There are several Italians in the ranks of the US giant of alternative investments KKR, at the center of the economic-financial debate these days, after the expression of interest in acquiring 100% of the Milan-listed telecommunications TIM group (see here a previous article by BeBeez).

In KKR for 20 years, after a three-year experience in investment banking at Goldman Sachs, today KKR’s partner and co-head of European Private Equity is the Italian Mattia Caprioli, who therefore leads from London not only the Italian private equity activities of KKR, but precisely, together with his colleague Philipp Freise, the entire European private equity business and sits in the relevant European investment committee and portfolio management committee.

Mr. Caprioli has worked across the board on deals in the most varied sectors, from industrial to consumer goods to healthcare and services and has helped to close some of the largest European deals, such as those in Walgreens Boots Alliance and Legrand.

Technically, however, the TIM affaire is a deal managed at level of the KKR Global Infrastructure platform and in fact the manager who is holding the ranks of the deal for the US investment group is in the first instance Alberto Signori, managing director, who joined KKR in 2018 with responsibility for the deals in the infrastructure sector in Europe, the Middle East and Africa. Mr. Signori hails from Infracapital, the infrastructure investment arm of M&G, and before that he spent 10 years in the investment banking divisions of UBS and Dresdner Kleinwort (now Commerzbank) dealing with m&a, structured finance and infrastructure.

In fact, Mr. Signori was the one who was involved in the deal on FiberCop concluded last April by KKR with TIM and Fastweb, which led the infrastructure fund to buy from TIM, for 1.8 billion euros, a 37.5% stake of FiberCop, the new company resulting from the merger between TIM’s secondary network (from the closet in the street to the customers’ homes) and the fiber network developed by FlashFiber, in turn a TIM (80%) and Fastweb (20%) joint-venture. At the same time Fastweb, in exchange for 4.5% of FiberCop, had contributed 20% of FlashFiber, which was then incorporated into FiberCop (see here a previous article by BeBeez). A deal that was evidently prodromal to the one now proposed for the entire TIM group, which, at the price currently offered of 50.5 cents per share, is worth the monstrous figure of over 33 billion euros in enterprise value.

All the above without forgetting that KKR’s senior advisor for investment activities at a global level in the technology, media and telecommunications sectors since September 2019 is another Italian or Diego Piacentini (see here a previous article by BeBeez). Mr. Piacentini, moreover, since last September has also been appointed advisor of Milan-listed Exor (the investment holding of the Agnelli family) and chairman of Exor Seeds (see here a previous article by BeBeez). The manager has over 30 years of experience in the technology sector. He worked for over 10 years at Apple Europe, in Paris, then for 16 years at Amazon in Seattle as senior vice president of International Consumer Business, where he reported to company founder Jeff Bezos and followed the launch and growth of the e -commerce in Europe, Japan, China and India. In 2016 he was appointed extraordinary Commissioner of the Renzi government for the implementation of the digital agenda, a role he held until 2018.

Meanwhile, KKR’s infrastructure platform globally is grinding into more billion-dollar investments. Also last April and again on the subject of the fiber tlc network, at the same time as the FiberCop deal, KKR together with another infrastructural investor, DTCP, announced an investment of 700 million euros in Open Dutch Fiber and a strategic agreement with T-Mobile Netherlands (see the press release here). While a few days ago the announcement of the acquisition of CyrusOne, a REIT that invests in data centers on a global scale, valued at 15 billion dollars. The operation will be conducted by KKR in tandem with another infrastructure giant, Global Infrastructure Partners (see here a previous article by BeBeez). But that’s not all, because there is already another mega-deal still in sight in the datacenter sector, the one on the London-based group Global Switch Holdings, which in turn manages thirteen main datacenters connectivity hubs in Europe and Asia- Pacific and which is valued at around 8 billion pounds (11 billion dollars, see Bloomberg here). In fact, KKR is one of the parties in the running for the group today controlled by the Chinese steel producer Jiangsu Shagang Group and participated by the Chinese fund Avic Trust. Also competing for Global Switch are infrastructure investment platforms from Blackstone, DigitalBridge, Digital Realty Trust and Equinix.

