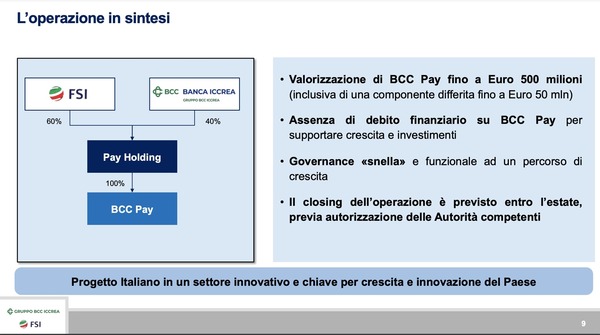

The FSI private equity fund, led by Maurizio Tamagnini, returns to invest in fintech and secures 60% of BCC Pay, the e-money business of Iccrea Banca, the parent company of the Iccrea Cooperative Banking Group, in a deal worth 500 million euros, including a deferred component up to euro 50 millions (see here the press release and here the presentation slides). BCC Pay counts 4 million payment cards, over 200,000 POS and approximately 50 billion euros of transactions per year.

The FSI private equity fund, led by Maurizio Tamagnini, returns to invest in fintech and secures 60% of BCC Pay, the e-money business of Iccrea Banca, the parent company of the Iccrea Cooperative Banking Group, in a deal worth 500 million euros, including a deferred component up to euro 50 millions (see here the press release and here the presentation slides). BCC Pay counts 4 million payment cards, over 200,000 POS and approximately 50 billion euros of transactions per year.

The first rumors about the project date back to 2018, when rumors were that Iccrea was precisely studying a spin-off of the e-money activities in an ad hoc company and then looking for an investor for signing a partnership (see here a previous article by BeBeez).

The rumors about a possible deal leaked back last September, when however talks were about the possibility for the bank to sell only a minority stake of the business. Then it was said that the entire e-money business could be worth around 400 million euros (see here a previous article by BeBeez). But that figure was based only on the numbers of Ventis spa, a company wholly owned by Iccrea Banca for which Iccrea had obtained the authorization from the Bank of Italy in 2019 for the establishment of an Electronic Money Institution (Istituto di Moneta Elettronica or IMEL in Italian) (see here the press release of the time).

In reality, Mauro Pastore, general manager of Iccrea Banca, explained yesterday at a press conference, that before the acquisition, Iccrea Banca will transfer to BCC Pay, the new name of Ventis spa, further activities in the field of e-money, which are currently carried out directly by the bank, and for which separate official balance sheet numbers are therefore not available at the moment. Hence the greater value of the operation. In the meantime, last October 2021 BCC Pay obtained the IMEL license from the Bank of Italy. In fact, Iccrea Banca’s general manager, Mr. pastore, explained that the license previously obtained by Ventis spa was specifically made to expire in order to request a new one under the new name and in view of the further development project. BCC Pay will be led by ceo Fabio Pugini, current general manager.

As for the structure of the transaction, FSI fund will enter the capital of BCC Pay through the newco Pay Holding, which will purchase the entire capital of BCC Pay spa. In turn, Iccrea Banca will reinvest 40% in Pay Holding. BCC Pay will be totally debt-free, so as to allow the company to conduct the investments necessary for development, without already being burdened by debt. The debt may instead be contracted upstream, by Pay Holding, with the equity commitment which in the end could be around 270 millions. The closing of the transaction is expected by the Summer. In the transaction, Iccrea Banca was assisted by Prometeia and Legance Avvocati Associati (Team Rome). FSI was assisted by KPMG (Team Corporate Finance and Team Deal Advisory), Gianni & Origoni and Studio Biscozzi Nobili Piazza.

BCC Pay today serves the 128 banks of the BCC Iccrea group, the largest Italian cooperative banking group, the fourth largest banking group in Italy for assets with approximately 175 billion euros and the third for capillarity with the banks of the group active in over 1,700 Italian municipalities and with more than 2,500 branches. Following the transaction, BCC Pay will continue to distribute its services over the long term on the network of the BCCs part of the BCC Iccrea Group. But not only that. The fact that BCC Pay will be controlled by FSI was intended precisely to allow the company to be independent from the Iccrea group and to be able to offer its services to other, reasonably small banks.

Icrrea Banca’s general manager, Mauro Pastore, commented: “We are very satisfied with the conclusion of this agreement in a sector where we want to continue investing in innovation, technology and infrastructure with a top-level partner such as FSI. With this operation, we increase the ability of the group’s mutual banks to better support customers, shareholders and territories, through the higher quality of the offer and the security of payments. As the largest Italian cooperative banking group, we have the task of encouraging these changes, with a path that offers our customers, current and future, services in step with the times and with their needs “.

The Italian digital payments market is growing and has levels of penetration even lower than the European average. In a context of continuous innovation, the partnership represents an Italian and independent project, focused on the development of BCC Pay mainly through: the expansion of the offer and the constant improvement of the service; innovation and digitization (also on innovative payment methods, for example the service Buy-Now-Pay-Later, a rapidly growing market segment, with the successes of the Italian scaleup company ScalaPay and the Swedish unicorn Klarna); the commercial focus on mutual banks and their needs; the possibility of expanding the customer base to other banks and operators.

