Cerved‘s Board of Directors formally judged as formally fair but essentially just sufficient the new price offered by Castor Bidco as part of the takeover bid announced last March on the group specializing in business information and credit management (see here the press release).

Cerved‘s Board of Directors formally judged as formally fair but essentially just sufficient the new price offered by Castor Bidco as part of the takeover bid announced last March on the group specializing in business information and credit management (see here the press release).

In fact, we recall that on the morning of Friday 27 August Castor Bidco announced the upward revision of the price of the takeover bid from 9.50 to 10.20 euros per share (see here a previous article by BeBeez).

Castor Bidco is owned by ION Investment Group, Andrea Pignataro‘s investment holding company, and GIC, the Singapore sovereign fund, and is launching the takeover bid on Cerved with the financial support of the FSI fund (just become a 9% shareholder of ION after the sale of its stake in Cedacri to ION itself, see here a previous article by BeBeez).

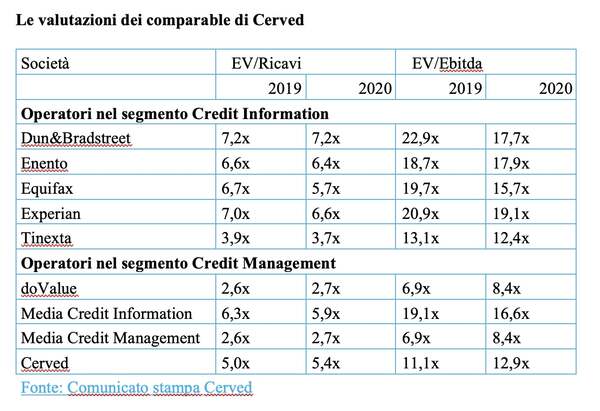

The new implicit enterprise value for Cerved rose to 11.1x and 12.9x, respectively on the 2019 and 2020 ebitda, but still remains well below the average of listed companies active in the credit information sector, equal to 19.1x and 16.6x the 2019 and 2020 ebitda, although well above the average of listed companies active in the credit management sector, equal to 6.9x and 8.4x the 2019 and 2020 ebitda.

The new implicit enterprise value for Cerved rose to 11.1x and 12.9x, respectively on the 2019 and 2020 ebitda, but still remains well below the average of listed companies active in the credit information sector, equal to 19.1x and 16.6x the 2019 and 2020 ebitda, although well above the average of listed companies active in the credit management sector, equal to 6.9x and 8.4x the 2019 and 2020 ebitda.

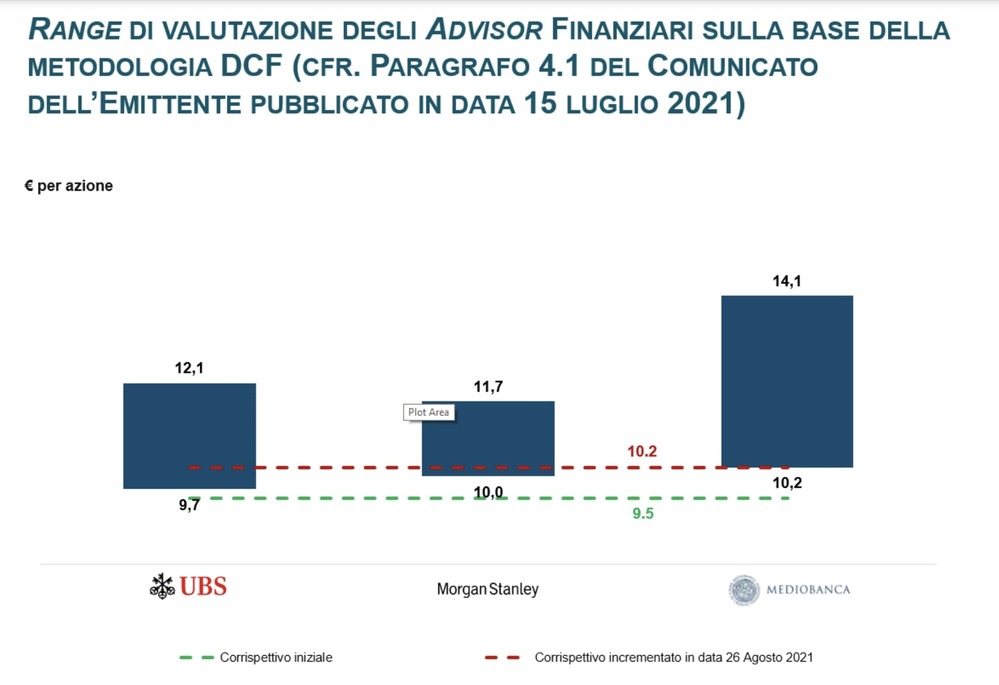

And Cerved’s BoD, chaired by Gianandrea De Bernardis, in its note yesterday stressed that the increased consideration falls within the ranges of congruity indicated by the advisors, “even if in the lower part of these ranges”, as shown by the picture in this page.

The assessments to which Cerved’s BoD refers are those issued by the financial advisors UBS, Morgan Stanley and Mediobanca last July, in view of the publication of the first press release of the Board with which the BoD had sent back the initial offer from ION to the sender both for the too low price and because that price precluded the shareholders “from accessing the expected benefits from the possible sale of Cerved Credit Management Group srl“, not reflected in the amount of the consideration (see here a previous article by BeBeez).

For UBS, in particular, the fair value per share should be between 9.7 and 12.1 euros; for Morgan Stanley between 10 and 11.7 euros; and for Mediobanca between 10.2 and 14.1 euros. The price of 10.2 euros, therefore, is the highest among the minimums in all the ranges proposed by the advisors.

We remind you that the increased consideration of the takeover bid incorporates a premium equal to 44.9% compared to the official price of the shares as of March 5, 2021, the trading day prior to March 8, 2021, the date of announcement of the offer; and 53.6% compared to the weighted arithmetic average of the official prices recorded by the shares in the 12 months prior to the announcement of the takeover bid. In the event that all the shares are tendered, the maximum outlay for Castor Bidco will be just under 2 billion euros.

Yesterday in Piazza Affari the Cerved stock closed practically unchanged at 9.96 euros against 9.95 of last Friday. Subscriptions remain very low: the total did not exceed 1,82% of the shares involved at the end of yesterday’s trading day, 10 days before the new term of the takeover bid, which was postponed to 9 September to coincide with the price increase.

Finally, a point of controversy in the press release of the Board of Directors regarding the increase to 80% of the minimum threshold for joining the takeover bid from the previous 50% plus one share, decided by Castor Bidco again at the end of last week in conjunction with the relaunch on the price.

The BoD, writes the note, “acknowledges that, according to the bidder’s statement in the relaunch press release, ‘an equity investment equal to 80% of the Cerved Group share capital allows the bidder to have sufficient voting rights to approve the resolutions pertaining to the ordinary shareholders’ meeting of the issuer including the resolution on the merger as well as to limit the dilutive effect of said merger for the offeror, limiting the participation weight of any minority shareholders’. In this regard, the Board of Directors refers to the considerations expressed in the issuer’s press release in paragraph 3.1. regarding the possible merger following the possible success of the offer, noting that even the ownership of an investment equal to 80% of the share capital of Cerved Group does not in itself appear sufficient to assure the bidder that the aforementioned merger will be carried out “.