In a few days it is expected the decision of the Italian Antitrust regarding the acquisition of Agrifarma spa, owner of the Arcaplanet brand of pet products shops, announced last June by Cinven, in conjunction with the acquisition of the German pet products shops chain Maxizoo (see here a previous article by BeBeez). In fact, on November 22nd 2021, Italy’s Competition and Market Authority (AGCM) announced the start of an investigation and that the proceeding had to be finalized within next 45 days (see here the Antitrust Bulletin). Meanwhile, on January 3rd, the deadline for third parties to send their observations to the AGCM expired.

In a few days it is expected the decision of the Italian Antitrust regarding the acquisition of Agrifarma spa, owner of the Arcaplanet brand of pet products shops, announced last June by Cinven, in conjunction with the acquisition of the German pet products shops chain Maxizoo (see here a previous article by BeBeez). In fact, on November 22nd 2021, Italy’s Competition and Market Authority (AGCM) announced the start of an investigation and that the proceeding had to be finalized within next 45 days (see here the Antitrust Bulletin). Meanwhile, on January 3rd, the deadline for third parties to send their observations to the AGCM expired.

Arcaplanet stand alone at the end of June counted 382 stores in Italy, in addition to other 130 Maxizoo stores. At the beginning of November, the Arcaplanet stores in Italy had then become 391 (see the press release here).

