Icade Healthcare Europe has acquired two nursing homes for elderly people (Residenze Sanitarie per Anziani o RSAs) and a psychiatric facility from KOS, the health group controlled by CIR (the Milan-listed investment holding company owned by entrepreneur Carlo De Benedetti) and participated by F2i Healthcare, an investment veichle owned by Italy’s infrastructure private equity firm F2i sgr (see the press release here).

Icade Healthcare Europe has acquired two nursing homes for elderly people (Residenze Sanitarie per Anziani o RSAs) and a psychiatric facility from KOS, the health group controlled by CIR (the Milan-listed investment holding company owned by entrepreneur Carlo De Benedetti) and participated by F2i Healthcare, an investment veichle owned by Italy’s infrastructure private equity firm F2i sgr (see the press release here).

Icade has also signed, again with KOS, a letter of intent for the acquisition in the second half of 2023 of two RSAs still to be built. The entire transaction, which will be structured as a sale-and-lease-back deal, has a value of 51 million euros. The five properties, located in Lombardy, Liguria (Residenza Anni Azzurri Franchiolo in Sanremo), Marche and Emilia-Romagna, have a total of 514 beds and will be managed by KOS with a 15-year lease.

With this transaction, the portfolio of the Healthcare Property Investment Division of the French investment group Icade will reach almost 790 million euros in assets under management. At the end of 2020, the total assets held by Icade were worth 14.7 billion euros including residential properties and offices.

