US private equity real estate fund IPI Partners has officially announced the acquisition of Supernap Italia, a company specializing in the design, construction and management of datacenter ecosystems in Italy (see the press release here). The interest of IPI Partners had been known for a few days (see here a previous article by BeBeez).

Supernap Italia is controlled by Supernap International sa (21.26%) and ACDC Holdings sarl (78.74%). In turn Supernap International is a partnership between US-based Switch and ACDC Fund, signed by Orascom TMT Investments and Accelero Capital.

In detail, IPI Partners acquired 100% of the share capital of the company’s controlling shareholder, ACDC Holdings sarl, from affiliates of Accelero Capital Holdings sarl.

In the context of the transaction, the Supernap shareholders’ meeting appointed a new board of directors consisting of: Matt A’Hearn (chairman), Lauren Sullivan, Josh Friedman and Sherif Rizkalla. IPI’s legal advisors in relation to the transaction were Gibson, Dunn & Crutcher LLP, Legance and Arendt & Medernich, while White & Case LLP, Giliberti Triscornia Associati and NautaDutilh were legal advisors to ACDC

“We are proud of the great progress we have made in establishing our market presence and demonstrating our ability to meet the capacity needs of some of the world’s leading technology companies,” Supernap ceo Sherif Rizkalla said, who added. : “IPI is the ideal partner to help us in the further development and implementation of our hyperscale infrastructures, in Italy and throughout Europe, and to accelerate growth plans”.

“Supernap has an established management team that has built strong relationships with an important operator base and has built a track record of developing and managing world-class datacenters”, Matt A’Hearn, partner of IPI, said, adding: ” We see this operation as a great opportunity in Europe, a market that we believe will continue to grow at a significant rate. In relation to this investment, IPI envisages the use of resources that can make it possible to seize the opportunities arising from the expansion capabilities within and around the existing Supernap campus. We look forward to working with Sherif and his team. ”

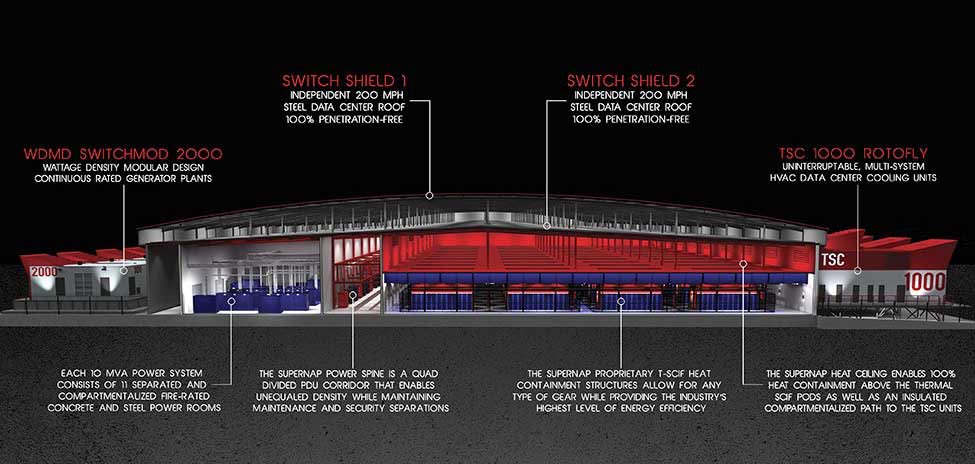

The Italian company has been managing the Siziano (Pavia) datacenter since the end of 2016, which offers colocation, power and connectivity services and is the most advanced datacenter in Southern Europe. The datacenter, which is spread over 42 thousand square meters of space within a 100 thousand square meter campus, required an investment of 300 million euros from the shareholders in 2019. The project predicts breakeven in 2022 and positive results growing from 2024. The company’s financial condition has since improved dramatically and the company has sufficient capital available to continue its aggressive growth strategy.

We recall that Supernap Italia listed a 63 million euro bond on ExtraMot Pro last December 2020. The bond expires in December 2025 and pays a floating rate coupon, equal to the 6-month Euribor rate plus 375 basis points (see here a previous article by BeBeez).

IPI Partners, specialized in digital infrastructures, was born in 2016 as a joint venture between Iconiq Capital and Iron Point Partners and has quickly become one of the major international operators. IPI is now in fundraising for its real estate fund IPI Data Center Partners Fund II, targeting 1.5 billion dollars. At the end of December 2020, it had raised 1.145 billion dollars already (see SEC filing here).