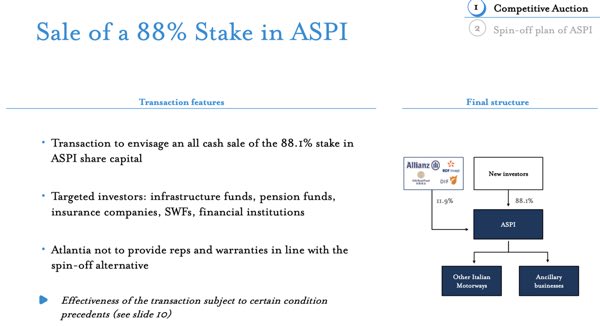

SPIOn 1 April, Thursday, Milan-listed Atlantia received the awaited fourh offer of Cdp-Blackstone-Macquarie for its 88.06% stake in Autostrade per l’Italia (ASPI) (see here a previous post by BeBeez). The deadline for tabling a bid for ASPI, part of Milan-listed Atlantia, expired on 27 March, Saturday (see here a previous post by BeBeez).Cdp-Blackstone-Macquarie tabled a binding offer for ASPI on the ground of an enterprise value of 9.1 billion euros. Cdp-Blackstone-Macquarie had said that they needed further time for making an offer for 88.06% of ASPI. Meanwhile, Atlantia’s shareholders meeting voted not to postpone from march 31st till July 31st the deadline for accepting bids for control of a newco where ASPI’s stake was to be transferred as an alternative to the direct sale of ASPI’s stake (see here a previous post by BeBeez).

SPIOn 1 April, Thursday, Milan-listed Atlantia received the awaited fourh offer of Cdp-Blackstone-Macquarie for its 88.06% stake in Autostrade per l’Italia (ASPI) (see here a previous post by BeBeez). The deadline for tabling a bid for ASPI, part of Milan-listed Atlantia, expired on 27 March, Saturday (see here a previous post by BeBeez).Cdp-Blackstone-Macquarie tabled a binding offer for ASPI on the ground of an enterprise value of 9.1 billion euros. Cdp-Blackstone-Macquarie had said that they needed further time for making an offer for 88.06% of ASPI. Meanwhile, Atlantia’s shareholders meeting voted not to postpone from march 31st till July 31st the deadline for accepting bids for control of a newco where ASPI’s stake was to be transferred as an alternative to the direct sale of ASPI’s stake (see here a previous post by BeBeez).

On 28 March, Sunday, the Carraro family said it aims to launch an offer at 2.4 euros per share for delisting the eponymous producer of industrial vehicles (see here a previous post by BeBeez). The value of the offer amounts to 51.2 million euros. However, Abemarle Asset Management, who owns 1% of Carraro, said that the bidders have to sweeten their offer that is lower than the target price of 3 euros that sell-side analysts of Intesa Sanpaolo and Banka Akros set on 26 March, Friday. Carraro has losses of 3.3 million and sales of 478.7 million with an ebitda of 32.6 millioni and debt of 123.6 million.

Marco Giovannini, the ceo of Milan-listed Guala Closures that owns 14.2% of the company and 24.3% of the voting rights together with the other managers, signed an agreement with Peninsula Capital (9.8% shareholder with 8.8% voting rights) for negotiating with Investindustrial that is reportedly interested in delisting the business through a public offer at 8.2 euros per share (see here a previous post by BeBeez). Investindustrial currently owns 48.9% of Guala and 43.5% of the voting rights. Guala has sales of 572 million euros, an adjusted ebtida of 98 million and a net financial debt of 462.5 million.

IWG (International Workplace Group), a provider of co-working places acquired Italian competitor Copernico Holding from Pietro Martani, Leonardo Ferragamo, Capital For Progress Single Investment (Cfpsi), and other private investors that subscribed a 10 million euros round in 2015 (See here a previous post by BeBeez). Cfpsi is fka Spac Capital for Progress 2 (CFP2), a vehicle that failed to carry a business combination with ABK after having raised 65 million. IWG has sales of 2.65 billion GBPs with an ebitda of 428.3 million.

In the first semester of 2020-2021 season, Italian football club Inter Milan posted lossed of 62.7 million euros (see here a previous post by BeBeez). Inter Milan issued a Luxembourg-listed bond of 375 million due to mature in 2022 and hired Goldman Sachs as it is considering options for refinancing such a liability. The team reportedly attracted the interest of BC Partners, EQT, Arctos Sports Partners, Ares Management Corporation, Temasek Holdings, Public Investment Fund (PIF) of Saudi Arabia, Mubadala and Fortress. FC Inter belongs to Chinese conglomerate Suning.

Neo Apotek, the club deal vehicle for investing in drugtores that Banca Profilo launched in 2019, aims to raise 50 million euros by the end of 1H21 for acquiring 35-40 pharmacies by the end of 2022 further to the 24 assets that are already in portfolio (See here a previous post by BeBeez). Neo Apotek aims to own 60-70 shops and generate sales of 140 million. Private equity Route Capital Partners is an investor in the vehicle.

Exacto, a company of Stefano Giusto, invested 7 million euros for acquiring a 21.4% of Milan-listed Renergetica of which it alread owned 60.81% (See here a previous post by BeBeez). In July 2020 Renergetica issued a senior minibond of 8 million and a subordinated minibond of 4 million, both maturing on 31 December 2025 and paying a 5.7% coupon. Exacto subscribed the subordinated issuance, while Anthilia the senior one. Renergetica turnover amounts to 9.4 million with a 44% ebitda margin.

