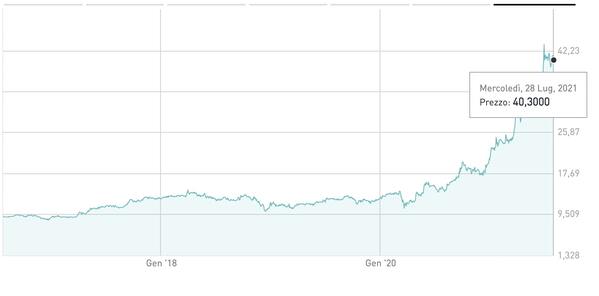

Milan-listed Italian Wine Brands (IWB) closed the acquisition of Enoitalia on the ground of an enterprise value of 150.5 million euros (see here a previous post by BeBeez). The Pizzolo Family, the vendors, reinvested in the group, subscribing a capital increase of IWB for a 15.91% stake. The companies will generate an aggregate turnover of 405.1 million and an ebitda of 42.7 millions and are giving birth to the first private wine Italian group for dimensions. IWB’s market capitalization amounts to 359 million. IWB was listed on the Italian Stock Exchange in 2015 after a merger between Provinco Italia and Giordano Vini and cash support coming from a convertible bond issued by a pre-booking company (IPO Challenger) structured by Electa Ventures.

NB Renaissance, part of Neuberger Berman, acquired more than 95% of Sicit, an Italian producer of fertilizers, after closing of the tender offer on the Italian Stock Exchange (see here a previous post by BeBeez). NB can now squeeze out all the remaining share of Sicit at 16.80 euros each and delist the company.

Andrea Bonomi, the founder of pan European private equity Investindustrial, said to Stefania Peveraro, the Editor in Chief of BeBeez, in an interview for MF Milano Finanza that in the last 12 months the fund invested 1.5 billion euros and sold portfolio companies for 1.9 billion (see here a previous post by BeBeez). Investindustrial recently listed on NYSE Ermenegildo Zegna, an iconic Italian fashion firm, through a business combination with its Spac Investindustrial Acquisition Corp. Investindustrial is one of the investors that BeBeez Private Data, the Database that BeBeez developed with FSI, monitors (find out how to subscribe for only 110 euros a month)

BF, a Milan-listed investment holding that owns Bonifiche Ferraresi, will act as cornerstone investor of Fondo Italiano Agritech & Food (FIAF), part of Fondo Italiano d’Investimento (see here a previous post by BeBeez). BF will pour 120 million euros in FIAF. BF belongs to Fondazione Cariplo (23.632%), Cdp Equity (18.915%), Sergio Dompé (14.07%), and to the ceo Federico Vecchioni (12.864%). FIAF set a fundraising target of 700 million.

Spanish private equity Portobello Capital acquired Farmol, an Italian manufacuturer of products for personal hygiene, the pharmaceutical and the cosmetics sectors, from Green Arrow Capital (GAC – 70%) and the Innocenti Family(see here a previous post by BeBeez). GAC’s founder and ceo Eugenio de Blasio previously said to BeBeez that the Mediobanca and Intesa Sanpaolo – led auction for selling the company for 100 million euros stopped in 2019 because of the coronavirus turmoil. Milan-based M&A advisor Ethica Corporate Finance assisted Portobello. Farmol has sales of above 110 million. In 2012, Fondo Italiano d’Investimento (FII) subscribed to a capital increse of 6.25 million for a 32.9% of the company and sold for the same amount the stake and invested in a 3 million convertible loan. In 2016, Quadrivio Private Equity Fund (a vehicle that GAC acquired in 2018) purchased 70% of Farmol. Portobello Capital has assets under management for 1.5 billion.

