Engineering Ingegneria Informatica spa, a group specialized in software development and technologies at the service of public and private companies, is preparing to distribute reserves for 17 million euros to the parent company Centurion Bidco spa, which in turn is controlled by Bain Capital, NB Renaissance and NB Aurora (Neuberger Berman) private equity firms. Radiocor Italian press agency writes.

Engineering Ingegneria Informatica spa, a group specialized in software development and technologies at the service of public and private companies, is preparing to distribute reserves for 17 million euros to the parent company Centurion Bidco spa, which in turn is controlled by Bain Capital, NB Renaissance and NB Aurora (Neuberger Berman) private equity firms. Radiocor Italian press agency writes.

The decision, also made possible by the good performance of activities in 2020 which closed in profit, is also functional to Centurion’s need to pay in turn the half-yearly coupons to the subscribers of its high yield bond issued last autumn for 605 million euros (see here a previous article by BeBeez). The senior secured issue, maturing on 30 September 2026 and paying a 5.875% coupon, was entirely placed with institutional investors and listed on the Luxembourg Stock Exchange.

Furthermore, Radiocor writes, in order to optimize the corporate structure, as always happens downstream of leveraged acquisitions, the private equity funds are meanwhile working on the reorganization of the control chain through the merger of Centurion with Engineering which should take place in second part of the year.

Meanwhile, the Engineering board of directors has recently been expanded to 13 members with the entry of Aurelio Regina, entrepreneur, partner of Egon Zehnder and head of the Confindustria Energy technical group, while the baton will soon be handed over to the helm. of the company. The funds are in fact choosing the new ceo of Engineering who will take the place of Paolo Pandozy, destined for the role of chairman.

Based in Rome, Engineering is one of the leading companies engaged in the digital transformation of public and private companies and organizations, with an innovative offer of platforms for the main market segments. With approximately 12,000 professionals in 65 offices (in Italy, Belgium, Spain, Germany, Switzerland, Norway, Sweden, the Republic of Serbia, Brazil, Argentina and the USA), Engineering designs, develops and implements innovative solutions for the business areas in which digitization generates the major changes, including Digital Finance, Smart Government & E-Health, Augmented Cities, Digital Industry, Smart Energy & Utilities, Digital Telco & Multimedia.

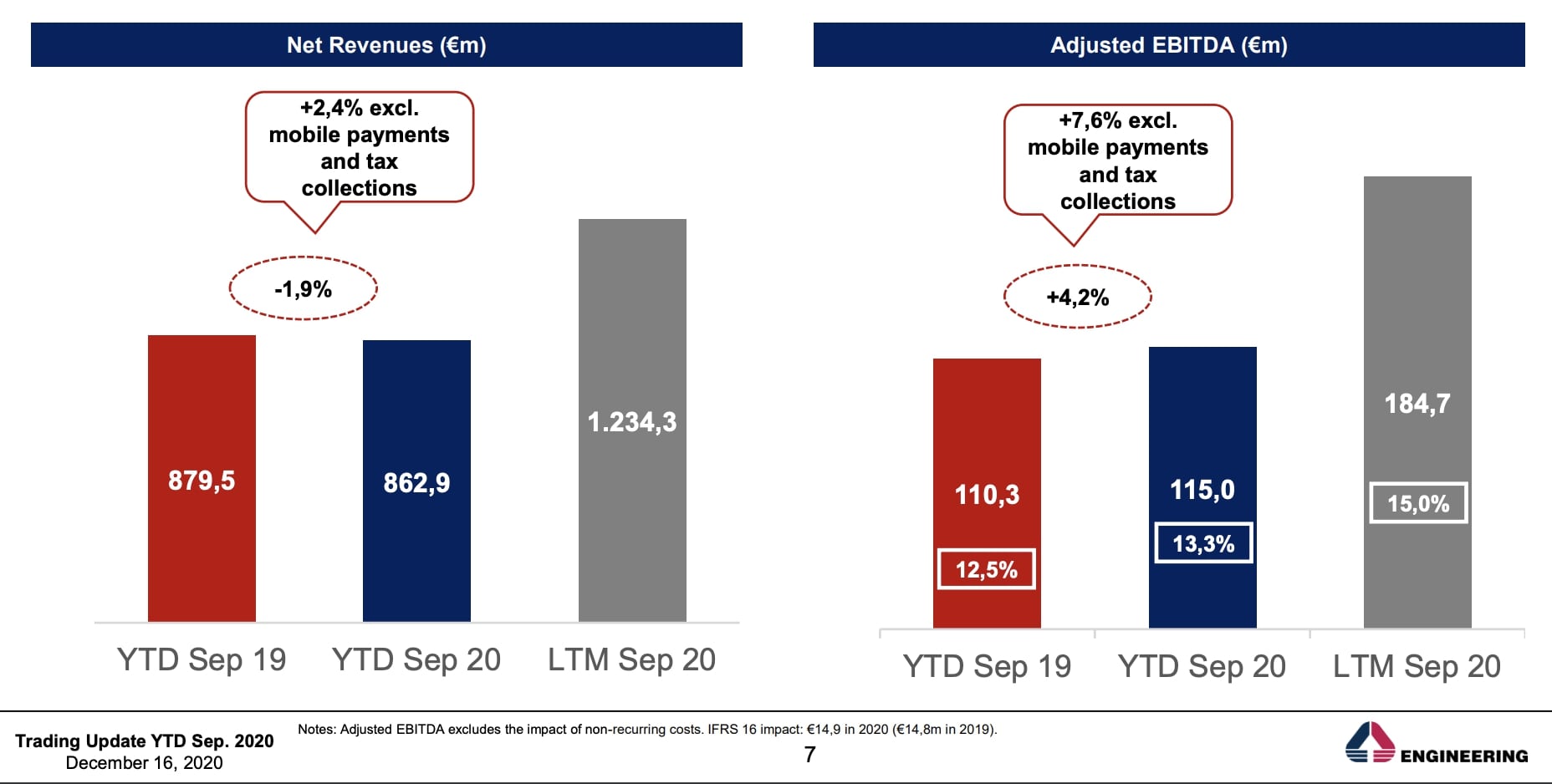

The company had closed FY 2019 with a 1.27 billion euros in revenues (+ 8.2%), an ebitda of 160 million euros (+ 8.5%, with an ebitda margin of 13%) a net profit of approximately 44 million euros and a net financial position, including the impact of IFRS16, of 288.6 millions (see here a previous article by BeBeez and here the 2019 financial statements). The nine months of 2020 of the group instead closed with 862.9 million euros in revenues (-1.9% from 9 months 2019) and an ebitda of 115 millions (+ 4.2%) (see here the presentation to analysts).

In the past four years, the company has completed 20 acquisitions in Italy and abroad. In particular, in 2008 it bought Atos Origin Italia, in 2013 it was the turn of T-Systems Italia and then in 2017 of Infogroup, sold by Intesa Sanpaolo (see here the press release of the time). During 2019, Engineering also concluded the acquisitions of 100% of the fintech startup company Deus Technology (see here a previous article by BeBeez) and of 80% of Digitelematica, specialized in e-commerce solutions for large-scale distribution (see here a previous article by BeBeez).