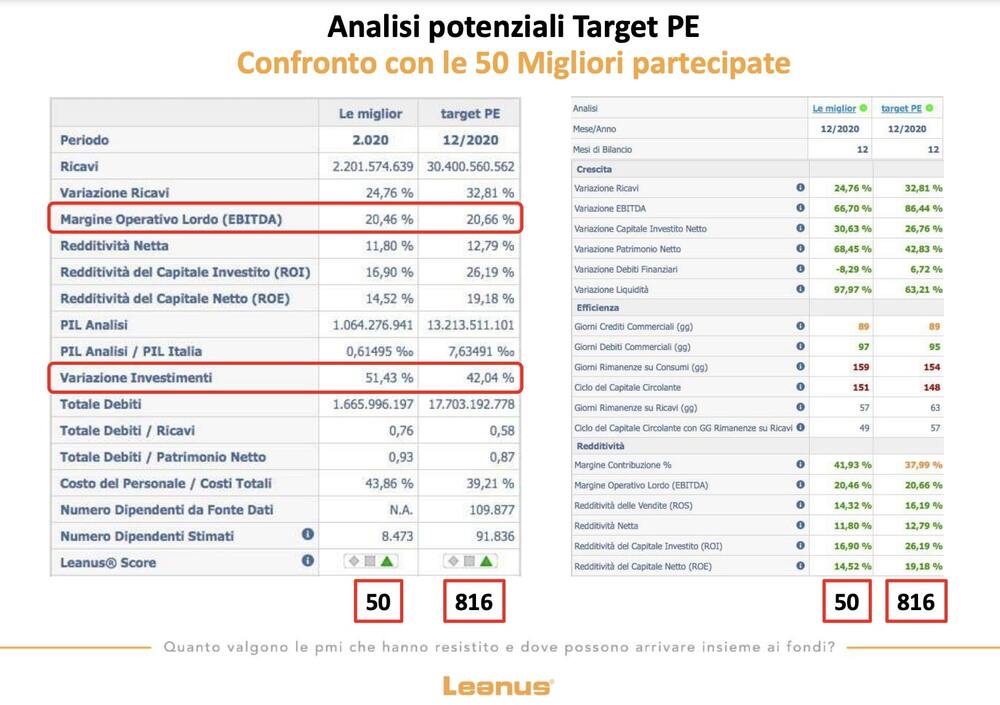

Private equity funds may target more than 800 potential targets in the same or better shape of their best portfolio companies said a report that Leanus made for the Caffé di BeBeez of 14 December, Tuesday, that Finint Investments sponsored (see here a previous post by BeBeez). At the same event BeBeez presented the aggregate data on the private equity deals of the first 11 months of 2021 in Italy (see here a previous article by BeBeez with the video and the slides) as emerged from the BeBeez Report January – November 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data.

Private equity funds may target more than 800 potential targets in the same or better shape of their best portfolio companies said a report that Leanus made for the Caffé di BeBeez of 14 December, Tuesday, that Finint Investments sponsored (see here a previous post by BeBeez). At the same event BeBeez presented the aggregate data on the private equity deals of the first 11 months of 2021 in Italy (see here a previous article by BeBeez with the video and the slides) as emerged from the BeBeez Report January – November 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data.

On 20 December, Monday, iconic Italian fashion brand Ermenegildo Zegna listed on NYSE with a market capitalization of 2.4 billion dollars and an enterprise value of 3.1 billion dollar after having completed a business combination with the Spac Investindustrial Acquisition Corp (IIAC) (see here a previous post by BeBeez). Zegna has sales of 1.2 billion euros, a core adjusted ebitda of 264 million, an adjusted ebit of 111 million, and a net financial debt of 84 million.

Cinven recapitalized its controlling stake in Ufinet International, an optic fiber company worth 2.5 billion euros (see here a previous post by BeBeez). Milan-listed Enel reinvested for a 19.5% of Ufinet of which owned 21%.

Vision Group, an Italian retailer of specs that owns the VisionOttica brand, signed the agreement for the acquisition of the shops chain VistaSì, which has the brand GrandVision, from EssilorLuxottica (see here a previous post by BeBeez). Vision Group is a portfolio company of Arcadia Small Cap Fund managed by Arcadia sgr, which bought a 46.3% in the company in 2014. VisionOttica has sales of 57.2 million euros, an ebitda of 1.4 million and a net financial debt of 12.1 million.

Milan-listed Snam, Spain’s Enagás and French GRTgaz, signed a partnership for investing in the sector of green hydrogen (see here a previous post by BeBeez).The companies invested 33 million euros each in Clean H2 Infra Fund, an impact fund that Ardian and FiveT Hydrogen that raised 800 million ahead of a target of 1.5 billion. H2 Infra attracted the resources of Air Liquide, TotalEnergies, Vinci, Plug Power, Chart Industries, and Baker Hughes. Asian Lotte Chemical, Axa, Groupe ADP, Ballard, EDF, and Schaeffler also announced their intention of investing in the fund.

Clessidra Private Equity acquired from Xenon Private Equity the majority of Impresoft, a tech company that was born in 2019 out of the merger of 4ward, Brainware, Gruppo Formula, Impresoft, and Qualitas Informatica (see here a previous post by BeBeez). Impresoft’s key managers and Italmobiliare will also invest in the company which has sales of 87 million euros.

The Equity Club (TEC), a club deal that Mediobanca and Roberto Ferraresi launched, invested in Cy4Gate (Cy4G), a Milan-listed cyber security company (see here a previous post by BeBeez). Milan’s M&A advisor Klecha & Co assisted TEC who poured 20 million euros in the target’s capital increase. Cy4G will raise up to a further 50 million and after then it will belong to Elettronica (38.5%), TEC (8% – 16%). Cy4G launched the capital increase for acquiring RCS Lab, an Italian forensic intelligence and data analysis firm on the ground of an enterprise value of 90 million at the closing and an earn-out of up to 15 million in 2023.