Star Capital acquired the majority of Centro C, a provider of integrated solution and managed printing services for offices, with the financing support of illimity Bank (see here a previous post by BeBeez). Centro C has sales of 5.2 million euros, an ebitda of 1.5 million and net cash of 2.7 million. Star Capital will integrate Centro C with Gamma, a managed printing services company, in view of generating a turnover of 15 million. Star Capital is one of the investors that BeBeez Private Data, the Database that BeBeez developed with FSI, monitors (find out how to subscribe for only 110 euros a month)

Demas, an Italian distributor of veterinary products that belongs to LBO France, acquired 85% of Italian competitor Punto Azzurro from the Fracalanza Family who will keep a 15% stake (see here a previous post by BeBeez). Punto Azzurro has sales of 12.5 million euros with an ebitda of 0.388 million euro. Sergio Fracalanza will be the chairman of the board of the merged companies while Fabrizio Foglietti will act as ceo. Demas has sales of 147 million.

BNL acquired from Progressio a stake in Assist Digital, a provider of digital customer relationship management (Crm) services (see here a previous post by BeBeez). Assist Digital belongs to BNL and Progressio (30%), Enrico Donati (17.25%), Giorgio De Giorgi (12.67%), Franco Fradiani (2.23%), Francesca Gabrielli (2.17%), and smaller investors. Assist Digital has a turnover of above 100 million euros with an ebitda in the region of 10 million.

Specchiasol, an Italian producer of food integrator that since July 2020 belongs to White Bridge Investments, acquired the majority of Wellmicro, a biotech company, from the founder Andrea Castagnetti (25% owner), Pania Investments (20%) and TD Investments (45%) (see here a previous post by BeBeez). Other shareholders of Wellmicro are Almacube (5%), Marco Candela and Elena Biagi (5%). Specchiasol has sales of 27.7 million, an ebitda of 1.3 million and net debts of 7.3 million.

Entangled Capital acquired 73% of Nuova Pasquini & Bini (NPB), a producer of vases in recycled plastic, from the families Checchi and Silvi, who will keep the remaining 27% (see here a previous post by BeBeez). NPB has sales of 22 million (50% export) with a 20% ebitda margin. The company aims to grow in North America and carrying on acquisitions.

Itelyum, a manager of industrial waste that belongs to Stirling Square, attracted the interest of Dbag, Space Capital and Blue Water for a minority stake (see here a previous post by BeBeez). In February 2020, Stirling Square hired Rotschild for selling Itelyum. The company has sales of 340 million euros.

Vimercati, an Italian producer of automotive components, acquired Progind, a designer and producer of moulds for plastics and sheet metal, from the Gallo family (see here a previous post by BeBeez). Progind has sales of 11.1 million euros, an ebitda of 1.2 million and a net financial debt of 5 million. Vimercati has sales of 112.2 million, an ebitda of 15 million with a net financial debt of 6.9 million.

Synlab, a Frankfurt-listed medical diagnostic company of which Cinven owns a controlling stake, acquired Italian competitor Tronchet from Giorgio Tronchet (see here a previous post by BeBeez). Tronchet has sales of 22 million euros.

Renovars, the holding that owns Facile Ristrutturare, Facile Immobiliare, Compara Facile, and Credito Facile, shortened its controlling chain ahead of a listing on Milan market (see here a previous post by BeBeez). Renovars controlling shareholders are Loris Cherubini (48.34%) and Giovanni Amato (47.74%) and shareholders with less than 1% stakes. Facile Ristrutturare has sales of 72.3 million euros, an ebitda of 2.4 million and net cash of 0.96 million.

Italy’s F2i is leading the race for the acquisition of ReLife which attracted the interest of Antin Infrastructure Partners and Whitehelm as well (see here a previous post by BeBeez). The target’s value is in the region of 500 million euros. Relife’s majority owner is Xenon Private Equity which could keep a 10% or less while the operative shareholders may retain a 18%. ReLife was born in October 2018 out of the merger of Benfante and Cartiera Bosco Marengo and grew through further acquisitions

The auction for Italian packaging company Induplast, a portfolio company of Europe Capital, is close to an end as Armònia – Azimut Libera Impresa are in exclusive talks (see here a previous post by BeBeez). Houlihan Lokey is handling the sale of the asset on the ground of a value of 140-150 million euros. Induplast reportedly attracted the interest of FII, Charterhouse and Ardian. The Cortesi and Leidi sold the majority of Induplast to Europe Capital Partners in June 2018. After then, the company acquired Vexel in 2019 and Verve in 2020. Induplast has sales of above 40 million with an ebitda in the region of 14 million.

