US private equity giant KKR presented to Italy’s tlc Milan-listed TIM‘s Board of Directors a “non-binding and indicative” expression of interest to launch a takeover bid on 100% of the group’s ordinary and savings shares, with the aim of delisting it from the Italian Stock Exchange, at the indicative price of 50.5 cents per ordinary or saving share, to be paid entirely in cash, for a total price, therefore, of approximately 11 billion euros (see the press release here).

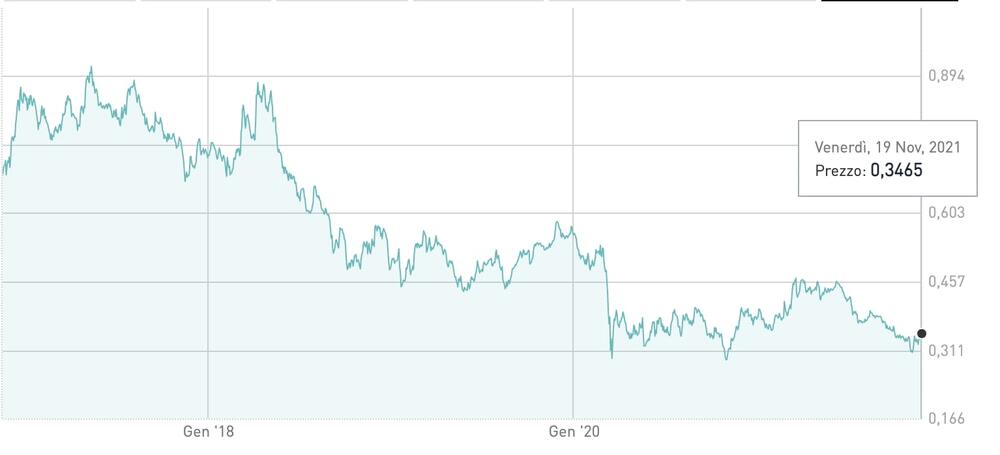

We recall that the market in the last six months has punished the stock with a drop of 21%, and that, at the prices of 0.3465 euros per share on Friday 19 November, TIM capitalizes on approximately 5.2 billion euros (approximately 7.37 billions including savings shares).

The takeover bid would be subject to the condition that the minimum subscription threshold of 51% of the share capital of both categories of shares is reached and is also subject to the performance of a confirmatory due diligence with an estimated duration of four weeks, as well as to the approval by the relevant institutional subjects, in particular the Italian Government. The expression of interest was qualified by KKR as “friendly” and aims to obtain the approval of the directors of the company and the support of management. The proposal was discussed yesterday by the Board of Directors convened in an extraordinary session by the chairman Salvatore Rossi.

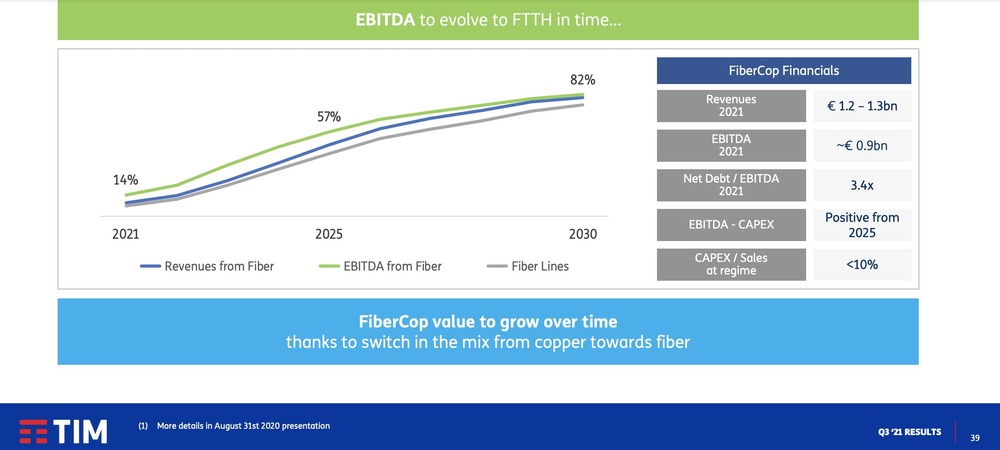

The announcement comes after rumors that have been chasing each other since the beginning of the month on the possibility that KKR will increase its stake in FiberCop, the new company into which were transferred TIM’s secondary tlc network (from the closet in the street to the customers’ homes) and the network in fiber developed by FlashFiber, the joint venture of TIM (80%) and Fastweb (20%). The rumors, in fact, had not stopped there and talks were the private equity giant was actually thinking of launching a takeover bid on the telephone group listed on Piazza Affari.

