ION Investment, the global technology provider of the financial sector, founded more than 20 years ago by the Italian entrepreneur Andrea Pignataro, supported by the Singapore GIC fund and the Italian FSI fund, led by Maurizio Tamagnini, has won the battle for Cerved, a leading Italian group active in the business information and credit management sectors and listed on the Italian Stock Exchange.

With a final step, yesterday the adhesions to the takeover bid launched by the vehicle Castor Bico spa actually reached 78.9% of the capital.

We remind you that Castor Bidco spa is owned 91% by ION Investment and the rest by GIC (6.32%) and other institutional investors. The FSI fund also has a 9% stake in ION’s acquisition vehicle used for buying Cedacri, the group specialized in the outsourcing of IT and back office services to banks of which the FSI fund owned 27.1% (see here a previous article by BeBeez). FSI has in fact reinvested in DGB Bidco Holdings Limited, the vehicle under Irish law with which ION had made the acquisition. And not only that. FSI also has an agreement with ION for which FSI undertakes to subscribe, against the payment of 150 million euros, a bond issued by Castor Bidco Holdings Limited, direct parent of Castor Bidco spa, redeemable or convertible into special category shares of the Castor Bidco Holdings itself.

Only on Wednesday evening Sept 8, the appeal still lacked more than half of the necessary subscriptions to reach the new minimum threshold of 66.67% of the capital, considered indispensable for the takeover bid to be valid (see here a previous article by BeBeez). But in fact, on the other hand, yesterday the adhesion of a large number of investors arrived, after a first large group of investors had already decided in this sense in recent days, following the last amendment to the takeover bid conditions announced in the race by Castor Bidco last Sept 3, Friday.

The takeover bid price had in fact been raised from 10.20 to 10.5 euros per share, but only in the event of subscriptions exceeding 90% of the offer, and at the same time the minimum subscription threshold was reduced to 66.67. %, in order to allow Castor Bidco to have sufficient voting rights to approve the resolutions pertaining to the extraordinary shareholders’ meeting, including any merger resolution functional to the delisting.

Since 90% has not been reached, the adherents of the takeover bid will therefore receive 10.2 euros per share. At that price, the equity value is 1.991 billion euros and, considering the net financial position of 560 millions, the enterprise value is 2.55 billions.

For the moment, therefore, Castor Bidco will pay out 1.57 billions. But the total account will amount to around 2 billion euros in the event that, following the merger, the remaining part of Cerved’s capital will make use of the right of withdrawal, permitted in the event that a merger results in the exit from the list.

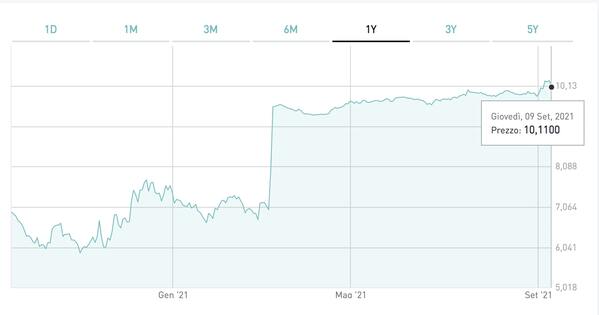

Meanwhile, yesterday the stock of the group specialized in business information and credit management in Piazza Affari closed down by 1.65% to 10.11 euros.

The offer, which started on July 16 and whose original deadline was set for August 5 (see here a previous article by BeBeez), had already been extended for the first time to August 31. Subsequently, on 29 August, the offer was extended again to today, with an additional first adjustment to the increase in the price, from 9.5 to 10.20 euros and an increase in the minimum subscription threshold from 50% + 1 share. 80% (see here a previous article by BeBeez). We recall that the new price was judged congruous but barely sufficient by the board of directors of Cerved (see here a previous article by BeBeez) which instead did not pronounce on the latest change to the takeover bid conditions.

Cerved thus becomes part of ION, a European group that closed 2020 with an ebitda of 1.4 billion dollars against a cash flow of 1.2 billions and over 2 billion dollars in revenues. Numbers that led to a group valuation of 35 billion dollars, of which 27 billion of equity value (see here a previous article by BeBeez) and to which we must now add those of Cedacri and Cerved, valued respectively 1.5 billions and 2.55 billions.

As for Cedacri, a new chapter of growth is now opening for Cerved, this time international. In particular, this evolution will concern both the business information activity, which is one of ION’s core businesses, and the credit management activity that ION did not operate up to now, for which the management of Cerved previously had launched a sale project (see here a previous article by BeBeez) and that ION will now keep within the group. According to BeBeez, the idea is to use the subsidiary Cerved Credit Management as a platform for international expansion and consolidation of the sector and then acquire, starting from Cerved, more targets in Europe active in the management of non-performing credit.

The story of Cedacri and now of Cerved repeats the one already experienced by two other champions of Italian tech that the same team of FSI long ago, when it was still working for Fondo Strategico Italiano (now Cdp Equity), has grown in its portfolio and which today have made the international leap: the former Metroweb, now OpenFiber, with Macquarie, arrived in relay at Enel; and Sia, destined to merge with Nexi and Nets.

In fact, we recall that the FSI team, when still working for Fondo Strategico Italiano, had invested in Metroweb in 2012, when it was worth 450 million euros and then made it grow and finally sold it in 2016 to Cdp and Enel who then merged into Open Fiber (see here a previous article by BeBeez) and to which an equity value of 5.3 billion euros was assigned, in the transaction that saw Macquarie buy 40% of the capital from Enel and Cdp acquired the remaining 10% stake still owned by Enel (see here a previous article by BeBeez). Again the FSI team when still working for Fondo Strategico Italiano, had invested in Sia in 2013 when it had 1500 employees (see here a previous article by BeBeez), while today it has 3500, it is about to merge with the Milan-listed paytech company Nexi (see here a previous article by BeBeez) which in turn has already merged with the Danish paytech Nets (see the press release here) and the group will become the largest pan-European paytech platform (see here a previous article by BeBeez).