Four non-binding offers arrived last week to take over the corporate assets of Piaggio Aero Industries and Piaggio Aviation, the two companies in extraordinary administration operating under the Piaggio Aerospace brand and headed by Mubadala, a sovereign fund of the Abu Dhabi government. This was announced yesterday by Piaggio Aerospace (see the press release here). The four offers for Piaggio Aerospace came from the shortlist of 5 subjects who were selected last February by the extraordinary commissioner Vincenzo Nicastro (see here a previous article by BeBeez).

The offers will now be reviewed by Mr. Nicastro in collaboration with a team of experts. Their analysis will then be sent to the Ministry for Economic Development (MISE), in order to be able to start negotiations with whoever has presented the project deemed best. Negotiations are expected to last a maximum of one month, to then arrive at an irrevocable and binding offer.

“I intend to start this last phase as soon as possible, immediately after a further authorization step requested by the Ministry. Authorization that I hope will arrive promptly and will not further slow down the sales process more than it has already happened so far ”, Mr. Nicastro declared last February (see here a previous article by BeBeez). While yesterday he added: “The range of purchase proposals we have received is large. Now the most delicate phase begins, which I hope will lead to identifying the optimal solution in the interest not only of Piaggio Aerospace and of those who work there, but also of those who have credits against the company “.

The auction has been running since 2020 and has already been extended several times also due to the coronovirus (see here a previous article by BeBeez). The invitation to express interest was originally answered by 19 subjects from all parts of the world, 11 of which were subsequently admitted to the data room (see here a previous article by BeBeez).

We recall that in January 2020 the extraordinary commissioner received 30 requests for filing Piaggio Aviation’s liabilities for a total amount of 747.9 million euros (see here the Quarterly Report at 31 March 2020 of Piaggio Aviation) and 1,407 applications for admission to the liabilities for Piaggio Aero Industries, for a total amount of over 928 million (see here the Quarterly Report at 31 March 2020 of Piaggio Aero Industries).

Meanwhile, the Piaggio Aerospace group, which employs around 940 people, is continuing its production and commercial programs, with some further orders close to being signed. We remind you that last August the two companies of the group obtained from Banca Ifis a loan of 30 million euros in the form of advance contracts and factoring operations, after the definitive go-ahead received from the Ministry of Economic Development and with the approval of the Committee of Surveillance (see here a previous article by BeBeez). From May 2020, in addition to the maintenance of aircraft and engines supplied to government fleets, part of the aircraft production was also restarted, after registration by the Court of Auditors made the contract, signed in December 2019 with the Armed Forces, executive. , for the purchase of 9 P.180 aircraft and the modernization of a further 19 for an order portfolio of approximately 900 million euros.