Italian pharma company Giuliani acquired Nathura, a nutraceutical firm that owns the brand Psyllogel, from the Ricotti Family, sources said to BeBeez(See here a previous post by BeBeez). UBI Banca financed the transaction.

Dedalus, an Italian IT company for the health care sector of which Ardian owns 75%, acquired Denmark’s competitor Amphi Systems A/S (See here a previous post by BeBeez). In the last 6 years, Dedalus acquired more than 40 companies and has a turnover in the region of 700 million euros.

Milan-listed Unipol and Milan-listed private banking firm Banca Intermobiliare hired Kpmg to sell their bankassurance joint venture BIM Vita (see here a previous post by BeBeez). Unipol owns 70% of BIM Vita. Vendors could fetch 30 million euros. Banca Intermobiliare (BIM) also called off the negotiations for acquiring a controlling stake in Banca Consulia from British private equity Attestor Capital (See here a previous post by BeBeez). Banca Consulia attracted an offer of 32 million euros evenly split in cash and shares. Once completed the deal, Consulia shareholder would have had 15% of BIM.

MBE Worldwide, a logistic company that belongs to Graziano Fiorelli and Oaktree Capital Management (40% since January 2020), acquired Dutch marketing and printing company Multicopy (See here a previous post by BeBeez). MBE has sales of 858 million euros.

Pharma.1, a club deal vehicle that Carlo Pelanda heads, acquired the majority of pharma company Biofer from the Bitossi Lapini Family, while Gianmaria Ristori will keep a minority of the business (See here a previous post by BeBeez). Banco Bpm financed the transaction. Biofer has sales of 30 million euros (65% export), an ebitda of 4.3 million and a net debt of 5.8 million.

Kryalos, an Italian financial firm that Paolo Bottelli founded, has assets under management for 7.9 billion euro (+20% yoy), a brokerage margin of 28.4 million (+26%), an ebitda of 13.4 million (+21%), and net profits of 8.5 million (+19%) (See here a previous post by BeBeez). The firm’s net cash is of 11 million.

Made in Italy Fund, a private equity that Quadrivio and Pambianco launched, acquired Italian fashion brand Dondup from 80% owner L Catterton, Matteo Marzotto (11%) and Massimo Berloni (9%) (See here a previous post by BeBeez). Matteo Anchisi, the company’s ceo, will invest for a minority of the target. Made in Italy Fund aims to raise 300 million euros. Dondup has sales of 52.6 million and an ebitda of 14.2 million

L-Catterton aims to acquire Italian fashion brand Etro, who previously attracted the interest of Qatar’s Mayhoola, the owner of Valentino, Pal Zileri and Balmain (See here a previous post by BeBeez). Gimmo Etro founded the company in the late 60s and his kids Jacopo, Kean, Veronica, and Ippolito currently run the business. Etro has sales of 283.59 million euros.with an ebitda of 15.7 million.

Dolciaria Acquaviva, an Italian producer of frozen baked products that belongs to Ergon Capital Partners, acquired Dolce Milano from Mario Laddaga and Carmine Santillo and Unigel from Claudio Zanaglio (see here a previous post by BeBeez). Dolce Milano has sales of 15.2 million euros, an ebitda of 0.13 million and a net debt of 0.943 milion. Unigel has a turnover of 3.5 million and an ebitda of 0.414 million. Dolciaria Acquaviva has revenues of 61.8 million, and an ebitda of 12 million.

Cassa Depositi e Prestiti (CDP) investments in funds for 2020 amount to 35.6 billion euros, (+4% since the end of 2019) (see here a previous post by BeBeez). CDP posted net profits of 2.8 billion (+1%) and reiterated it aims to support Italian SMEs and startups through its acceleration programmes and funds of funds.

Targa Telematics, an Italian smart-mobility and Internet of Things (IoT) company, hired William Blair for finding a minority investor (see here a previous post by BeBeez). Nicola De Mattia and Adriano Scardellato are the company’s ceo and chairman. In 2019, Targa Telematics merged with UbiEst, a provider of IoT-based geolocalization services and technologies. Targa has sales of 40 million euros.

QC Terme, a company that manages 10 Italian thermal centres that belongs to the Quadrio Curzio Family and White Bridge, aims to raise 40 million euros (15 million through a capital increase) (see here a previous post by BeBeez). Marco Pinciroli and Stefano Devescovi head White Bridge.

Evoca (fka N&W Global Vending), an Italian producer of vending machines, signed a joint venture with Chinese peer Macas Electronic Technology Company (See here a previous post by BeBeez). The companies aim to achieve a leadership position in the Asian market. Andrea Zocchi is the ceo of Evoca which has sales of 462.7 million euros with an adjusted ebitda of 105.5 million. In 2018, Lone Star, the owner of Evoca, unsuccessfully tried to sell the asset on the ground of an enterprise value of 1.5 billion.

The workers of Grotto, the fashion firm that owns the Gas brand, could take 10% of the company from Claudio Grotto, the owner of 65% of the company who aims to donate part of his stake (see here a previous post by BeBeez). However, Gas creditors that will hold a meeting on 20 May, Thursday, must agree with the company’s receivership plan. Grotto’s debt is of 53.7 million euros. Unicredit, Intesa, Mps, UBI Banca, and BPM (6.5 million) AMCO (12.7 million), which acquired the NPEs of BPVI and Veneto Banca, and Dea Capital (34.5 million) are the company’s main lenders. Gas has sales of 26 million with an ebitda of 1.5 million and cash of 7 million.