Spanish private equity Azora Capital sold to Eni Gas e Luce, a retail vendor of utility services that belongs to Eni, a portfolio of renewable energy plants with a power of 1.2 GW based in Spain (see here a previous post by BeBeez). Santander Corporate & Investment Banking assisted Eni, while Lazard advised Azora Capital. In 1Q21, Eni Gas e Luce generated net profits of 270 million euros with an adjusted ebit of 1.3 billion

Gradiente acquired 67% of FiloBlu, a business accelerator for the online retailing of FMCG, from Ardian, who acquired a 33% in 2018, and the founder Christian Nucibella that will keep a 33% (see here a previous post by BeBeez). FiloBlu has sales of above 56 million euros. Gradiente is one of the investors that BeBeez Private Data, the Database that BeBeez developed with FSI, monitors (find out how to subscribe for only 110 euros a month)

Vam Investments, the private equity that Francesco Trapani and Marco Piana head, acquired from Andrea Manfredi a 20% of Supermoney, an online broker for consumer finance and utility services (see here a previous post by BeBeez). Supermoney has sales of 6.4 million euros, an ebitda of 1.4 million and a net financial debt of 1.8 million.

Gourmet Italian Food (GIF), a portfolio company of Alcedo, acquired 70% of Fabian, the owner of the brand Fabian Snack and a third-parties producer of snacks (see here a previous post by BeBeez). Alcedo owns 60% of GIF whose ceo is Fabio Luise. Fabian has sales of 3.8 million euros, an ebitda in the region of 0.3 million and net cash of 70,000 euros

Vincenzo Macaione launched Welldone Global Advisor, a midmarket corporate finance advisor and investor, thanks to support of the Cordioli family, active in the metal transformation sector and in real estate with its Cordifin Group (see here a previous post by BeBeez). In September, Welldone will launch Welldone Credit Financing, a vehicle that already attracted commitments for 30 million euros. Further directors of the company are Francesco Carobbi, Massimo De Dominicis, Giorgio Di Stefano, and Michele Zonin, senior advisor for the Wine and Food Business.

Hvd Partners, a Swiss turnaround investor, will acquire Sampsistemi (Samp) and Sampsistemi Extrusion from troubled Italian diversified group Maccaferri (see here a previous post by BeBeez). Bologna Court carried on the auction on the ground of a 2.3 million euros ascking price and an escrow deposit of 0.46 million. Both the companies are in receivership. Banca Privata Leasing and Solution Bank provided Officine Maccaferri with a loan of 20 million. Such resources will help the company towards the receivership process to which Ad Hoc Group (AHG – a consortium that Carlyle, Man GLG and Stellex Capital formed) is aiming (See here a previous post by BeBeez). The controlling shareholder of Solution Bank (fka Credito di Romagna) is Hong Kong’s SC Lowy.

PFH Palladio Holding, an investment holding that Roberto Meneguzzo heads, will invest 1.8 million euros together with Smart Capital in the IPO on Milan market of Compagnia dei Caraibi (CDC), a distributor of wines and spirits (see here a previous post by BeBeez). Edelberto Baracco is the sole owner of CDC, which has sales of 24.9 million euros with net profits of one million. At the closure of trading of 28 July, Wednesday, CDC shares price was up 24.64%, or 4.30 euros (see here a previous post by BeBeez). CDC’s publicly traded equity is of 27.43% for a market capitalization of 62.7 million and an enterprise value of 65 million. Compagnia dei Caraibi raised 13.8 million as the investors exercised the over-allotment option.