Maurizio Tamagnini, ceo of FSI, added: “We are delighted to enter into a long-term partnership with the third Italian banking network. This investment confirms the role of FSI as an engine of digital growth and a leading investor in the Italian fintech sector, where we have invested around 600 million euros over four years. Digital payments are at the heart of the transformation of banks and will continue to grow thanks to new products and greater diffusion”.

In fact, FSI now has a solid track record in the sector. In particular, in the last year it has completed two investments and a reinvestment. On the latter front we recall the deal on Cedacri, the group specialized in the outsourcing of IT and back office services to banks of which the FSI fund owned 27.1% (see here a previous article by BeBeez).

Last June ION Investment Group, the global technology provider of the financial sector, founded more than 20 years ago by the Italian entrepreneur Andrea Pignataro, in fact signed the closing of the acquisition of the entire capital of Cedacri, based on a valuation of 1,5 billion euros. The operation involved the exit from the share capital of Cedacri of the shareholder banks, while FSI reinvested in the vehicle with which ION bought the group and today owns 9% of the new Cedacri group, after a reinvestment equal to approximately as much as 2x the capital initially invested by FSI in Cedacri in January 2018. We recall that at that time FSI had bought 27.1% of Cedacri at a price of 99 million euros, equal to approximately 370 million euros of equity value for 100%, to which 59 million of positive net financial position were added, for a total of 430 million of enterprise value (see here a previous article by BeBeez). According to BeBeez, those 59 million were paid to the selling banks as an extra-dividend before the closing..

Those numbers were calculated on the basis of an estimated 2017 turnover of 330 million euros and an estimated ebitda of 42 millions. Since then, however, the company has grown a lot, including through acquisitions. In January 2019 Cedacri had in fact won the tender to acquire the entire capital of Oasi spa, the subsidiary of Nexi active in the development of solutions for banking compliance. Oasi was valued at 151 million euros, or about 10x the ebitda of 2017, which was 15 millions (see here a previous article by BeBeez). In June 2019, Cedacri also bought 88% of Cad It, the Italian leader in the supply of application software and services for the finance area of banking institutions, public administration and industry (see here a previous article by BeBeez). Finally, in 2020 the group signed an agreement with Deutsche Bank for the migration of all its core banking systems to the Cedacri platform: this was the first major IT outsourcing and innovation project of a global bank in Italy (see here the press release).

Furthermore, Cedacri entered the same ION group that gained control of Cerved, specialized in business information and credit management, following a takeover bid last Summer. Operation in which FSI also participated, undertaking to subscribe, against the payment of 150 million euros, a bond issued by Castor Bidco Holdings Limited, the vehicle of the takeover bid (see here a previous article by BeBeez).

Last November, on the other hand, FSI invested in Lynx, a system integrator specialized in the design and implementation of technological solutions to support large companies in the utility sector, banks, insurance companies and the public administration. FSI has acquired 49.9% of the company, investing above all in a capital increase, also in this case to put the company in a position to invest in both organic growth and acquisitions and create a reference player in the digital sector in Italy (see here a previous article by BeBeez).

Finally, we recall that the FSI team, when still working for the then Italian Strategic Fund (now Cdp Equity), in 2013 had invested in Sia, a leader in payment services and infrastructures (see here a previous article by BeBeez) which is to marry with the paytech listed on Piazza Affari Nexi (see here a previous article by BeBeez) which in turn merged with the Danish company Nets so that the resulting group will become the largest pan-European paytech platform (see here a previous article by BeBeez).

Moreover, still in the payments business, Nexi in turn bought Intesa Sanpaolo‘s merchant acquiring business in December 2019, which had sold the related business unit for one billion euros in exchange of the purchase by the bank of a 9.9% stake in Nexi from Mercury UK (vehicle that groups the shares in the Advent International, Bain Capital and Clessidra funds) (see here a previous article by BeBeez). Even earlier, in 2017, when it was still called Icbpi, Nexi had bought DB Cards Acquiring from Deutsche Bank spa for 30 million euros (see here a previous article by BeBeez) and the merchant acquiring business of Mps for 520 million euros (see here a previous article by BeBeez). Even earlier, in 2016, it was the turn of Setefi, the company specialized in payment services at the time wholly owned by Intesa Sanpaolo, and Intesa Sanpaolo Card (the pay cards issued abroad by the bank) for 1.035 billion euros (see here a previous article by BeBeez)

As for the most recent risk in the payment sector in Italy, we recall that at the beginning of January the French electronic payments group Worldline completed the acquisition of 80% of the capital of Axepta, a subsidiary specialized in electronic payment services of BNL (BNP group Paribas), with the bank keeping the remaining 20% of the capital. The transaction, announced in July 2021, was conducted on the basis of an overall valuation of 220 million euros (see the press release here).