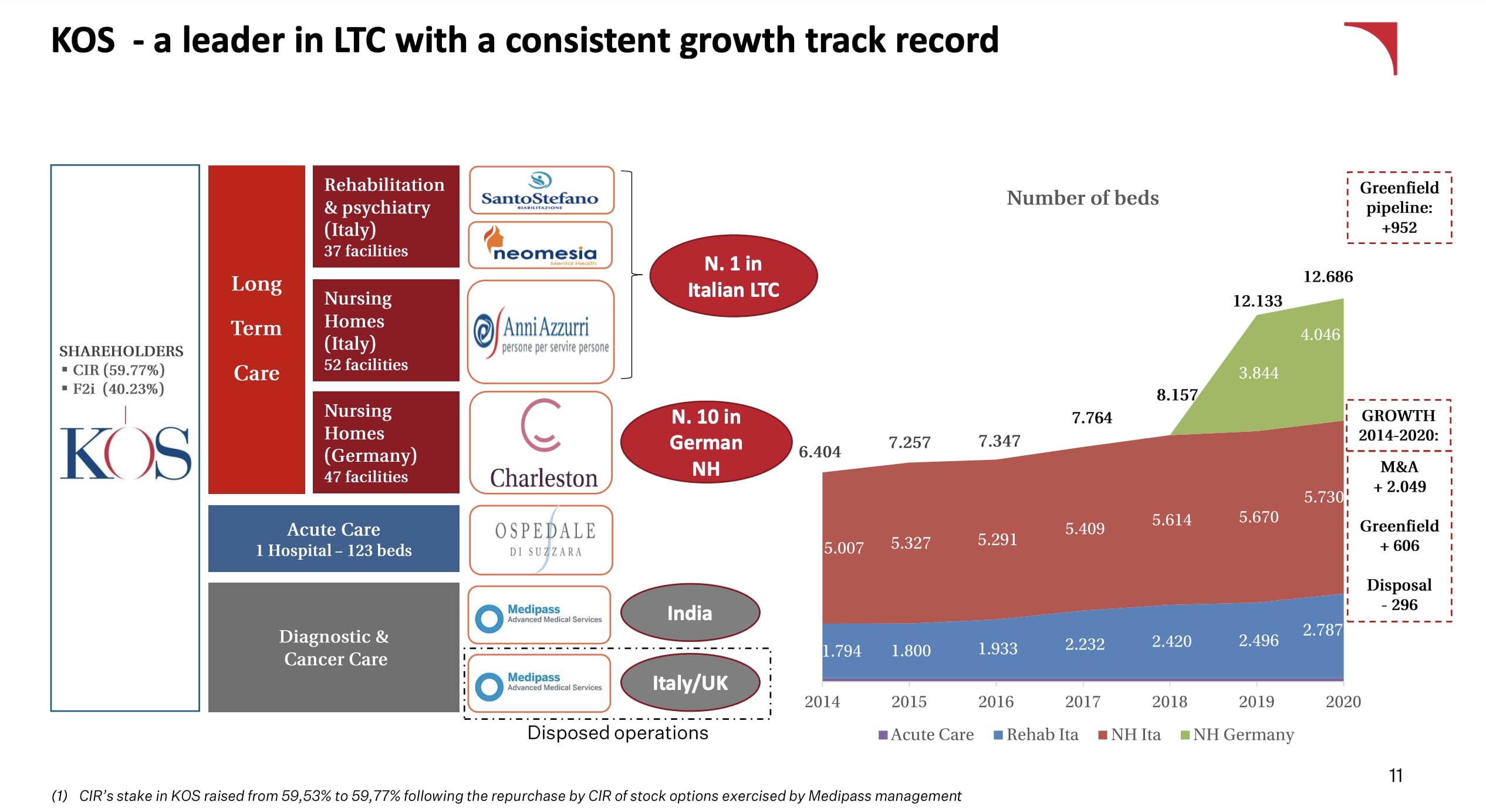

As for KOS, the group closed FY 2020 with 202 million euros of assets in the balance sheet (from 211.2 millions at the end of 2019), valued at 250 millions at fair value (from 270.5 millions) (see here the analysts’ presentation for CIR FY 2020 results). KOS in 2020 reached 631.6 million euros in revenues (from 537.8 millions in 2019) with a 111.7 millions ebitda (from 121.7 millions) and a net loss of 13.3 millions (from a positive result of 22 millions), with a net financial debt, including the impact of IFRS 16, of 931 millions (from 1.1 billions).

As for KOS, the group closed FY 2020 with 202 million euros of assets in the balance sheet (from 211.2 millions at the end of 2019), valued at 250 millions at fair value (from 270.5 millions) (see here the analysts’ presentation for CIR FY 2020 results). KOS in 2020 reached 631.6 million euros in revenues (from 537.8 millions in 2019) with a 111.7 millions ebitda (from 121.7 millions) and a net loss of 13.3 millions (from a positive result of 22 millions), with a net financial debt, including the impact of IFRS 16, of 931 millions (from 1.1 billions).

However, we remind you that about 10% of the 2019 turnover was related to Medipass srl, a company active in the sector of oncological treatments and advanced diagnostic imaging in Italy and the United Kingdom, sold to DWS Alternatives Global Limited in September 2020 (see here a previous article by BeBeez). The acquisition was made on the basis of an enterprise value of 169.2 million euros and an equity value of approximately 103 millions, net of the outlay made by KOS to acquire the Medipass’s assets in India. In fact, before the sale, KOS bought back its Indian subsidiaries from Medipass: Clearmedi Healthcare and Clearview Healthcare. The deal allowed KOS to realize a net capital gain of approximately 50 million euros and to reduce debt by approximately 163 millions in 2020.

KOS currently manages 90 facilities in Italy, with almost 8,700 beds, and 47 in Germany, with about 4,000 beds. There are almost 13,700 collaborators, of which about 8,900 in Italy (7,400 employees) and about 3,800 in Germany.

Among the latest KOS operations, we recall that in November 2020 it purchased two RSAs in Liguria and Emilia Romagna (see here a previous article by BeBeez). Last August 2020 KOS had sold two RSAs in Liguria and Veneto to a primary real estate fund (see here a previous article by BeBeez). In March 2020 KOS took over the health practice of the Villa Armonia Nuova nursing home, a Roman residential structure for the hospitalization and treatment of psychiatric pathologies authorized and accredited also for the treatment of eating disorders and for the treatment of the onset of the disease psychiatric treatment in minor adolescents (see here a previous article by BeBeez).