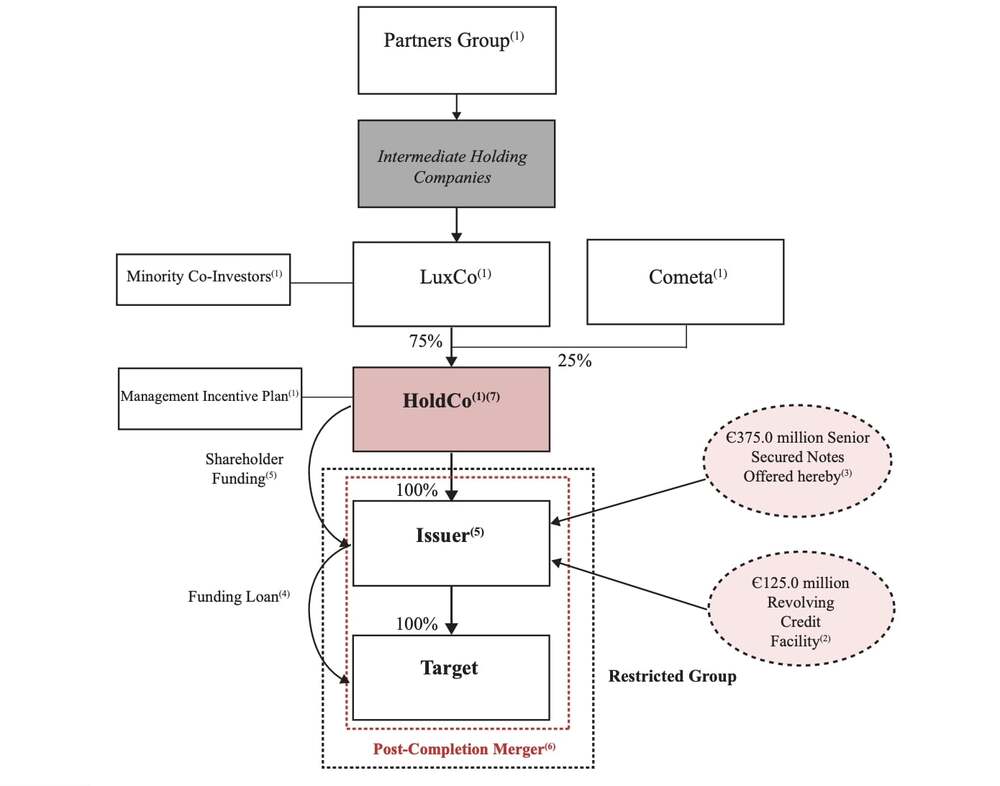

The acquisition of Eolo is a transaction worth 1.3 billion euros (see here a previous post by BeBeez). Partners Group acquired the asset and issued a London-listed senior secured bond of 375 million with a coupon of 4.875% and due to mature on 21 October 2028. The issuance received from FitchRatings a B+ rating, while the company received a B. Moody’s gave the company a B3 rating and a B2 to the issuance. Partners Group paid 1.125 billion for acquiring the asset, 119.1 million for repaying the company’s debt at the closing, 14 millions in transaction costs, 40 millions in cash for supporting the target’s working capital. The company received a 6.5-year super senior revolving credit facility of 125 millions from Unicredit and other lenders. Eolo has sales of 187 million and an ebitda of 95 million.

Italian football club Inter is not for sale, chairman Steven Zhang said (see here a previous post by BeBeez). Earlier in May, Chinese conglomerate Suning, the major shareholder of the team, received a three-year loan of 275 million from Oaktree. Suning already converted the facility in equity for 75 millions and in total had converted 132 millions of shareholders loan into equity sice Suning is a shareholder.

Focus Investments, an investor in real estate distressed assets that was born from a spin-off from Prelios, signed a debt restructuring agreement with Banco BPM, MPS and AMCO (see here a previous post by BeBeez) while in the last few months Prelios’ major shareholder, Davidson Kempner Capital Management, had bought distressed credits from IntesaSanpaolo, UniCredit, Banca Popolare di Sondrio e BPER who sold them to securitization veichle Borromini SPV srl.

Walter Maiocchi could carry on a white knight deal for Italian troubled Grotto, the owner of the fashion brand GAS (see here a previous post by BeBeez). On 16 September, Thursday, the company’s creditors did not accept the receivership proposal. In 2018, Maiocchi acquired troubled Italian fashion firm Malo. Before tabling a bid, the entrepreneur wants to have a clear idea of the financials of Grotto and replace the eponymous family. Dea Capital Alternative has 51% of Grotto’s debt or 34.5 million euros. Maiocchi previously offered 10 million for Grotto in 2019.

Generalfinance, a factoring firm for distressed companies, issued a 7.5 million euros subordinated Tier 2 five-years bond (see here a previous post by BeBeez). The bond pays a coupon with a floating rate of 3M Euribor with a spread of 800 basis points. Such an issuance is part of a three-year Euro Commercial Paper Programme of 100 million. In 1H21 Generalfinance generated a turnover of 545 million and issued facilities of 432 million. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Macha, a chain of fast-casual and healthy food restaurants, received from illimity a 5-year loan of 4 million euros (see here a previous post by BeBeez). Macha will invest these resources in the opening of new shops. Tunde Pecsvari and Antonio Scognamiglio founded the company in 2016.

Lavoropiù, an Italian staffing agency, issued a minibond of 5 million euros maturing in 2028 that is part of the programme Intesa Sanpaolo Basket Bond (see here a previous post by BeBeez). Intesa Sanpaolo will subscribe the issuance. Lavoropiù belongs to the founder and chairman Tomaso Freddi (37.1%), Enrico Fini (29.48%), Piero Mani (15.53%), Enrico Fini (7.61%), and Erredue (4.9%). The company has sales of 122 million, an ebitda of 4.9 million and a net financial debt of 0.44 million. Daniele Ottavi, the ceo of Lavoropiù, said that the company would invest such proceeds in ints organic development and international expansion. Milan-listed firms Gruppo EdiliziAcrobatica, a Milan-listed construction company; Iervolino Entertainment, a content producer for tv and cinema; Triboo, a digital marketing firm; and Ambienthesis, a waste management and land reclamation business had previously joined the basket bond programme. The unlisted SMEs Vitillo, a manufacturer of industrial components; Fiorini Packaging; Valtellina, an Italian ICT company; Ledoga, a producer of vegetal tannin that is part of Silvateam; M-Cube, a marketing services provider that belongs to financial firm HLD Europe; Gruppo Illiria, Sigma, and Gruppo Cittadini dell’Ordine previously issued bonds as part of this basket.

Oslo-listed credit servicing firm Axactor acquired Italy’s competitor Credit Recovery Service (CR Service) from the founder Carmelo Chiofalo (see here a previous post by BeBeez). CR Service has a turnover of 6.2 million euros with an ebitda of 0.9 million. In 1H21, Axactor Italy generated a turnover of 14.3 million.

Italian proptech Reviva launched a Reeco (Real Estate External Company) that aims to close 10 acquisitions of real estate assets securing non performing loans by mid 2022 (see here a previous post by BeBeez).