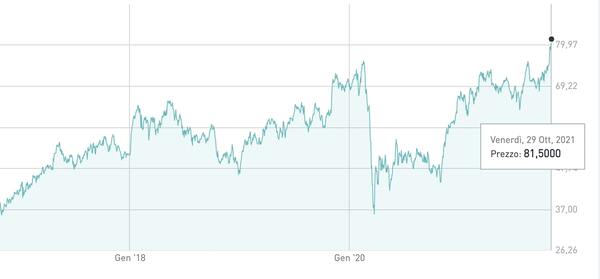

Exor stock reached an all-time high of 83.44 euros on Friday 29 October during the stock exchange session, and then closed at 81.50 euros with a +1.22%, following the announcement of the signing of the memorandum of understanding with France-based Covéa to buy the reinsurance company ParterRe for 9 billion dollars (7.7 billion euros) (see the press release here).

The transaction, which should see the signing of the binding contract by the end of the year and the final closing by mid-2022, is based on an equity value of PartnerRe of 7 billion dollars and concerns only the ordinary shares of the reinsurance company and not the preferred ones. listed on the NYSE.

The announcement comes after a first attempt to sell the insurance company in the Spring of 2020, again to Covéa. An operation that the French company had then canceled at the time, citing the worsening market situation that had occurred due to the pandemic after the signing of the memorandum of understanding at the beginning of March 2020 (see here the press release of the time).

After the deal ended in stalemate, Covea, in an attempt to resume relations with Exor, had agreed to invest 750 million dollars in SPVs managed by PartnerRe and to conduct other investments together with Exor for other 750 millions (see here the press release of that time). Now the current agreement foresees that Exor will buy back some of the SPV positions managed by PartnerRe from Covéa for approximately 725 million dollars. The SPVs will invest in property catastrophe reinsurance contracts (for the protection of properties from the risks of natural disasters) and in other so-called short-tail contracts (with quick repayment, such as fire policies) signed by PartnerRe. Covéa, Exor and PartnerRe will also continue to invest together in the funds managed by Exor.

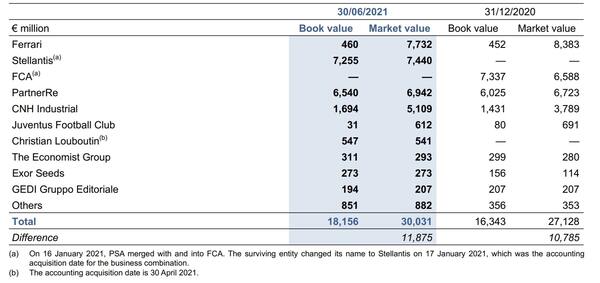

The consideration of 9 billion dollars, that is 7.7 billion euros, compares with the 6.54 billion euros of book value at the end of June 2021 (see here a previous article by BeBeez). The purchase price set in the previous memorandum of understanding with Covéa had also been set at 9 billion dollars (see the press release here at the time) and it was then specified that, taking into account the dividends paid in the meantime by the insurance company, Exor it would have brought home a cash return of 3 billion dollars. Now that figure is expected to rise to around 3.2 billions.

The consideration of 9 billion dollars, that is 7.7 billion euros, compares with the 6.54 billion euros of book value at the end of June 2021 (see here a previous article by BeBeez). The purchase price set in the previous memorandum of understanding with Covéa had also been set at 9 billion dollars (see the press release here at the time) and it was then specified that, taking into account the dividends paid in the meantime by the insurance company, Exor it would have brought home a cash return of 3 billion dollars. Now that figure is expected to rise to around 3.2 billions.

In fact, Exor had bought in 2016 all the PartnerRe ordinary shares, which were listed on the NYSE, for 6.1 billion dollars, after having bought a first package of ordinary shares equal to 9.9% of the capital in 2015, paying 609 millions. Exor also acquired the preferred stock for an additional 42.7 millions, leaving them listed on the NYSE, the opposite of the common stock that had been delisted (see the press release at the time).

According to Equita, a Milan-listed securities broker, once ParnterRe is sold, Exor will see its NAV rise by 5% to 125 euros per share, with the net financial position going from a net debt of 3.1 billion euros to net liquidity of over 4 billions, equal to 14% of the NAV, enabling the holding company to have great drypowder to be used in new investments and / or to pay an extraordinary dividend. Also according to Equita, Exor would thus reach a firepower of between 8 and 9 billion euros, considering the leverage.

Recall that this year Exor has invested heavily in scaleup tech, but that it also has in the fashion sector. As regards the first source, in the first half of the year Exor increased its investment in the capital of the subsidiary Exor Seeds by 122 million euros. In mid-October, it invested in TVS Supply Chain Solutions, a company that offers consulting and services for integrated logistics ranging from air transport to shipping, from trucks to last mile deliveries, part of the TVS group, an 8.5 billion dollar holding company. dollars in turnover. In fact, Exor led a capital increase of TVS Supply Chain Solution of 5.9 billion rupees, about 70 million euros. Exor was already close to the TVS group, having invested 3.9 billion rupees (about 43 million euros) last August in the startup MyTVS, an online platform that brings together after-sales services for cars. Also in the auto sector, last June Gedi, a publishing group indirectly controlled by Exor, last June acquired 78% of AutoXY, one of the first and main Italian search engines specialized in the automobile market, from Vertis Venture , the first venture capital fund managed by Vertis sgr dedicated to seed investments in Southern Italy. AutoXY CEO Boris Cito and cto Matteo Serafino retained 20% and 2% of the company, respectively.

We recall that Gedi is indirectly controlled by Exor at 89.62% following the takeover bid in Summer 2020 and is owned by Mercurio spa (with 5.19%) and by Cir (Compagnie Industriali Riunite, with 5.19 %). In September Exor participated in both the 50 million dollar round of Israeli IT scaleup Quantum Machines and the 118 million dollar round of newcleo, a startup with offices in Great Britain and Italy that aims to develop a new generation of nuclear reactors that will contribute to eliminate dependence on fossil fuels. Last May Exor and the Italian steel Marcegaglia group also participated in the 105 million dollar Series A round of the Swedish H2 Green Steel scaleup, which was also joined by a large group of international investors. Finally, in March Exor announced its investment in Archer Aviation, a Californian startup that produces electric vertical takeoff aircraft, alongside Spac Atlas Crest Investment Corp, Stellantis and other investors.

Apart from the tech sector, we remind you that last June the Agnelli family’s holding also signed a partnership with The World-Wide Investment Company Limited (WWICL), the oldest family office in Hong Kong, to invest together in medium-sized Italian companies of excellence of consumer goods that want to develop globally (see here a previous article by BeBeez). To do this, they set up the newco NUO spa, 50% owned by NUO Capital, an investment company headed by WWICL, and 50% by Exor, endowing it with a capital of 300 million euros.

As for the luxury sector, finally, we remind you that last March Exor announced the acquisition of 24% of the capital of the manufacturer of the iconic luxury shoes Christian Louboutin for 541 million euros. The sellers were the founders Christian Louboutin, Bruno Chamberlain, Henri Seydoux and Faheema Moosa. It was the second investment in the luxury sector for Exor in a few months, after the one announced in December 2020 in the Chinese fashion scaleup Shang Xia, alongside the founder Jiang Qiong Er and the French luxury giant Hermés, already present as an investor in the company. first hour (see the press release here).