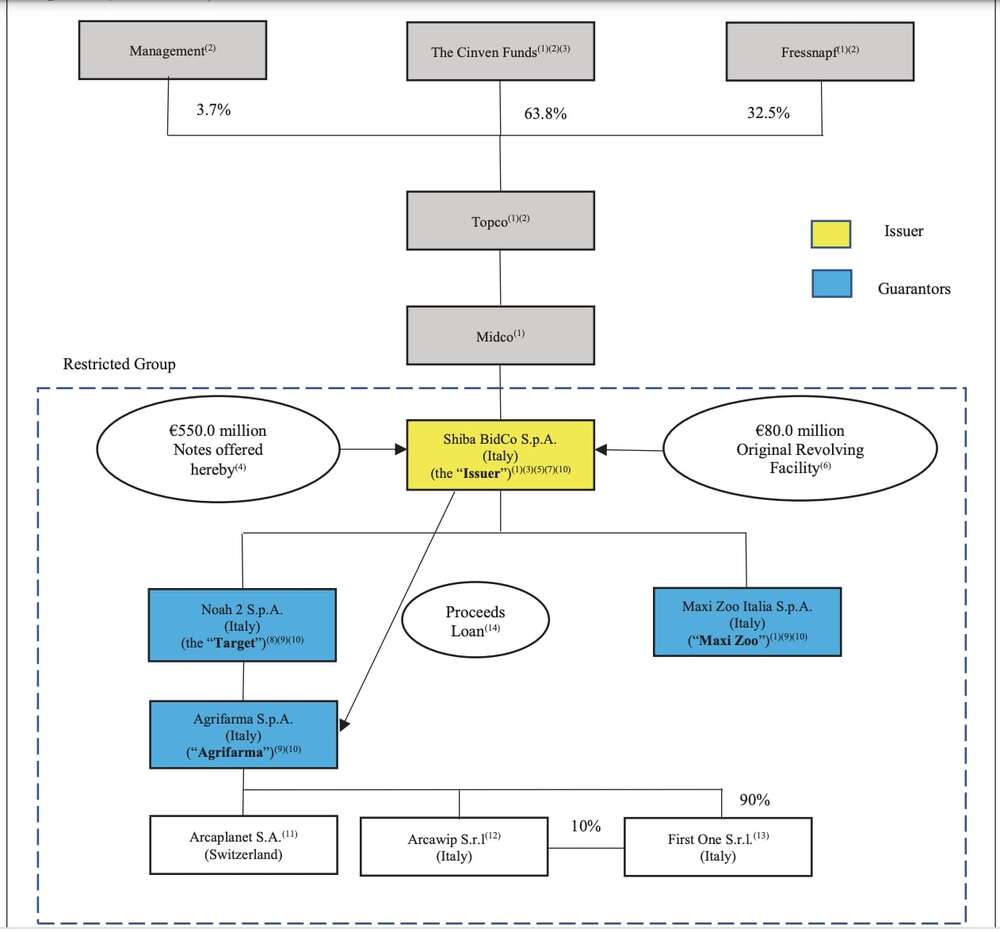

The transaction on Arcaplanet is actually a bit more complex than what was communicated last June. In fact, Fressnapf Beteiligungs, the former owner of Maxizoo, will also enter the shareholding structure of the new group not just as a consideration for transferring MaxiZoo but as in turn will also invest cash for the purchase of the Arcaplanet itself, with the result that at the top of the control chain of the new reality there will be not only Cinven (with 63.8% of the capital), but also Fressnapf with 32.5%, joined by the management with a 3.7% stake.

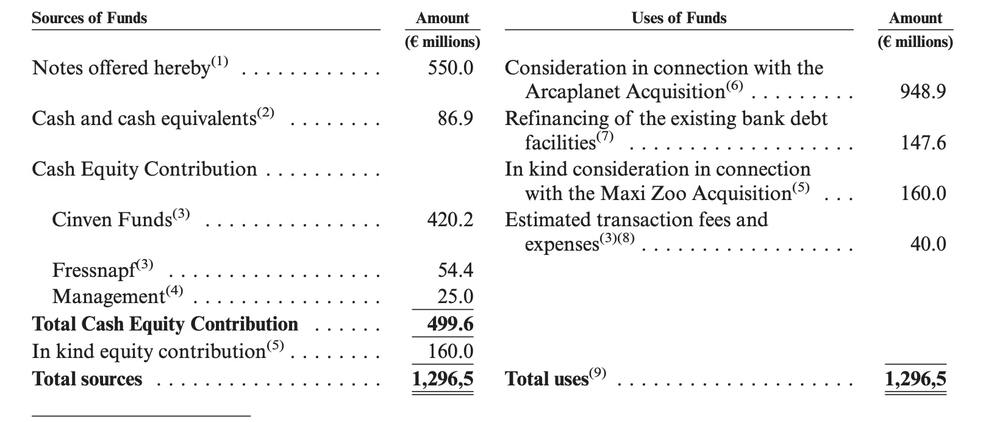

The transaction will be partially financed with a 550 million euros senior secured bond issue. For the rest, as stated in the Bond Prospectus, Cinven will contribute about 420 millions in cash, while Fressnapf will invest 54 millions in cash and will bring in Maxizoo, which has been assigned an equity value of 160 millions. The enterprise value of the entire operation, including the refinancing of the approximately 148 million of existing bank debt and the 40 million euros of transaction fees, is just under 1.3 billion euros.

The bond, which was listed on the Luxembourg Stock Exchange, matures on October 31, 2028, pays a coupon of 4.5% and was issued by Shiba Bidco spa, controlled by Shiba Midco Limited, in turn controlled by Shiba Topco Limited, which belongs precisely to Cinven and Fressnapf. Moody’s assigned Shiba Bidco a B2 rating and a Ba2 rating to both the bonds and the new 80 million euro supersenior revolving line.

The new group recorded pro-forma net revenues of 463.8 million euros in 2020 with an ebitda of 62 millions, while the 12 months ending on June 30th 2021 (LTM) closed with 511.1 million euros of revenues and 109 million euros of adjusted ebitda.

Arcaplanet stand alone had closed 2020 with 339.2 millions in revenues (from 305.9 millions in 2019) and the 12 months ending on June 30th 2021 (LTM) closed with 369.1 millions in revenues, while the adjusted 2020 ebitda was 52.8 millions (from 40.4 millions in 2019) while the LTM ebitda at June 2021 had risen to 65.3 millions. All with a net financial debt at the end of 2020 of 70.4 millions (from 93.5 millions in 2019).