As of September 30, KKR’s global infrastructure platform was managing over 40 billion dollars in assets, which is just under 10% of the total 460 billions in assets managed by the entire KKR Group at the same date. A figure up by over 30 billions in just three months, given that at the end of June the assets under management were “only” 429 billions, of which 234 billions invested in listed securities and the other 195 billions in unlisted assets. All this is then distributed between private equity, credit, infrastructure and real estate.

On the other hand, KKR continues to raise funds of enormous size. For example, in May it raised about 18.5 billion dollars in less than 5 months for its latest North American buyout fund, the KKR North America Fund XIII (see here a previous article by BeBeez). Among the latest investment strategies launched by KKR there is also that of impact private equity, which has already included an Italian target in the portfolio. Last year, in fact, the KKR Global Impact Fund, had acquired 70% of CMC Machinery, the main producer of automated packaging solutions in Italy, with 30% remaining in the hands of the Ponti family (see here a previous article by BeBeez). Last October, the Climate Pledge Fund, an Amazon investment vehicle that invests in companies engaged in the development of sustainable technologies and decarbonisation processes (see here a previous article by BeBeez), also entered the company’s capital. raised last February at 1.3 billion dollars, of which 130 million invested from the budget of KKR itself.

Yes, because in turn KKR and its managers are large investors: of the total of 429 billions under management at the end of June, 31 billions were those who had been engaged in KKR vehicles by the same parent company KKR and by the current or previous management team. The managers, for their part, participate as usual in this sector in the earnings of the operations on which they work (carried interest) and this is precisely the richest part of their remuneration. It is no coincidence that the historical founders of KKR are among the richest men in the United States, as are their fellow founders of the big buyout houses. The difference from once upon a time is that today some of the investment vehicles and some of the management companies are listed, with the major international asset managers becoming shareholders, but with the founders still holding significant stakes resulting in to rich dividends.