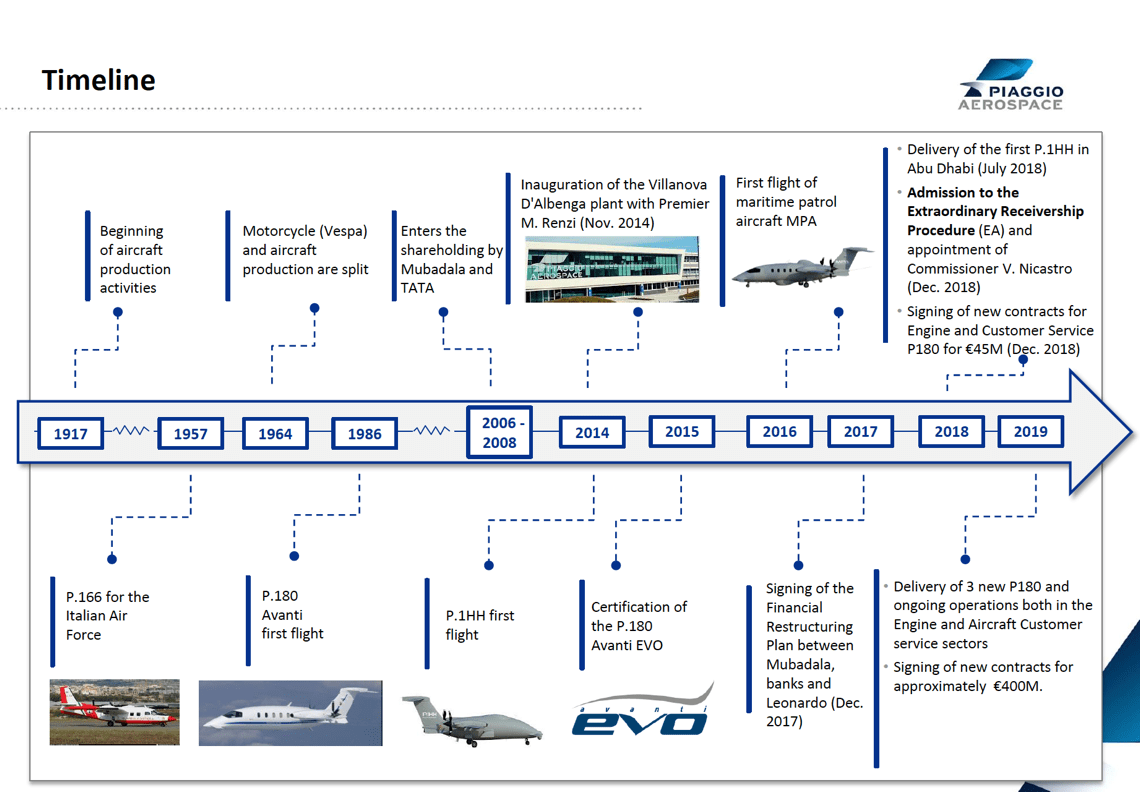

Piaggio was born in 1884 in Genoa. In 1915 it started the production of certified aircraft engines and aircraft and in 1964 it entered the jet market. In 1998 the company was taken over by a consortium of entrepreneurs including Piero Ferrari, vice president of Ferrari and son of Enzo Ferrari, founder of the iconic prancing horse group. At the same time, its name changed to Piaggio Aero Industries, which focused on the aviation and aeronautical engines business. In 2006 the new partner Mubadala Development joined, acquiring 35% of the capital (see here the press release of the time). The rest of the capital belonged to the Ferrari and Di Mase families (55%), while the remaining 10% of the shares were in the hands of some banking institutions and other minor shareholders. After a first crisis, the company managed to recover, only to enter the crisis again in 2009, again due to a new drop in orders. In November 2013, Tata Limited, a British company of the Indian industrial group Tata and Mubadala Development Company had become reference shareholders of Piaggio Aero Industries having subscribed, together with Piaggio’s chairman Piero Ferrari, a share capital increase of 190 million euros ( see here the press release), with Tata Limited which at that point held 44.5% of the shares of Piaggio Aero Industries, Mubadala Development 41% and Piero Ferrari 2%. Not having subscribed to the capital increase, the Di Mase family‘s stake in Piaggio Aero, through the HDI fund, was reduced to 12.5%.

In 2014 Piaggio Aero Industries and its subsidiaries passed almost entirely under Mubadala (75% owned by the Emirati Mdc Pa Cooperatief and 25% by Mubadala Development Company Pjsc), with the exception of 1.95% in the hands of Pietro Ferrari, which the entrepreneur then later sold to Mubadala. The emirs had then decided to invest 145 million euros in a new plant in Villanova d’Albenga, in the province of Savona, closing the two historic sites of Finale Ligure and Sestri Ponente, while the offices in Rome and Genoa remained active. Piaggio Aerospace closed the 2015 financial statements with losses of 140 million, down to 79.5 million in 2016.

In 2018, the Renzi government had ordered 10 systems from Piaggio consisting of 2 P2HH drones and a ground piloting station, for a value of 776 million over 15 years, in addition to 58 million a year for maintenance. But the Conte government canceled the order. Negotiations were opened with MISE to deliver a 250 million order to Piaggio, reducing orders from 10 to 4. In December 2018, the Mubadala fund therefore requested extraordinary administration for the company, as “despite the commitment and the hard work of all employees, as well as the significant financial support sustained by the shareholder over the years, the fundamental assumptions of the recovery plan approved in 2017 have not materialized. The continuing uncertainty and current market conditions mean that the company is no longer financially sustainable “(see here the ministerial decree for admission to extraordinary administration). In 2018, Piaggio’s debts amounted to 618.8 million euros, against a turnover of approximately 100 million (-66% since 2014). The extraordinary commissioner had then filed with MISE the unitary plan for the sale of the corporate assets of Piaggio Aero Industries and Piaggio Aviation in August 2019, a program which was then approved by the MISE in November 2019. The extraordinary commissioner had then filed with MISE the unitary plan for the sale of the corporate assets of Piaggio Aero Industries and Piaggio Aviation in August 2019, a program which was then approved by the MISE in November 2019.