In reality, the name of KKR was not the only one to circulate in relation to the TIM dossier. There were also talks about an interest from the Swedish fund EQT, from Advent International and from CVC Capital Partners. “Advent and CVC say they are open to dialogue with all stakeholders in order to transparently identify a system solution for the industrial strengthening of TIM”, a spokesman for the funds told infact ANSA yesterday, who at the same time denied that there had been contacts with the French group Vivendi, a 23.75% shareholder of TIM, which has no intention of leaving room for KKR. In fact, rumors had spread that Vivendi had enlisted CVC to create a counter-string in response to KKR’s advances, but in reality, yesterday Vivendi also denied the rumors (see ANSA here), although the French group nevertheless expressed opposition to KKR’s offer. during the meeting of the Board of Directors, because it considers it hostile and urged by the ceo Luigi Gubitosi, with whom the French shareholders currently have rather tense relations.

The intervention of KKR is to be seen in the framework of a particularly delicate moment for the Italian telecommunications group, after quarterly accounts below expectations, which showed revenues down by 2.1% to 3.826 billion euros in the quarter from 3.918 billion in the third quarter 2020 and an ebitda down 5.9% to 1.669 billions from 1.773 billions, data which brought total revenues for the 9 months to 11.4 billions (from 11.449 billions in the nine months of 2020) and the ebitda to 4.886 billions (from 5.112 billions), albeit against a decline in adjusted net financial debt to 22.164 billions from 25.469 billions (see the press release here).

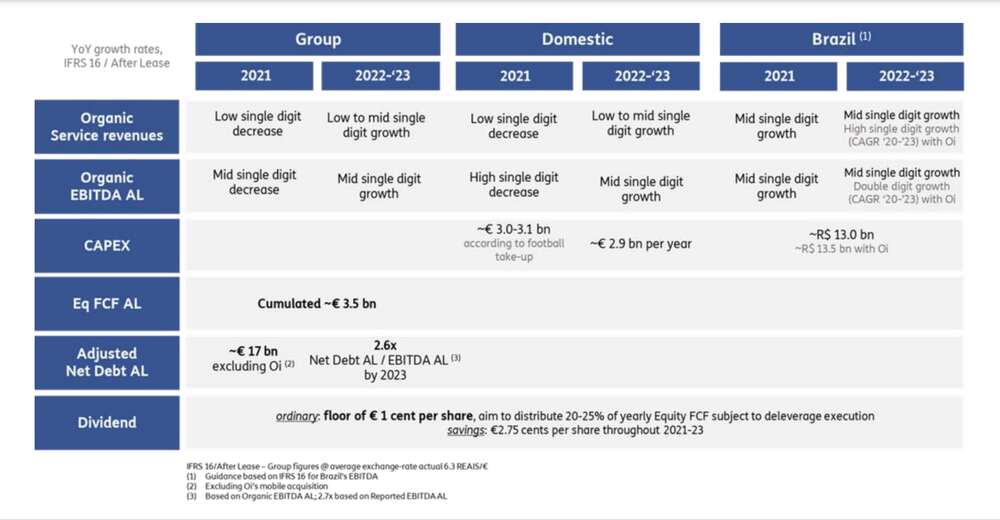

A situation that led the group to announce a new profit warning: the guidance for the current year, in fact, has been reduced in the sense that the group expects a decrease in “low single digit” revenues for 2021 (i.e. it will decrease by a percentage between 0% and 4%) and for the “mid single digit” ebitda (i.e. it will decrease by a percentage between 4% and 6%) and then review the growth of both values in the two-year period 2022-23 . But already in July the group had updated its ebitda estimates for the year downwards: ebitda was previously expected with a “stable to low single digit growth” (see the press release here).

Above all, the declining performance of the domestic market weighs heavily, but also the failure to take off in terms of revenues of the new “Beyond connectivity” strategy that focuses on activities outside the core business of connectivity such as Cloud (Noovle) and Serie A streaming with DAZN (Timvision). But above all on the latter front the results are still minimal compared to the objectives.

