholders have 49% of Cherry Bank. Further directors of the bank are Giuseppe Benini (chairman), Gabriele Piccolo (Vice chairman), Stefano Aldrovandi, Elisa Cavezzali, Laura Gasparini, Emanuele Leoni, Bruno Pedro Colaco Catarino, and Marina Vienna

Walter Maiocchi and other investors acquired The Organic Factory, an Italian producer of biologic oil and lecithin that is in receivership (see here a previous post by BeBeez). Enrico Ceccato and Paolo Scarlatti founded The Organic Factory in 2016. In June 2018, the company attracted the resources of Electa Ventures and Azimut Global Counseling, through Ipo Club, a pre-booking company or pre-listing investment vehicle. Ipo Club subscribed a convertible bond in two tranches of 8 million each. In addition, Electa Ventures, Ipo Club and Azimut acquired special shares of the company ahead of a listing. However, The Organic Factory posted debts of 35 million to procure organic grain at competitive costs in Kazakhstan. Such a project drained resources for 20 million and the board of directors required Paolo Frigati to resign.

Milan Court accepted the debt restructuring proposal of Chiara Edificatrice Milanese, an Italia real estate developer that belongs to the Pirovano Family (see here a previous post by BeBeez). Chiara Edificatrice Milanese has debt of 12 million euros, sales of 654k euros and an ebitda of 88k euros.

Rome Court accepted the secondary receivership proposal of Blue Air, a Romanian low cost airline (see here a previous post by BeBeez). The main receivership procedure is taking place in Romania. Steven Greenway is the ceo of Blue Air.

Carraro, an Italian producer of automotive components that belongs to the Arduini and the eponymous Family, called off the issuance of its expected bond in light of the current war between Russia and Ukraine (see here a previous post by BeBeez). Carraro was going to issue a 6-years bond of 120 million euros with a fixed rate coupon of 3.75%. The company would have invested such proceeds in refinancing its financial debt.

Adelasia, a subsidiary of Fera (Fabbriche Energie Rinnovabili Alternative), received a financing facility of 30.5 million euros from Iccrea Banca, Bcc Milano, Bcc Centropadana, Bcc dell’Oglio e del Serio e delle Alpi Marittime, and Bcc Carrù (see here a previous post by BeBeez). Fera, a renewable energy company, has sales of 0.738 million and an ebitda of minus 1.5 million. Adelasia will invest the proceeds in building the Monte Greppino Wind Farm with a power of 25.2 MWp.

Italian car rental firm Sicily by Car received from UniCredit a 24-months ESG financing facility of 10 million euros for which the EIB (European Investment Bank) provided a warranty (see here a previous post by BeBeez). The company will invest these proceeds in purchasing of hybrid vehicles. This facility is part of the PNRR’s European Credit Guarantee Fund. Tommaso Dragotto is the chairman of Sicily By Car who has sales of 98.7 million, an ebitda of 20.3 million and a net financial debt of 13 million. Dragotto reportedly said that the company aims to list on Milan market.

Domori, a chocolate producer that Gruppo Illy owns through Polo del Gusto, replaced Lelio Mondella with Lamberto Vallarino Gancia as the company’s ceo (see here a previous post by BeBeez). In April 2021, Andrea Macchione resigned as ceo of Domori and Mondella took the role. Vallarino Gancia is an alumnus of University of California Davies and previously worked as chairman of Gancia. Domori has sales of 26 million euros in line with the covenants of the 6-years 5 million euros minibond it issued in December 2020 and for which Mediocredito Centrale (MCC) provided a warranty for 90% of the issuance.