Ambienta acquired the majority of French urban green care services firm Cap Vert from the family office Evolem, BNP Développement, the founder Alain Capillon, and the managers (see here a previous post by BeBeez).

Roen Est, an asset of Italy’s CCC Holdings Europe (CCCHE) acquired Spain’s Kobol and Arctic from Daniel Manas and Antonio Alemany (see here a previous post by BeBeez). Kobol, is a producer of gas coolers, capacitors, dry coolers, evaporators and condensing units. Arctic operates in the field of industrial refrigeration and air conditioning. Greg Deldicque is the chairman and ceo of CCCHE, a vehicle that targets European SMEs with sales of 10 – 150 million euros. Further investors in CCHE are Italmobiliare, Luca Pretto, Alberto Pretto, and FIEE (18 million).

Biofarma Group acquired Giellepi’s unit of finished products and rebranded it as International Health Science (see here a previous post by BeBeez). Biofarma Group is an Italian producer of food integrators, medical devices and cosmetics that born in 2020 out of the merger of Nutrilinea and Biofarma, an asset of White Bridge investments. Carlo Terruzzi is the founder and ceo of Giellepi and will keep his role.

Star7, an Italian product information group filed for an IPO on Euronext Growth Milan and set a price of 8.25 – 9.50 euros per share (see here a previous post by BeBeez). The company finally placed shares through a capital increase and sales raising a total of 15 million euros at a 8.25 euros price corresponding to a 74 million euro market capitalization, including also special shares and started negotiations yestarday (see here the press release). Star7 (fka Star) was born in 2000 as the Italian subsidiary of Swiss Star and earlier in November attracted the resources of Kais Renaissance Eltif, a vehicle that Kairos Partners launched, who subscribed a capital increase of 3 million.

Retex, an Italian company for the digital transformation of the retail sector that belongs to Alkemia (fka Nem), acquired a controlling stake in marketing and communication firm Connexia from Marina Salamon that previously held 80% of the target (see here a previous post by BeBeez). Managing partners Massimiliano Trisolino and Andrea Redaelli and Connexia’s ceo Paolo d’Ammassa kept a minority of the business and their operative roles. Connexia has sales of 23 million euros. After such an acquisition, Retex will generate sales of 75 million with an ebitda of 7.5 million.

G Square Healthcare Private Equity acquired the majority of Ca’ Zampa, a veterinary services company (see here a previous post by BeBeez). G Square subscribed a capital increase of the company whose shareholders are the Passera Family, the Doris Family and MC Partners. The families will keep a minority while Giovanna Salza, the company’s founder, will remain in charge as ceo

French Sinext, an asset of Cerea Partners, acquired 75% of Dima, a provider of industrial machinery for the dairy production, from the Aldrovandi Family who will keep 25% of the firm and their management (see here a previous post by BeBeez). Dima has sales of 6 million euros, an ebitda of 0.834 million and net financial cash of 3.4 million. Cerea belongs to French food giant Unigrains whose shareholders are AGPB, AGPM, Crédit Agricole, Natixis, Bnp Paribas, and SocGen.

Wealth For Health (W4H), an Italian search fund for the health care sector, acquired OPT, a developer of added value projects for pharmaceutical companies and hospitals (See here a previous post by BeBeez). Oreste Pitocchi, the founder of OPT acquired a minority of W4H and kept his chairman role. Davide Lucano will be the new ceo. Mediocredito Trentino Alto Adige financed the transaction. Giacomo Andreoli, Giuliano Rizzi, Dario De Sanctis, and High Net Worth Individuals launched W4H.

Brevi Milano, an Italian producer of items for children in receivership that since 2018 belongs to Spanish investor in special situation businesses Phi Industrial, bankrupted (see here a previous post by BeBeez). Phi poured 2.5 million euros in Brevi.

Circet, a French company that belongs to Intermediate Capital Group (ICG), acquired Ceit, an Italian company for the TMT, transport and energy infrastructures (see here a previous post by BeBeez). Ceit has sales of 292 million euros with an ebitda of 31 million.

Mandarin Capital Partners (MCP) acquired 70% of Croci, an Italian manufacturer of pets products, from the founder and ceo Dario Croci who will keep minority (see here a previous post by BeBeez). Croci has sales of 50 million euros (35% abroad). The company may carry on acquisitions.

Entangled Capital and Capital Dynamics acquired a controlling stake in Crestani, a producer of vials for the pharmaceutical and cosmetic sector that belongs to the eponymous Family (see here a previous post by BeBeez). The funds will add the target to SM Pack, a company that acquired in 2020 with a turnover of 17.6 million, an ebitda of 1.18 million and a net financial debt of 4.8 million. Banco Azzoaglio financed the buyers.

Robert Lewis and John Aiello of JRL Investment Partners and other entrepreneurs from Usa acquired a 60% of Italian football club Cesena FC from Holding Cfc, a vehicle of Michele Manuzzi and Augusto Patrignani, who will keep a 40% of the asset (see here a previous post by BeBeez).

The Italian Sea Group, a Milan-listed producer of luxury boats and yachts, acquired bankrupted Perini Navi for 80 million euros (see here a previous post by BeBeez). In 2019, Perini generated sales of 55 millions, an ebitda of minus 25 millions, losses of 35-40 millions, with debts of 100 millions.

Dealz launched M&A Dealz, a platform for the Italian SMEs with revenues of at least one million euros (See here a previous post by BeBeez). Giuseppe Fumagalli founded Deals in January 2021 together with Cristiano Benazzi and Paolo Muoio.