Results that disappointed the French partner Vivendi, so much so that in the past few weeks he has been moving towards a change of top management and in particular, therefore, ceo Luigi Gubitosi.

The game is obviously very complicated and has significant system implications. And for this it is evident that the position of the Italian Government and the exercise or not of its golden power will be crucial. At the moment the Government is at the window, but with a positive attitude. In fact, a press note released yesterday states that “the Government takes note of the interest in TIM shown by qualified institutional investors. The interest of these investors in making investments in important Italian companies is positive news for the country. If this were to to materialize, the market will first assess the solidity of the project. TIM is the largest telephony operator in the country. It is also the company that holds the most significant part of the telecommunications infrastructure. The Government will closely monitor the developments of the expression of interest and will carefully evaluate, also with regard to the exercise of its prerogatives, the projects that affect the infrastructure. The Government’s objective is to ensure that these projects are compatible with the rapid completion of the ultra-broadband connection, as envisaged in the National Recovery and Resilience Plan, with the necessary investments in development infrastructure, and with the preservation and growth of employment. In this perspective, it was considered that the various aspects of the affair were followed by a Working Group made up of government representatives holding the institutional skills mainly involved, as well as administrations and experts”.

To better understand everything, we remind you that another important shareholder of TIM, with 9.8% of the capital, is the National Promotional Institution Cassa Depositi e Prestiti, which will soon also be a shareholder of the FTTH (Fiber To The Home) network operator OpenFiber at 60%. Last August, in fact, Milan-liste energy giant Enel signed the contract for the sale of 50% Open Fiber to Cdp Equity (a company of the Cdp Group, which already owns the 50%) and Macquarie Asset Management, with Cdp Equity acquiring 10% and Macquarie 40 % (see here a previous article by BeBeez).

Last April, however, TIM, KKR Infrastructure and Fastweb had signed the closing of the transaction with which KKR Infrastructure and Fastweb entered the capital of FiberCop (see here a previous article by BeBeez). KKR Infrastructure bought 37.5% of FiberCop from TIM for a value of 1.8 billion euros, based on an enterprise value of approximately 7.7 billions, while Fastweb subscribed FiberCop shares corresponding to 4.5% of the capital of the company, through the contribution of 20% of FlashFiber, which was simultaneously incorporated into FiberCop. TIM therefore today owns 58% of FiberCop.

Last April, however, TIM, KKR Infrastructure and Fastweb had signed the closing of the transaction with which KKR Infrastructure and Fastweb entered the capital of FiberCop (see here a previous article by BeBeez). KKR Infrastructure bought 37.5% of FiberCop from TIM for a value of 1.8 billion euros, based on an enterprise value of approximately 7.7 billions, while Fastweb subscribed FiberCop shares corresponding to 4.5% of the capital of the company, through the contribution of 20% of FlashFiber, which was simultaneously incorporated into FiberCop. TIM therefore today owns 58% of FiberCop.

The ultimate goal of the two operations OpenFiber and FiberCop is to establish a single company in the national network, necessary for the development of digital in Italy, which will necessarily involve OpenFiber (see here a previous article by BeBeez). The boards of directors of TIM and Cassa Depositi e Prestiti in August 2020 approved a letter of intent between TIM and Cdp Equity aimed at integrating FiberCop with OpenFiber to give life to AccessCo, a company also open to other investors and destined to manage the single national network. AccessCo will be established through the merger between FiberCop and Open Fiber (see here a previous article by BeBeez).