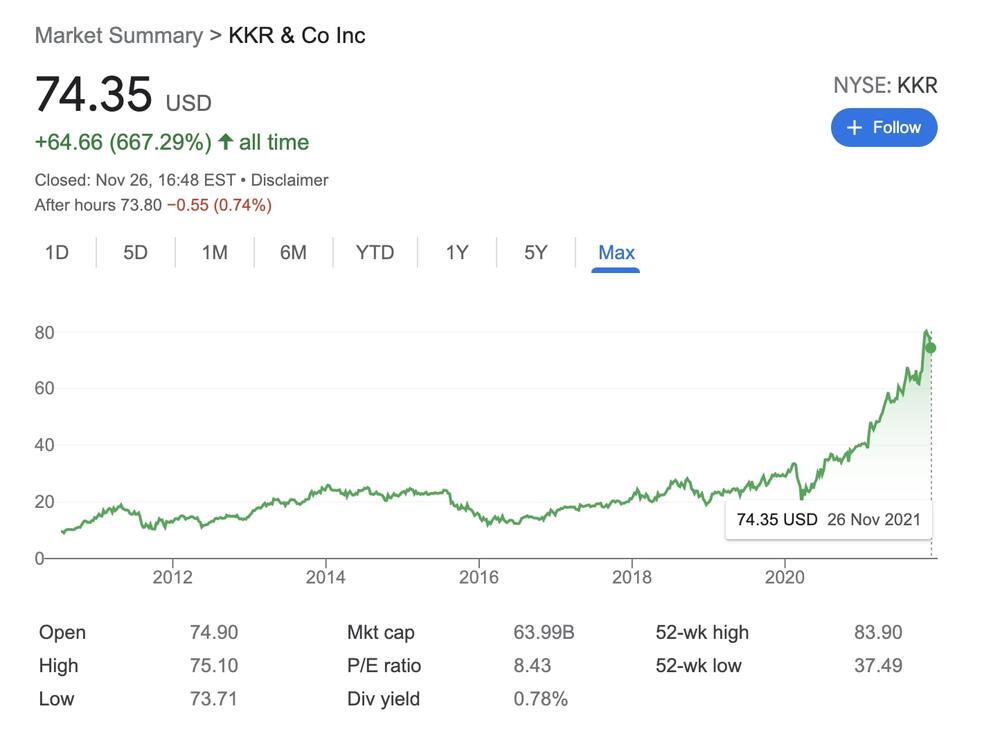

KKR & Co Inc has been listed in New York since 2010 and, after ten years of prices below 30 dollars per share, has seen the stock make an incredible leap, going from a minimum below 23 dollars at the beginning of 2020 to the current 75 dollars, equal to a market capitalization of approximately 64 billions, including preferred shares.

Last October Henry Kravis and George Roberts, the two historic founders of KKR, left the operational leadership of the US private equity giant, with Joe Bae and Scott Nuttall being appointed co-CEOs, while Mr. Kravis and Mr. Roberts retain their role as executive co-chairs of the board (see here a previous article by BeBeez). The two managers founded KKR in 1976 together with Jerome Kohlberg (KKR is the acronym for Kohlberg, Kravis & Roberts), all former managers of the then Bear Sterns, a well-known merchant bank at the time. Eleven years later, in 1987, Kohlberg left the group at odds with his partners and founded the private equity firm Kohlberg & Co. Forbes estimates that Roberts, Roberts, now 78, has amassed a fortune of 9.1 billion dollars, followed by Kravis, 77, with 8.6 billions. But even the two new co-CEOs are already billionaires in dollars: Nattal would have a personal fortune of 1.2 billions, followed closely by Bae with 1.1 billion.

KKR and especially Mr. Kravis and Mr. Roberts ended up in the spotlight of the international media for what has always been remembered as the mother of all takeover bids, so much so that two Wall Street Journal journalists then published a book that has become a classic of financial literature, titled Barbarians at the Gate (buy the book here on Amazon from the BeBeez Bookstore section) and which consisted of the collection of the series of articles on the history of the buyout of RJR Nabisco, a North American conglomerate with activities in the tobacco and food sector, then listed at Wall Street. The story began in the late 1980s with the idea of F. Ross Johnson, then ceo of RJR Nabisco, to organize a management buyout financed by Shearson Lehman Hutton, a well-known merchant bank at the time. The investment banking division was spun off from that bank in 1994, renamed none other than Lehman Brothers.

Well, that manager, F. Ross Johnson, had been too optimistic. In fact, Henry Kravis and his cousin George R. Roberts had the same idea about RJR Nabisco for their investment veichle KKR which by that time had already become a big player in the sector. After a series of takeover bids and counter takeover bids, KKR got the better of Ross Johnson and Shearson Lehman Hutton. RJR Nabisco thus ended up in KKR’s portfolio for 25.1 billion dollars in 1988, thanks to a takeover bid at as much as 109 dollars per share, compared to the 55 dollars at which the stock was quoted before the financial battle began a few months earlier. This is a staggering figure not only for those times, but also by today’s standards. To understand it, the buyout of US First Data in 2007, again by KKR, had been for 25.7 billion dollars and the one of the electricity group TXU Energy, also in 2007 by KKR and TPG, was 32, 8 billions.

In any case, back to RJR Nabisco, even KKR hadn’t put the 25.1 billion dollars on the plate alone. On the contrary. The fund had been financed by the Coca-Cola pension fund, the Georgia-Pacific pension fund, United Technologies, the foundations of MIT and Harvard universities, and the New York State Common Retirement Fund. All according to a scheme that the founders of KKR, including Kholberg, had personally experienced on a smaller scale when they were still working for Bear Sterns. And that ended up in a story that was covered by all the newspapers of the time (see here the New York Times), when in 1964 Orkin Exterminating Company, by the standards of the time a large company, listed at Wall Street and specialized in pest control services, was the object of a takeover bid launched by the small Rollins Broadcasting. The latter paid Orkin 62.4 million dollars, but with the advisory of Bear Sterns it had a good 60 million financed, thus putting only 2.4 million dollars of equity on the plate. Many identify the Orkin acquisition as the first leveraged buyout in history.