Apollo Global Management, the New York-listed private capital giant with approximately 461 billion dollars in assets under management, announced yesterday that Rimini Bidco srl, a newco controlled by Apollo Impact, Apollo’s ESG investment platform, has signed a agreement to acquire approximately a 67% stake of Reno de Medici (RDM), one of the main European producers of recycled-based cardboard listed on the Star segment of the Milan Stock Exchange. Apollo is now preparing to launch a mandatory takeover bid on all residual shares of RDM with the aim of delisting the company.

The shares were sold by Cascades Inc., one of the main Canadian paper groups, which up to now holds 57.6%, and the compatriot Caisse de Depot et Placement du Quebec, owner of 9.1% (see here the press release by Apollo and here the one by Cascades). The purchase took place at a price of 1.45 euro per share, for a total of over 365 million euros, based on an enterprise value of around 553 millions. The valuation corresponds to approximately 7.8-7.9x the ebitda expected for 2021 (or around 70 million euros). The closing of the transaction is expected within the third quarter of the year. After that, at the same price of 1.45 euros per share, the mandatory tender offer will be launched.

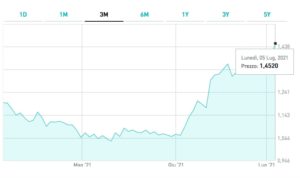

On the news yesterday, the market price of the Reno de Medici stock promptly aligned itself with the terms of the Apollo offer, closing with a + 3.85% jump at 1.45 euros. The price, which represents a premium of 24% compared to the weighted average price for the volumes traded in the last 90 days, “will not be subject to adjustments, except in cases of potential value extractions (so-called leakage, such as, for example, any distributions dividends, capital repayments or other similar distributions of profits or assets to sellers or, as applicable, other potential extractions of value, as better identified in share purchase agreements), it being understood that the payment to shareholders of RDM dividends relating to the year 2020 (which took place on May 31, 2021) will not be considered a leakage “.

In the event that the delisting should not be carried out at the end and due to the effect of the mandatory offer, it can then be carried out through the merger of Reno de Medici in Rimini or in another company controlled by the Apollo funds.

Rimini will finance the operation, including any refinancing of RDM’s existing debt, through a combination of its own funds and a bank loan for which the entire commitment has already been obtained from leading international banks.

Allen & Overy and Paul, Weiss, Rifkind, Wharton & Garrison acted as Apollo’s legal advisers. Jones Day and Rothschild & Co. acted as legal and financial advisor to Cascades, respectively. Latham & Watkins acted as legal advisor to Caisse de dépot ed placement du Québec.

“The moment of this sale allows Cascades to liquidate the value generated by the multi-year transformation initiatives of RDM, which have helped to support the significant increase in Reno De Medici’s share prices in the last year”, commented Mario Plourde, ceoof Cascades Inc. In fact, we recall that the Reno de Medici stock at the end of November 2019 (that is before the effects of the pandemic on market prices were felt) traded at 0.9 euros.

The stock benefited from a policy of gradual international expansion of Reno de Medici, active in 70 countries, also carried out through acquisitions, the latest of which were the one, closed a few days ago, of the Spanish Papelera del Principado, and the one, closed last June, ofthe Dutch Eska. A few months earlier, in February, the Italian paper group had instead sold its French subsidiary La Rochette to the German holding company specialized in turnaround Mutares to focus on the production of cardboard from recycled material (see here a previous article by BeBeez).

The group closed 2020 with consolidated revenues down to 679.5 million euros from 701.6 million in 2019, however the ebitda grew by more than 15% to 83.8 millions while net financial debt was just 8.87 million euros. In the first quarter of 2021, turnover fell again, also following the sale of La Rochette, to 153.5 million from 182.6 in the same period of 2020, and ebitda to 12.7 millions from 20.2.

“We are excited to be working with Apollo in this next phase of growth for RDM. Over the past five years our exceptional team has made significant progress in growing our platform and optimizing our businesses across Europe”, said Michele Bianchi, ceo of the RDM Group, who added: “Looking to the future, we are equally enthusiastic about the commitment, shared by Apollo, to the circular economy, of which we are both contributors and beneficiaries. We look forward to trying our ambitious sustainability goals, so as to contribute to a better future for all our stakeholders”.

The operation on RDM will be the first of the Apollo Impact platform, launched in 2020. Marc Becker, senior partner and co-lead of Apollo Impact, commented: “As the first investment driven by the Apollo Impact platform, RDM fully embraces our look for valid companies in which we believe we can guide profitability and performance in order to increase the positive effects for society and for the planet “. Andrea Moneta, Apollo’s senior advisor for Italy, added: “RDM highlights the important role that Italy is playing in building a more sustainable global economy and Apollo’s commitment to collaborate with the best Italian companies, entrepreneurs and managers, to support their long-term growth “.

Apollo Impact pursues impact objectives by investing in five key areas: economic opportunities; instruction; health, safety and well-being; industry 4.0; climate and sustainability. The platform is led by co-managers Marc Becker and Joanna Reiss and impact chairperson Lisa Hall.

The acquisition of Reno de Medici is further confirmation of Apollo Global Management’s strong interest in Italy, across a wide range of asset classes, from corporate turnarounds to NPLs and Utps. In fact, last May he sent a binding offer of 215 million euros for the control of SECI, the holding company of the Maccaferri family, but the family didn’t accept it (see here a previous article by BeBeez). And a few weeks ago, in mid-June, Apollo announced a joint venture with illimity bank aimed at investing in Italy up to 500 million euros in single-name NPLs and UTPs linked to real estate (see here a previous article by BeBeez).