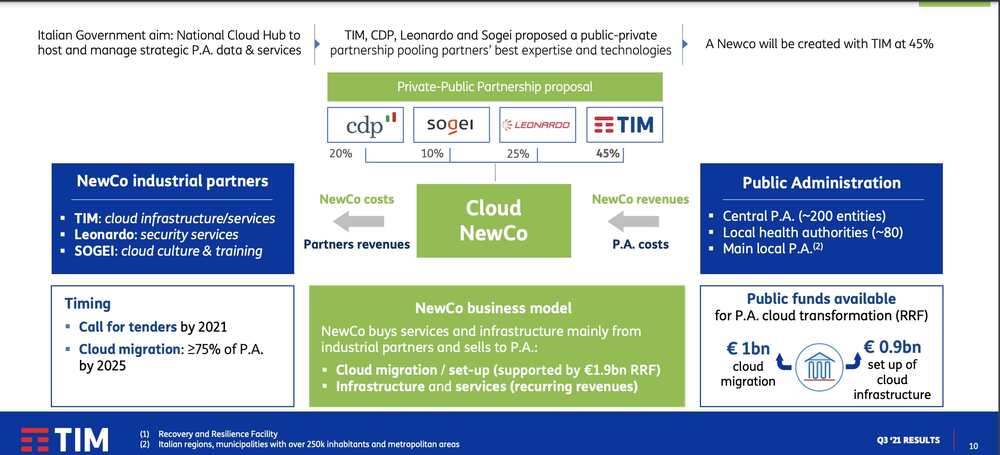

All this, then, while the game is also open for Cloud Italy, that is for the creation of the National Strategic Pole (PSN), an infrastructure for the cloud management of data and applications of the Public Administration (PA), which is part of the scope of the overall plan to accelerate the digital transformation to guarantee the security and national control of data desired by the Presidency of the Council of Ministers. The infrastructure will be managed by an economic operator selected through the launch of a public-private partnership on the initiative of a proponent. The evaluation of the partnership proposals will be concluded within 90 days from the date of receipt of the first proposal received and therefore next December 28th. To date, three consortiums are racing: TIM-CDP-Sogei-Leonardo, the combination Almaviva-Aruba and the duo Engineering Ingegneria Informatica-Fastweb.

All this, then, while the game is also open for Cloud Italy, that is for the creation of the National Strategic Pole (PSN), an infrastructure for the cloud management of data and applications of the Public Administration (PA), which is part of the scope of the overall plan to accelerate the digital transformation to guarantee the security and national control of data desired by the Presidency of the Council of Ministers. The infrastructure will be managed by an economic operator selected through the launch of a public-private partnership on the initiative of a proponent. The evaluation of the partnership proposals will be concluded within 90 days from the date of receipt of the first proposal received and therefore next December 28th. To date, three consortiums are racing: TIM-CDP-Sogei-Leonardo, the combination Almaviva-Aruba and the duo Engineering Ingegneria Informatica-Fastweb.

The announcement of KKR’s move on TIM comes a few days after the signing of the agreement with Investindustrial for the purchase of GeneraLife, one of the main players in fertility clinics in Europe, based in Spain but with an all-Italian scientific direction (see here a previous article by BeBeez).

Last year, however, again in Italy, KKR, through its KKR Global Impact Fund, had acquired 70% of CMC Machinery, the main producer of automated packaging solutions in Italy, with 30% remaining in the hands of the Ponti family (see here a previous article by BeBeez). Last October, the Climate Pledge Fund, an Amazon investment vehicle that invests in companies engaged in the development of sustainable technologies and decarbonisation processes, also entered the company’s capital (see here a previous article by BeBeez).

Among KKR’s latest large international operations, however, we recall the one announced a few days ago together with Global Infrastructure Partners and that is the acquisition of CyrusOne, a REIT that invests in data centers on a global scale for a total of 15 billion dollars (see here a previous article by BeBeez). Last October, NYSE-listed Coty cosmetics group sold another 9% of Wella to KKR, thus dropping its stake to 30.6% (see here a previous article by BeBeez). Recall that in December 2020 Coty had conducted the carve-out of its hair and nail care activities, and therefore essentially of the brands Wella, Clairol, OPI and ghd, which have become a separate company (precisely Wella) of the which KKR had bought a 60% stake for 2.5 billion dollars and Coty had kept 40% (see here a previous article by BeBeez).

As of the end of June, KKR had 429 billion dollars in assets under management. By May, it raised about 18.5 billions in less than 5 months for its latest North American buyout fund, the KKR North America Fund XIII (see here a previous article by BeBeez). Last October Henry Kravis and George Roberts, the two historic founders of KKR, left the operational leadership of the US private equity giant, with Joe Bae and Scott Nuttall being appointed co-CEOs, while Kravis and Roberts retain their role as executive co-chairs of the board (see here a previous article by BeBeez). The two managers founded KKR in 1976 together with Jerome Kohlberg (KKR is the acronym for Kohlberg, Kravis & Roberts), all former managers of the then Bear Sterns, a well-known merchant bank at the time. Eleven years later, in 1987, Kohlberg left the group at odds with his partners and founded the private equity firm Kohlberg & Co.